Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Market Valuations

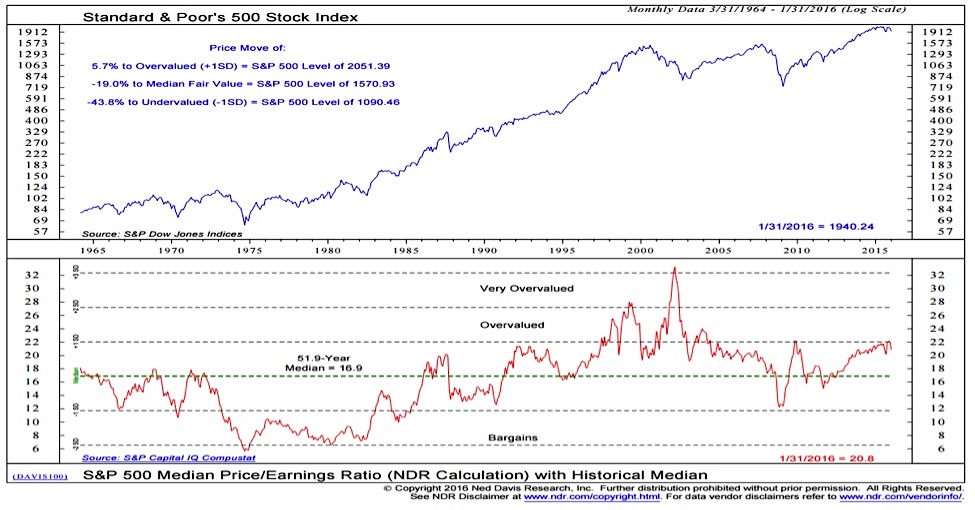

BofA's analysis of current stock market valuations incorporates several key stock valuation metrics. They examine traditional measures like the Price-to-Earnings Ratio (P/E) and the more cyclically adjusted Shiller PE ratio (CAPE), along with assessments of market capitalization across various sectors. Their market analysis considers not just current valuations but also the potential for future earnings growth to justify those valuations.

- BofA's view on whether current valuations are justified by earnings growth potential: BofA's analysts likely weigh the current P/E ratios against projected earnings growth rates. A high P/E ratio might be acceptable if future earnings are expected to grow significantly, justifying the current high price. However, if earnings growth projections are more modest, the high valuations might be viewed as unsustainable.

- Comparison of current valuations to historical averages and potential implications: Historical data provides context. BofA likely compares current valuation metrics to long-term historical averages. Significantly higher-than-average valuations may signal an overvalued market, raising concerns about a potential correction or downturn.

- Mention any specific sectors BofA identifies as overvalued or undervalued: BofA's analysis probably dissects valuations across various market sectors. Some sectors might appear overvalued relative to their growth prospects, while others might present better value opportunities. This sectoral analysis is crucial for investors building diversified portfolios.

- Inclusion of relevant charts and graphs illustrating BofA's findings (if available): Visual representations of BofA's findings – such as charts comparing current P/E ratios to historical averages or graphs showing valuation dispersion across sectors – would strengthen their analysis and make it more accessible to investors. (Note: Actual BofA charts would need to be sourced separately).

Identifying Key Risks Contributing to Investor Anxiety

Several factors fuel investor anxiety regarding high stock valuations. These include macroeconomic conditions and geopolitical events.

- The impact of inflation on corporate earnings and stock prices: High inflation erodes corporate profit margins, impacting earnings growth and potentially putting downward pressure on stock prices. BofA likely assesses the inflation outlook and its impact on different company sectors.

- Analysis of the Federal Reserve's monetary policy and its potential influence on valuations: The Federal Reserve's actions (interest rate hikes, quantitative tightening) significantly impact stock valuations. BofA's analysis probably incorporates projections of future Fed policy and its potential effects on market liquidity and investor sentiment.

- The role of geopolitical uncertainty and its effect on market sentiment: Geopolitical events (wars, trade disputes) create uncertainty, impacting investor confidence and potentially leading to market volatility. BofA's assessment likely considers the impact of current global uncertainties.

- Discussion of recession risks and their potential impact on stock valuations: The risk of a recession is a major factor influencing investor decisions. BofA probably assesses the likelihood of a recession and its potential consequences for corporate earnings and stock valuations.

BofA's Strategic Recommendations for Investors

Navigating the current market requires a well-defined investment strategy. BofA likely recommends a cautious yet opportunistic approach.

- Suggestions for portfolio diversification strategies to mitigate risk: Diversification across asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk. BofA probably advocates for a diversified portfolio to weather market downturns.

- Advice on managing risk exposure in a volatile market: In a volatile market, risk management is crucial. BofA likely advises investors to assess their risk tolerance and adjust their portfolios accordingly, potentially reducing exposure to high-risk assets.

- Emphasis on a long-term investment horizon and avoiding short-term market timing: BofA probably stresses the importance of a long-term investment strategy, discouraging short-term market timing attempts which often fail.

- Recommendations regarding specific sectors or asset classes to consider: Based on their valuation analysis, BofA may recommend specific sectors or asset classes they deem relatively undervalued or less vulnerable to market downturns.

- Potential strategies for defensive investing during periods of uncertainty: Defensive investing strategies focus on preserving capital during uncertain times. This might involve investing in low-volatility stocks or increasing holdings in government bonds.

Alternative Perspectives and Counterarguments

While BofA's concerns are valid, it's important to consider alternative viewpoints.

- Arguments supporting the continued growth of the market: Proponents of continued market growth may highlight factors like technological advancements driving productivity and long-term earnings growth.

- Discussion of the potential for sustained earnings growth in specific sectors: Certain sectors might exhibit stronger growth potential, even in a slowing economy. These could be identified as attractive investment opportunities.

- Mentioning positive economic indicators that could counter recessionary fears: Positive economic indicators (strong employment data, robust consumer spending) might temper recessionary fears and support market optimism.

Conclusion

This article examined Bank of America's (BofA) assessment of investor concerns surrounding high stock market valuations. BofA's analysis considered key valuation metrics, identified significant risks like inflation and geopolitical uncertainty, and offered strategic recommendations for investors, including portfolio diversification and a long-term investment approach. While acknowledging concerns, the analysis also highlighted potential counterarguments for continued market growth.

Understanding investor concerns about high stock market valuations is crucial for making informed investment decisions. Continue your research into BofA's analysis and consult with a financial advisor to develop a robust investment strategy that addresses your individual risk tolerance and financial goals. Stay informed about the latest market trends and assess your portfolio's exposure to high valuations.

Featured Posts

-

Cavaliers Le Vert Free Agency Concerns A Report

May 07, 2025

Cavaliers Le Vert Free Agency Concerns A Report

May 07, 2025 -

Nhl 25s Arcade Mode A Deep Dive Into This Weeks Release

May 07, 2025

Nhl 25s Arcade Mode A Deep Dive Into This Weeks Release

May 07, 2025 -

The Papal Conclave History Process And Significance

May 07, 2025

The Papal Conclave History Process And Significance

May 07, 2025 -

Data Vykhoda 7 Sezona Seriala Chernoe Zerkalo Vse Chto My Znaem

May 07, 2025

Data Vykhoda 7 Sezona Seriala Chernoe Zerkalo Vse Chto My Znaem

May 07, 2025 -

Papal Conclave Explained How The Next Pope Is Chosen

May 07, 2025

Papal Conclave Explained How The Next Pope Is Chosen

May 07, 2025

Latest Posts

-

Klubo Rekordas Pakartotas Nba Lyderiu Istorinis Pasirodymas

May 07, 2025

Klubo Rekordas Pakartotas Nba Lyderiu Istorinis Pasirodymas

May 07, 2025 -

Istorinis Pasiekimas Nba Lyderiai Pakartoja Klubo Rekorda

May 07, 2025

Istorinis Pasiekimas Nba Lyderiai Pakartoja Klubo Rekorda

May 07, 2025 -

Nba Lyderiai Pakartojo Klubo Rekorda Zaisdami Istoriniu Ritmu

May 07, 2025

Nba Lyderiai Pakartojo Klubo Rekorda Zaisdami Istoriniu Ritmu

May 07, 2025 -

The White Lotus Season 3 Debunking The Ke Huy Quan Kenny Cameo Rumors

May 07, 2025

The White Lotus Season 3 Debunking The Ke Huy Quan Kenny Cameo Rumors

May 07, 2025 -

Support The Cavs And Local Charities New Ticket Donation System

May 07, 2025

Support The Cavs And Local Charities New Ticket Donation System

May 07, 2025