IRS Data To Track Undocumented Immigrants: Judge Rules Against Block

Table of Contents

The Court's Ruling and its Rationale

While the specific case name is not provided in the outline, the judge's decision essentially rejected a motion to prevent the IRS from employing its data in immigration enforcement efforts. The ruling, though not explicitly stated, implicitly acknowledged the government's interest in national security and effective immigration law enforcement.

The arguments presented by opposing sides were sharply contrasted.

-

Plaintiff's Arguments: The plaintiffs argued that allowing the IRS to share tax data for immigration enforcement purposes constituted a serious violation of taxpayer privacy, potentially chilling the willingness of undocumented immigrants to file taxes. They raised concerns under the Fourth Amendment, arguing this amounted to unreasonable search and seizure.

-

Government's Arguments: The government countered that access to IRS data was crucial for identifying and apprehending undocumented individuals who might be engaged in tax fraud or other illegal activities. They emphasized the importance of national security and the need for robust immigration enforcement.

-

Key Legal Precedents: The judge's decision likely relied on established legal precedents concerning government access to information for legitimate law enforcement purposes, weighing the government's interest against individual privacy rights. (Specific case citations would be included here in a fully researched article).

-

The Judge's Reasoning: The judge's reasoning likely centered on a balancing test, weighing the government's compelling interest in immigration enforcement against the potential infringement on taxpayer privacy. The decision suggests the perceived benefits of using IRS data for immigration enforcement outweighed the privacy concerns, at least within the context of the presented case.

The Use of IRS Data for Immigration Enforcement

The IRS's potential methods for utilizing tax data in immigration enforcement are multifaceted.

-

Specific Examples: The IRS might cross-reference tax returns with immigration records to identify discrepancies or potential tax fraud associated with undocumented workers. Data analysis could reveal patterns indicative of employing undocumented labor, triggering further investigation.

-

Potential for Inaccuracies: The data matching process carries inherent risks of misidentification or inaccuracies. Errors in matching could lead to unjust targeting of individuals.

-

Concerns about Discriminatory Application: There are legitimate concerns that this policy could be applied discriminatorily, disproportionately affecting specific ethnic or racial groups.

The historical context reveals that tax information has been occasionally utilized for non-tax purposes throughout history, although the scale and nature of such usage have varied considerably.

Privacy Concerns and Civil Liberties

The use of IRS data for immigration enforcement raises significant privacy concerns.

-

Taxpayer Confidentiality: The principle of taxpayer confidentiality is paramount, ensuring that sensitive financial information is protected from unauthorized access and disclosure. The erosion of this confidentiality could have far-reaching consequences.

-

Chilling Effect: The fear of deportation could deter undocumented immigrants from filing taxes, even if they are legally obligated to do so, undermining tax compliance and revenue collection.

-

Existing Protections: While existing laws and regulations aim to protect taxpayer information, their sufficiency in this specific context is highly debated.

-

Government Surveillance: This case exemplifies a broader concern regarding government surveillance and the collection of personal data. The precedent set here could impact future data collection practices.

Political and Societal Implications

The court's ruling has profound political and societal implications.

-

Reactions from Advocacy Groups: Immigrant advocacy groups have expressed strong opposition to the use of IRS data for immigration enforcement, citing concerns about privacy violations and the potential for discriminatory practices.

-

Government Statements: Government officials have defended the use of IRS data, emphasizing the need for effective immigration enforcement and national security.

-

Public Opinion: Public opinion on this issue is highly divided, reflecting the complex interplay of competing values.

-

Long-Term Consequences: The long-term consequences include potential erosion of trust in government institutions and increased polarization on immigration issues.

Conclusion

The judge's decision to allow the IRS to use its data to track undocumented immigrants is a significant development with far-reaching consequences. The ruling highlights the ongoing tension between the government's interest in national security and effective immigration enforcement, and the fundamental right to privacy. While the government maintains that this access is vital for law enforcement, critics raise serious concerns about potential abuses, discriminatory impact, and the chilling effect on tax compliance among undocumented immigrants. The arguments surrounding the use of IRS data and immigration enforcement reveal a complex debate that will likely continue to unfold in the courts and in the public sphere.

Call to Action: Stay informed about the ongoing legal challenges and policy debates surrounding the use of IRS data and immigration enforcement. Learn more about the legal challenges surrounding IRS data and immigration, and engage in the critical conversation about balancing national security and individual privacy concerning the use of IRS data for immigration enforcement. Your informed participation is crucial for shaping the future of this complex issue.

Featured Posts

-

Zovnishnist Oleksiya Poroshenka Foto Ta Opis

May 13, 2025

Zovnishnist Oleksiya Poroshenka Foto Ta Opis

May 13, 2025 -

Aryna Sabalenka Claims 19th Wta Title In Miami

May 13, 2025

Aryna Sabalenka Claims 19th Wta Title In Miami

May 13, 2025 -

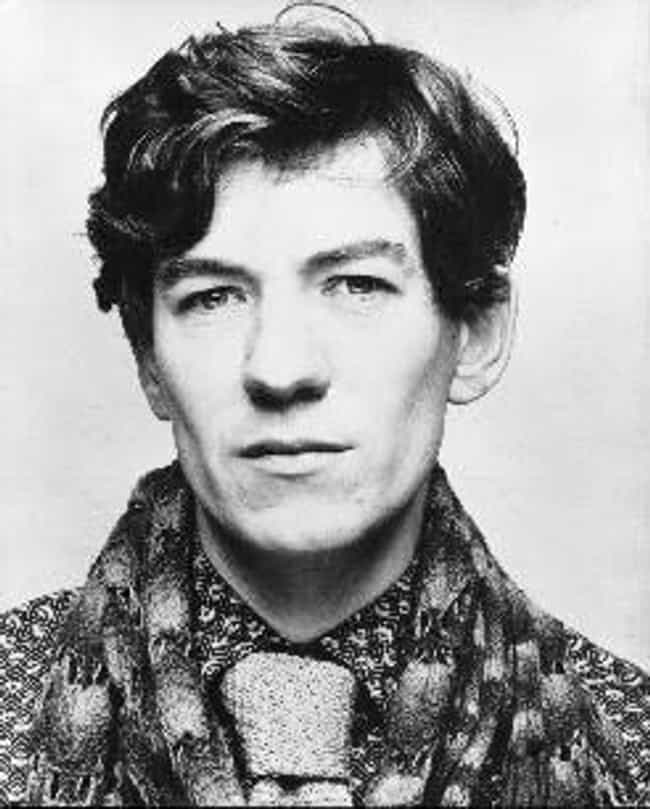

Ian Mc Kellen Honesty For Young Actors In Hollywood

May 13, 2025

Ian Mc Kellen Honesty For Young Actors In Hollywood

May 13, 2025 -

Nea Fos Ston Megalo Kataklysmo Tis Mesogeioy Apokalyptika Eyrimata

May 13, 2025

Nea Fos Ston Megalo Kataklysmo Tis Mesogeioy Apokalyptika Eyrimata

May 13, 2025 -

Obituaries A List Of Recently Deceased Local Residents

May 13, 2025

Obituaries A List Of Recently Deceased Local Residents

May 13, 2025

Latest Posts

-

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025 -

Country Musics Future Scotty Mc Creerys Sons Impressive Voice

May 14, 2025

Country Musics Future Scotty Mc Creerys Sons Impressive Voice

May 14, 2025 -

A Chip Off The Old Block Scotty Mc Creerys Son Sings George Strait

May 14, 2025

A Chip Off The Old Block Scotty Mc Creerys Son Sings George Strait

May 14, 2025 -

Scotty Mc Creerys Sons Sweet George Strait Tribute Watch Now

May 14, 2025

Scotty Mc Creerys Sons Sweet George Strait Tribute Watch Now

May 14, 2025 -

The Next George Strait Scotty Mc Creerys Sons Singing

May 14, 2025

The Next George Strait Scotty Mc Creerys Sons Singing

May 14, 2025