Investment Strategies For A 270MWh BESS In The Belgian Merchant Market

Table of Contents

Understanding the Belgian Merchant Market Landscape

The success of any BESS investment hinges on a deep understanding of the market it operates in. This section will analyze the regulatory framework and market dynamics specific to Belgium.

Regulatory Framework and Incentives

Belgium's regulatory landscape for energy storage is constantly evolving. Understanding the rules is crucial for successful BESS deployment. Key aspects to consider include:

- Grid connection procedures: Navigating the complex process of connecting a 270MWh BESS to the Belgian grid is paramount. This involves obtaining necessary permits and adhering to technical specifications. Costs associated with grid connection must be factored into your financial model.

- Government incentives and support schemes: The Belgian government may offer various incentives for renewable energy projects, including BESS deployments. Researching and securing these incentives can significantly enhance the project's profitability. These could include tax breaks, subsidies, or feed-in tariffs.

- Environmental regulations and permits: Obtaining the necessary environmental permits and complying with relevant regulations is crucial for the project's approval and operation.

Key Regulatory Considerations for BESS Investors in Belgium:

- Compliance with Elia (the Belgian transmission system operator) grid codes.

- Obtaining necessary permits from regional and federal authorities.

- Understanding and complying with safety regulations for energy storage systems.

Market Dynamics and Price Volatility

The Belgian electricity market exhibits price volatility influenced by factors like renewable energy generation, seasonal demand fluctuations, and overall European energy market dynamics.

- Historical and projected price volatility: Analyzing historical price data and forecasting future price trends is vital for effective arbitrage strategies. This involves understanding the interplay between supply and demand, particularly during peak hours.

- Peak demand periods and arbitrage opportunities: Identifying periods of high electricity prices allows for profitable arbitrage—charging the BESS during low-price periods and discharging during peak periods.

- Impact of renewable energy penetration: The increasing share of intermittent renewable energy sources impacts electricity price volatility, creating both challenges and opportunities for BESS deployment.

Key Characteristics of the Belgian Electricity Market:

- High penetration of renewable energy sources (wind and solar).

- Participation in the European electricity market.

- Relatively high electricity prices compared to some neighboring countries.

Optimizing Revenue Streams for your 270MWh BESS

A 270MWh BESS offers multiple revenue streams beyond simple arbitrage. Optimizing these streams is key to maximizing your return on investment (ROI).

Frequency Regulation and Ancillary Services

BESS plays a crucial role in maintaining grid stability by providing frequency regulation services. Participation in these markets generates additional revenue.

- Revenue generation: Elia's ancillary services market offers opportunities to provide frequency regulation, voltage control, and other grid support services, generating predictable revenue streams.

- Technical requirements and operational considerations: Meeting the stringent technical requirements for frequency regulation necessitates careful system design and control strategies.

- Benefits and challenges: The benefits include stable, predictable income. Challenges include the need for sophisticated control systems and fast response times.

Benefits and Challenges of Participating in Ancillary Services:

- Benefits: Stable, predictable income; improved grid stability; enhanced project value.

- Challenges: Strict technical requirements; need for sophisticated control systems; potential for penalties for non-compliance.

Energy Arbitrage and Peak Shaving

Arbitrage exploits price differences between periods of low and high electricity demand. A 270MWh BESS is well-suited for this.

- Profit margin analysis: Detailed modeling is required to estimate profit margins based on historical and projected price differentials. This involves considering charging and discharging efficiencies.

- Accurate forecasting and market timing: Accurate forecasting of electricity prices is essential for successful arbitrage. Sophisticated market forecasting models and real-time price monitoring are crucial.

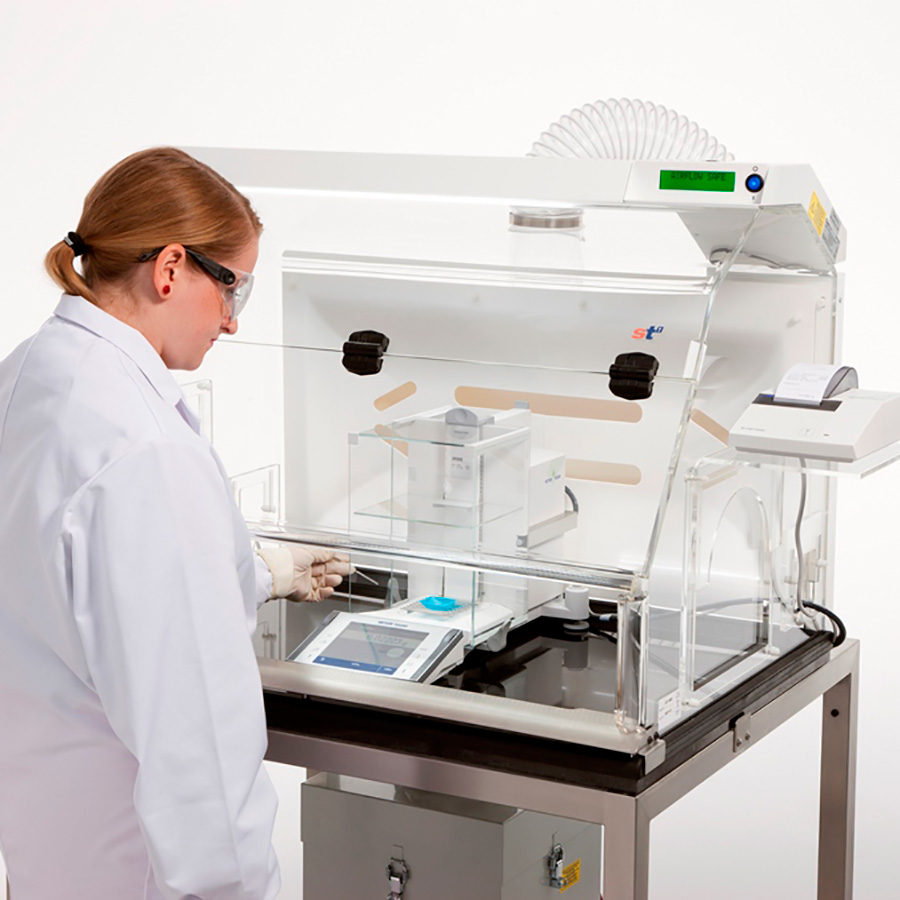

- Technical and logistical aspects: Efficient charging and discharging management, battery cycle life considerations, and power electronic converter efficiency are critical.

Technical and Logistical Aspects of Arbitrage:

- Real-time market data acquisition and analysis.

- Sophisticated battery management systems (BMS).

- Efficient power conversion technology.

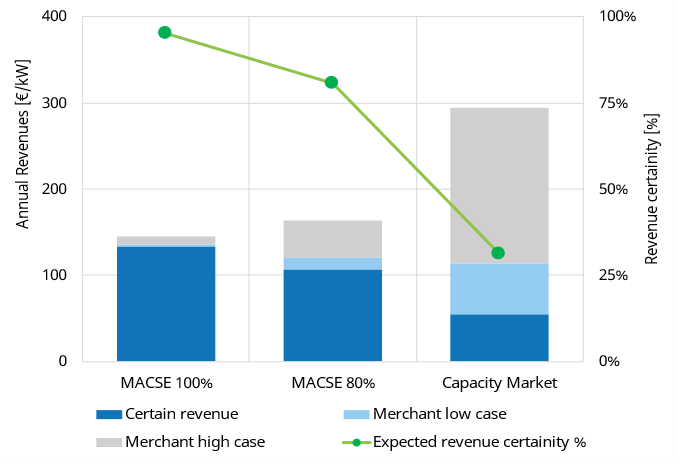

Capacity Market Participation

Belgium's capacity market aims to ensure sufficient electricity generation capacity to meet peak demand. BESS can provide this capacity.

- Revenue streams: Participating in the capacity market provides predictable revenue based on the capacity provided. This revenue stream complements arbitrage and frequency regulation income.

- Eligibility criteria and market rules: Understanding the eligibility criteria for BESS participation and the rules governing the capacity market is critical.

- Potential benefits and risks: While the capacity market offers predictable revenue, it's crucial to assess the risks associated with market changes and regulatory adjustments.

Potential Benefits and Risks of Capacity Market Participation:

- Benefits: Predictable revenue; improved project financeability.

- Risks: Changes in market rules; potential for reduced payments due to market oversupply.

Financial Modeling and Risk Assessment for BESS Investment

A robust financial model and thorough risk assessment are crucial for a successful BESS investment.

Developing a Comprehensive Financial Model

A detailed financial model is essential to assess the project’s viability.

- Projecting ROI: The model should include all relevant costs (capital expenditure, operating expenses, maintenance) and revenue streams (arbitrage, frequency regulation, capacity market).

- Sensitivity analysis: Conducting sensitivity analyses helps to understand the impact of various factors (electricity price volatility, battery degradation) on the project's profitability.

- Key parameters for financial modeling: Discount rate, inflation rate, battery lifespan, degradation rate, and operational and maintenance costs.

Key Parameters for Financial Modeling:

- Capital expenditure (CAPEX).

- Operating expenditure (OPEX).

- Revenue streams from arbitrage, frequency regulation, and capacity market participation.

- Battery degradation rate and lifespan.

- Discount rate and inflation rate.

Mitigating Risks Associated with BESS Investment

Several risks are associated with BESS investments, and mitigation strategies are essential.

- Technological failure: Risk mitigation strategies include selecting reputable technology providers, implementing robust maintenance programs, and procuring insurance.

- Market volatility: Hedging strategies can mitigate the impact of electricity price fluctuations. Diversifying revenue streams also reduces reliance on a single source of income.

- Regulatory changes: Staying informed about regulatory developments and adapting the investment strategy accordingly is crucial.

- Due diligence: Thorough due diligence, involving legal and technical expertise, is paramount.

Key Risk Mitigation Strategies:

- Diversification of revenue streams.

- Robust maintenance programs.

- Comprehensive insurance coverage.

- Regular monitoring and performance optimization.

Conclusion

Investing in a 270MWh BESS in the Belgian merchant market presents substantial opportunities for high returns. However, success requires a well-defined strategy that considers the complexities of the energy market. By effectively leveraging multiple revenue streams—frequency regulation, energy arbitrage, and potential capacity market participation—and by implementing robust risk management strategies, investors can maximize the return on their investment. Conduct thorough due diligence, build a comprehensive financial model, and remain informed about the constantly evolving regulatory landscape to ensure the success of your 270MWh BESS project in the dynamic Belgian energy market. Start planning your Belgian Merchant Market BESS investment today!

Featured Posts

-

Dope Girls Review Cocaine Electronica And Glamour In A Wwi Drama

May 04, 2025

Dope Girls Review Cocaine Electronica And Glamour In A Wwi Drama

May 04, 2025 -

Lizzos Trainer Shaun T On Ozempic Claims Annoying

May 04, 2025

Lizzos Trainer Shaun T On Ozempic Claims Annoying

May 04, 2025 -

Cocaines Global Surge The Role Of Potent Powder And Narco Sub Networks

May 04, 2025

Cocaines Global Surge The Role Of Potent Powder And Narco Sub Networks

May 04, 2025 -

45 000 Rare Book A Bookstores Unexpected Find

May 04, 2025

45 000 Rare Book A Bookstores Unexpected Find

May 04, 2025 -

Nhl Standings Who Will Claim The Western Conference Wild Card Spots

May 04, 2025

Nhl Standings Who Will Claim The Western Conference Wild Card Spots

May 04, 2025

Latest Posts

-

Eurovision Song Contest 2024 Deutschlands Kandidat Fuer Den Esc 2025

May 04, 2025

Eurovision Song Contest 2024 Deutschlands Kandidat Fuer Den Esc 2025

May 04, 2025 -

Eurovision 2024 Wer Singt Fuer Deutschland Beim Esc 2025

May 04, 2025

Eurovision 2024 Wer Singt Fuer Deutschland Beim Esc 2025

May 04, 2025 -

Abor And Tynna Das Wiener Duo Singt Fuer Deutschland Beim Esc

May 04, 2025

Abor And Tynna Das Wiener Duo Singt Fuer Deutschland Beim Esc

May 04, 2025 -

Esc 2024 Abor And Tynna Wiener Duo Vertritt Deutschland

May 04, 2025

Esc 2024 Abor And Tynna Wiener Duo Vertritt Deutschland

May 04, 2025 -

Chefsache Esc 2025 Deutschland Praesentiert Sonderausgabe

May 04, 2025

Chefsache Esc 2025 Deutschland Praesentiert Sonderausgabe

May 04, 2025