Is A 40% Increase In Palantir Stock Price By 2025 Realistic?

Table of Contents

Analyzing Palantir's Current Financial Performance and Growth Potential

To assess the plausibility of a 40% Palantir stock price increase by 2025, we need to carefully examine the company's current financial standing and growth trajectory.

Palantir Revenue, Earnings, and Financial Performance

Palantir's recent financial reports reveal a complex picture. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus. Analyzing key metrics like:

- Revenue growth rate: Comparing year-over-year revenue growth provides insights into the company's expansion trajectory.

- Earnings per share (EPS): Analyzing EPS trends helps gauge the company's profitability and its ability to generate returns for shareholders.

- Operating margins: Tracking operating margins reveals efficiency in managing expenses relative to revenue generation.

reveals whether Palantir is on track to support a significant stock price increase. Charts illustrating these financial metrics offer a clear visual representation of the company's financial health, aiding in the Palantir stock price prediction. Accessing detailed PLTR financials from reputable sources is crucial for in-depth analysis.

Government Contracts and Commercial Adoption: Fueling Palantir's Growth?

Palantir's revenue stream is significantly influenced by its government contracts, particularly within the defense and intelligence sectors. However, the company is actively pursuing commercial clients to diversify its revenue sources.

- Government contracts: While lucrative, dependence on government contracts can introduce volatility depending on budgetary cycles and geopolitical situations.

- Commercial adoption: Expansion into the commercial sector holds significant growth potential, opening doors to a broader range of clients and revenue streams.

- Risk assessment: Analyzing the risks associated with both sectors is vital for a comprehensive Palantir stock price prediction. Potential regulatory hurdles, competition, and contract renewal challenges should be factored in.

Assessing Market Trends and Competitive Landscape

The big data analytics market is expanding rapidly, presenting both opportunities and challenges for Palantir.

Big Data Analytics Market Growth and Palantir's Positioning

The overall growth of the big data analytics market significantly influences Palantir's prospects.

- Market size and growth rate: Understanding the market's size and anticipated growth trajectory is critical. Researching market reports and forecasts provides valuable data for a realistic Palantir stock price prediction.

- Market saturation: Assessing the potential for market saturation and its impact on future growth is essential.

- Competitive pressures: Analyzing competitive pressures from established players and new entrants helps gauge Palantir's ability to maintain market share.

Key Competitors and Their Impact on PLTR Stock

Palantir faces stiff competition from tech giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform.

- Competitive analysis: A comparative analysis of Palantir's strengths and weaknesses against its competitors is necessary. This should consider factors like technological innovation, pricing strategies, and market penetration.

- Competitive advantage: Determining Palantir's unique competitive advantages, such as its specialized expertise in data integration and analysis for government and high-security sectors, is crucial.

- Impact on stock price: Evaluating the potential impact of competitive pressures on Palantir's market share and subsequent stock price is critical for informed investment decisions.

Considering Geopolitical Factors and External Risks

Geopolitical events and economic conditions significantly influence the stock market and can impact Palantir's performance.

Geopolitical Instability and its Impact on Palantir's Business

Geopolitical instability can drive demand for Palantir's services, particularly in defense and intelligence sectors, but also carries inherent risks.

- Increased demand: Conflict and political uncertainty can create increased demand for Palantir's data analysis capabilities.

- Operational risks: Operating in unstable geopolitical regions presents logistical and security risks that can impact profitability and operations.

- Regulatory hurdles: Navigating international regulations and compliance requirements can be complex and costly.

Economic Factors and Market Volatility's Influence on Palantir Stock

Economic downturns and market volatility can negatively affect investor sentiment and impact Palantir's stock price.

- Economic resilience: Analyzing Palantir's resilience to economic fluctuations and its ability to sustain growth during economic downturns is important.

- Market sentiment: Understanding investor sentiment towards the company and the broader technology sector is critical for predicting stock price movements.

- Investment strategy: Considering various investment strategies to mitigate risks associated with market volatility is essential for prudent investors.

Conclusion: Is a 40% Increase in Palantir Stock Price by 2025 Realistic? A Final Verdict

Predicting a 40% increase in Palantir's stock price by 2025 requires careful consideration of various factors. While Palantir's growth potential in the expanding big data analytics market is undeniable, the competitive landscape, geopolitical risks, and economic uncertainties present challenges. A balanced perspective acknowledges both the substantial opportunities and the inherent risks associated with Palantir investments. While significant revenue growth and commercial adoption are positive indicators, thorough due diligence is paramount.

While a 40% increase in Palantir stock price by 2025 presents both opportunities and challenges, thorough due diligence is crucial before making any investment decisions. Continue your own research on Palantir stock and make an informed choice.

Featured Posts

-

Short And Sweet A Stephen King Tv Show Perfect For A Quick Binge Under 5 Hours

May 10, 2025

Short And Sweet A Stephen King Tv Show Perfect For A Quick Binge Under 5 Hours

May 10, 2025 -

Kultoviyat Roman Na Stivn King Skoro Na Netflix

May 10, 2025

Kultoviyat Roman Na Stivn King Skoro Na Netflix

May 10, 2025 -

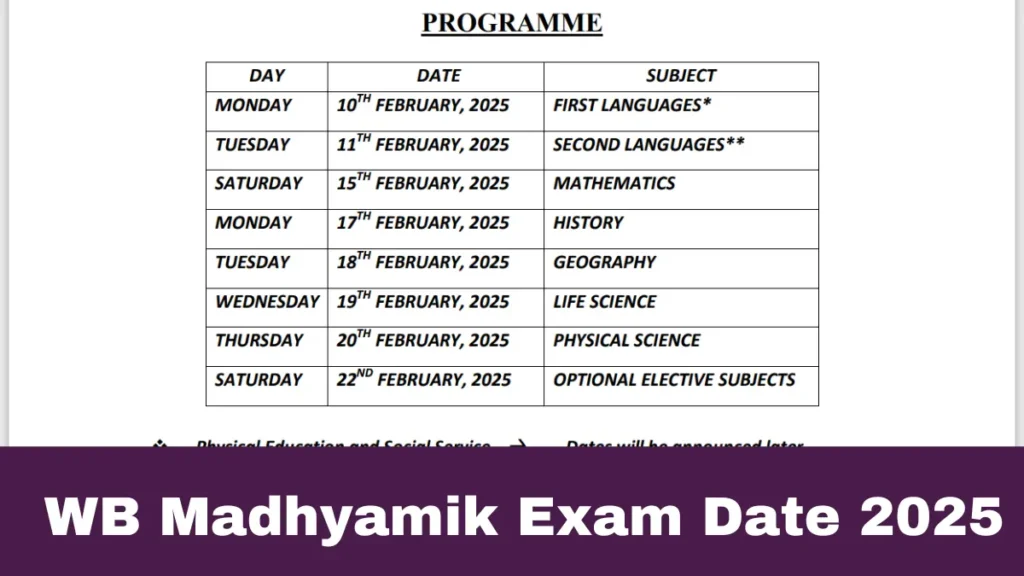

West Bengal Madhyamik Exam 2025 Merit List And District Wise Results

May 10, 2025

West Bengal Madhyamik Exam 2025 Merit List And District Wise Results

May 10, 2025 -

Why Elevated Stock Market Valuations Shouldnt Deter Investors Bof A

May 10, 2025

Why Elevated Stock Market Valuations Shouldnt Deter Investors Bof A

May 10, 2025 -

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025