Investor Concerns: Why Scholar Rock Stock Fell On Monday

Table of Contents

H2: Negative Clinical Trial Data as a Catalyst for the Stock Drop

The primary catalyst for Monday's Scholar Rock stock decline was undoubtedly the release of disappointing clinical trial data. Specifically, the phase 2 trial for SRK-015, a key drug candidate in Scholar Rock's pipeline, failed to meet its primary endpoints. This negative clinical trial result sent shockwaves through the market, significantly impacting investor confidence.

- Specific details of the trial results: The trial failed to demonstrate statistically significant improvement in the targeted metric, a crucial measure of the drug's efficacy. This lack of efficacy raises serious concerns about SRK-015's potential for future success.

- Safety concerns: While no major safety concerns were explicitly reported, the absence of efficacy significantly diminishes the drug's overall profile and potential market viability. Further investigation into the safety profile will be crucial in determining future development plans.

- Comparison to expectations: Prior to the results announcement, analysts and investors had expressed optimism regarding SRK-015's potential. The stark contrast between expectations and the actual results triggered a wave of selling pressure.

- Impact on investor confidence: The negative clinical trial results eroded investor confidence in Scholar Rock's ability to deliver on its promises, leading to the significant drop in stock price. This setback casts a shadow over the company's short-term prospects and its overall value proposition.

H2: Broader Market Sentiment and Biotech Sector Weakness

The decline in Scholar Rock stock wasn't solely attributable to the negative clinical trial data. The broader market context played a significant role. The biotech sector, as a whole, has experienced increased volatility and a general downturn in recent months. This negative market sentiment amplified the impact of Scholar Rock's news.

- Biotech market downturn: The biotech sector is known for its inherent risk and volatility. Recent macroeconomic factors, such as interest rate hikes and inflation, have exacerbated the risk-averse sentiment among investors, leading to sell-offs across the board.

- Macroeconomic factors: The prevailing macroeconomic conditions created a climate of uncertainty, contributing to a negative investor outlook. Risk-averse investors are less likely to hold onto speculative biotech stocks during periods of economic uncertainty.

- Exacerbated impact: The negative sentiment in the broader biotech market served to magnify the impact of Scholar Rock's disappointing clinical trial results. What might have been a smaller dip in other market conditions resulted in a more substantial drop.

- Other biotech sell-offs: The sell-off in Scholar Rock stock wasn't an isolated event. Other biotech companies also experienced price declines around the same time, suggesting a wider trend of investor caution in the sector.

H3: Analyst Downgrades and Target Price Reductions

Following the release of the negative clinical trial data, several analysts downgraded their rating for Scholar Rock stock and significantly reduced their target prices. These actions further fueled the decline.

- Analyst rating changes: Several prominent investment firms issued sell ratings or reduced their ratings on SRRK stock. This reflected their diminished confidence in the company's future prospects.

- Target price reductions: Target price reductions reflected the decreased valuation of Scholar Rock in the wake of the disappointing clinical trial results. The magnitude of these reductions underscored the severity of the situation.

- Impact on investor confidence: Analyst downgrades significantly impact investor confidence. These actions often trigger further sell-offs as investors follow the lead of established experts in the field.

H2: Potential Long-Term Implications and Future Outlook for Scholar Rock Stock

While the recent decline in Scholar Rock stock is certainly concerning, it's crucial to assess the long-term implications and future prospects of the company. The immediate future will depend heavily on Scholar Rock's management's response, its financial strength, and the performance of its remaining pipeline drugs.

- Pipeline beyond SRK-015: Scholar Rock has other drug candidates in its pipeline. The success or failure of these programs will be critical in determining the company's long-term viability.

- Financial strength: Scholar Rock's financial position and ability to withstand this setback will play a critical role in its recovery trajectory. A strong financial position can provide the resources needed to continue development efforts.

- Management response and future plans: The company's response to the negative clinical trial results—its communication, strategic adjustments, and future plans—will heavily influence investor sentiment.

- Potential recovery: A clear roadmap for recovery, outlining new strategies and focusing on its remaining pipeline, will be critical in regaining investor confidence and potentially reversing the current trend.

3. Conclusion:

The significant drop in Scholar Rock stock on Monday was a multifaceted event driven by a confluence of factors: negative clinical trial data for SRK-015, a prevailing negative sentiment within the broader biotech sector, and subsequent analyst downgrades and target price reductions. The interplay of these factors created a perfect storm resulting in a substantial decline.

While the recent decline in Scholar Rock stock is undeniably concerning, understanding the reasons behind it empowers investors to make informed decisions. Continue monitoring Scholar Rock's progress, carefully analyzing future clinical trial results for remaining pipeline drugs, and diligently reviewing analyst reports for updates to gauge the long-term prospects of this Scholar Rock stock. Staying informed is crucial for navigating the volatility inherent in the biotech market. Careful consideration and long-term investment strategies will be vital for investors in this dynamic sector.

Featured Posts

-

Nba Injury Report Thunder Vs Pacers March 29th Game

May 08, 2025

Nba Injury Report Thunder Vs Pacers March 29th Game

May 08, 2025 -

Dc Comics Batman Gets A Revamp New Series And Suit

May 08, 2025

Dc Comics Batman Gets A Revamp New Series And Suit

May 08, 2025 -

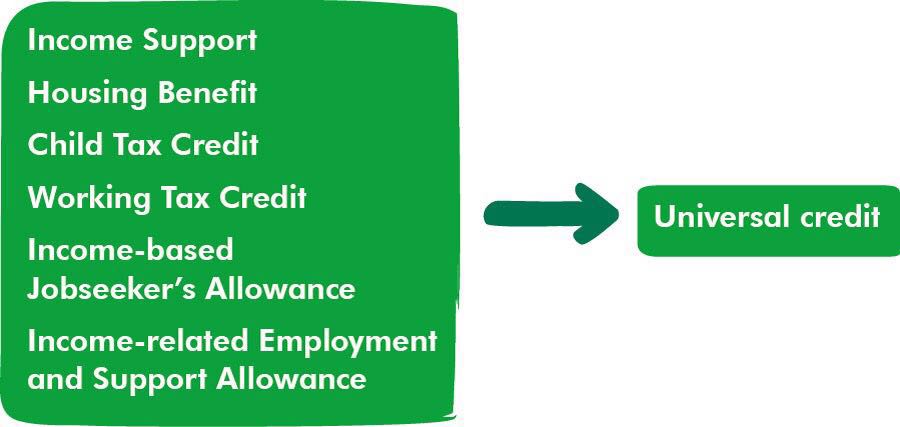

Two Benefits Ending Soon Dwp Announces Final Payments

May 08, 2025

Two Benefits Ending Soon Dwp Announces Final Payments

May 08, 2025 -

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025 -

New Batman 1 Dc Comics Unveils Rebooted Dark Knight

May 08, 2025

New Batman 1 Dc Comics Unveils Rebooted Dark Knight

May 08, 2025