Investor Sentiment: Shopify Stock Benefits From Nasdaq 100 Listing

Table of Contents

The Significance of the Nasdaq 100 Listing for Shopify

The Nasdaq 100 is an index of the 100 largest non-financial companies listed on the Nasdaq Stock Market. Inclusion in this elite group carries significant weight. Being listed on the Nasdaq 100 immediately boosts a company's profile and credibility. It signals to the market that the company has reached a certain level of maturity, stability, and growth potential. This increased visibility is a powerful magnet for institutional investors, who often base their investment decisions on index membership.

- Increased exposure to a broader range of investors: The Nasdaq 100 is tracked by numerous index funds and ETFs, automatically bringing Shopify stock into the portfolios of millions of investors.

- Enhanced credibility and trust among investors: Being part of the Nasdaq 100 instills a sense of confidence and security in potential investors.

- Potential for increased trading volume and liquidity: Inclusion in the index generally leads to higher trading volume, making it easier to buy or sell Shopify stock.

- Inclusion in popular ETFs tracking the Nasdaq 100: This provides passive exposure to Shopify for a vast number of investors who may not actively seek out individual stocks.

Analyzing the Shift in Investor Sentiment Towards Shopify Stock

Before its Nasdaq 100 listing, Shopify stock, while exhibiting strong growth, experienced periods of volatility reflecting broader market trends and investor concerns about its valuation. However, the positive sentiment surrounding the listing itself acted as a powerful catalyst.

- Positive media coverage following the Nasdaq 100 inclusion: The news was widely reported, generating significant positive buzz and attracting attention from both individual and institutional investors.

- Changes in analyst ratings and price targets: Many analysts upgraded their ratings and price targets for Shopify stock following the listing, reflecting increased confidence in the company's future prospects.

- Increased demand from institutional investors: Large institutional investors, often bound by index tracking mandates, were obligated to purchase Shopify stock, driving up demand.

- Impact on options trading activity: The increased interest in Shopify stock led to a surge in options trading activity, further indicating a heightened level of investor engagement.

Factors Influencing Positive Investor Sentiment Beyond the Listing

The positive impact on investor sentiment wasn't solely due to the Nasdaq 100 listing. Shopify’s underlying strength and consistent performance contributed significantly.

- Strong revenue growth and profitability: Shopify has consistently delivered impressive financial results, showcasing strong revenue growth and increasing profitability.

- Innovation in e-commerce technology: The company's continuous innovation in e-commerce technology has maintained its competitive edge and attracted new merchants to its platform.

- Expansion into new markets and customer segments: Shopify's strategic expansion into new markets and customer segments has broadened its revenue streams and reduced its reliance on any single market.

- Successful implementation of new strategies: Shopify has effectively executed new strategies, further boosting its growth trajectory and investor confidence.

Potential Risks and Challenges Affecting Shopify Stock

While the outlook for Shopify stock appears positive, it's crucial to acknowledge potential risks.

- Increased competition in the e-commerce market: The e-commerce landscape is highly competitive, with established players and new entrants constantly vying for market share.

- Economic slowdown or recessionary pressures: An economic downturn could negatively impact consumer spending, reducing demand for Shopify's services.

- Changes in consumer spending habits: Shifts in consumer preferences and spending habits could affect the demand for e-commerce solutions.

- Regulatory changes affecting the e-commerce industry: New regulations or changes to existing regulations could pose challenges to Shopify's operations.

Conclusion: Understanding Investor Sentiment and Shopify's Future

The Nasdaq 100 listing has undeniably had a positive impact on investor sentiment towards Shopify stock. This, coupled with Shopify's strong fundamentals and consistent growth, creates a favorable environment for the stock. However, investors should remain aware of the potential risks outlined above. To make informed investment decisions regarding Shopify stock, continuous monitoring of investor sentiment and market dynamics is crucial. Further research into Shopify's financial reports, strategic initiatives, and competitive landscape will provide a more complete picture. By carefully considering these factors and keeping a close eye on investor sentiment surrounding Shopify stock and its position within the Nasdaq 100, you can make better-informed investment decisions.

Featured Posts

-

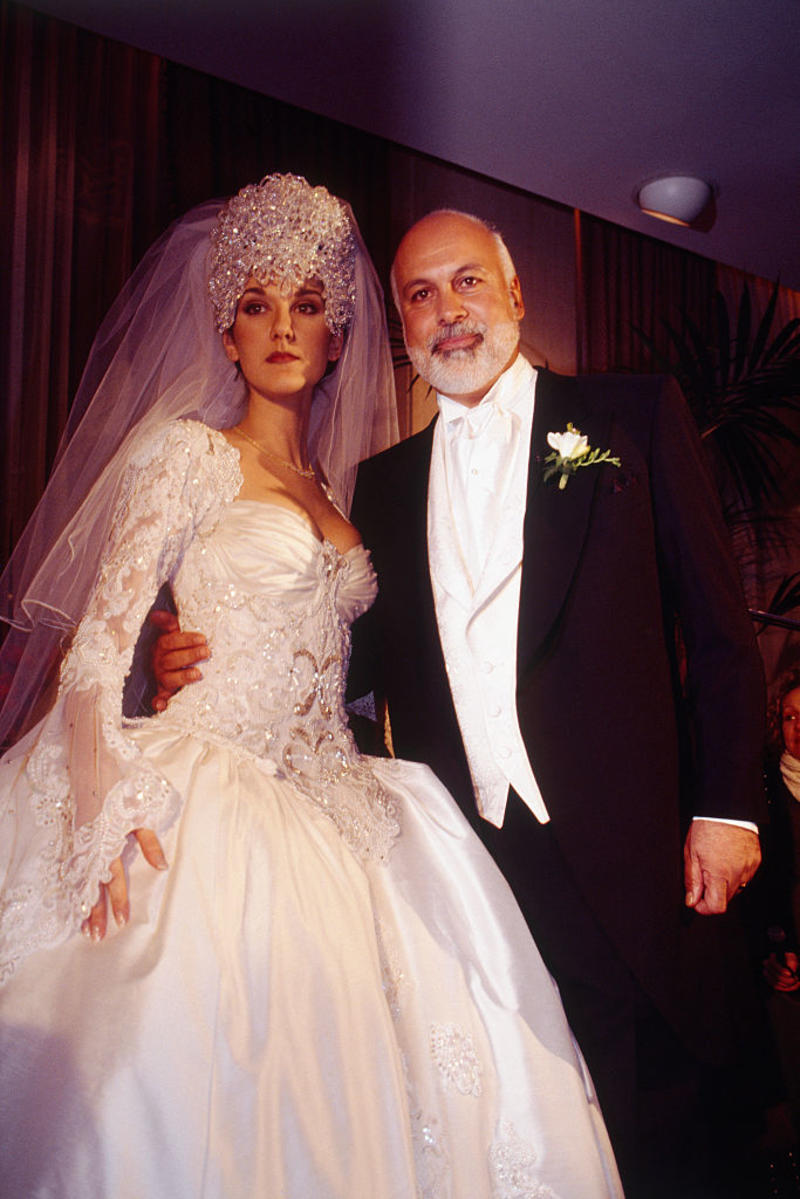

Zhittya Ta Kar Yera Selin Dion Khvoroba Osobiste Zhittya Ta Suchasniy Stan

May 14, 2025

Zhittya Ta Kar Yera Selin Dion Khvoroba Osobiste Zhittya Ta Suchasniy Stan

May 14, 2025 -

Snow White Live Action Remake Improvements And Changes

May 14, 2025

Snow White Live Action Remake Improvements And Changes

May 14, 2025 -

Tommy Fury Vs Jake Paul Rematch Furys U Turn After Fight

May 14, 2025

Tommy Fury Vs Jake Paul Rematch Furys U Turn After Fight

May 14, 2025 -

R Sociedad Vs Sevilla Minuto A Minuto De La Fecha 27 De La Liga

May 14, 2025

R Sociedad Vs Sevilla Minuto A Minuto De La Fecha 27 De La Liga

May 14, 2025 -

Dokovic Rusi Federerove Rekorde Detaljna Analiza

May 14, 2025

Dokovic Rusi Federerove Rekorde Detaljna Analiza

May 14, 2025