Is A Trillion-Dollar Palantir Possible By 2030? A Data-Driven Analysis

Table of Contents

Palantir Technologies, a data analytics powerhouse known for its work with government agencies and commercial clients, has experienced significant growth since its IPO. But can this momentum propel it to a staggering trillion-dollar market capitalization by 2030? This article aims to analyze the feasibility of this ambitious goal using a data-driven approach. We'll examine Palantir's current market position, the growth potential of the big data analytics market, technological advancements impacting the company, and the inherent risks involved in achieving such a monumental valuation. We'll explore factors influencing Palantir's stock, its revenue growth, and its overall financial performance to paint a clearer picture.

H2: Palantir's Current Market Position and Growth Trajectory

Palantir's current market capitalization, while substantial, is still a considerable distance from a trillion dollars. Analyzing its recent financial performance is crucial to understand its growth trajectory. The company's revenue streams are diversified, including significant government contracts and a rapidly expanding commercial client base.

- Government Contracts: While providing a stable revenue stream, reliance on government contracts can create vulnerabilities to budgetary changes and shifts in political priorities.

- Commercial Clients: The growth of Palantir's commercial client base is a key indicator of its long-term potential, offering opportunities for diversification and broader market penetration.

To project future growth, we must analyze historical data and account for industry trends. While Palantir has demonstrated strong revenue growth, extrapolating this growth to reach a trillion-dollar valuation by 2030 requires a sustained, exceptionally high rate of expansion, potentially exceeding current market expectations. [Insert chart/graph showing Palantir's revenue growth over time]. This growth needs to be coupled with significant increases in Palantir stock price, which, in turn, depends on several interacting factors.

H2: Market Opportunities and Growth Potential for Big Data Analytics

The big data analytics market is experiencing explosive growth, fueled by factors like the increasing volume of data generated globally, the widespread adoption of cloud computing, and advancements in artificial intelligence (AI). These market drivers present significant opportunities for Palantir. However, the competitive landscape is intensely competitive, with established tech giants and agile startups vying for market share.

- Key Market Drivers: The increasing demand for data-driven decision-making across various industries is a significant driver of growth, coupled with government spending on data analysis and cybersecurity.

- Competitive Advantages: Palantir’s sophisticated software and its ability to handle highly complex data sets provide a competitive edge. Its strong relationships with government agencies also offer a unique market positioning.

- Potential Risks: Increased competition, particularly from companies with stronger brand recognition, could hinder Palantir's market share growth. Regulatory hurdles and data privacy concerns also pose significant challenges.

H2: Technological Advancements and Palantir's Innovation Pipeline

Palantir's R&D investments are crucial to its long-term success. The company’s ability to innovate and adapt to changing technological landscapes will significantly affect its valuation. The integration of AI and machine learning into its products enhances their capabilities, opening up new market opportunities.

- Product Portfolio Expansion: Developing new products and services to address emerging market needs is vital for maintaining a competitive edge and driving further growth.

- AI and Machine Learning Integration: Palantir’s continued investment in AI and machine learning will significantly improve its ability to analyze and interpret data, enhancing the value proposition for its clients.

- Adaptability: The ability to rapidly adapt to changes in technology and customer requirements will be critical for Palantir’s long-term viability.

H2: Risks and Challenges to Reaching a Trillion-Dollar Valuation

Reaching a trillion-dollar valuation presents considerable challenges. Several factors could hinder Palantir’s growth trajectory.

- Economic Downturn: A global economic recession could significantly impact spending on data analytics software, potentially affecting both government and commercial clients.

- Increased Competition: The competitive landscape is dynamic, with new entrants constantly emerging, putting pressure on Palantir's market share and pricing strategies.

- Regulatory Risks: Changes in data privacy regulations and cybersecurity standards could impose compliance costs and potentially limit market access.

- Scaling Challenges: Expanding the business to support a trillion-dollar valuation will require overcoming significant operational and managerial challenges. This includes effectively managing rapid growth, maintaining high quality, and expanding their workforce.

Conclusion: The Likelihood of a Trillion-Dollar Palantir by 2030

Based on our analysis, reaching a trillion-dollar valuation by 2030 for Palantir presents a significant challenge. While the company holds strong positions in the growing big data analytics market and has a robust innovation pipeline, several risks and challenges must be considered. Sustained, exceptional revenue growth, coupled with favorable market conditions and successful navigation of regulatory and competitive landscapes, are essential. The analysis' limitations include the inherent uncertainty of future market conditions and technological advancements. Nevertheless, Palantir's potential remains significant.

Do you think a trillion-dollar Palantir is possible by 2030? Share your thoughts in the comments below! #Palantir #TrillionDollarValuation #BigDataAnalytics #TechInvesting #PalantirStock #MarketCap #FutureofDataAnalytics

Featured Posts

-

Suksesi I Psg Se Formacioni Ideal Per Gjysmefinalet E Liges Se Kampioneve

May 09, 2025

Suksesi I Psg Se Formacioni Ideal Per Gjysmefinalet E Liges Se Kampioneve

May 09, 2025 -

Elon Musks Net Worth A Comprehensive Look At His Business Ventures

May 09, 2025

Elon Musks Net Worth A Comprehensive Look At His Business Ventures

May 09, 2025 -

Racist Stabbing Woman Kills Man In Unprovoked Attack

May 09, 2025

Racist Stabbing Woman Kills Man In Unprovoked Attack

May 09, 2025 -

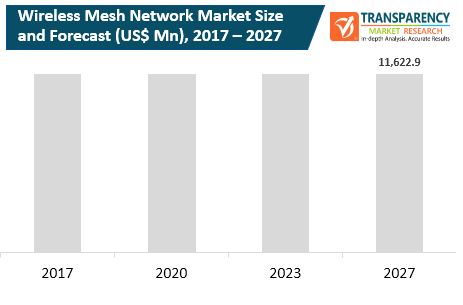

Wireless Mesh Network Market Analysis 9 8 Compound Annual Growth Rate Predicted

May 09, 2025

Wireless Mesh Network Market Analysis 9 8 Compound Annual Growth Rate Predicted

May 09, 2025 -

Possible Les Miserables Cast Boycott Of Trumps Kennedy Center Performance

May 09, 2025

Possible Les Miserables Cast Boycott Of Trumps Kennedy Center Performance

May 09, 2025