Investing In The Future Of Transportation: Uber's Autonomous Vehicles And ETF Potential

Table of Contents

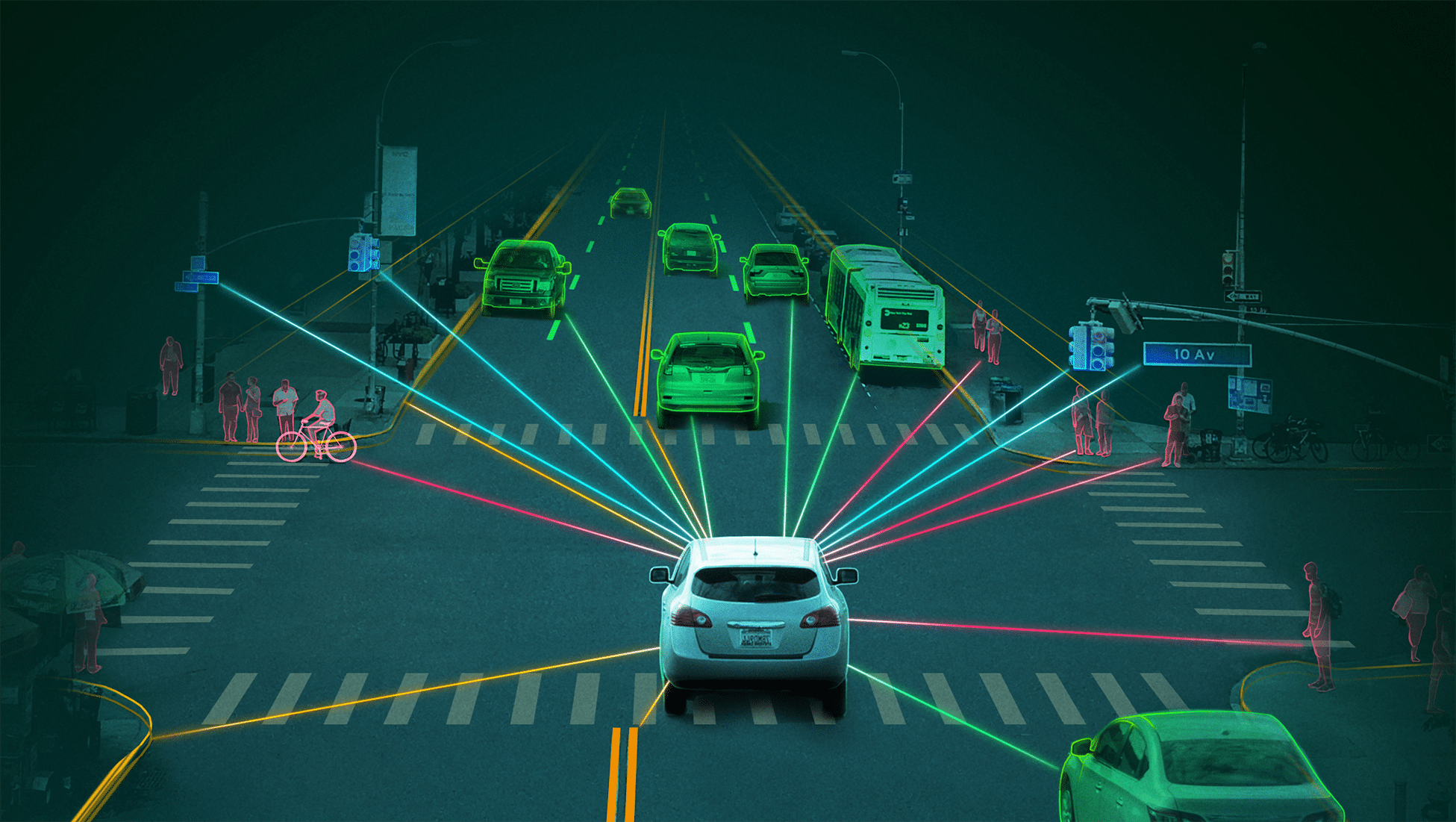

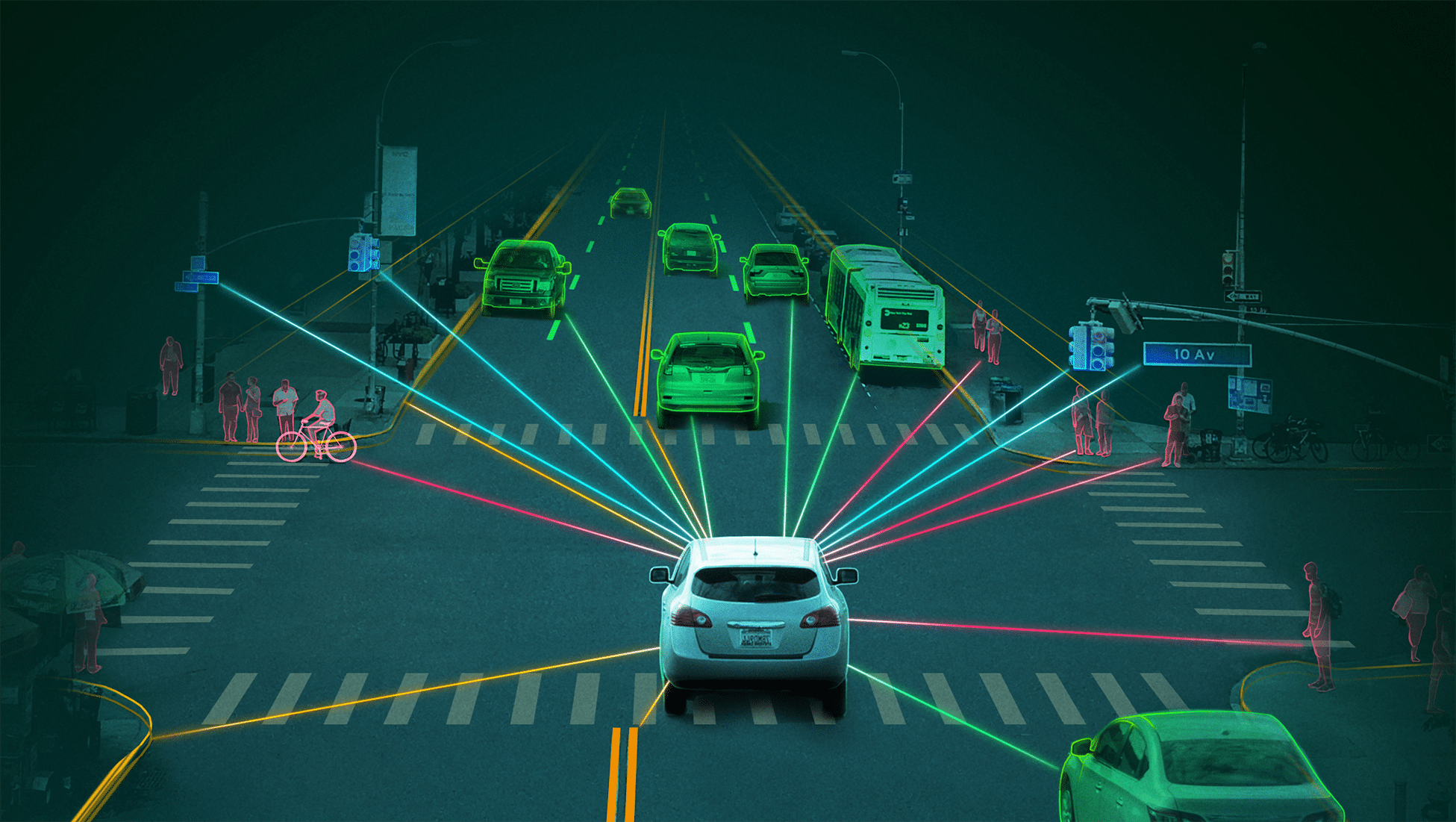

Uber's Autonomous Vehicle Technology: A Deep Dive

Uber's journey into autonomous vehicles began with the acquisition of Otto, a self-driving truck startup, in 2016. This strategic move signaled Uber's serious commitment to developing and deploying self-driving technology. Since then, Uber's Advanced Technologies Group (ATG) has been heavily invested in research and development, aiming to integrate autonomous driving capabilities into its ride-sharing platform. However, the path hasn't been without its challenges.

Key technological advancements and challenges Uber faces include:

-

Sensor Technology Advancements and Limitations: Uber relies on a suite of sensors, including LiDAR, radar, and cameras, to perceive its environment. While these technologies have advanced significantly, accurately interpreting complex scenarios, particularly in adverse weather conditions, remains a challenge. Improving the robustness and reliability of sensor data processing is crucial for safe and reliable autonomous driving.

-

Software Development for Complex Driving Scenarios: Programming self-driving cars to handle unpredictable situations like navigating busy intersections, dealing with unexpected pedestrian behavior, or managing adverse weather conditions (rain, snow, fog) requires incredibly sophisticated software. This is a complex and ongoing area of development, requiring substantial computing power and algorithmic refinement.

-

Regulatory Hurdles and Public Perception: The deployment of autonomous vehicles faces significant regulatory hurdles. Governments worldwide are still developing comprehensive safety regulations and guidelines for testing and operating self-driving cars. Overcoming these regulatory barriers and building public trust in the safety and reliability of the technology are critical for widespread adoption.

The successful integration of autonomous vehicles has the potential to significantly impact Uber's business model. Reduced labor costs and increased operational efficiency through 24/7 availability could lead to higher profitability and market share. However, the transition will require substantial investment and careful management.

The Financial Landscape: Assessing the Risks and Rewards

Investing in Uber's autonomous vehicle program presents a high-risk, high-reward scenario.

-

High Initial Investment Costs and Long-Term Return Timelines: Developing self-driving technology requires massive upfront investment in research, development, testing, and infrastructure. Returns on this investment are likely to be long-term, potentially stretching over several years or even decades.

-

Potential for Significant Returns Upon Successful Commercialization: If Uber successfully commercializes its autonomous vehicle technology, the potential financial rewards are enormous. The potential to disrupt the transportation industry and capture significant market share could translate into substantial returns for investors.

-

Competition from Other Tech Giants and Established Automakers: Uber faces intense competition from other tech giants like Google's Waymo and established automakers such as Tesla, General Motors, and Ford, all vying for dominance in the autonomous vehicle market. This competitive landscape increases the uncertainty surrounding Uber's prospects.

Valuing a technology still under development is inherently challenging. Traditional valuation methods may not adequately capture the future potential of a disruptive technology like autonomous vehicles. The concept of "technological disruption" is central here; established players might be overtaken by innovative newcomers, making accurate predictions difficult.

Exploring ETF Investment Opportunities

Exchange-Traded Funds (ETFs) offer a diversified way to gain exposure to the autonomous vehicle market. Instead of investing directly in a single company like Uber, ETFs provide exposure to a basket of companies involved in various aspects of the autonomous driving ecosystem, mitigating risk.

-

Diversification Benefits of ETFs: ETFs reduce the risk associated with investing in a single company by diversifying across multiple companies involved in different stages of the autonomous vehicle supply chain (sensor manufacturers, software developers, automotive manufacturers, etc.).

-

Risks Associated with ETF Investments in Emerging Technologies: While ETFs offer diversification, they are still subject to the inherent risks associated with investing in emerging technologies. The autonomous vehicle sector is still in its early stages, and there's no guarantee of success for any specific company or technology.

Several ETFs offer exposure to the autonomous vehicle sector, although direct exposure to Uber's specific autonomous vehicle technology might require a direct investment in Uber stock. Research into ETFs focused on technology, transportation, and robotics would be beneficial. Comparing expense ratios and historical performance between different ETFs is crucial for making an informed investment decision.

Regulatory and Ethical Considerations

The widespread adoption of autonomous vehicles is intertwined with complex regulatory and ethical considerations.

-

Legal and Ethical Implications: Determining liability in accidents involving autonomous vehicles is a major legal challenge. Questions around who is responsible—the manufacturer, the software developer, or the owner—need to be addressed through clear and comprehensive legislation. Job displacement in the transportation sector is another significant ethical concern that needs careful consideration and mitigation strategies.

-

Role of Government Regulations: Government regulations play a crucial role in shaping the future of autonomous vehicle deployment. Clear and consistent safety standards are needed to ensure public safety and promote innovation. Different regulatory landscapes in various countries will influence the pace of adoption and market development.

-

Public Acceptance and Trust: Gaining public acceptance and building trust in the safety and reliability of autonomous vehicles is paramount. Public perception and confidence are critical for widespread adoption and market success.

Conclusion

Investing in Uber's autonomous vehicle technology and related ETFs presents a high-risk, high-reward opportunity. While the path to widespread adoption is fraught with challenges—from technological hurdles and regulatory uncertainties to ethical concerns—the potential for transformative change in the transportation sector is undeniable. Carefully considering the risks and potential returns, alongside diversification through ETFs, is crucial for navigating this exciting, yet volatile, investment landscape. Further research into specific ETFs and Uber's progress in autonomous vehicle development is highly recommended before making any investment decisions related to autonomous vehicle technology and the potential for growth in the self-driving car market.

Featured Posts

-

Analyzing Ufc Vegas 106 Burns Vs Morales Fight Predictions And Betting Lines

May 19, 2025

Analyzing Ufc Vegas 106 Burns Vs Morales Fight Predictions And Betting Lines

May 19, 2025 -

Ierosolyma I Istoriki Topothesia Tis Anastasis Toy Lazaroy

May 19, 2025

Ierosolyma I Istoriki Topothesia Tis Anastasis Toy Lazaroy

May 19, 2025 -

New Photos Jennifer Lawrence And Husband Cooke Maroney Following Baby No 2 News

May 19, 2025

New Photos Jennifer Lawrence And Husband Cooke Maroney Following Baby No 2 News

May 19, 2025 -

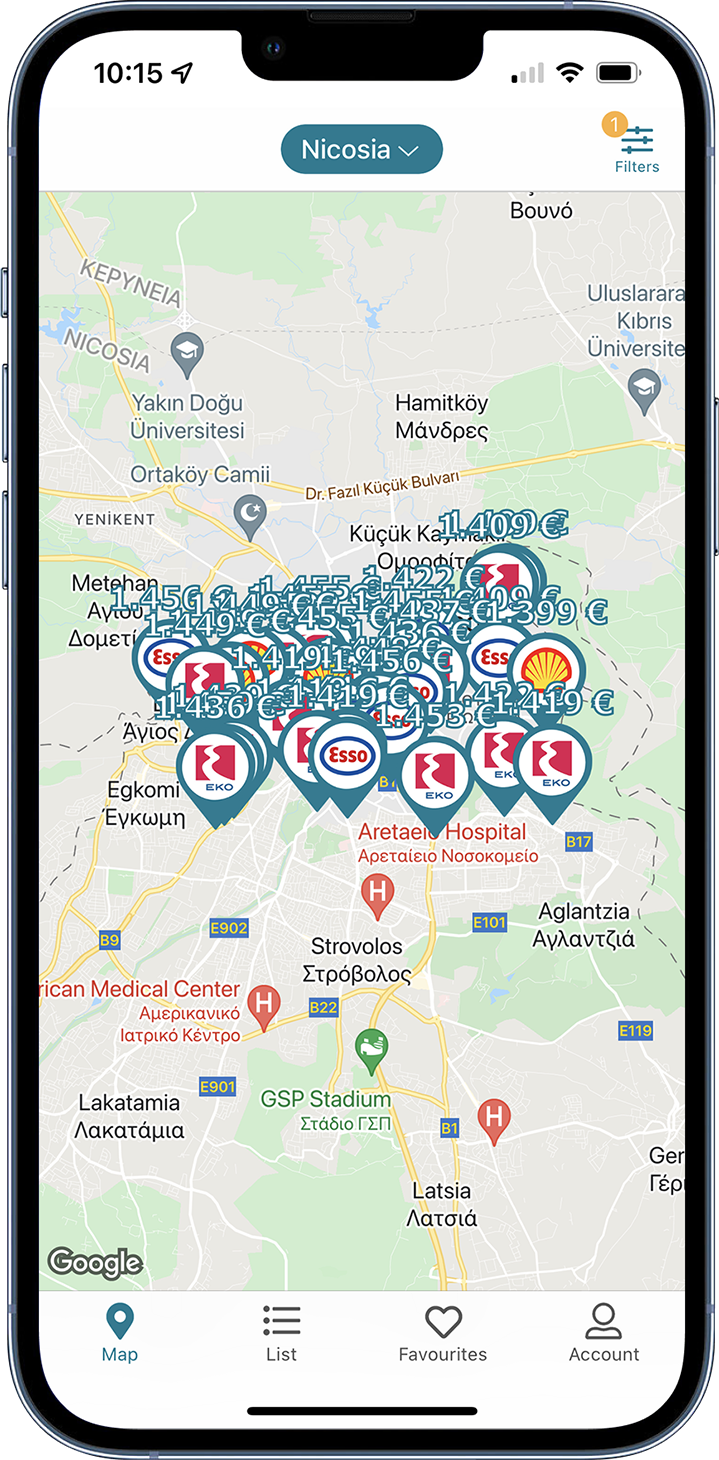

Poy Na Breite Ta Pio Fthina Kaysima Stin Kypro

May 19, 2025

Poy Na Breite Ta Pio Fthina Kaysima Stin Kypro

May 19, 2025 -

The Palm Springs Fertility Clinic Bombing Key Details On Suspect Guy Bartkus

May 19, 2025

The Palm Springs Fertility Clinic Bombing Key Details On Suspect Guy Bartkus

May 19, 2025