Is Buying A House Possible While Paying Off Student Loans?

Table of Contents

Assessing Your Financial Situation

Before you even begin browsing listings, a thorough assessment of your financial situation is crucial. This involves understanding your student loans, evaluating your income and expenses, and ultimately calculating how much home you can realistically afford.

Understanding Your Student Loan Debt

Knowing the specifics of your student loan debt is paramount. This includes:

- Types of loans: Federal loans often offer income-driven repayment plans, while private loans may have less flexible terms.

- Interest rates: Higher interest rates mean more money paid over the life of the loan, impacting your budget.

- Repayment plans: Standard repayment plans have fixed monthly payments, while income-driven plans adjust payments based on your income.

- Loan balances: Knowing your total outstanding balance is essential for accurate financial planning.

Understanding your loan amortization schedule – the breakdown of principal and interest payments over time – will help you anticipate your monthly obligations and factor them into your homeownership budget. Careful management of your student loan repayment is key to successfully navigating the process of buying a house.

Evaluating Your Income and Expenses

Creating a detailed budget is the next critical step. This involves:

- Tracking spending habits: Use budgeting apps or spreadsheets to monitor your income and expenses accurately.

- Identifying areas for savings: Look for areas where you can cut back on spending to free up more money for your down payment and future mortgage payments.

- Creating a realistic budget: This budget should include your student loan payments, living expenses (rent, utilities, groceries, transportation), and anticipated homeownership costs (property taxes, insurance, maintenance).

Thorough budgeting for a house, including consistent expense tracking and realistic income analysis, is crucial for financial planning success.

Calculating Your Affordable Home Price

Armed with your budget, you can now determine how much house you can afford. This involves:

- Using online mortgage calculators: Many free online tools can help estimate your monthly mortgage payment based on loan amount, interest rate, and loan term.

- Understanding your debt-to-income ratio (DTI): Lenders use your DTI (total debt payments divided by gross monthly income) to assess your ability to repay a mortgage. A lower DTI improves your chances of approval.

- Considering property taxes and insurance: Don't forget to factor these essential costs into your monthly housing budget.

Aiming for affordable housing options and understanding your debt-to-income ratio are key to finding a home you can comfortably afford.

Exploring Strategies for Homeownership

Even with student loan debt, several strategies can accelerate your path to homeownership.

Saving for a Down Payment

Saving for a down payment is a significant hurdle. However, several strategies can help you accelerate the process:

- High-yield savings accounts: Maximize your savings by using accounts that offer higher interest rates.

- Investment strategies: Consider low-risk investments to grow your savings faster, but remember that investments carry some risk.

- Utilizing employer matching programs: If your employer offers a matching program for retirement savings, take advantage of it to boost your savings.

Consistent contributions to your down payment savings are crucial for achieving your homeownership goals.

Improving Your Credit Score

A higher credit score translates to better mortgage rates and increased chances of loan approval. Improving your credit score involves:

- Paying bills on time: Consistent on-time payments are the most significant factor in your credit score.

- Reducing credit utilization: Keep your credit card balances low (ideally under 30% of your credit limit).

- Monitoring your credit reports: Regularly check your credit reports for errors and take steps to correct them.

Improving your credit report and credit utilization are essential steps towards securing a favorable mortgage rate.

Choosing the Right Mortgage

Different mortgage options cater to various financial situations. Explore:

- Fixed-rate vs. adjustable-rate mortgages: Fixed-rate mortgages provide predictable monthly payments, while adjustable-rate mortgages (ARMs) have interest rates that change over time.

- FHA loans: These government-backed loans require lower down payments and are often more accessible to borrowers with less-than-perfect credit.

- VA loans: These loans are available to eligible veterans and active-duty military personnel and often require no down payment.

- Conventional loans: These loans are not government-backed and typically require higher credit scores and larger down payments.

Shopping around for the best mortgage rates and understanding the different mortgage types is crucial for securing favorable loan terms.

Seeking Professional Advice

Navigating the complexities of buying a house while paying off student loans can be overwhelming. Seeking professional help is highly recommended.

Consulting with a Financial Advisor

A financial advisor can provide personalized financial planning tailored to your unique situation:

- Creating a personalized financial plan: They will help you create a comprehensive plan that addresses both your student loan debt and your homeownership goals.

- Exploring debt consolidation options: They can help determine if consolidating your student loans would improve your financial situation.

- Strategic budgeting advice: They can offer expert advice on optimizing your budget and maximizing your savings.

A personalized financial plan can significantly impact your success in buying a house while managing your student loan debt.

Working with a Mortgage Lender

A mortgage lender will guide you through the mortgage application process:

- Pre-approval process: Get pre-approved to understand how much you can borrow and strengthen your offer when you find a house.

- Understanding mortgage requirements: They will explain the necessary documentation and requirements for loan approval.

- Negotiating loan terms: They can help you negotiate the best possible interest rate and loan terms.

Working closely with a mortgage lender simplifies the complexities of the mortgage application process.

Conclusion: Making Buying a House While Paying Off Student Loans a Reality

Buying a house while paying off student loans is certainly challenging, but it's not impossible. By carefully assessing your financial situation, exploring various homeownership strategies, and seeking professional guidance, you can make your dream a reality. Remember the key takeaways: create a detailed budget, prioritize saving for a down payment, improve your credit score, shop around for the best mortgage rates, and don't hesitate to seek expert advice from financial advisors and mortgage lenders. Start planning your journey towards homeownership today—even with student loans! Take control of your finances and begin working towards "buying a house with student loan debt" successfully.

Featured Posts

-

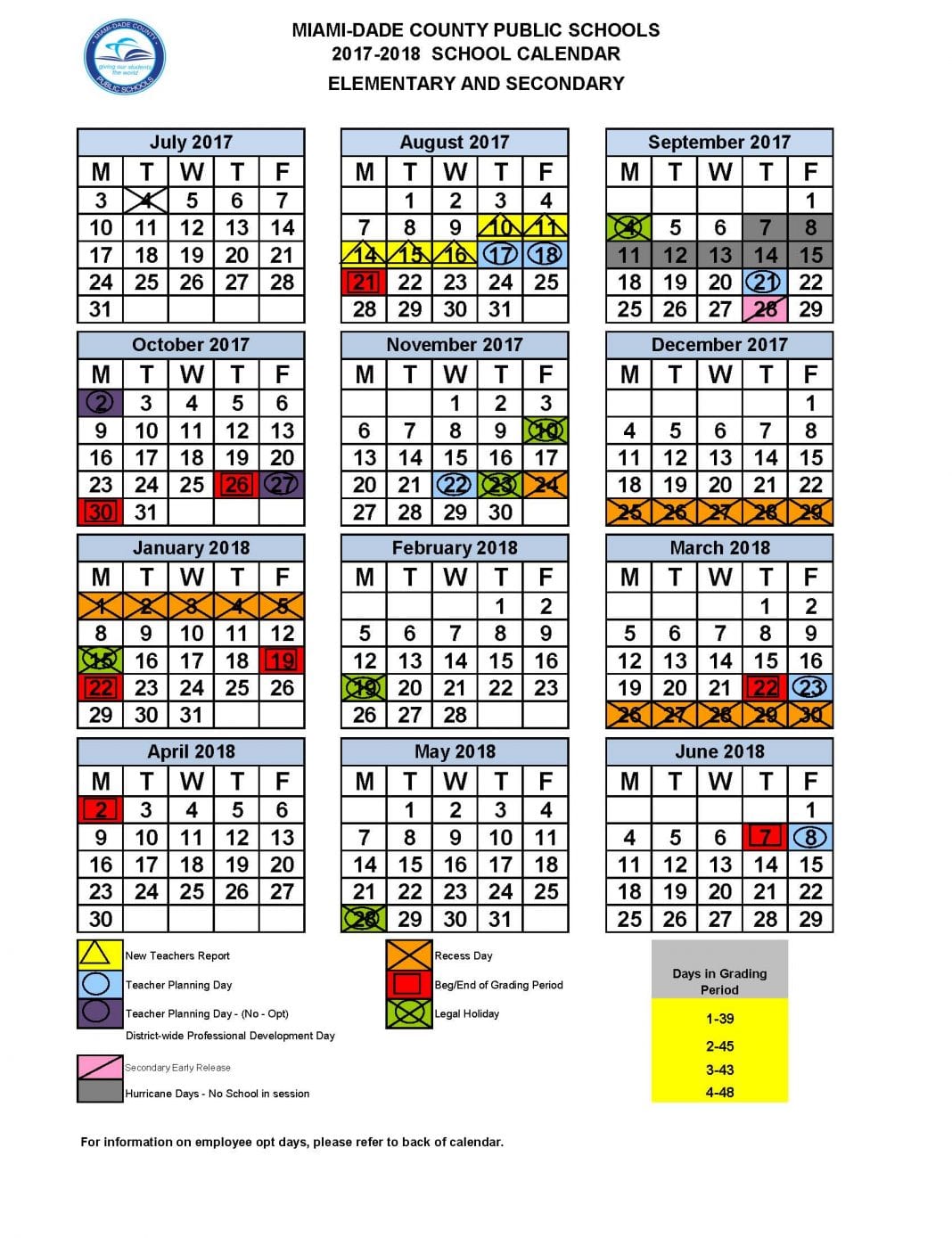

High School Confidential Week 26 2024 25 School Year

May 17, 2025

High School Confidential Week 26 2024 25 School Year

May 17, 2025 -

Knicks Vs Pistons Series Bet365 Bonus Code Nypbet And Betting Preview

May 17, 2025

Knicks Vs Pistons Series Bet365 Bonus Code Nypbet And Betting Preview

May 17, 2025 -

Whats Preventing Top Nba Teams From Winning A Championship

May 17, 2025

Whats Preventing Top Nba Teams From Winning A Championship

May 17, 2025 -

Positive News On Mitchell Robinsons Status After Knicks Losing Streak

May 17, 2025

Positive News On Mitchell Robinsons Status After Knicks Losing Streak

May 17, 2025 -

Reddit Down Thousands Of Users Worldwide Affected

May 17, 2025

Reddit Down Thousands Of Users Worldwide Affected

May 17, 2025