Iran Plastics Exports To China: Impact Of US Sanctions

Table of Contents

Pre-Sanctions Trade Dynamics: A Look at the Past

Before the intensification of US sanctions, Iran was a significant exporter of plastics to China. This trade relationship flourished due to Iran's abundant petrochemical resources and China's massive demand for raw materials in its plastics manufacturing industry. Analyzing this pre-sanctions period provides a crucial baseline to understand the current situation.

- Quantifying Pre-Sanctions Trade: While precise figures are difficult to obtain due to data limitations, estimates suggest a considerable volume of Iranian plastics, primarily polyethylene (PE) and polypropylene (PP), flowed into the Chinese market. This trade represented a vital part of Iran's overall export portfolio.

- Key Players: Several major Iranian petrochemical companies, such as Petrochemical Commercial Company (PCC), played a significant role in exporting plastics to China. These companies established strong trade relationships with Chinese importers and processors.

- Competitive Landscape: Before sanctions, Iranian plastics faced competition from other regional and international producers. However, Iran held a competitive advantage due to its low production costs, thanks to its substantial natural gas reserves.

- Trade Agreements: While no specific bilateral trade agreements exclusively focused on plastics existed, Iran's broader trade relationships with China facilitated the flow of these goods. Preferential tariffs or other trade incentives were not extensively documented in this sector.

The Impact of US Sanctions on Iranian Plastics Exports

US sanctions have significantly disrupted Iran plastics exports to China. These sanctions, imposed over concerns about Iran's nuclear program and other geopolitical factors, have created numerous obstacles for Iranian exporters.

- Types of Sanctions: Sanctions impact various aspects of the plastics trade. Financial sanctions hinder access to international payment systems like SWIFT, making transactions difficult and expensive. Restrictions on technology transfer limit the ability of Iranian companies to upgrade their production facilities and remain competitive.

- Payment System Challenges: The exclusion from SWIFT has forced Iranian companies to rely on alternative, often less efficient and more costly, payment mechanisms, increasing transaction risks and costs.

- Shipping and Logistics: Sanctions have also impacted shipping and logistics. Securing insurance for shipments from Iran is increasingly difficult, and some ports may be reluctant to handle Iranian cargo, leading to delays and increased costs.

- Impact on Iranian Businesses: The combination of financial constraints, logistical hurdles, and uncertainty about future sanctions has severely hampered investment and growth within the Iranian plastics industry. Many businesses have struggled to maintain operations and export volumes.

China's Role and Strategies in Maintaining Trade

Despite US sanctions, China has shown a continued interest in maintaining trade relations with Iran, driven by its need for affordable raw materials for its vast plastics industry.

- China's Reliance on Iranian Plastics: China remains a significant consumer of Iranian petrochemicals, including plastics. Diversifying its supply chain to fully replace Iranian imports is challenging due to the sheer scale of Iran's production and the competitive pricing.

- Circumventing Sanctions: To overcome the hurdles presented by sanctions, China has reportedly employed strategies like using third-party intermediaries in other countries to facilitate transactions and shipments.

- Risks for Chinese Companies: Chinese companies engaged in trade with Iran face significant risks, including potential secondary sanctions from the US. These risks require careful consideration and mitigation strategies.

- Investment in Iranian Infrastructure: China's Belt and Road Initiative has included investments in infrastructure projects in Iran, potentially indirectly supporting Iranian plastics production and export capabilities, albeit indirectly.

The Role of Alternative Trade Routes and Payment Mechanisms

To navigate the challenges posed by sanctions, Iran and China have explored alternative trade routes and payment mechanisms.

- Alternative Payment Systems: These include barter trade arrangements, bilateral currency swaps, and the use of less regulated financial institutions. The effectiveness of these systems varies and often leads to higher costs and increased transaction risks.

- Alternative Shipping Channels: The reliance on land routes and less frequently used seaports has increased, adding to shipping times and costs. This has made Iranian exports less competitive in global markets.

- Effectiveness and Limitations: While alternative strategies allow trade to continue, they are often inefficient, risky, and more expensive than traditional methods. They do not fully negate the negative impacts of US sanctions.

Future Outlook and Predictions for Iran's Plastics Exports to China

Predicting the future of Iran plastics exports to China is challenging due to the ongoing uncertainty surrounding US sanctions and broader geopolitical developments.

- Potential for Increased Trade: Despite the hurdles, the underlying demand for Iranian plastics in China is likely to remain. China's ongoing need for affordable raw materials will continue to exert pressure to find ways to maintain the trade relationship.

- Impact of US Foreign Policy Changes: Any shift in US foreign policy towards Iran could significantly alter the landscape. Easing or lifting sanctions would undoubtedly boost Iranian exports, while further tightening of restrictions could severely limit them.

- Sustainability of Current Practices: The long-term sustainability of current trade practices—relying on workarounds and alternative routes—is questionable. The inherent inefficiencies and risks associated with these methods make them unlikely to be a long-term solution.

- Shifts in Exported Plastics: The types of plastics exported might shift in response to market demands, technological advancements, and sanctions-related challenges. Focus could shift to specific products where Iranian competitiveness remains strong, even under sanctions.

Conclusion

The impact of US sanctions on Iran plastics exports to China is a complex and dynamic issue with far-reaching implications. While China has employed various strategies to maintain trade, the challenges remain significant. The future of this relationship hinges on multiple factors, including the future of US sanctions, the resilience of Chinese engagement, and Iran's ability to adapt and innovate. Further research and analysis into Iran plastics exports to China, including a deeper dive into specific types of plastics and evolving trade mechanisms, are crucial for understanding the ongoing developments in this strategically important market.

Featured Posts

-

Open Ai Unveils Simplified Voice Assistant Development

May 07, 2025

Open Ai Unveils Simplified Voice Assistant Development

May 07, 2025 -

Will Xrp Reach 5 By 2025 A Comprehensive Look At The Potential

May 07, 2025

Will Xrp Reach 5 By 2025 A Comprehensive Look At The Potential

May 07, 2025 -

Nba Lyderiai Istorinis Ritmas Ir Pakartotas Klubo Rekordas

May 07, 2025

Nba Lyderiai Istorinis Ritmas Ir Pakartotas Klubo Rekordas

May 07, 2025 -

Nba Star Anthony Edwards Faces Financial Fallout From Suspension

May 07, 2025

Nba Star Anthony Edwards Faces Financial Fallout From Suspension

May 07, 2025 -

2025 Nhl Draft Lottery A Utah Hockey Club Perspective

May 07, 2025

2025 Nhl Draft Lottery A Utah Hockey Club Perspective

May 07, 2025

Latest Posts

-

Market Dislocation Fuels Brookfields Opportunistic Investment Approach

May 08, 2025

Market Dislocation Fuels Brookfields Opportunistic Investment Approach

May 08, 2025 -

Canadas Trade Strategy Gains Traction In Washington

May 08, 2025

Canadas Trade Strategy Gains Traction In Washington

May 08, 2025 -

Brookfield Capitalizes On Market Dislocation Strategic Investments Unveiled

May 08, 2025

Brookfield Capitalizes On Market Dislocation Strategic Investments Unveiled

May 08, 2025 -

Encouraging Signs Washingtons Stance On Canadian Trade Policy

May 08, 2025

Encouraging Signs Washingtons Stance On Canadian Trade Policy

May 08, 2025 -

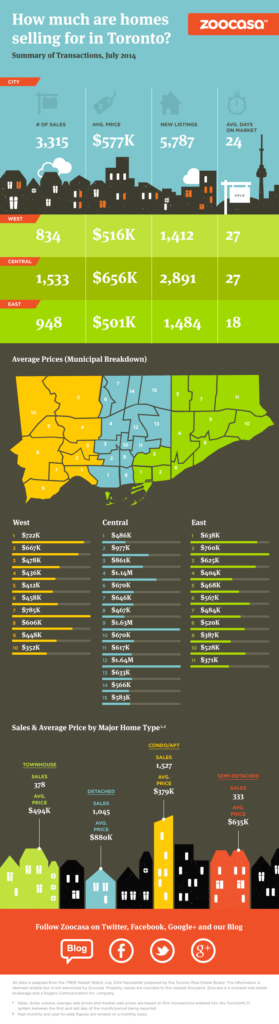

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025