Is BigBear.ai Holdings, Inc. (NYSE: BBAI) A Top Penny Stock To Watch?

Table of Contents

BigBear.ai's Business Model and Technology

BigBear.ai's core offering centers around providing AI-powered solutions to a diverse range of sectors, primarily focusing on defense, intelligence, and commercial applications. Their technology utilizes advanced artificial intelligence, machine learning, and data analytics to solve complex problems and deliver actionable insights.

AI-Powered Solutions

BigBear.ai offers a portfolio of sophisticated AI solutions, including:

- Advanced analytics and predictive modeling: Used for threat detection, risk assessment, and resource optimization in defense and intelligence sectors.

- Geospatial intelligence solutions: Providing insights from geographic data for various applications, including mapping, terrain analysis, and target identification.

- Cybersecurity solutions: Leveraging AI to identify and mitigate cyber threats, ensuring data protection for clients.

- Commercial applications of AI: Expanding into commercial markets with solutions focused on data analysis, predictive maintenance, and fraud detection.

These solutions target diverse markets, encompassing government agencies, defense contractors, and commercial enterprises seeking advanced AI capabilities.

Competitive Landscape

BigBear.ai operates in a competitive AI landscape, facing established players and emerging startups. Key competitors include companies specializing in AI-driven analytics, cybersecurity, and geospatial intelligence. A thorough market analysis is needed to fully understand BigBear.ai's competitive advantage. While BigBear.ai possesses strong technological capabilities, its market share and revenue compared to larger competitors need careful consideration. This competitive landscape introduces significant risks and necessitates a detailed assessment of BigBear.ai's unique strengths and weaknesses relative to its competitors.

Financial Performance and Stock Valuation

Analyzing BigBear.ai's financial health is crucial for any potential investor. Examining their financial statements provides insights into their revenue growth, profitability, and overall financial stability.

Recent Financial Results

BigBear.ai's recent financial reports should be examined for key metrics like revenue growth, profit margins, and debt-to-equity ratio. These figures offer a snapshot of their financial performance and potential for future growth. (Note: For the most up-to-date financial data, refer to BigBear.ai's official investor relations website.) Analyzing these trends is essential for assessing the company's financial health and sustainability.

Stock Price and Volatility

The BBAI stock price has exhibited considerable volatility, typical of a penny stock. Tracking its historical stock price, including the 52-week high and low, and daily trading volume provides a picture of its price fluctuations. Analyzing historical stock charts can give insights into market sentiment and investor behavior. However, past performance does not guarantee future results. The inherent volatility underscores the high risk associated with investing in BBAI.

Risks and Potential Rewards of Investing in BBAI

Investing in BBAI, like any penny stock, involves substantial risks and potential rewards. A careful assessment of both is critical before making an investment decision.

Potential Risks

Investing in BigBear.ai presents several key risks:

- High market volatility: Penny stocks are notoriously volatile, meaning the BBAI stock price can experience significant swings in short periods.

- Financial uncertainty: The company's financial performance is subject to change, impacting the stock price.

- Competitive pressures: Intense competition in the AI market could hinder BigBear.ai's growth.

- Dependence on government contracts: A significant portion of BigBear.ai's revenue may rely on government contracts, introducing geopolitical and budgetary risks.

Potential Rewards

Despite the risks, investing in BBAI also offers potential rewards:

- High-growth potential: If BigBear.ai successfully executes its business strategy and expands its market share, the stock price could experience substantial growth.

- First-mover advantage: BigBear.ai's AI solutions could provide a competitive edge in certain niche markets.

- Technological innovation: Continued advancements in AI technology could significantly enhance BigBear.ai's offerings and increase its market value.

Conclusion

BigBear.ai (BBAI) presents a compelling but risky investment opportunity. Its focus on AI-powered solutions in high-growth sectors offers potential for substantial returns. However, the company's financial performance, competitive landscape, and the inherent volatility of penny stocks should be carefully considered. Is BigBear.ai (BBAI) the right penny stock for you? Further research and careful consideration of your own risk tolerance are crucial before investing in this volatile sector. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to BigBear.ai or other penny stocks. Remember, investing in penny stocks always carries significant risk.

Featured Posts

-

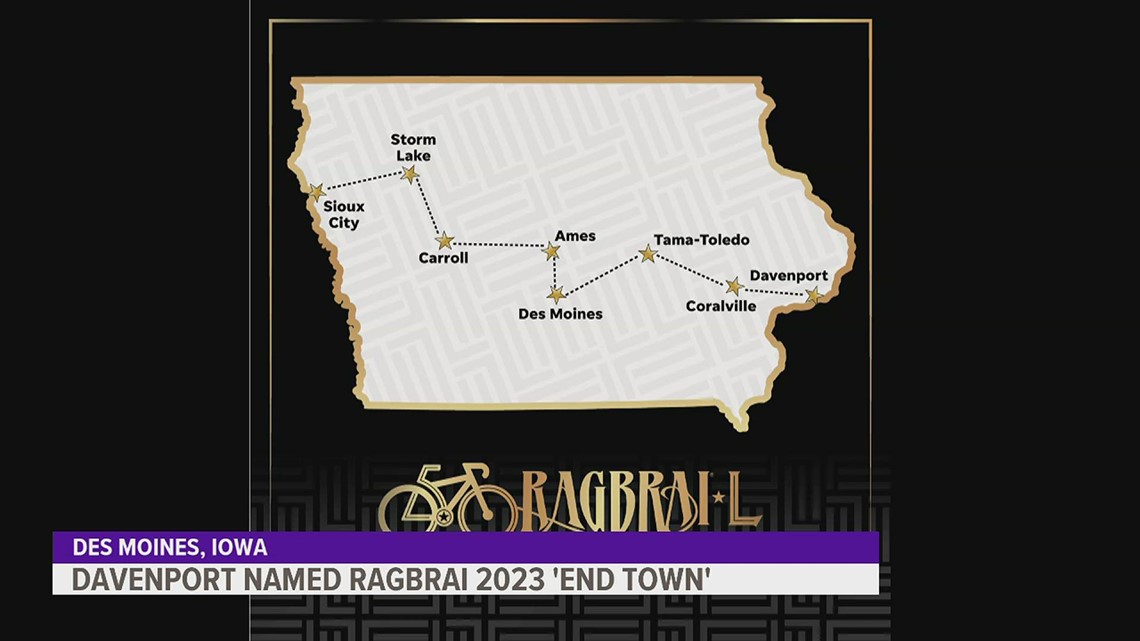

Scott Savilles Biking Journey From Ragbrai To Daily Commutes

May 21, 2025

Scott Savilles Biking Journey From Ragbrai To Daily Commutes

May 21, 2025 -

Espace Julien Les Ecrivains Avant Le Hellfest

May 21, 2025

Espace Julien Les Ecrivains Avant Le Hellfest

May 21, 2025 -

Suomi Mm Karsinnat 2024 Huuhkajien Uusi Valmennusstrategia

May 21, 2025

Suomi Mm Karsinnat 2024 Huuhkajien Uusi Valmennusstrategia

May 21, 2025 -

Gbr Top Stories Grocery Deals 2 K Quarter And Doge Poll Results

May 21, 2025

Gbr Top Stories Grocery Deals 2 K Quarter And Doge Poll Results

May 21, 2025 -

Abn Amro Sterke Stijging Occasionverkoop Door Toenemend Autobezit

May 21, 2025

Abn Amro Sterke Stijging Occasionverkoop Door Toenemend Autobezit

May 21, 2025

Latest Posts

-

Nuffy Realizes Dream Touring Alongside Vybz Kartel

May 22, 2025

Nuffy Realizes Dream Touring Alongside Vybz Kartel

May 22, 2025 -

The Beenie Man Effect Transforming It In New York

May 22, 2025

The Beenie Man Effect Transforming It In New York

May 22, 2025 -

Beenie Man And The Future Of It In New York An Analysis

May 22, 2025

Beenie Man And The Future Of It In New York An Analysis

May 22, 2025 -

Is Beenie Man Disrupting The New York It Scene

May 22, 2025

Is Beenie Man Disrupting The New York It Scene

May 22, 2025 -

Vybz Kartels Exclusive Interview Life In Prison And Beyond

May 22, 2025

Vybz Kartels Exclusive Interview Life In Prison And Beyond

May 22, 2025