Investor Guide: BofA's View On High Stock Market Valuations

Table of Contents

BofA's Current Stance on High Stock Market Valuations

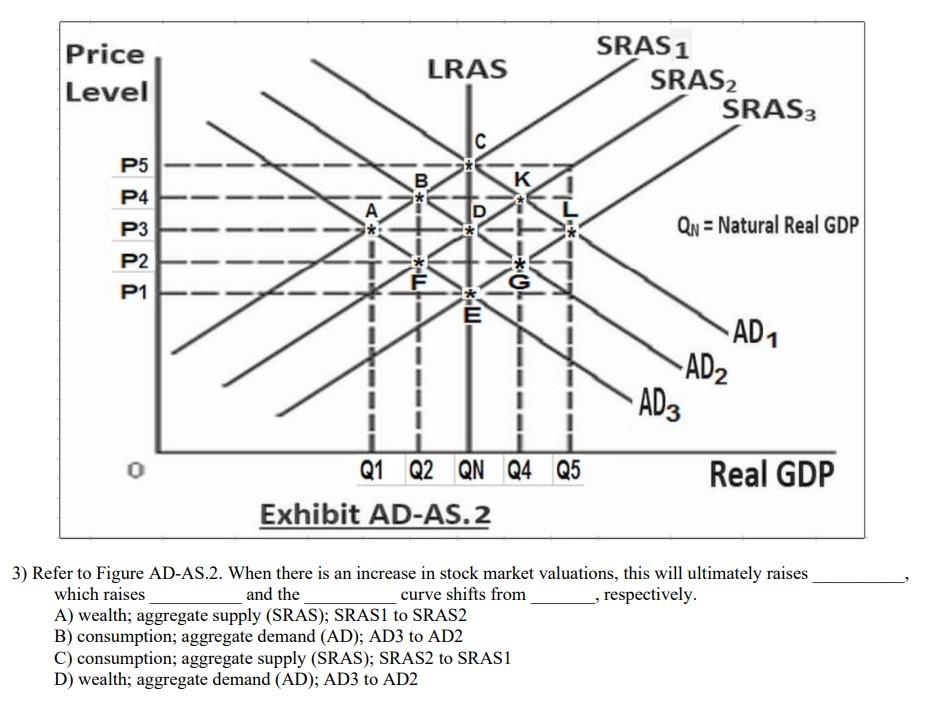

BofA's stance on current high stock market valuations is typically nuanced, shifting based on prevailing economic conditions and market data. While they don't issue blanket "bullish" or "bearish" pronouncements, their analysis often reveals a cautious optimism. Their assessments hinge heavily on their proprietary valuation metrics and forecasts for key economic indicators.

-

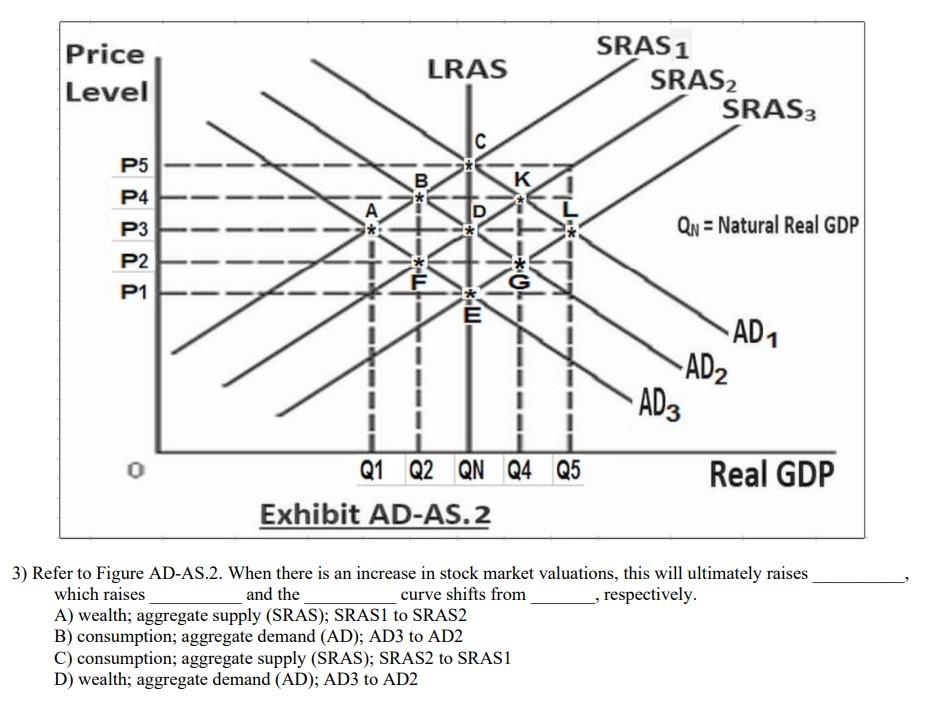

Summary of BofA's valuation metrics: BofA regularly utilizes various metrics to gauge market valuations, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and various sector-specific valuation multiples. Their reports detail how these metrics compare to historical averages, highlighting potential overvaluation or undervaluation in specific sectors. For example, in a recent report (insert date and report title if available), they might have noted that the S&P 500's P/E ratio is above its historical average, suggesting a degree of overvaluation in the broader market.

-

Overvalued and Undervalued Sectors: BofA's analysts often identify sectors they deem overvalued or undervalued, based on their valuation models and forward-looking projections. For example, they might flag the technology sector as potentially overvalued due to high growth expectations, while suggesting that certain value-oriented sectors, like energy or financials, might be relatively undervalued based on their analysis. (Remember to replace this with specific examples from actual BofA reports if available).

-

BofA's Forecasts: BofA's economists and strategists regularly release forecasts on future market performance. These forecasts often factor in their assessment of current valuations. A high valuation might be viewed as a potential headwind to future market returns, implying lower expected returns in their forecast compared to a scenario with lower valuations.

Factors Contributing to High Stock Market Valuations (According to BofA)

BofA attributes current high valuations to a confluence of factors, none of which exist in isolation. Understanding these interconnected forces is crucial for navigating the market successfully.

-

Low Interest Rates: Historically low interest rates, implemented by central banks like the Federal Reserve, have pushed investors towards riskier assets like stocks, seeking higher yields than what bonds can offer. This increased demand for stocks has, in turn, contributed to higher valuations.

-

Strong Corporate Earnings (or Lack Thereof): While strong corporate earnings can support high valuations, BofA's assessment likely incorporates a nuanced view. It considers not just the current profitability of companies, but also the sustainability of such earnings and the degree to which they justify current market prices.

-

Quantitative Easing and Monetary Policies: Extensive quantitative easing (QE) programs, implemented by central banks in response to economic crises, have injected significant liquidity into financial markets. This increased liquidity can drive up asset prices, including stocks, contributing to higher valuations.

-

Investor Sentiment and Market Speculation: Investor psychology plays a crucial role. Periods of exuberance, fueled by optimism and speculation, can drive up asset prices beyond what fundamental analysis might suggest. BofA's analyses often incorporate assessments of investor sentiment to gauge the potential for overvaluation.

BofA's Strategies for Navigating High Stock Market Valuations

BofA's recommendations for navigating high valuations typically emphasize a cautious, strategic approach.

-

Defensive Investing Strategies: BofA might suggest prioritizing value stocks (companies trading below their intrinsic value) or dividend-paying stocks, which offer a steady income stream, as more defensive options in a potentially overvalued market.

-

Sector-Specific Recommendations: Based on their analysis of specific sectors, BofA might recommend overweighting undervalued sectors while underweighting those deemed overvalued. This would involve adjusting your portfolio allocation accordingly.

-

Diversification: Diversification across different asset classes (stocks, bonds, real estate, etc.) remains crucial, particularly in a high-valuation environment. This helps mitigate risk associated with potential market corrections.

-

Cautious Approach and Cash Holdings: BofA might advise maintaining a higher-than-normal cash position in your portfolio, which allows you to take advantage of potential dips in the market or invest when valuations become more attractive.

Risks Associated with High Stock Market Valuations

Investing in a market with high valuations carries inherent risks that BofA highlights in their reports.

-

Market Correction or Crash: High valuations often precede market corrections or crashes. A sudden decline in stock prices can significantly impact your portfolio.

-

Rising Interest Rates: Rising interest rates can negatively affect stock valuations, as higher borrowing costs reduce corporate profitability and make bonds a more attractive investment.

-

Underperformance Relative to Historical Averages: High valuations often lead to lower future returns compared to historical averages. Investors should temper their expectations accordingly.

-

Understanding Your Risk Tolerance: Understanding your own risk tolerance is paramount before making investment decisions, especially in an environment of high stock market valuations.

Conclusion

BofA's view on high stock market valuations emphasizes a cautious approach, incorporating a thorough analysis of valuation metrics, underlying economic factors, and potential risks. Their recommendations often center on diversification, defensive investing strategies, and maintaining a suitable level of cash holdings, reflecting the uncertainty inherent in a market characterized by high valuations. Remember that high stock market valuations are not a guarantee of an imminent crash, but rather a signal to proceed with caution and carefully assess your investment strategy.

Call to Action: Stay informed on the ever-evolving landscape of high stock market valuations. Regularly review BofA's research and analyses, along with other reputable sources, to make well-informed investment decisions. Understanding BofA's perspective on high stock market valuations, and continuously monitoring the market dynamics, is crucial for successful portfolio management and navigating the complexities of the current investment environment. Continue your research and refine your strategy based on the latest market data and expert opinions, including further analysis of high stock market valuations.

Featured Posts

-

Gibonni Na Sajmu Knjiga U Sarajevu Promovisanje Novog Izdanja

May 04, 2025

Gibonni Na Sajmu Knjiga U Sarajevu Promovisanje Novog Izdanja

May 04, 2025 -

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Predictions

May 04, 2025

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Predictions

May 04, 2025 -

Why Fleetwood Macs Albums Remain Popular A Look At Their Bestsellers

May 04, 2025

Why Fleetwood Macs Albums Remain Popular A Look At Their Bestsellers

May 04, 2025 -

Newark Airport Flight Chaos United Airlines Cancellations After Faa Staffing Issue

May 04, 2025

Newark Airport Flight Chaos United Airlines Cancellations After Faa Staffing Issue

May 04, 2025 -

Special Little Bags Finding The Perfect Pocket Sized Companion

May 04, 2025

Special Little Bags Finding The Perfect Pocket Sized Companion

May 04, 2025

Latest Posts

-

Your Guide To Ufc Des Moines Predictions

May 04, 2025

Your Guide To Ufc Des Moines Predictions

May 04, 2025 -

Ufc Des Moines Predictions For The Main Event And Undercard

May 04, 2025

Ufc Des Moines Predictions For The Main Event And Undercard

May 04, 2025 -

May 3rd Ufc Fight Night Figueiredo Vs Sandhagen In Des Moines

May 04, 2025

May 3rd Ufc Fight Night Figueiredo Vs Sandhagen In Des Moines

May 04, 2025 -

Ufc Des Moines Figueiredo And Sandhagen To Clash In May 3rd Main Event

May 04, 2025

Ufc Des Moines Figueiredo And Sandhagen To Clash In May 3rd Main Event

May 04, 2025 -

Ufc Des Moines Fight Night Predictions And Betting Odds

May 04, 2025

Ufc Des Moines Fight Night Predictions And Betting Odds

May 04, 2025