Is $1,500 The Next Ethereum Price Target? Crucial Support Level Under Scrutiny

Table of Contents

Technical Analysis: Chart Patterns and Indicators Suggesting $1,500 as Support/Resistance

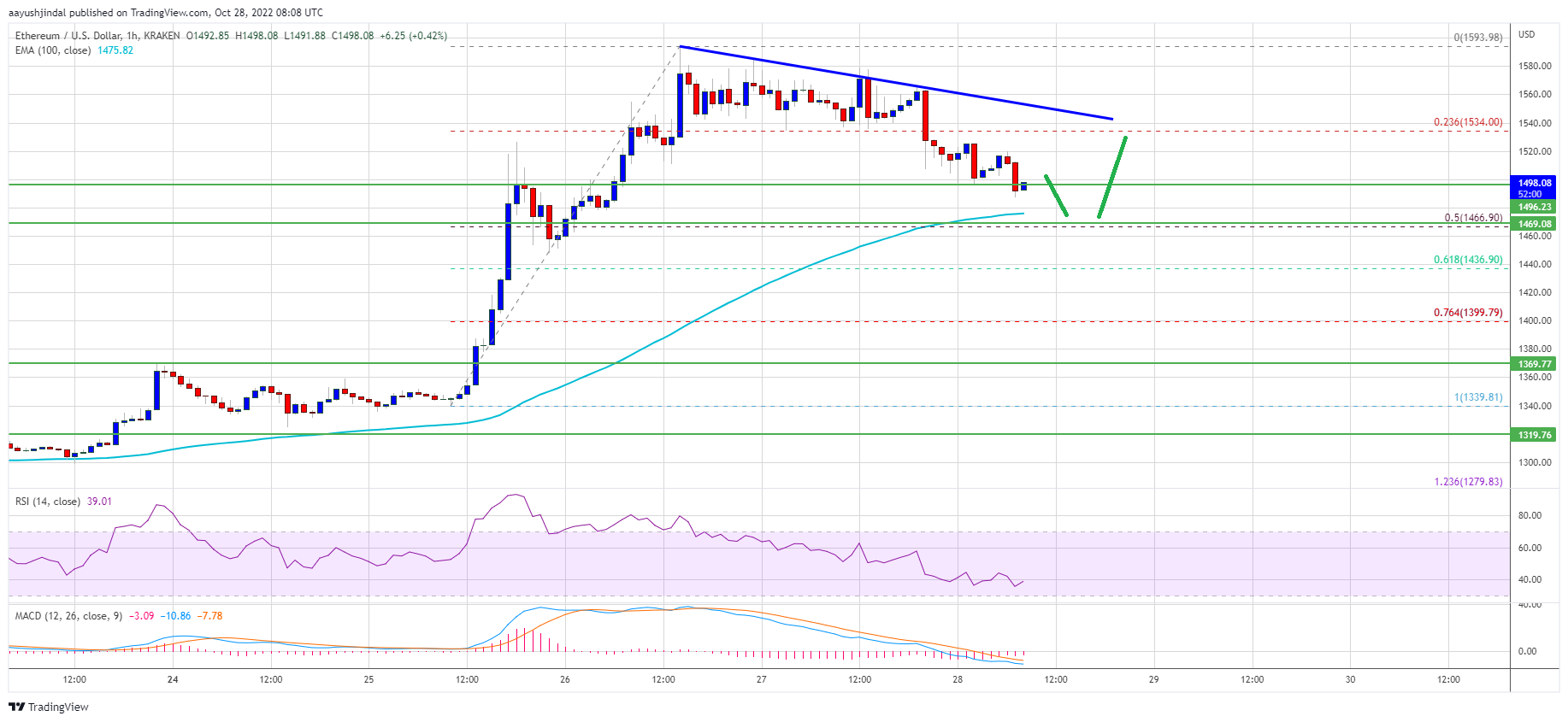

Technical analysis provides valuable insights into potential price movements by studying historical price data and chart patterns. Looking at Ethereum's price charts, we see several indicators suggesting $1500 as a significant support or resistance level.

-

Support/Resistance Levels: The $1500 mark has acted as both support (a level where buying pressure prevents further price drops) and resistance (a level where selling pressure halts further price increases) in the past. A break above this level could signal a bullish trend, while a break below could lead to further downward pressure.

-

Key Chart Patterns: Depending on the timeframe analyzed, various patterns could emerge. For example, a "double bottom" pattern near $1500 could suggest a bullish reversal, while a "head and shoulders" pattern might indicate a bearish continuation. (Insert relevant chart showing the potential pattern here).

-

Technical Indicators: Moving averages (e.g., 50-day and 200-day), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) can provide further confirmation. A bullish crossover of moving averages coupled with an RSI above 50 could signal a positive outlook. (Insert chart showing RSI and MACD here).

Potential Breakouts: A decisive break above $1500 could propel Ethereum towards higher price targets, potentially reaching $1800 or even $2000, depending on other market conditions. Conversely, a breakdown below $1500 might trigger a further price decline, potentially testing lower support levels.

- Key support/resistance levels identified: $1500, $1800, $2000, $1200, $1000.

- Technical indicators suggesting bullish/bearish sentiment: RSI, MACD, Moving Averages.

- Potential price targets based on technical analysis: $1800 - $2000 (bullish), $1200 - $1000 (bearish).

Fundamental Analysis: Ethereum's Underlying Value and Network Activity

Beyond technical analysis, the fundamental strength of the Ethereum network plays a crucial role in determining its price.

-

On-chain Metrics: Analyzing key on-chain metrics like transaction volume, active addresses, gas fees, and DeFi TVL (Total Value Locked) provides insights into network activity and user engagement. High transaction volume and increasing active addresses generally signal a healthy network and could support higher prices.

-

The Shanghai Upgrade Impact: The Shanghai upgrade, enabling withdrawals of staked ETH, has been a major factor influencing the price. Initially, there were concerns about a potential sell-off due to unlocked ETH. However, the actual impact has been more nuanced, with the effect on price depending on the rate of withdrawals and overall market sentiment.

-

Broader Crypto Market Correlation: Ethereum's price often correlates with Bitcoin's price and the overall cryptocurrency market. A bullish trend in Bitcoin often boosts Ethereum's price, while a bearish trend can negatively impact both.

-

Key on-chain metrics and their significance: Transaction volume, active addresses, gas fees, DeFi TVL.

-

Impact of the Shanghai upgrade on network activity and price: Initially cautious, now showing mixed effects depending on withdrawal rates and market sentiment.

-

Correlation with Bitcoin's price and the broader crypto market: Strong positive correlation observed historically.

Macroeconomic Factors and Regulatory Landscape: External Influences on Ethereum's Price

External factors significantly impact the price of Ethereum.

-

Inflation and Interest Rates: High inflation and rising interest rates generally lead to risk aversion among investors, potentially causing capital flight from riskier assets like cryptocurrencies.

-

Regulatory Developments: Regulatory uncertainty or unfavorable regulations in key markets can negatively affect investor sentiment and Ethereum's price. Conversely, clear and favorable regulatory frameworks can boost investor confidence.

-

Geopolitical Events: Geopolitical instability and global events can create uncertainty in financial markets, impacting investor sentiment and leading to price volatility in cryptocurrencies.

-

Impact of inflation and interest rates on investor sentiment: Negative correlation; higher inflation and interest rates often lead to risk aversion.

-

Potential regulatory changes and their effect on Ethereum's price: Can have both positive and negative impacts depending on the nature of the regulations.

-

Influence of geopolitical instability on the crypto market: Increased volatility and potential price drops are common during periods of geopolitical uncertainty.

Conclusion: Is $1,500 the Next Ethereum Price Target? A Final Verdict

Analyzing Ethereum's price from technical, fundamental, and macroeconomic perspectives reveals a complex picture. While technical indicators suggest $1500 as a crucial support/resistance level, the impact of the Shanghai upgrade and broader market conditions remain significant factors. Macroeconomic headwinds and regulatory uncertainty add further layers of complexity. Therefore, predicting with certainty whether $1500 will be the next price target is impossible. However, the level's historical significance and current market dynamics suggest it will play a key role in shaping Ethereum's future price movements. Remember that cryptocurrency investments are inherently risky, and price predictions are not financial advice.

Stay updated on the latest developments affecting the Ethereum price. Continue monitoring the $1500 support level, as a break above or below could signal significant price movements. Further research into Ethereum’s future price targets is encouraged.

Featured Posts

-

Copa Libertadores Liga De Quito Vs Flamengo Termina En Empate

May 08, 2025

Copa Libertadores Liga De Quito Vs Flamengo Termina En Empate

May 08, 2025 -

Lahwr Myn 5 Ahtsab Edaltyn Khtm Baqy 5 Ka Mstqbl

May 08, 2025

Lahwr Myn 5 Ahtsab Edaltyn Khtm Baqy 5 Ka Mstqbl

May 08, 2025 -

Confrontacion Violenta Entre Flamengo Y Botafogo Jugadores Se Enfrentan En El Campo Y Los Vestuarios

May 08, 2025

Confrontacion Violenta Entre Flamengo Y Botafogo Jugadores Se Enfrentan En El Campo Y Los Vestuarios

May 08, 2025 -

Toronto Home Sales Plunge 23 Drop Year Over Year Prices Down 4

May 08, 2025

Toronto Home Sales Plunge 23 Drop Year Over Year Prices Down 4

May 08, 2025 -

Toronto Real Estate Market Update Sales Down 23 Prices Fall 4

May 08, 2025

Toronto Real Estate Market Update Sales Down 23 Prices Fall 4

May 08, 2025