Is A Trillion-Dollar Palantir Possible By 2030? Exploring The Opportunities And Challenges

Table of Contents

H2: Palantir's Current Strengths and Market Position

Palantir's core offerings, Gotham and Foundry, are sophisticated platforms designed for data integration and analysis. Gotham, initially focused on government contracts, provides powerful tools for intelligence analysis and counter-terrorism efforts. Foundry, its commercial platform, caters to a broader range of clients, enabling them to harness the power of their data for improved decision-making. These platforms give Palantir a significant foothold in the market.

Currently, Palantir's market capitalization reflects its impressive growth, but its revenue streams and profitability are key indicators of its future trajectory. Analyzing its financial performance reveals a company striving for consistent revenue growth and improved profitability, essential for achieving a trillion-dollar valuation. Palantir's competitive advantages stem from its proprietary data integration and analysis technologies, a focus on high-value, complex data problems, and a strong track record of delivering results for demanding clients. This positions them as a technological leader in the big data analytics space.

- Strong government contracts portfolio: A significant source of revenue and a testament to the platform's effectiveness.

- Growing adoption in the commercial sector: Expansion beyond government clients signifies broad market applicability.

- Proprietary data integration and analysis technologies: A key differentiator providing a competitive edge.

- Focus on high-value, complex data problems: Attracting high-paying clients and building a reputation for excellence.

H2: Opportunities for Exponential Growth

Palantir's growth potential is substantial. Expanding into new markets like healthcare and finance presents significant opportunities. Healthcare data analytics offers the potential to revolutionize patient care and drug discovery, while the financial technology (fintech) sector can benefit from Palantir's advanced risk management and fraud detection capabilities.

Strategic partnerships and acquisitions can also accelerate growth. Collaborating with industry leaders and acquiring smaller, specialized companies can broaden product offerings, enhance technological capabilities, and expand market reach. The increasing demand for AI-driven solutions is another significant catalyst for growth. Palantir's expertise in AI and machine learning (ML) positions it to capitalize on this burgeoning market.

- Untapped potential in emerging markets: Global expansion can significantly increase the customer base.

- Strategic alliances to broaden product offerings: Partnerships can introduce new functionalities and reach new client segments.

- First-mover advantage in AI-powered data analytics: Early adoption of cutting-edge technology provides a significant competitive advantage.

H2: Challenges and Risks to Reaching a Trillion-Dollar Valuation

Despite its strengths, Palantir faces significant challenges. The competitive landscape is crowded, with established tech giants posing considerable competition. These players possess vast resources and established market positions, creating intense market competition. Regulatory hurdles and compliance issues also pose a risk, particularly concerning data privacy and security. Stringent regulations related to data handling and security can impact operations and profitability.

Technological disruptions and innovation also present risks. The rapid pace of technological advancement necessitates constant innovation to avoid obsolescence. Emerging technologies could render current solutions outdated, impacting market share and revenue.

- Intense competition from established tech companies: Maintaining a competitive edge requires continuous innovation and adaptation.

- Data privacy and security concerns: Stringent regulations and potential breaches represent significant operational and financial risks.

- Potential for technological obsolescence: Staying ahead of the curve in rapidly evolving technology is crucial for long-term success.

H3: The Role of AI and its potential impact on valuation

Advancements in artificial intelligence, particularly machine learning and deep learning, are pivotal to Palantir's future. AI applications within its platforms can significantly enhance data analysis capabilities, leading to more accurate predictions, improved decision-making, and ultimately, increased revenue growth and market share. However, the development and deployment of AI also pose risks. Significant investment in AI research and development is needed to maintain a competitive edge, and there are ethical considerations and potential biases in AI algorithms that must be addressed.

3. Conclusion:

The possibility of Palantir achieving a trillion-dollar valuation by 2030 is a complex question. While the company boasts considerable strengths and significant growth opportunities in the burgeoning fields of AI and big data analytics, substantial challenges remain. Intense competition, regulatory hurdles, and the inherent risks associated with technological disruption must be carefully addressed. Success will depend on Palantir's capacity for continuous innovation, adaptability to evolving market demands, and effective management of its expansion. Further research and ongoing monitoring of Palantir stock and developments in big data analytics are crucial for a comprehensive understanding of Palantir's future prospects. Stay informed to witness this exciting company's journey toward its ambitious goals.

Featured Posts

-

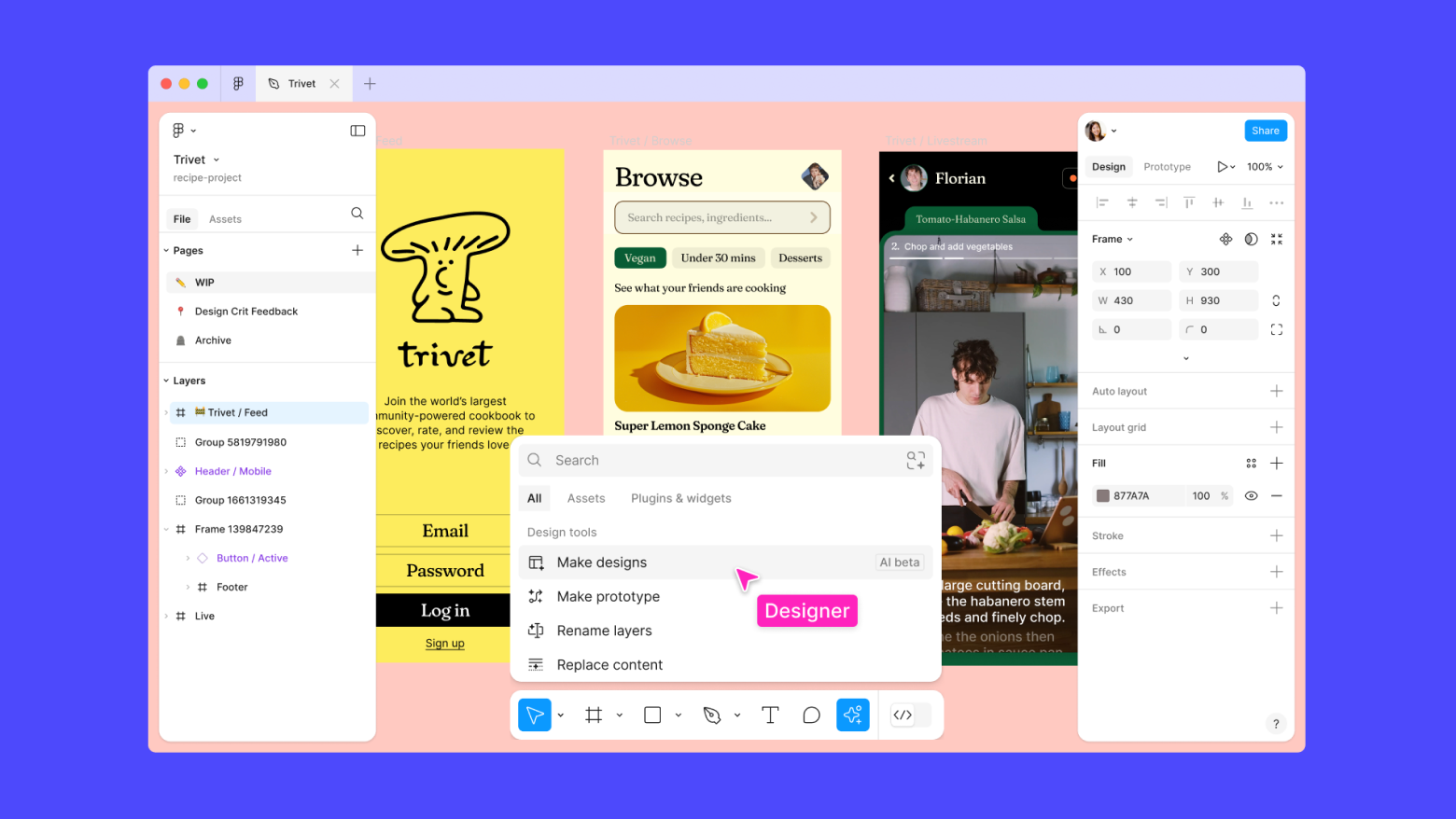

Understanding The Competitive Advantage Of Figmas Ai

May 10, 2025

Understanding The Competitive Advantage Of Figmas Ai

May 10, 2025 -

The Trump Administration On May 8th 2025 Day 109 In Review

May 10, 2025

The Trump Administration On May 8th 2025 Day 109 In Review

May 10, 2025 -

Public Reaction To Pam Bondis Statements On Killing American Citizens

May 10, 2025

Public Reaction To Pam Bondis Statements On Killing American Citizens

May 10, 2025 -

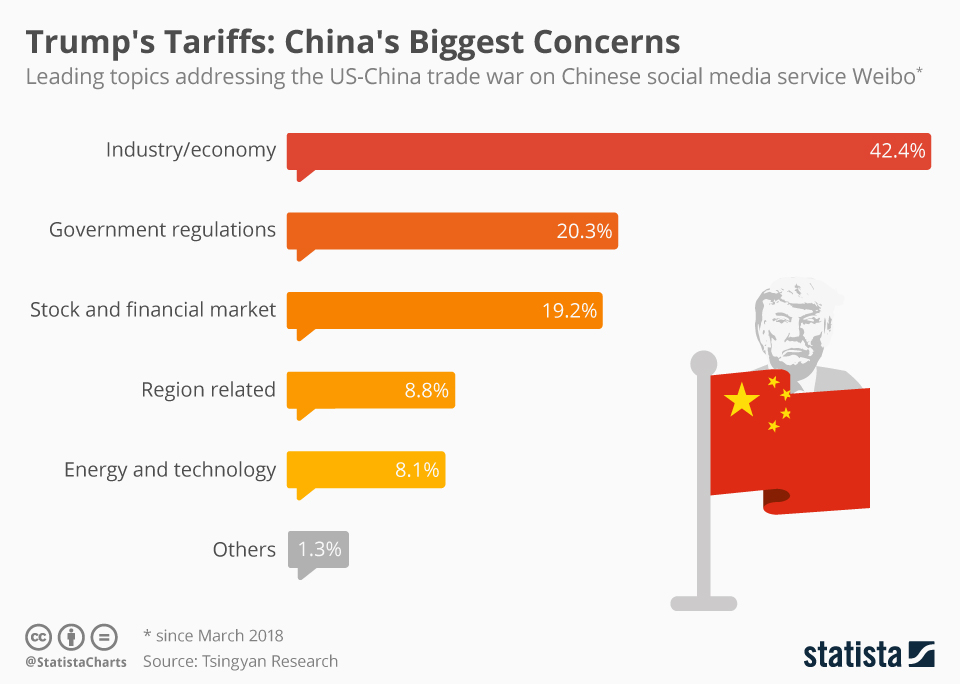

Stronger Eu Response To Us Tariffs A French Ministers Plea

May 10, 2025

Stronger Eu Response To Us Tariffs A French Ministers Plea

May 10, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 10, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 10, 2025