IPO Slowdown: The Role Of Tariffs And Global Uncertainty

Table of Contents

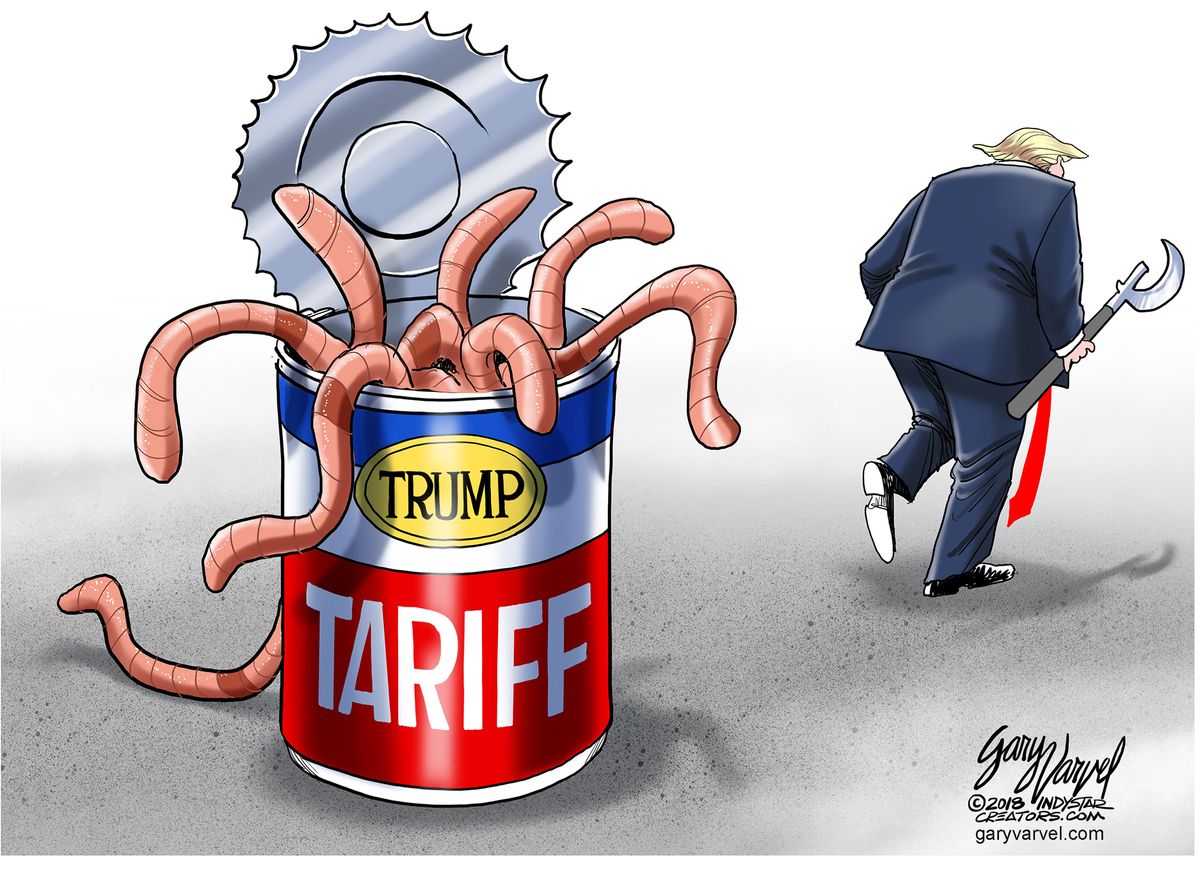

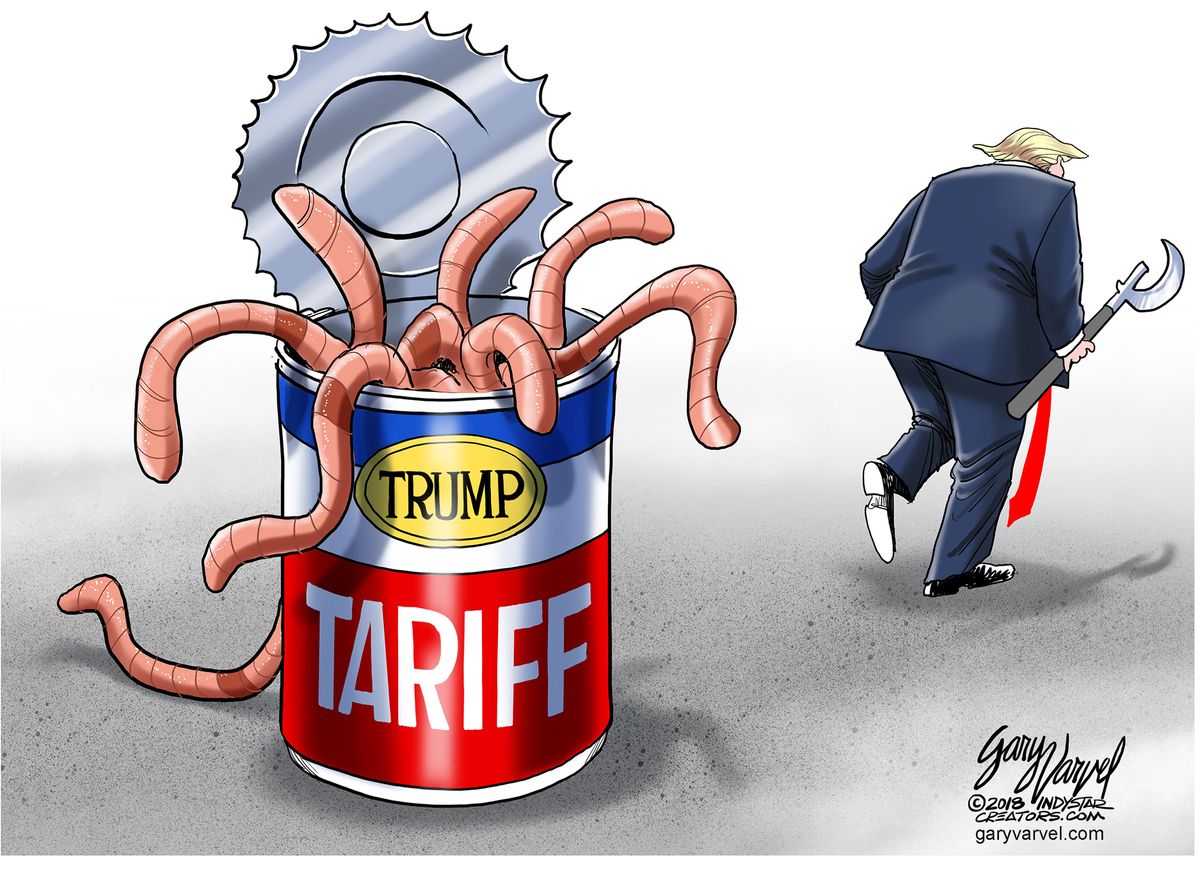

The Impact of Tariffs on IPO Decisions

Escalating tariffs are a major force behind the current IPO slowdown. They directly impact corporate profitability and inject significant uncertainty into the market, making it a risky time for companies to launch IPOs.

Reduced Corporate Profitability

Tariffs increase input costs for businesses, squeezing profit margins. This effect is particularly pronounced in industries heavily reliant on imported goods and components. Manufacturing, technology, and agriculture are prime examples. The increased cost of raw materials, components, and finished goods directly translates into lower profitability.

- Decreased investor confidence: Lower profits make a company appear less attractive to potential investors, reducing the likelihood of a successful IPO.

- Lower valuations: Reduced profitability directly impacts valuation during the IPO process, potentially leading to lower proceeds for the company.

- Delay or cancellation of IPO plans: Faced with lower valuations and weaker investor sentiment, companies often postpone or abandon their IPO plans entirely.

Increased Uncertainty and Market Volatility

Tariff disputes create uncertainty about future trade relations, leading to significant market volatility. This instability directly impacts investor sentiment and risk appetite. The unpredictability makes it incredibly difficult to accurately forecast future earnings, a critical factor for investors assessing IPOs.

- Difficulty in accurately forecasting future earnings: Fluctuations in tariff rates make it hard for companies to project future revenue and profitability.

- Increased risk aversion among investors: Uncertainty breeds caution; investors become more risk-averse, demanding higher returns to compensate for increased uncertainty.

- Higher cost of capital for businesses: The increased risk translates into a higher cost of capital for businesses seeking financing through an IPO, making the process less attractive.

Global Uncertainty Beyond Tariffs

The IPO slowdown isn't solely attributable to tariffs; broader global uncertainty plays a significant role. Geopolitical risks and macroeconomic factors further dampen investor enthusiasm for IPOs.

Geopolitical Risks

Geopolitical events, such as Brexit, ongoing trade wars, and political instability in various regions, create uncertainty and negatively impact investor confidence. These events can trigger capital flight, making investors less inclined to invest in riskier assets like newly public companies.

- Reduced cross-border investment: Geopolitical instability discourages investment across borders, hindering the flow of capital into IPOs.

- Flight to safety by investors: Investors seek "safe-haven" assets like government bonds during times of geopolitical uncertainty, reducing the demand for equities.

- Increased demand for safe-haven assets: This shift in demand leads to a lower appetite for riskier investments like newly issued stocks.

Macroeconomic Factors

Broader macroeconomic conditions significantly influence IPO activity. Slowing global growth, rising interest rates, and potential recessions all contribute to a less favorable investment climate. These factors impact investor behavior and company valuations, making IPOs less attractive.

- Decreased demand for equities: During economic slowdowns, investors tend to reduce their equity holdings, impacting the demand for IPOs.

- Increased scrutiny of company financials: In uncertain economic times, investors scrutinize company financials more intensely, making it harder for companies to meet investor expectations.

- Higher hurdle rate for IPO success: The higher risk associated with an economic downturn increases the bar for IPO success, requiring stronger fundamentals and greater investor confidence.

The Future of IPOs in a Turbulent Market

The current environment presents significant challenges, but also opportunities for strategic adaptation. Understanding the factors that could lead to a rebound is essential for long-term planning.

Strategies for Navigating the Slowdown

Companies can take proactive steps to navigate the current IPO environment:

- Focusing on operational efficiency and profitability improvements: Demonstrating strong financial performance and resilience is crucial for attracting investors.

- Strengthening their balance sheets: A strong balance sheet reduces risk and enhances investor confidence.

- Developing a robust investor relations strategy: Clear communication with potential investors is key to building trust and securing investment.

Potential for a Market Rebound

A rebound in IPO activity is possible, contingent on certain factors:

- Resolution of trade disputes: A reduction in trade tensions would significantly boost investor confidence.

- Improved global economic growth: A stronger global economy would create a more favorable environment for IPOs.

- Increased investor confidence: A return of investor confidence is crucial for revitalizing IPO activity.

Conclusion:

The current IPO slowdown is multifaceted, driven by escalating tariffs, broader global uncertainty, and macroeconomic factors. This challenging environment requires strategic adaptation. Reduced corporate profitability, increased market volatility, and geopolitical risks all contribute to a difficult climate for businesses considering going public. While the short-term outlook remains uncertain, companies can mitigate these risks and prepare for a potential market rebound through operational efficiency, balance sheet strengthening, and robust investor relations. Staying informed about global trade developments and macroeconomic trends is crucial for understanding the ongoing IPO slowdown and navigating this challenging market. Understanding the factors contributing to the IPO slowdown is essential for making informed decisions and capitalizing on future opportunities.

Featured Posts

-

A Realistic Look At Each Mlb Teams 2025 Playoff Chances

May 14, 2025

A Realistic Look At Each Mlb Teams 2025 Playoff Chances

May 14, 2025 -

Eurojackpotin 40 000 E Voitto Uskomaton Onni Suomessa

May 14, 2025

Eurojackpotin 40 000 E Voitto Uskomaton Onni Suomessa

May 14, 2025 -

Eurojackpot Voitto Suomessa 4 8 Miljoonaa Euroa Jaetut

May 14, 2025

Eurojackpot Voitto Suomessa 4 8 Miljoonaa Euroa Jaetut

May 14, 2025 -

Eurojackpotin Jaettipotti Nousee 54 Miljoonaa Euroa Jaossa

May 14, 2025

Eurojackpotin Jaettipotti Nousee 54 Miljoonaa Euroa Jaossa

May 14, 2025 -

Estonias Absurd Eurovision Bet An Italian Twist

May 14, 2025

Estonias Absurd Eurovision Bet An Italian Twist

May 14, 2025