Iron Ore Falls As China Curbs Steel Output: Market Impact Analysis

Table of Contents

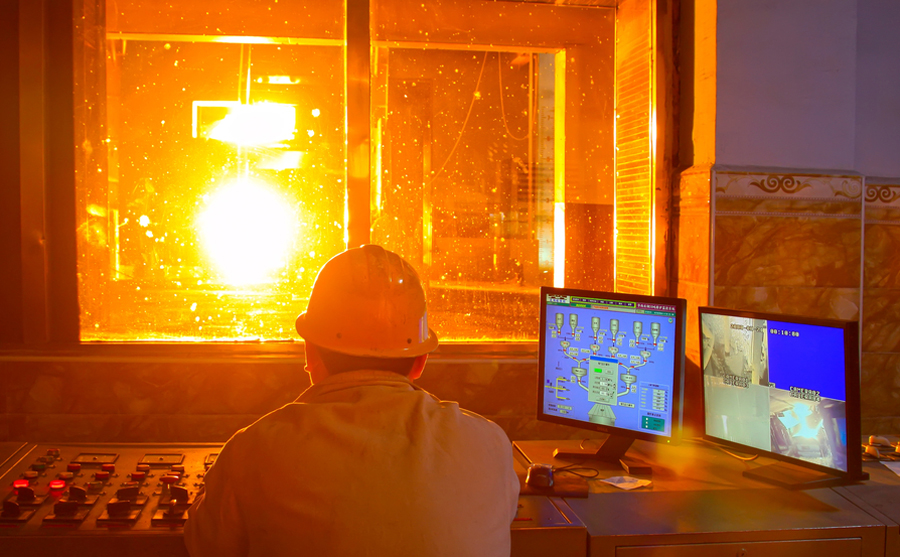

China's Steel Production Cuts: The Driving Force

China's decision to curb steel production stems from a confluence of factors. Environmental concerns are paramount, with the government aiming to reduce carbon emissions and improve air quality. Years of overcapacity in the steel industry have also contributed to the decision, leading to inefficient production and price wars. Finally, a slowing Chinese economy has reduced the demand for steel, further justifying production cuts.

The policies implemented include:

- Stricter environmental regulations: Increased scrutiny on emissions, stricter penalties for non-compliance, and limitations on production during specific periods.

- Production quotas: Imposing limits on the amount of steel individual mills can produce.

- Targeted crackdowns on smaller, less efficient mills: These mills often lack the resources to upgrade their facilities to meet environmental standards.

These policies have resulted in a substantial reduction in China's steel output. Statistics show a [Insert percentage]% decrease in steel production during [Insert time period], impacting millions of tons of steel annually. This dramatic steel output reduction is the primary driver behind the falling iron ore price.

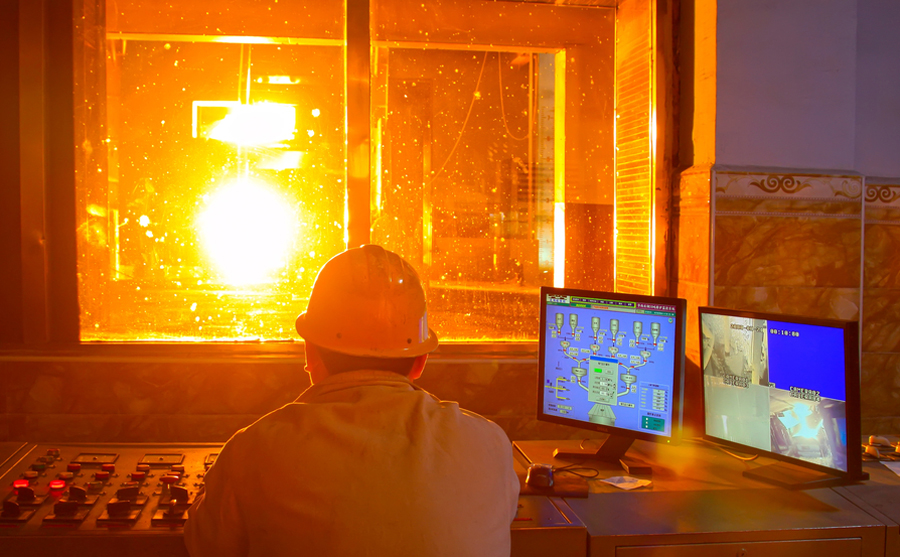

Impact on Iron Ore Demand and Prices

The direct correlation between reduced steel production and decreased iron ore demand is undeniable. Steel mills, the primary consumers of iron ore, are significantly reducing their purchases, leading to a surplus in the market. This oversupply is directly reflected in plummeting iron ore prices.

[Insert chart/graph illustrating the recent fall in iron ore prices].

The impact isn't uniform across all iron ore grades. Higher-grade ores, preferred for their higher iron content and lower impurity levels, are experiencing a proportionally larger price drop compared to lower-grade ores. This is because steel mills are prioritizing efficiency and cost-effectiveness during this period of reduced production. The iron ore price forecast remains uncertain, with significant price volatility expected in the short term. Trading of iron ore futures reflects this uncertainty.

Supply Chain Disruptions and their Ripple Effects

The reduced demand for iron ore isn't limited to steel mills. The entire iron ore supply chain is feeling the pinch.

- Iron ore miners: Facing reduced sales and revenue, leading to potential layoffs and mine closures.

- Transportation companies: Experiencing a decline in shipping volumes, impacting their profitability.

- Related businesses: Suppliers of mining equipment, logistics providers, and other support services are all affected.

These disruptions can lead to significant job losses, especially in regions heavily reliant on iron ore production. Smaller players in the supply chain are particularly vulnerable, facing potential bankruptcy due to decreased sales and financial strain. The supply chain disruption presents a complex challenge for all stakeholders.

Global Market Implications: Beyond China

China's actions aren't confined to its domestic market. The global iron ore market is experiencing a ripple effect. Iron ore exports from major producing countries like Australia and Brazil are declining, leading to lower revenues for these nations. The shift in demand has already started altering international trade patterns, potentially reshaping market shares in the long run. The price fluctuations are influencing the strategies of Australia iron ore and Brazil iron ore producers, prompting them to adapt to the changing global landscape.

Investment Strategies in a Changing Market

Navigating the volatile iron ore market requires a carefully crafted investment strategy. Risk management is crucial, with diversification being a key element. Hedging strategies can help mitigate losses during periods of high price volatility.

Investors have several options:

- Iron ore stocks: Investing directly in companies involved in iron ore mining or processing.

- ETFs (Exchange-Traded Funds): Diversified investments tracking the performance of the iron ore market.

- Futures contracts: Allowing investors to speculate on future price movements.

However, investors should be aware of the significant risks involved. The uncertainty surrounding China's future policies and the global economic outlook makes the iron ore investment landscape highly unpredictable.

Conclusion: Navigating the Future of Iron Ore in a Post-Curb Market

China's steel production cuts have significantly impacted iron ore demand and prices, triggering ripple effects throughout the global supply chain. Understanding the dynamics between China's policies and the iron ore market is crucial for navigating this changing landscape. The future of iron ore remains uncertain, with potential for further price fluctuations and market shifts. To stay informed about the latest developments regarding "Iron Ore Falls as China Curbs Steel Output," subscribe to our updates or follow reputable financial news sources. Further research into effective risk management and diversification strategies for iron ore investments is strongly recommended.

Featured Posts

-

90 Nhs Staff Accessed Nottingham Attack Victim Records Privacy Violation Inquiry

May 09, 2025

90 Nhs Staff Accessed Nottingham Attack Victim Records Privacy Violation Inquiry

May 09, 2025 -

Pam Bondi Signals Imminent Release Of Epstein Files

May 09, 2025

Pam Bondi Signals Imminent Release Of Epstein Files

May 09, 2025 -

Black Rock Etf A Billionaires Guide To Potential 110 Gains In 2025

May 09, 2025

Black Rock Etf A Billionaires Guide To Potential 110 Gains In 2025

May 09, 2025 -

Oilers Even Series Against Kings With Overtime Victory

May 09, 2025

Oilers Even Series Against Kings With Overtime Victory

May 09, 2025 -

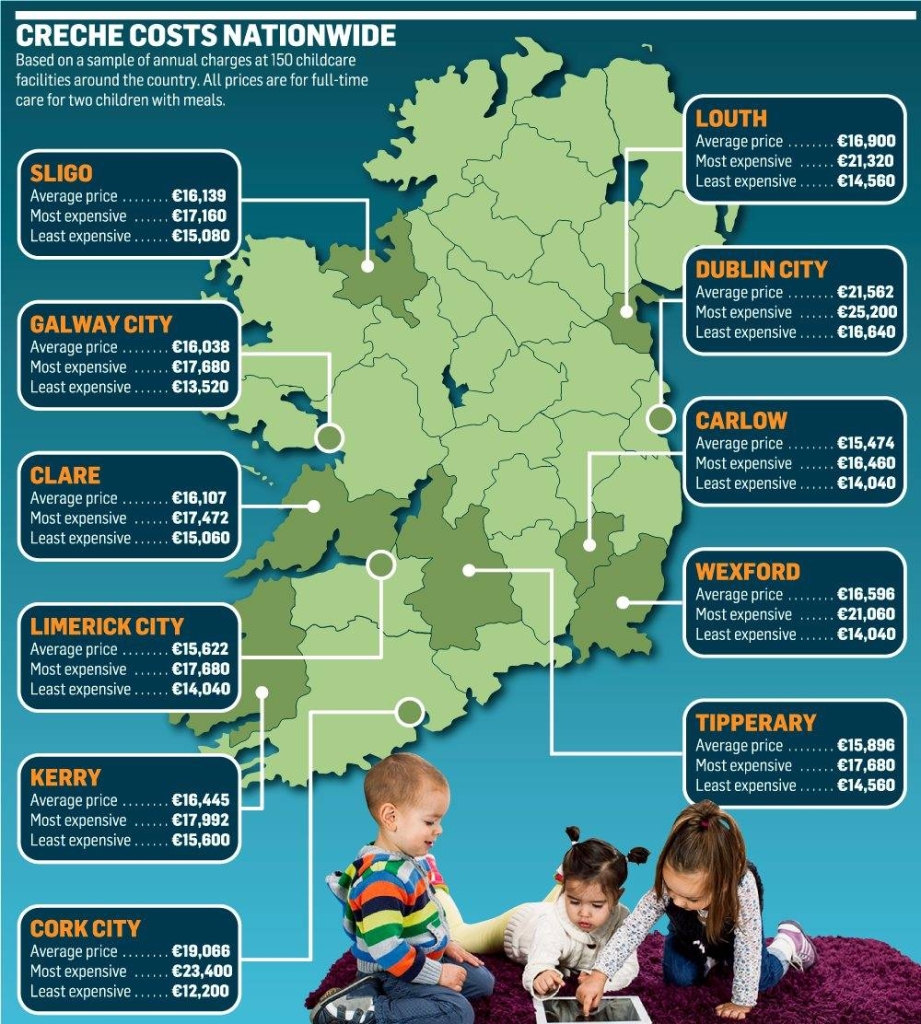

The High Cost Of Childcare One Mans Experience With Babysitters And Daycare

May 09, 2025

The High Cost Of Childcare One Mans Experience With Babysitters And Daycare

May 09, 2025