Is Apple Vulnerable? Analyzing The Impact Of Tariffs On Buffett's Holdings

Table of Contents

Apple's Global Supply Chain and Tariff Sensitivity

Apple's success is built upon a complex, globally dispersed supply chain. A significant portion of its manufacturing relies on factories in China and other countries, making it highly susceptible to tariffs imposed on imported goods. These tariffs can affect various aspects of Apple's production, from individual components to finished products.

- Percentage of Apple products manufactured in China: While Apple doesn't release precise figures, estimates suggest a significant portion of its manufacturing occurs in China, making it particularly sensitive to US-China trade tensions.

- Specific components sourced from tariff-affected regions: Many crucial components, such as processors, displays, and other electronic parts, are sourced from countries subject to tariffs, increasing Apple's overall production costs.

- Potential impact of increased import costs on Apple's profit margins: Higher import costs directly translate to reduced profit margins, potentially impacting Apple's overall profitability and investor confidence, including that of Berkshire Hathaway. This could lead to decreased dividends and slower growth for one of Buffett's most prized holdings.

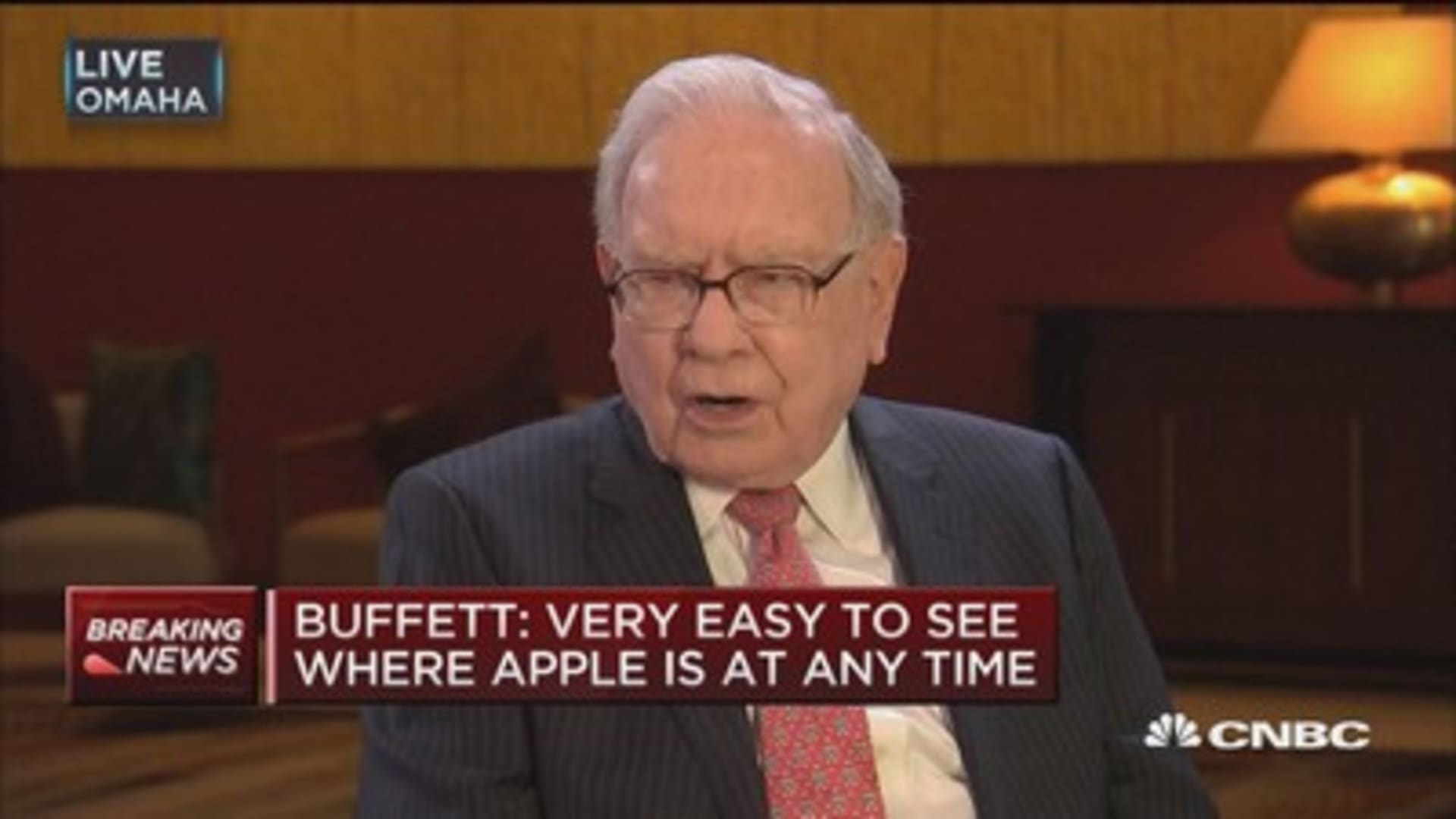

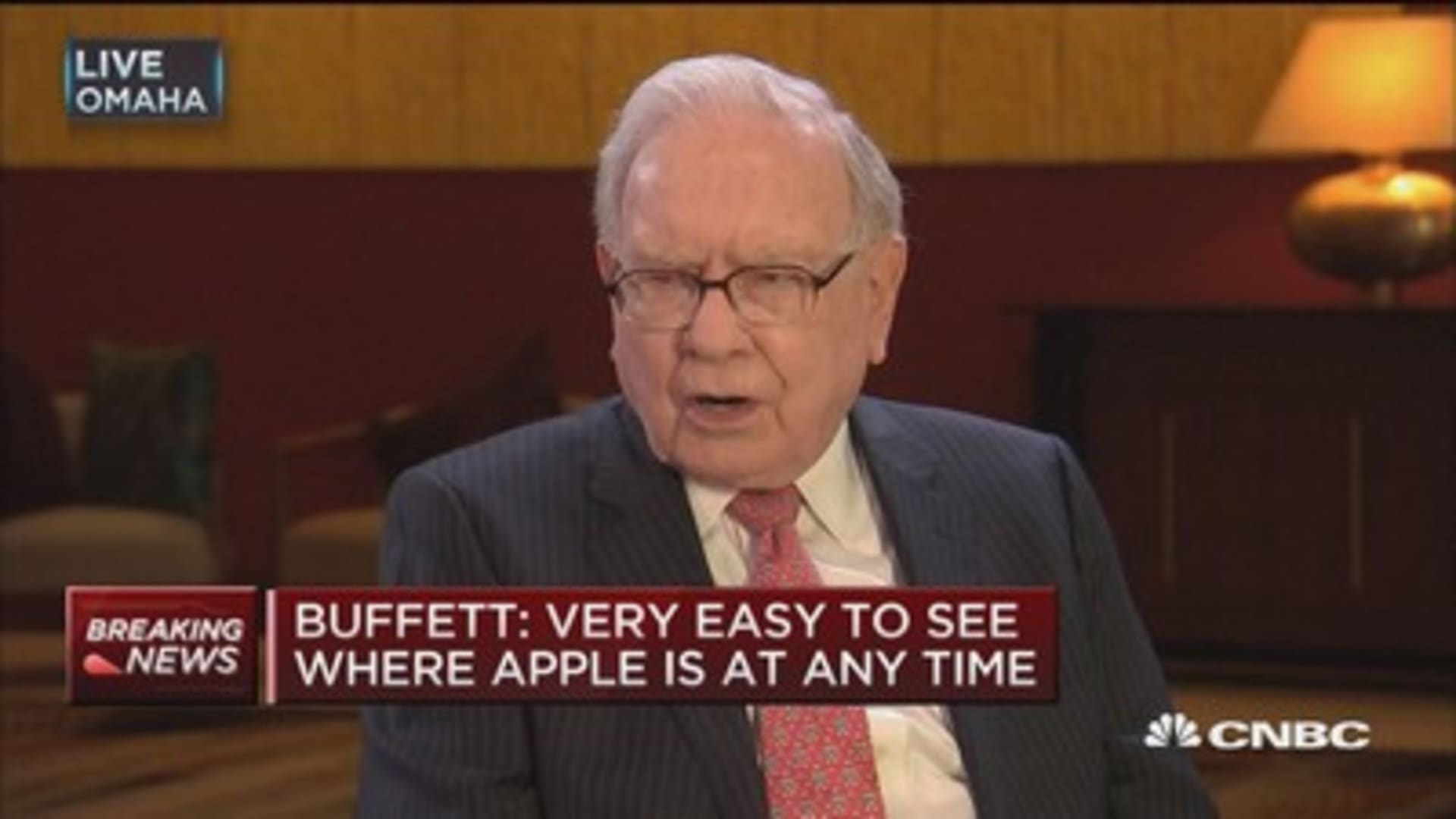

Berkshire Hathaway's Investment in Apple and Potential Losses

Berkshire Hathaway holds a massive stake in Apple stock, representing a substantial portion of its investment portfolio. This significant investment makes Buffett's company directly exposed to any negative impact on Apple's stock price caused by tariffs. Increased prices or decreased demand due to tariffs could trigger a decline in Apple's stock value, leading to potential losses for Berkshire Hathaway.

- Value of Berkshire Hathaway's Apple holdings: Berkshire Hathaway's Apple holdings represent billions of dollars, making any significant downturn a considerable financial risk.

- Potential percentage loss for Berkshire Hathaway under different tariff scenarios: Depending on the severity and duration of the tariffs, potential losses for Berkshire Hathaway could range from minor setbacks to substantial financial impacts. Modeling various tariff scenarios is crucial for assessing the potential risks.

- Historical data on Apple's stock performance in relation to trade policies: Examining past instances where trade policies impacted Apple’s stock price can provide valuable insight into potential future scenarios. This historical analysis can inform predictions about the market’s reaction to current trade tensions.

Consumer Impact and Demand Elasticity

The increased prices resulting from tariffs on Apple products could significantly affect consumer demand. Whether this impact is substantial depends on the price elasticity of demand for Apple products. While Apple enjoys strong brand loyalty, a significant price increase might push some consumers towards alternative brands offering similar functionality at a lower cost.

- Analysis of consumer behavior in response to previous price increases: Past data on how Apple customers reacted to price hikes can illuminate consumer sensitivity to price changes.

- Potential market share loss for Apple due to higher prices: Depending on the price increase and the availability of competitive alternatives, Apple could experience a reduction in market share.

- Discussion of substitute products and their competitive advantage: Analyzing competitive products and their pricing strategies is crucial to understand the potential impact of tariffs on Apple's market position. The existence of strong substitutes with similar features but lower prices could significantly impact demand for Apple products.

Apple's Mitigation Strategies and Future Outlook

Apple is not a passive player in the face of trade challenges. The company can employ several strategies to mitigate the impact of tariffs, such as diversifying its manufacturing base, adjusting prices strategically, or engaging in lobbying efforts to influence trade policies.

- Examples of Apple's past responses to trade challenges: Reviewing Apple's historical responses to similar trade issues provides insights into its potential strategies.

- Potential for relocating manufacturing to reduce tariff exposure: Shifting some of its manufacturing operations to countries outside of tariff-affected regions could reduce Apple's vulnerability. This, however, presents logistical and economic challenges.

- Long-term forecast for Apple's profitability considering tariff risks: The long-term impact of tariffs on Apple's profitability is uncertain and depends on numerous factors, including the duration of tariffs, Apple's ability to mitigate their impact, and the overall macroeconomic environment.

Conclusion: Is Apple Truly Vulnerable? A Look at Tariffs and Buffett's Stake

Our analysis reveals that Apple, despite its considerable strength, is significantly exposed to the impact of tariffs. This exposure, in turn, poses a potential risk to Berkshire Hathaway's substantial investment in Apple. Escalating trade tensions could severely impact Apple's financial performance and its market dominance. While Apple is actively seeking ways to mitigate these risks, the uncertainties surrounding global trade policy warrant continued vigilance.

Stay informed about the impact of tariffs on Apple, monitor Buffett's investment strategies in light of these trade risks, and continue analyzing Apple's vulnerability to future trade policies. Understanding the interplay between global trade, corporate strategy, and investment decisions is crucial in today's interconnected world.

Featured Posts

-

Is Demna Gvasalia The Right Choice For Gucci

May 25, 2025

Is Demna Gvasalia The Right Choice For Gucci

May 25, 2025 -

Heinekens Strong Revenue Growth Reaffirming Outlook In Challenging Market

May 25, 2025

Heinekens Strong Revenue Growth Reaffirming Outlook In Challenging Market

May 25, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 25, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 25, 2025 -

Uspekhi I Provaly Chto Udalos Nashemu Pokoleniyu

May 25, 2025

Uspekhi I Provaly Chto Udalos Nashemu Pokoleniyu

May 25, 2025 -

Dow Jones Grinds Higher Following Positive Pmi Report

May 25, 2025

Dow Jones Grinds Higher Following Positive Pmi Report

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025