Is A Real Estate Investment A Safe Bet?

Table of Contents

Understanding the Risks of Real Estate Investment

While the potential for profit is significant, understanding the inherent risks in real estate investment is crucial. Ignoring these risks can lead to significant financial losses.

Market Volatility and Economic Fluctuations

The real estate market is susceptible to economic downturns. Several factors can impact property values and rental income:

- Economic downturns: Recessions often lead to decreased property values and lower rental demand, impacting your investment's profitability.

- Interest rate hikes: Higher interest rates make mortgages more expensive, reducing buyer demand and potentially slowing rental growth.

- Market corrections: Periodic market corrections can cause significant short-term drops in property values.

Effective market research and diversification are essential to mitigate these risks. Thoroughly analyzing local market trends, understanding economic forecasts, and diversifying your real estate portfolio across different geographical locations and property types are crucial strategies for mitigating market risk. Careful property valuation is also key to avoiding overpaying for assets.

Property Management Challenges and Hidden Costs

Owning investment properties involves more than just collecting rent. Many unforeseen challenges and hidden costs can significantly impact profitability:

- Unexpected repairs: Plumbing issues, roof damage, appliance failures – these can be costly and arise unexpectedly.

- Tenant issues: Dealing with late rent payments, property damage, and tenant turnover can be time-consuming and stressful. Thorough tenant screening is vital.

- Property taxes, insurance, and management fees: These recurring expenses can eat into your profits if not adequately budgeted for.

Accurate budgeting is critical to successfully manage your real estate investment. Factor in potential vacancy rates (periods without a tenant) and the cost of professional property management if you don't handle it yourself.

Liquidity Concerns

Unlike stocks or bonds, real estate is not highly liquid. Selling a property can be a lengthy process, often requiring significant effort and time:

- Time to sell: Finding a buyer, negotiating a sale, and completing the transaction can take months, or even longer, depending on market conditions.

- Real estate market conditions: A slow market can further delay the sale and potentially impact the final selling price.

Investors needing quick access to their capital should be aware of this illiquidity. It's crucial to have a long-term perspective and sufficient emergency funds to cover unexpected expenses.

Mitigating Risks and Maximizing Returns in Real Estate Investment

While risks exist, they can be minimized with careful planning and strategic decision-making.

Due Diligence and Thorough Research

Conducting thorough due diligence is paramount before making any real estate investment:

- Property inspection: A professional inspection can uncover potential problems that could be expensive to fix.

- Property appraisal: An independent appraisal ensures you're paying a fair market price for the property.

- Market analysis: Understanding the local real estate market, rental rates, and future growth potential is crucial.

- Legal advice: Consulting with experienced real estate lawyers can protect your interests and ensure compliance with regulations.

Engaging a reputable real estate agent experienced in investment properties can significantly aid in the due diligence process.

Diversification Strategies

Diversification is key to mitigating risk in real estate investment:

- Geographic diversification: Spreading your investments across different geographic locations reduces the impact of localized market downturns.

- Property type diversification: Investing in a mix of residential and commercial properties can balance your portfolio.

- Investment strategy diversification: Consider strategies like rental income, property flipping, or investing in Real Estate Investment Trusts (REITs) to diversify your approach.

Long-Term Investment Perspective

Real estate investment is often viewed as a long-term strategy:

- Real estate returns: While short-term fluctuations can occur, real estate tends to offer better returns over the long term, especially when compared to other assets.

- Patience: A long-term perspective is essential to weathering market fluctuations and achieving significant returns.

- Investment strategy: Develop a strategic investment plan based on thorough research and risk tolerance.

Conclusion

Real estate investment offers substantial potential rewards but also presents inherent risks. Understanding market volatility, managing property-related challenges, and recognizing liquidity concerns are crucial for success. However, by conducting thorough due diligence, employing diversification strategies, and adopting a long-term investment perspective, you can significantly mitigate risks and maximize returns in your real estate investment. Start your real estate investment journey today by conducting thorough research and seeking professional advice tailored to your financial goals and risk tolerance. Learn more about smart real estate investment strategies and make informed decisions to build a strong and successful real estate portfolio.

Featured Posts

-

Understanding The Celebrity Antiques Road Trip Format And Its Appeal

May 09, 2025

Understanding The Celebrity Antiques Road Trip Format And Its Appeal

May 09, 2025 -

Lisa Ray Vs Air India Actresss Complaint And The Airlines Rebuttal

May 09, 2025

Lisa Ray Vs Air India Actresss Complaint And The Airlines Rebuttal

May 09, 2025 -

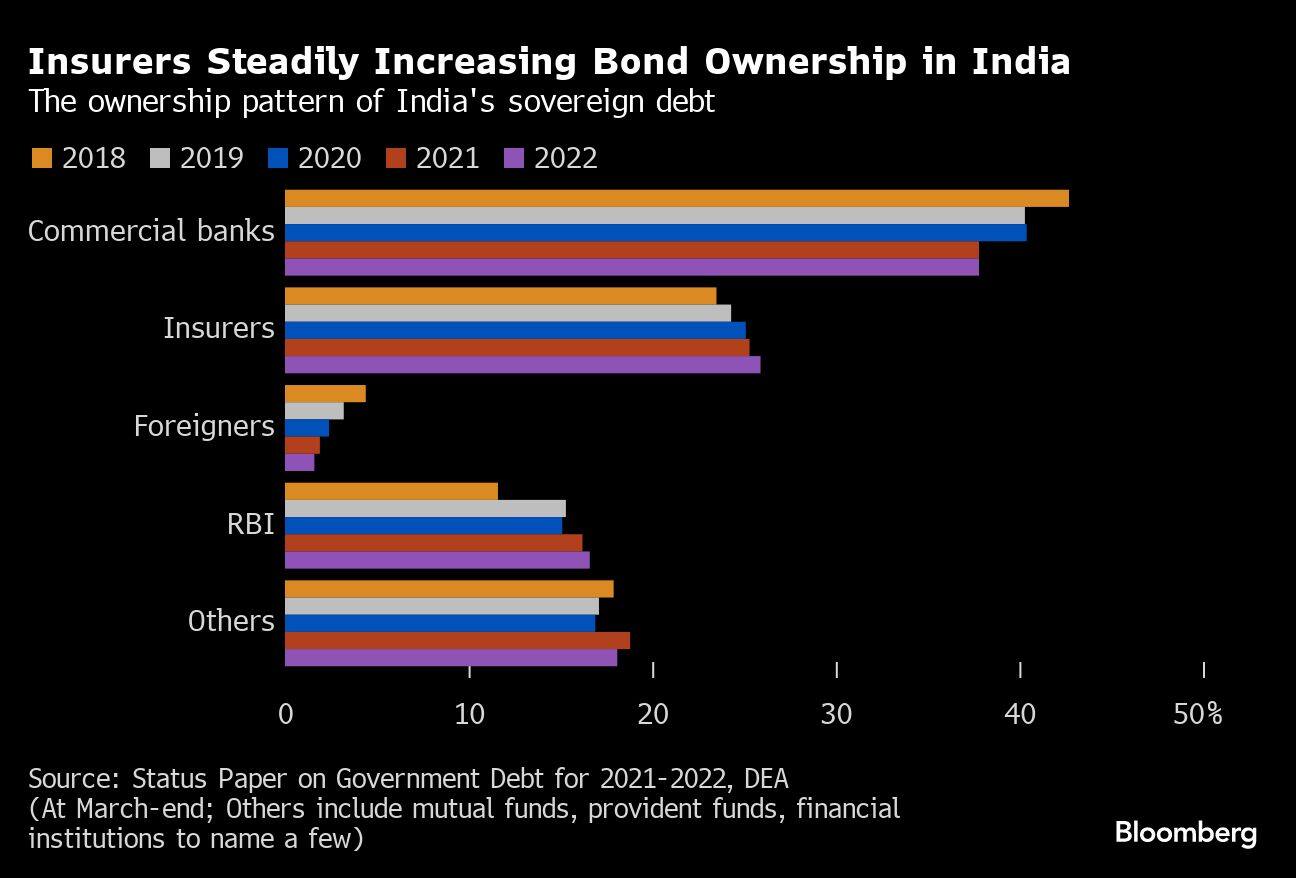

Indian Insurers Push For Relaxed Bond Forward Regulations

May 09, 2025

Indian Insurers Push For Relaxed Bond Forward Regulations

May 09, 2025 -

23 Year Old Claims To Be Madeleine Mc Cann New Dna Evidence Examined

May 09, 2025

23 Year Old Claims To Be Madeleine Mc Cann New Dna Evidence Examined

May 09, 2025 -

Harry Styles Devastated Reaction To Poor Snl Impression

May 09, 2025

Harry Styles Devastated Reaction To Poor Snl Impression

May 09, 2025