Investor Concerns About High Stock Market Valuations: A BofA Response

Table of Contents

BofA's Assessment of Current Market Valuations

Bank of America's stance on current market valuations is nuanced. While acknowledging the elevated price levels compared to historical averages, they don't necessarily declare the market as definitively "overvalued." Their assessment is more cautious than outright alarmist. Instead, they emphasize the need for careful consideration of various factors before reaching a conclusion.

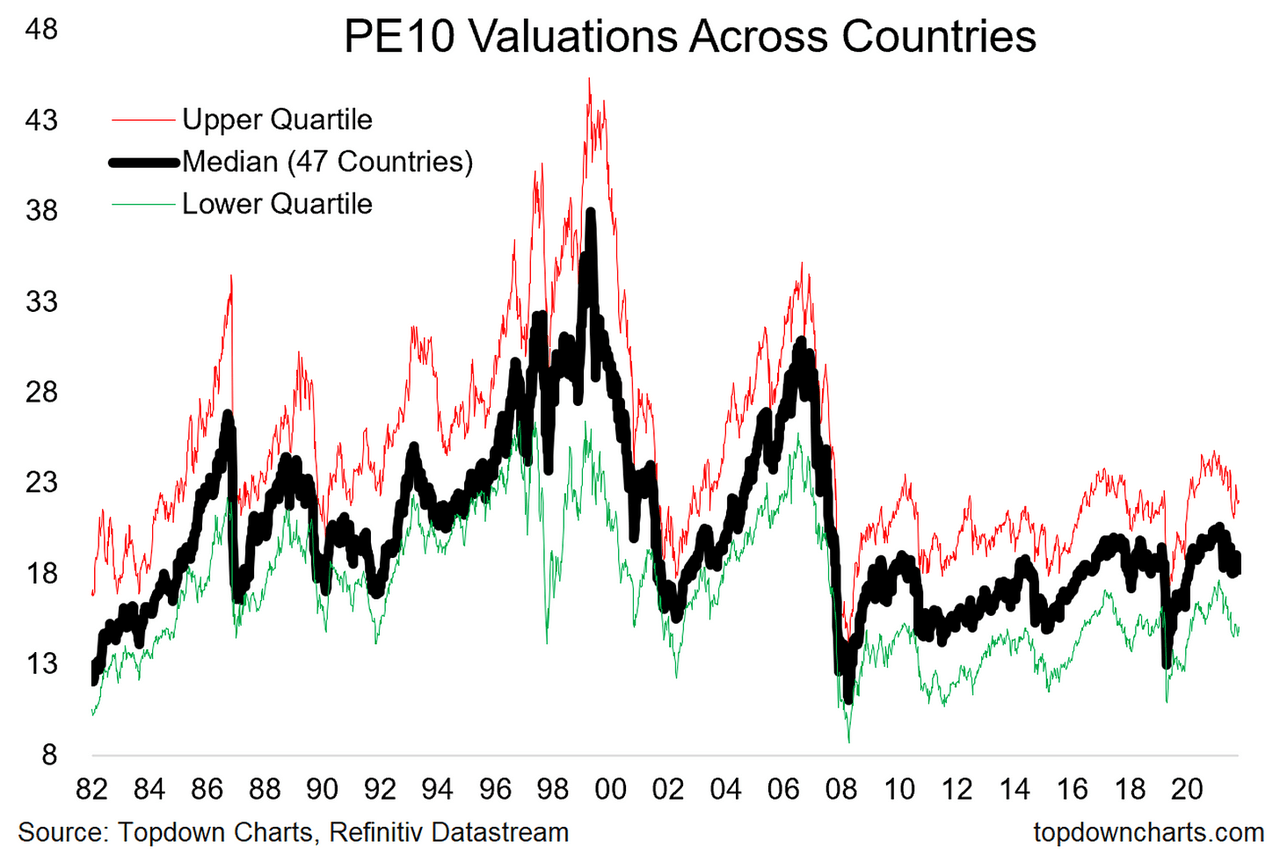

- Specific Metrics: BofA utilizes a range of metrics to assess valuation, including the price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various discounted cash flow models. They also consider sector-specific valuations and compare them against historical data.

- BofA's Analysis: Their analysis involves comparing current valuation metrics to historical averages and considering the current economic climate. They acknowledge that some sectors may be overvalued while others remain attractively priced. They highlight the influence of low interest rates and strong corporate earnings on these metrics.

- Comparison to Historical Valuations: BofA's reports often include comparisons to past market cycles, noting that while valuations are high relative to some historical periods, they are not unprecedented. This historical context helps to temper immediate reactions to high valuations.

Factors Contributing to High Stock Market Valuations (According to BofA)

BofA attributes the elevated stock market valuations to a confluence of factors:

- Low Interest Rates: Exceptionally low interest rates globally have pushed investors toward higher-yielding assets, including equities. This increased demand has driven up stock prices. The low cost of borrowing also encourages companies to invest and expand, further boosting earnings.

- Strong Corporate Earnings and Profit Growth: Many companies have reported robust earnings growth in recent years, supporting higher valuations. This positive performance fuels investor confidence and justifies higher price-to-earnings ratios.

- Technological Innovation and Growth Sectors: The rapid growth of technology and related sectors has attracted significant investment, leading to premium valuations for companies in these areas. Investors are willing to pay more for companies perceived to have high future growth potential.

- Inflationary Pressures: While inflation can negatively impact valuations, in some instances, it can also lead to higher corporate pricing power, boosting profit margins and subsequently stock prices. BofA's analysis accounts for the complex interaction between inflation and market valuations.

BofA's Recommendations for Investors

BofA's advice to investors navigating these high valuations isn't a blanket "sell" recommendation. Instead, they advocate for a strategic and cautious approach.

- Suggested Portfolio Adjustments: They suggest diversification across various sectors and asset classes to mitigate risk. This includes considering alternative investments and carefully assessing sector-specific valuations.

- Strategies for Mitigating Risk: BofA emphasizes the importance of risk management, including carefully considering individual risk tolerance and investment time horizons. They may recommend strategies like dollar-cost averaging to reduce the impact of market volatility.

- Investment Opportunities: While acknowledging potential overvaluation in some areas, BofA highlights specific sectors or companies that they believe offer attractive investment opportunities despite the overall market conditions. They often emphasize value investing and companies with strong fundamentals.

Addressing Specific Investor Concerns

Many investors are anxious about the potential for a market correction or even a bubble burst. BofA addresses these concerns:

- Addressing the Risk of a Market Correction: BofA acknowledges the risk of a market correction but emphasizes that corrections are a normal part of market cycles. They advise against panic selling and suggest focusing on long-term investment strategies.

- Analyzing the Potential for a Bubble Burst: BofA's analysts carefully analyze the potential for a bubble, assessing the underlying fundamentals and comparing current conditions to historical bubbles. They typically highlight the differences and caution against making direct comparisons.

- Discussing Alternative Investment Strategies: They might suggest alternative investments, such as bonds or real estate, to diversify portfolios and reduce reliance on potentially overvalued equity markets.

Conclusion

BofA's response to investor concerns about high stock market valuations is multifaceted. They acknowledge the elevated valuations but avoid making sweeping pronouncements of an impending crash. Instead, their recommendations emphasize strategic diversification, risk management, and a focus on long-term investment goals. Understanding BofA's nuanced perspective on the current market environment is crucial for making informed investment decisions. Stay informed about market trends and consult with a financial advisor to develop a personalized investment strategy that addresses your individual risk tolerance and concerns about high stock market valuations.

Featured Posts

-

Eurovision Song Contest 2025 Venue Dates And Key Information

May 19, 2025

Eurovision Song Contest 2025 Venue Dates And Key Information

May 19, 2025 -

Kibris Ta Stefanos Stefanu Nun Rolue Baris Icin Bir Firsat Mi

May 19, 2025

Kibris Ta Stefanos Stefanu Nun Rolue Baris Icin Bir Firsat Mi

May 19, 2025 -

Credit Mutuel Am Comprendre Les Resultats Du 4eme Trimestre 2024

May 19, 2025

Credit Mutuel Am Comprendre Les Resultats Du 4eme Trimestre 2024

May 19, 2025 -

Retirement Announcement 5 Time Grammy Nominees Final Show In May Amidst Health Challenges

May 19, 2025

Retirement Announcement 5 Time Grammy Nominees Final Show In May Amidst Health Challenges

May 19, 2025 -

El Mundo Del Tenis Lamenta La Muerte De Manuel Orantes

May 19, 2025

El Mundo Del Tenis Lamenta La Muerte De Manuel Orantes

May 19, 2025