Is Elon Musk's Anger Good For Tesla Stock?

Table of Contents

Elon Musk's outspoken and often controversial personality has become synonymous with Tesla. His anger, frequently expressed on social media and in public statements, is a point of constant discussion among investors. But does this volatile behavior actually benefit Tesla's stock price, or is it a detriment to long-term growth? This article explores the complex relationship between Elon Musk's anger and Tesla's market performance.

The Impact of Musk's Public Persona on Investor Sentiment

Elon Musk's public persona significantly influences investor sentiment towards Tesla. While his actions can generate short-term gains, the long-term consequences remain a subject of debate.

Positive Impacts (Short-Term):

- Increased Media Attention: Musk's controversial statements often generate significant media coverage, boosting Tesla's brand awareness and potentially attracting new investors. The sheer volume of news coverage, even if negative, can translate to increased visibility.

- Hype and Excitement: Musk's passionate pronouncements, even if laced with anger, can create excitement and anticipation surrounding new product launches or technological advancements. This hype can temporarily inflate the stock price.

- Authentic Leadership (Perceived): Some investors might perceive Musk's outspokenness as a sign of authentic leadership, even if unconventional. This resonates with investors who value transparency and a direct, if abrasive, communication style.

- Example: The announcement of the Cybertruck, despite its unconventional design, initially generated considerable buzz and short-term stock price increases.

Negative Impacts (Long-Term):

- Alienating Investors: Musk's volatile behavior can alienate potential investors seeking stability and predictability. Many institutional investors prioritize risk mitigation, and Musk's actions increase perceived risk.

- Reputational Damage: Controversial tweets and public outbursts can damage Tesla's brand reputation, leading to reputational risk and potentially affecting sales. Negative publicity can deter customers and investors alike.

- Market Volatility: Musk's actions create uncertainty in the market, leading to significant price fluctuations in Tesla's stock. This volatility can be detrimental to long-term investment strategies.

- Example: Musk's tweets regarding taking Tesla private, and subsequent SEC investigations, led to significant stock price volatility and negative consequences.

- Example: Lawsuits and regulatory investigations related to Musk's public statements and actions can create further uncertainty and risk for Tesla investors.

Analyzing the Correlation Between Musk's Anger and Tesla Stock Performance

Establishing a direct causal link between Musk's anger and Tesla's stock performance is challenging. However, analyzing historical data can provide some insights.

- Examining instances of significant stock price movements following controversial tweets or public statements reveals a complex picture. Sometimes, the stock price rises temporarily, while at other times it experiences a sharp decline.

- Statistical analysis, while complex due to the numerous variables influencing Tesla's stock price (market trends, competitor actions, etc.), can help determine if a correlation exists. This analysis needs to carefully control for extraneous factors.

- A comprehensive analysis would consider broader market trends, economic conditions, and news cycles alongside Musk's actions to isolate the impact of his behavior.

- Example Chart (Hypothetical): A chart illustrating Tesla's stock price movements alongside a timeline of significant Musk-related controversies could visualize potential correlations, but wouldn't prove causation.

- Limitation: Attributing specific stock price changes solely to Musk's behavior is an oversimplification. Many other factors influence stock performance.

The Role of Social Media and Public Relations in Managing the Narrative

Musk's prolific use of Twitter and other social media platforms significantly impacts the narrative surrounding Tesla and his leadership.

- Twitter's Influence: His tweets, often impulsive and controversial, directly impact investor sentiment and market perception. Positive announcements can boost the stock, while negative or inflammatory statements can lead to losses.

- Public Relations Challenges: Tesla's public relations team faces the immense challenge of managing the fallout from Musk's unpredictable behavior. Mitigating negative consequences requires proactive and responsive PR strategies.

- Competing Narratives: Multiple narratives exist surrounding Musk – visionary leader, reckless innovator, controversial figure – and these competing perceptions influence investor decisions.

- Example: Tesla's PR efforts to counter negative press stemming from Musk's tweets have varied in effectiveness, highlighting the ongoing challenge.

- Challenge: Balancing Musk's outspoken nature with maintaining a positive brand image for Tesla is a significant and ongoing challenge for the company.

Conclusion

This article has explored the complex relationship between Elon Musk's anger and the performance of Tesla stock. While short-term gains may be seen due to increased media attention and hype, the long-term effects of his volatile behavior raise serious concerns about brand reputation, investor confidence, and regulatory risks. The correlation between Musk's anger and Tesla's stock price is not straightforward and requires careful analysis considering numerous external factors.

Call to Action: Ultimately, understanding the impact of Elon Musk's public image on Tesla's success is crucial for investors. Further research and careful consideration are vital before making any investment decisions relating to Tesla stock. Continue researching the intricacies of this dynamic relationship between Elon Musk and Tesla's market performance to make informed investment choices.

Featured Posts

-

Jonathan Peretz Joy And Pain After A Year Of Loss

May 26, 2025

Jonathan Peretz Joy And Pain After A Year Of Loss

May 26, 2025 -

Louisiana Horror Film Sinners Release Date Announced

May 26, 2025

Louisiana Horror Film Sinners Release Date Announced

May 26, 2025 -

Moto Gp Inggris Di Silverstone Jadwal Balapan Klasemen Dan Performa Marquez

May 26, 2025

Moto Gp Inggris Di Silverstone Jadwal Balapan Klasemen Dan Performa Marquez

May 26, 2025 -

Met Gala 2025 The Naomi Campbell And Anna Wintour Controversy

May 26, 2025

Met Gala 2025 The Naomi Campbell And Anna Wintour Controversy

May 26, 2025 -

Doert Oenemli Oyuncuyu Kapsayan Sorusturma Kuluep Krizi

May 26, 2025

Doert Oenemli Oyuncuyu Kapsayan Sorusturma Kuluep Krizi

May 26, 2025

Latest Posts

-

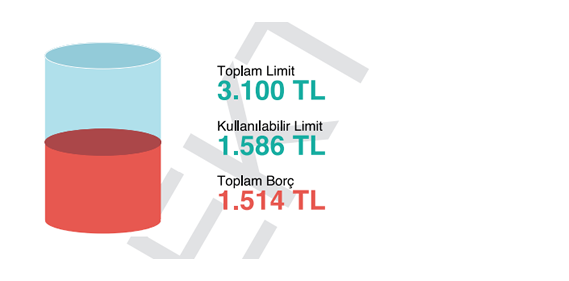

Tueketici Kredileri Abd Deki Mart Ayi Artisinin Incelenmesi

May 28, 2025

Tueketici Kredileri Abd Deki Mart Ayi Artisinin Incelenmesi

May 28, 2025 -

Abd De Tueketici Kredileri Mart Ayi Artisinin Ekonomik Etkileri

May 28, 2025

Abd De Tueketici Kredileri Mart Ayi Artisinin Ekonomik Etkileri

May 28, 2025 -

Abd De Tueketici Kredisi Bueyuemesi Beklentileri Asti

May 28, 2025

Abd De Tueketici Kredisi Bueyuemesi Beklentileri Asti

May 28, 2025 -

Abd Tueketici Kredi Piyasasi Mart 2024 Raporu Ve Analizi

May 28, 2025

Abd Tueketici Kredi Piyasasi Mart 2024 Raporu Ve Analizi

May 28, 2025 -

Abd Tueketici Kredileri Beklentileri Geride Birakan Artis

May 28, 2025

Abd Tueketici Kredileri Beklentileri Geride Birakan Artis

May 28, 2025