Investor Guide: BofA's Assessment Of Current Stock Market Valuations

Table of Contents

BofA's Overall Market Outlook

BofA's recent reports generally present a cautiously optimistic, or neutral, outlook on the current market. While acknowledging persistent economic headwinds, they haven't issued a strongly bearish prediction. Their assessment is nuanced, factoring in several key variables.

- Short-Term Prediction: BofA generally forecasts moderate growth in the short term, but with increased volatility due to factors like inflation and interest rate adjustments.

- Long-Term Prediction: The long-term outlook is more positive, projecting sustained, albeit potentially slower, growth driven by technological advancements and ongoing global economic recovery.

- Favorable Sectors: BofA often highlights sectors like healthcare and select segments of the technology sector as potentially offering better value and growth opportunities.

- Unfavorable Sectors: Sectors heavily reliant on consumer discretionary spending or facing significant regulatory hurdles might be viewed less favorably, with valuations potentially needing further adjustment.

- Key Economic Indicators: Inflation rates, interest rate changes implemented by central banks (like the Federal Reserve), and geopolitical stability are among the key economic indicators influencing BofA's overall market assessment and equity valuation analysis. A rise in inflation, for instance, generally leads to higher interest rates, potentially cooling down the market.

Key Valuation Metrics Used by BofA

BofA, like other major financial institutions, utilizes various valuation metrics to assess the current market conditions and determine whether stocks are appropriately priced. They typically rely on a combination of these metrics to arrive at a comprehensive valuation.

- Price-to-Earnings Ratio (P/E): This metric compares a company's stock price to its earnings per share. A high P/E ratio suggests that the market is willing to pay a premium for the company's earnings, potentially indicating overvaluation. BofA analyzes the P/E ratios across different sectors to identify potential overvaluation or undervaluation.

- Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's particularly useful for evaluating companies with negative earnings or those in high-growth sectors. A high P/S ratio can indicate potential overvaluation.

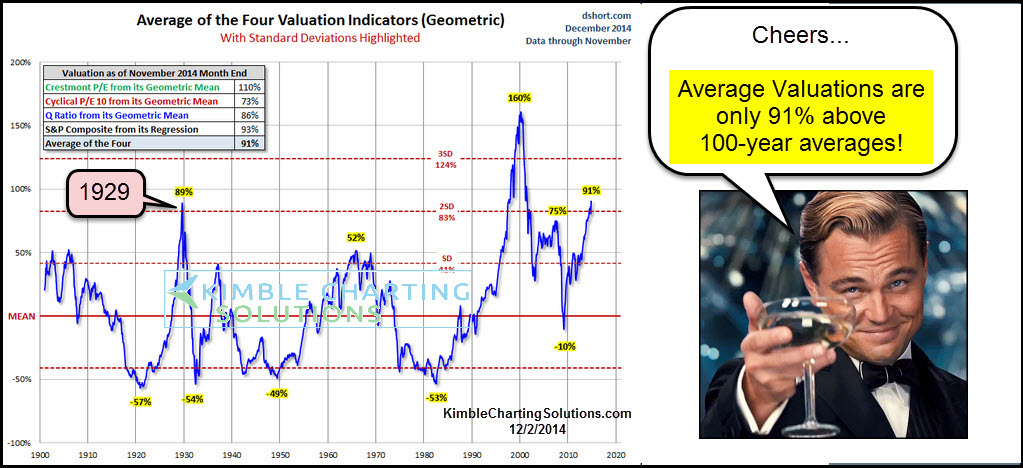

- Cyclically Adjusted Price-to-Earnings Ratio (CAPE): This metric adjusts the P/E ratio to account for cyclical variations in earnings, providing a smoother measure of valuation over the long term. BofA often uses this metric to compare current market valuations to historical averages.

BofA uses these metrics, comparing current levels to historical averages and considering industry benchmarks, to form its conclusions on overall market valuation and identify potential investment opportunities based on their equity valuation model.

BofA's Assessment of Specific Sectors

BofA's analysis extends to individual sectors, offering granular insights into their respective valuations and growth prospects. Their assessments are dynamic, reflecting changes in economic conditions and specific company performance.

- Overvalued Sectors: BofA may identify sectors where valuations are perceived as exceeding intrinsic value, potentially signaling caution to investors.

- Undervalued Sectors: Conversely, sectors trading at a discount relative to their fundamentals may be highlighted as potential investment opportunities.

- Reasons for Assessment: The reasons behind BofA's assessments typically include factors such as industry-specific growth rates, competitive landscapes, regulatory changes, and macroeconomic influences.

Technology Sector Valuation

The technology sector frequently receives detailed scrutiny from BofA due to its significant market capitalization and dynamic nature.

- Specific Companies: BofA's reports often cite specific technology companies, discussing their individual valuations based on the aforementioned metrics.

- Growth Predictions: The predictions for future growth within the technology sector consider advancements in artificial intelligence, cloud computing, and other key technological trends. However, growth projections are often tempered by concerns about competition and potential economic slowdown.

- Risks and Opportunities: Risks such as increased regulatory scrutiny, potential supply chain disruptions, and valuation multiples are frequently discussed alongside opportunities presented by emerging technologies and market consolidation.

Implications for Investors

BofA's market analysis has significant implications for investor strategies.

- Portfolio Adjustments: Based on their findings, BofA might suggest shifting allocations between different sectors or asset classes to optimize risk-adjusted returns.

- Risk Management Strategies: In volatile markets, BofA may advise employing risk mitigation techniques like diversification, hedging, or adopting a more conservative investment approach.

- Diversification Recommendations: Maintaining a well-diversified portfolio across various sectors and asset classes is almost always advocated to reduce overall portfolio risk and enhance returns.

Conclusion

This investor guide summarizes BofA's key findings regarding current stock market valuations, highlighting their overall market outlook and sector-specific assessments. Their analysis emphasizes the importance of understanding these valuations for making informed investment choices. While BofA’s cautiously optimistic outlook offers some guidance, remember that this is just one perspective. Conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions based on this or any other single market analysis. Continue to stay informed about BofA’s future reports and analysis on stock market valuations to adapt your investment strategy accordingly.

Featured Posts

-

En Vivo Uruguay Vs Colombia Sub 20 Minuto A Minuto Del Partido

May 12, 2025

En Vivo Uruguay Vs Colombia Sub 20 Minuto A Minuto Del Partido

May 12, 2025 -

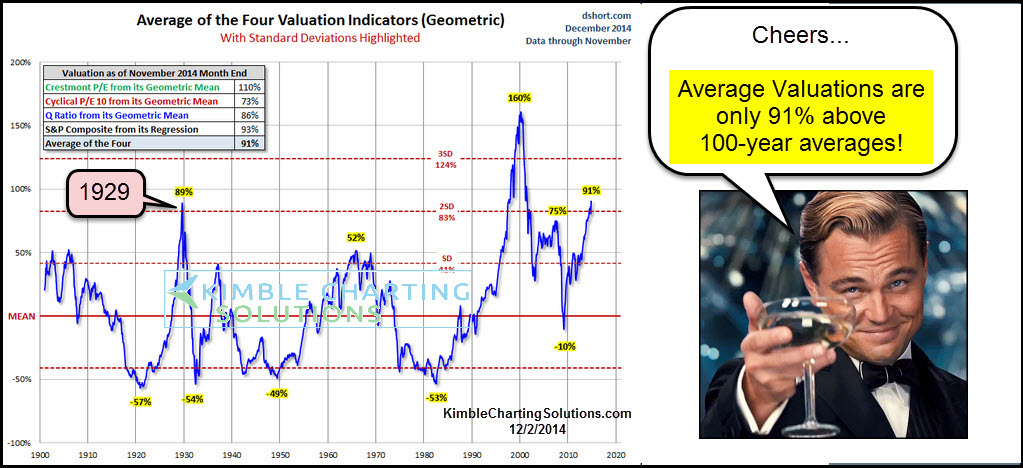

Is Black Gold Within Reach Analyzing Uruguays Offshore Drilling Prospects

May 12, 2025

Is Black Gold Within Reach Analyzing Uruguays Offshore Drilling Prospects

May 12, 2025 -

Conor Mc Gregors Bkfc Jose Aldo Press Conference Recreation

May 12, 2025

Conor Mc Gregors Bkfc Jose Aldo Press Conference Recreation

May 12, 2025 -

Flights Fun And Adventure Await

May 12, 2025

Flights Fun And Adventure Await

May 12, 2025 -

Activision Blizzard Acquisition Ftc Appeals Judges Ruling

May 12, 2025

Activision Blizzard Acquisition Ftc Appeals Judges Ruling

May 12, 2025