Is CoreWeave (CRWV) A Smart Investment? Jim Cramer Weighs In

Table of Contents

CoreWeave's Business Model and Market Position

CoreWeave's core business revolves around providing cloud computing services, specifically focusing on GPU-accelerated computing. This specialization caters to the burgeoning demand for powerful computing resources needed for AI model training, machine learning algorithms, and other computationally intensive tasks. Their competitive advantage lies in their advanced infrastructure, built on a foundation of state-of-the-art GPUs, and their specialized expertise in optimizing these resources for demanding workloads. This focus on a specific niche within the broader cloud computing market allows them to offer tailored solutions and attract clients with highly specialized needs.

The cloud computing market itself is experiencing explosive growth, driven by the increasing adoption of cloud-based services across all industries. The demand for AI processing power is further fueling this expansion, creating a prime environment for a company like CoreWeave to flourish. Their strategic position within this landscape allows them to capitalize on multiple trends simultaneously.

- Unique GPU cloud infrastructure: CoreWeave leverages cutting-edge GPU technology, providing superior performance for AI and machine learning applications.

- Focus on AI and machine learning workloads: Their specialized services are perfectly positioned to benefit from the rapidly expanding AI market.

- Strong partnerships with major technology companies: Collaborations with leading tech firms enhance their market reach and credibility.

- Scalable and flexible infrastructure: Their infrastructure allows them to adapt to fluctuating demands and grow alongside their clients.

Financial Performance and Growth Prospects

While CoreWeave is a relatively new public company, analyzing their available financial statements (post-IPO) is crucial to assess their performance and growth potential. Examining revenue growth rates, profitability margins (gross and operating), and customer acquisition costs provides insights into their financial health and efficiency. Projecting future revenue and earnings based on their current trajectory and market trends is also essential. Investors should look for sustainable revenue growth, improving profitability, and efficient customer acquisition strategies to indicate a strong and healthy business model.

Further indicators of future growth include their potential for expansion into new markets, the development of new product offerings, and their success in acquiring and retaining large enterprise clients. A robust pipeline of prospective clients is also a strong sign of future growth prospects.

- Revenue growth rate analysis: A consistently high revenue growth rate suggests a strong market position and demand for their services.

- Profitability margins: Healthy margins indicate efficient operations and pricing strategies.

- Customer acquisition costs: Low CAC shows effective marketing and sales efforts.

- Projected future revenue and earnings: Analyst forecasts and company projections provide a roadmap for potential future performance.

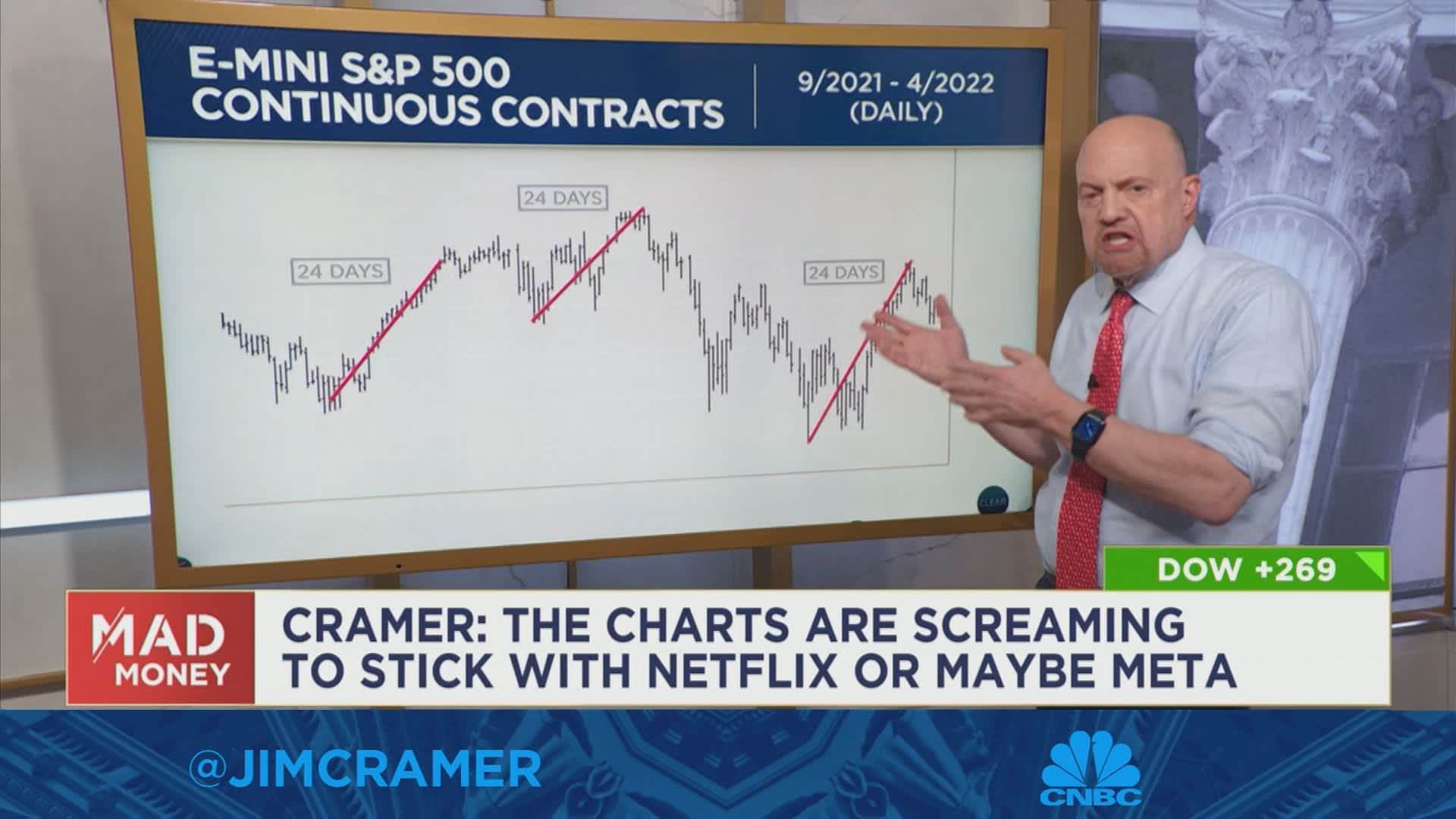

Jim Cramer's Perspective on CoreWeave (CRWV)

Jim Cramer, a well-known figure in the financial media, often shares his opinions on various stocks, influencing investor sentiment. While his pronouncements are not always predictive of future performance, understanding his perspective on CoreWeave (CRWV) – should he have publicly commented on it – can offer valuable insight. Searching reputable financial news sources and transcripts of his television appearances will provide any available information on his views. Analyzing his reasoning is important; does he focus on the company’s strengths, weaknesses, or market positioning? Understanding his investment criteria helps contextualize his opinions.

His comments, if available, can have a significant impact on investor behavior. A positive endorsement might lead to increased buying pressure, while a negative assessment could result in selling. Comparing his views on CoreWeave to his opinions on similar companies in the cloud computing or AI sectors provides further context for his assessment.

- Quotes from Jim Cramer on CRWV (if available): Direct quotes provide the most accurate representation of his views.

- Analysis of Cramer's investment philosophy: Understanding his overall approach helps interpret his specific comments on CRWV.

- Influence of Cramer's opinion on market behavior: Assessing the potential impact of his statements on stock prices.

- Comparison to Cramer's opinions on similar companies: Contextualizing his CoreWeave assessment within his broader views on the industry.

Risks and Potential Downsides of Investing in CoreWeave (CRWV)

Investing in CoreWeave, like any stock, involves inherent risks. The competitive landscape is intense, with established players and emerging competitors vying for market share. Economic downturns could impact spending on cloud computing and AI initiatives. Technological disruptions could render their current infrastructure obsolete, requiring costly upgrades. Regulatory changes related to data privacy and security could also pose significant challenges.

The overall risk profile of CoreWeave needs careful consideration. Investors should assess their own risk tolerance before investing. Understanding these potential downsides allows for informed decision-making.

- Competitive landscape and potential disruption: The presence of strong competitors presents a significant threat.

- Economic sensitivity of the cloud computing market: Economic downturns can decrease demand for cloud services.

- Technological obsolescence risks: Rapid technological advancements could necessitate costly infrastructure upgrades.

- Regulatory hurdles and compliance costs: Meeting regulatory requirements involves significant expense and effort.

Conclusion: Is CoreWeave (CRWV) Right for Your Portfolio?

CoreWeave (CRWV) presents a compelling investment opportunity in the rapidly growing cloud computing and AI markets. Its focus on GPU-accelerated computing, specialized expertise, and strong partnerships provide several key strengths. However, the competitive landscape, economic sensitivity, and technological risks warrant careful consideration. Jim Cramer's perspective, if available, provides additional insight but should not be the sole factor driving investment decisions.

Ultimately, whether CoreWeave (CRWV) is right for your portfolio depends on your individual risk tolerance, investment goals, and thorough due diligence. Remember to conduct your own comprehensive research, analyzing financial statements, industry trends, and competitive dynamics before making any investment decisions. Consider consulting with a qualified financial advisor for personalized guidance on your CoreWeave investment strategy or CRWV stock analysis within your overall portfolio. This analysis should serve as a starting point for your own in-depth exploration of this exciting high-growth stock opportunity.

Featured Posts

-

Councillors Wife Fails To Overturn Sentence For Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Fails To Overturn Sentence For Anti Migrant Social Media Post

May 22, 2025 -

Wtt Star Contender Chennai A Record 19 Indian Paddlers To Participate

May 22, 2025

Wtt Star Contender Chennai A Record 19 Indian Paddlers To Participate

May 22, 2025 -

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Rotsi Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 22, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Rotsi Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 22, 2025 -

Marks And Spencers Significant Cyberattack A 300 Million Loss

May 22, 2025

Marks And Spencers Significant Cyberattack A 300 Million Loss

May 22, 2025 -

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Latest Posts

-

Remembering A Rock Legend Frontman Passes Away At 32

May 22, 2025

Remembering A Rock Legend Frontman Passes Away At 32

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At Age Following Suicide

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At Age Following Suicide

May 22, 2025 -

Dropout Kings Adam Ramey Singer Dies At 31

May 22, 2025

Dropout Kings Adam Ramey Singer Dies At 31

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Dies At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Dies At 32

May 22, 2025 -

Popular Rock Band Frontman Dies At 32 Fans Mourn Beloved Musician

May 22, 2025

Popular Rock Band Frontman Dies At 32 Fans Mourn Beloved Musician

May 22, 2025