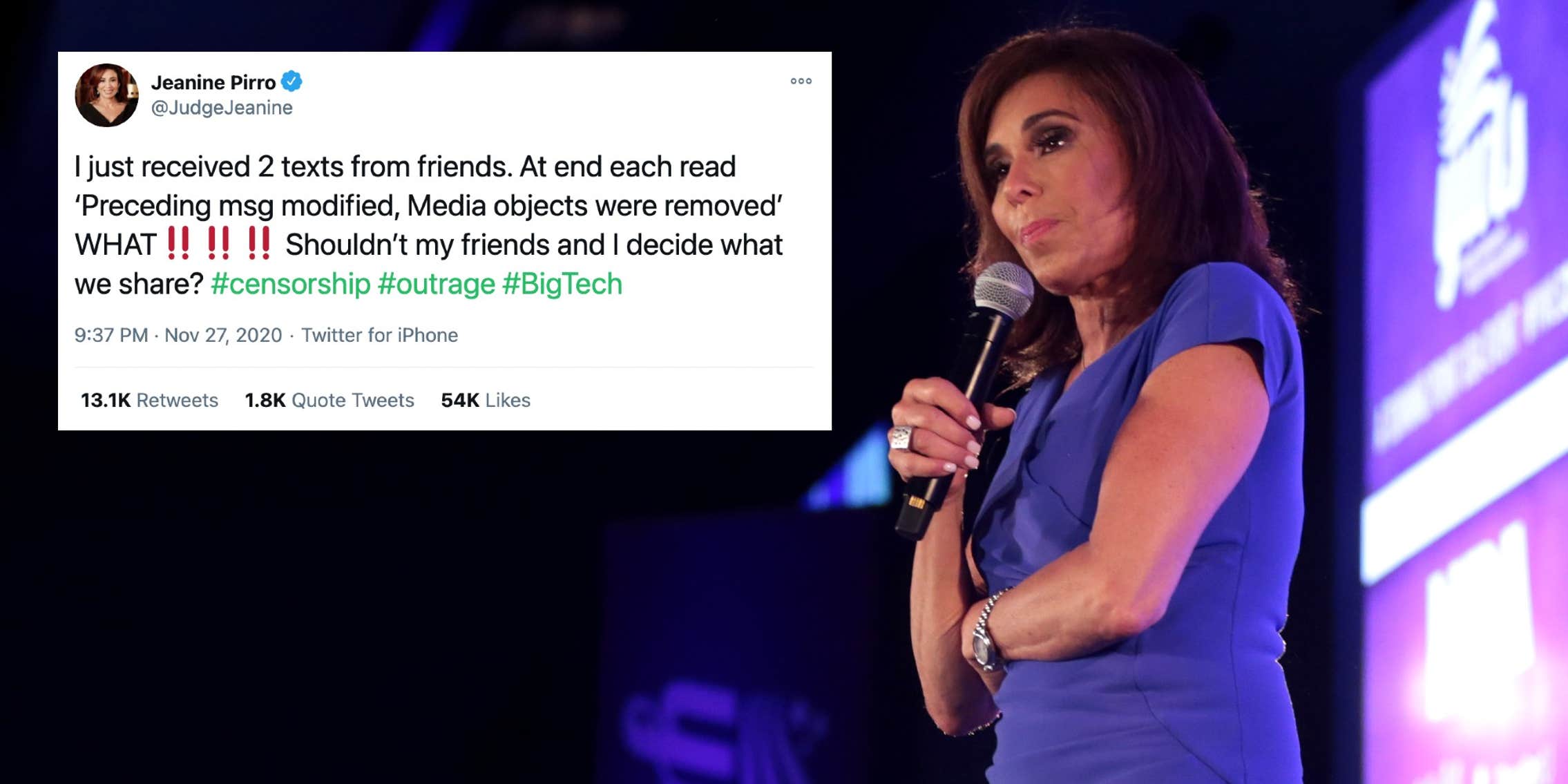

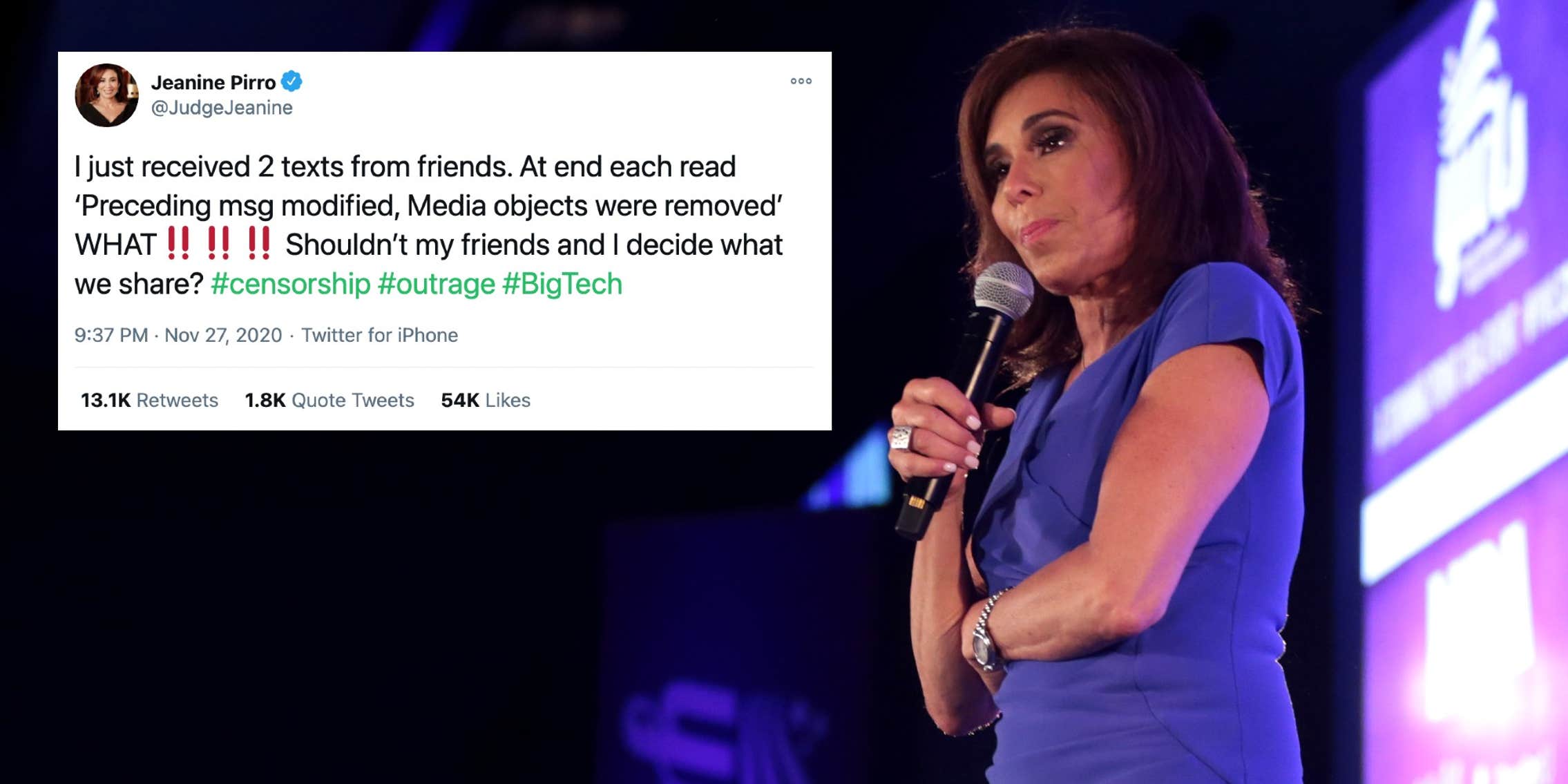

Is Jeanine Pirro Right? Should You Ignore The Stock Market Now?

Table of Contents

Jeanine Pirro, a prominent legal commentator, has recently offered opinions on the stock market's current state, sparking debate among investors. This article examines her perspective and explores whether ignoring the stock market is a wise decision in today's economic climate. We'll delve into current market trends, analyze potential risks, and offer strategies to help you determine the best course of action for your financial situation. We'll address questions like: Should you ignore the stock market in the face of uncertainty? What are the potential consequences? And what alternative strategies might be more suitable for your needs?

Jeanine Pirro's Stance on the Stock Market

While specific quotes and detailed analyses of Jeanine Pirro's recent statements regarding the stock market require further research to cite properly, her general sentiment often reflects a cautious approach to investment during times of economic uncertainty. Her reasoning likely stems from concerns about inflation, interest rate hikes, and potential recessionary pressures. She might be emphasizing the need for prudence and caution, especially for investors with less risk tolerance.

- Potential Quotes (placeholder - replace with actual quotes if available): "The current economic climate demands careful consideration before investing in the stock market." "Investors should be wary of excessive risk."

- Economic Indicators: Pirro might be referencing indicators such as the Consumer Price Index (CPI) for inflation, the Federal Funds Rate for interest rates, and unemployment figures to support her concerns.

- Suggested Course of Action (placeholder): Her likely recommendation would be to carefully evaluate personal financial goals and risk tolerance before committing to significant stock market investments. A more conservative approach, possibly involving diversification away from stocks, might be suggested.

Current State of the Stock Market

The current state of the stock market is dynamic and requires careful consideration. Major indices like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite fluctuate daily, reflecting the ongoing interplay of economic factors.

- Key Economic Indicators: Current inflation rates (check for the most recent data from reliable sources like the Bureau of Labor Statistics), interest rate levels set by the Federal Reserve, and unemployment rates (check the Bureau of Labor Statistics) are crucial factors influencing market performance.

- Expert Opinions and Predictions: Analysis from reputable financial experts and economists provides insights into potential future market trends. These predictions vary, adding to the complexity of the situation.

- Recent Market Events: Recent geopolitical events, corporate earnings reports, and shifts in consumer spending patterns all contribute to market volatility. A careful analysis of these events is necessary to gain a comprehensive understanding of the market's direction.

Risks of Ignoring the Stock Market

While a cautious approach is understandable, ignoring the stock market entirely carries significant risks.

- Missed Opportunities: History shows that even during periods of market downturn, there are periods of growth and recovery. Ignoring the market means missing potential opportunities for capital appreciation and dividend income.

- Delayed Investment Decisions: Prolonged inaction can lead to missed opportunities for compounding returns, which is crucial for long-term wealth building. The longer one delays, the less time their investments have to grow.

- Importance of Long-Term Investment Strategies: Ignoring market fluctuations is counterproductive to effective long-term investing, a crucial component of financial planning. The long-term outlook for stock markets historically has been upward.

Strategies for Navigating Market Uncertainty

Navigating market uncertainty requires a well-defined strategy.

-

Diversification: Diversifying investments across different asset classes, including stocks, bonds, real estate, and alternative investments, can help mitigate risk. Don't put all your eggs in one basket.

-

Well-Defined Investment Plan: Creating a personalized investment plan that aligns with your financial goals, risk tolerance, and time horizon is essential.

-

Managing Risk and Emotional Responses: Develop strategies to manage emotional responses to market fluctuations. Avoid panic selling or impulsive decisions driven by fear or greed. Sticking to your investment plan is vital.

-

Specific Diversification Examples: Consider a mix of large-cap and small-cap stocks, government and corporate bonds, and perhaps even real estate investment trusts (REITs) to diversify effectively.

-

Seeking Professional Advice: Consulting a certified financial advisor is highly recommended to receive personalized guidance based on your financial situation.

-

Emotional Discipline: Regularly reviewing your portfolio without letting daily market fluctuations dictate your decisions helps maintain emotional discipline.

When Ignoring the Stock Market Might Be a Viable Option

There are limited situations where temporarily ignoring the stock market might be considered.

-

Immediate Financial Needs: If you have immediate, pressing financial needs (e.g., emergency fund depletion), investing in the stock market may not be the priority. Focus on securing your immediate financial needs first.

-

High-Risk Aversion: Individuals with extremely high risk aversion might choose to prioritize preserving capital over potential market gains. This is a valid personal choice.

-

Alternative Investment Options: Consider low-risk savings accounts, money market accounts, or certificates of deposit (CDs) as alternatives to stock market investments during periods of uncertainty. These options generally offer lower returns but greater capital preservation.

-

Consult a Financial Advisor: It is crucial to consult with a financial advisor to discuss your specific situation and determine if ignoring the stock market is appropriate for you.

Conclusion

While Jeanine Pirro's cautious perspective highlights the need for prudence in the current economic climate, the decision of whether to ignore the stock market is highly personal. Carefully weigh your financial goals, risk tolerance, and the current economic landscape before making any investment decisions. Understanding your risk tolerance and investment horizon is key. Ignoring the stock market entirely might mean missing out on long-term growth opportunities. The most prudent course of action involves careful planning, diversification, and potentially seeking professional financial guidance. Don't ignore the importance of creating a robust, personalized investment strategy that aligns with your individual needs and circumstances.

Featured Posts

-

Rio Ferdinand Alters Champions League Final Prediction Psg Vs Arsenal

May 09, 2025

Rio Ferdinand Alters Champions League Final Prediction Psg Vs Arsenal

May 09, 2025 -

Imalaia Elaxista Xionia Sto Xamilotero Epipedo Ton Teleytaion 23 Eton

May 09, 2025

Imalaia Elaxista Xionia Sto Xamilotero Epipedo Ton Teleytaion 23 Eton

May 09, 2025 -

Finding The Real Safe Bet In Todays Market

May 09, 2025

Finding The Real Safe Bet In Todays Market

May 09, 2025 -

Franco Colapintos Deleted Drive To Survive Message What He Said

May 09, 2025

Franco Colapintos Deleted Drive To Survive Message What He Said

May 09, 2025 -

Cnn Politics Chief Justice Roberts On A Case Of Mistaken Identity

May 09, 2025

Cnn Politics Chief Justice Roberts On A Case Of Mistaken Identity

May 09, 2025