Is Nike's Revenue Heading For A Five-Year Low?

Table of Contents

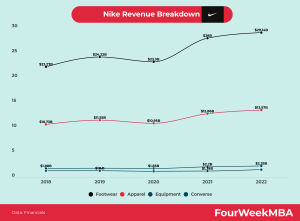

Declining Sales Figures and Market Share

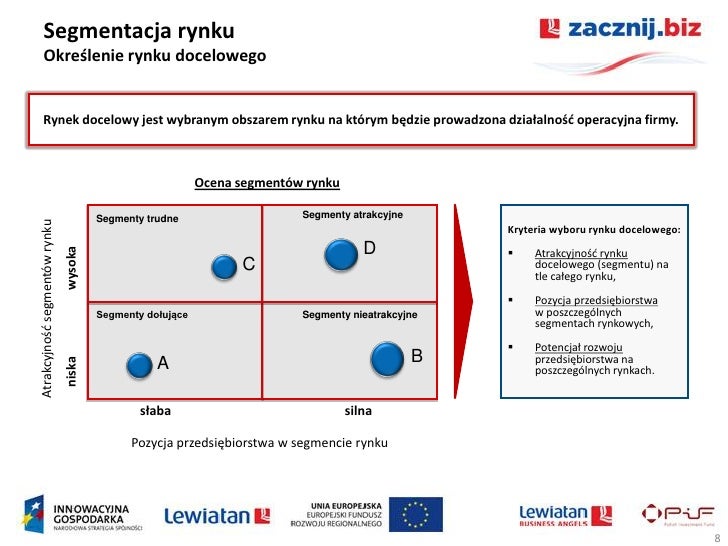

Recent quarterly and yearly sales reports for Nike reveal a concerning downward trend in Nike sales. This decline isn't isolated; it's accompanied by a decrease in market share, indicating a struggle against formidable competitors like Adidas, Under Armour, and Puma. This erosion of market dominance raises serious questions about Nike's future financial performance and the sustainability of its current strategies.

- Specific examples of declining sales: While overall numbers vary from quarter to quarter, specific product lines or geographical regions showing consistent underperformance provide crucial insights. For example, a decline in sales of a particular shoe model in a key market like North America would signal a significant problem.

- Comparative analysis of Nike's market share: A direct comparison of Nike's market share against its main competitors reveals the severity of the situation. A shrinking market share percentage indicates a loss of consumer preference and a growing challenge to Nike's brand dominance.

- Relevant industry reports: Industry analyses and reports from reputable financial institutions offer crucial context and independent validation of the observed downward trend in Nike sales and market share. These external reports add weight to the concerns surrounding Nike's financial future.

Impact of Global Economic Slowdown and Inflation

The global economic climate is significantly impacting consumer spending. High inflation rates and the threat of a global recession are forcing consumers to reconsider their discretionary spending, including purchases of athletic apparel and footwear. This downturn directly affects Nike's pricing strategies and overall sales volume.

- Statistical data on inflation and its correlation with Nike's sales: Correlating inflation rates with Nike's sales data can reveal a direct causal relationship. Higher inflation rates often correlate with reduced consumer spending on non-essential items like Nike products.

- Consumer behavior analysis during economic downturns: Analyzing consumer behavior during economic downturns reveals that consumers prioritize essential spending, often reducing or eliminating purchases of discretionary items like athletic apparel.

- Effect of increased material and manufacturing costs on Nike's profitability: Rising material and manufacturing costs directly impact Nike's profitability. Increased production costs are often passed onto consumers, potentially leading to lower sales volume due to increased pricing.

Increased Competition and Shifting Consumer Preferences

The athletic apparel market is increasingly competitive. New entrants, coupled with shifting consumer preferences, present significant challenges to Nike. Brand loyalty, once a cornerstone of Nike's success, is now being tested by the rise of competitors offering similar products at lower prices, or with a stronger focus on sustainable fashion and ethical sourcing.

- Impact of new entrants into the athletic apparel market: The emergence of new brands and direct-to-consumer models is disrupting traditional market dynamics, compelling Nike to constantly innovate to maintain its competitive edge.

- Shift toward sustainable and ethically produced apparel: Consumers are increasingly conscious of environmental and social issues, demanding more sustainable and ethically sourced products. Nike needs to adapt to meet these evolving consumer expectations to maintain relevance.

- Nike's innovation and technological advancements: Nike's investment in research and development, including new technologies and materials, is vital for staying ahead of the competition and appealing to consumer demand for innovative products.

Supply Chain Disruptions and Logistics Challenges

Persistent supply chain disruptions and logistics challenges continue to plague the global economy, and Nike is no exception. Port congestion, material shortages, and increased transportation costs all impact Nike's production and distribution capabilities, influencing the final product's price and profitability.

- Specific supply chain challenges faced by Nike: Identifying specific issues, such as port congestion delaying shipments or material shortages hindering production, helps understand the extent of the impact on Nike's operations.

- Impact of increased transportation costs on Nike's profitability: Increased transportation costs directly reduce Nike's profit margins, as these costs are often passed on to the consumer, thereby affecting sales volume.

- Nike's strategies for mitigating supply chain risks: Analyzing Nike's strategies for addressing these challenges is crucial for assessing their ability to overcome these obstacles and maintain a steady supply of products to the market.

Conclusion

Several interconnected factors contribute to the potential for Nike's revenue to reach a five-year low. Declining sales figures, a weakening market share, the impact of global economic headwinds, intensified competition, and persistent supply chain disruptions all play significant roles. While the outlook may seem challenging, Nike's long-term success depends on its ability to adapt to changing market dynamics and innovate to retain its position as a leading athletic apparel brand. Staying informed about Nike's revenue and financial performance by regularly checking reliable financial news sources and industry analyses is crucial for investors and consumers alike to assess whether Nike revenue is truly heading for a five-year low. Understanding the factors influencing Nike's revenue is critical for navigating the complexities of this dynamic market.

Featured Posts

-

Patrick Schwarzeneggers Nude Scenes Arnold Schwarzeneggers Reaction

May 06, 2025

Patrick Schwarzeneggers Nude Scenes Arnold Schwarzeneggers Reaction

May 06, 2025 -

Rihannas Pregnancy Journey Baby Number Three

May 06, 2025

Rihannas Pregnancy Journey Baby Number Three

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Analiza Rynku I Potencjalnych Dostawcow

May 06, 2025

Zamowienie Na Trotyl Z Polski Analiza Rynku I Potencjalnych Dostawcow

May 06, 2025 -

Maria Shriver On Patrick Schwarzeneggers White Lotus Role The Truth Revealed

May 06, 2025

Maria Shriver On Patrick Schwarzeneggers White Lotus Role The Truth Revealed

May 06, 2025 -

Will Colman Domingo Return As Norman Osborn A Spider Man Co Star Weighs In

May 06, 2025

Will Colman Domingo Return As Norman Osborn A Spider Man Co Star Weighs In

May 06, 2025

Latest Posts

-

2020 I Nvoyyembyeri 9 Ic Hyetvo Hayastani Kvorvo Stnyery Yev Zijvo Mnyery Adrbyejanin

May 06, 2025

2020 I Nvoyyembyeri 9 Ic Hyetvo Hayastani Kvorvo Stnyery Yev Zijvo Mnyery Adrbyejanin

May 06, 2025 -

Adrbyejani Agn I Pahanjvov Bbc I Adrbyejanakan Tsarayvo Tyan Ashkhatanqi Dadaryecvo M

May 06, 2025

Adrbyejani Agn I Pahanjvov Bbc I Adrbyejanakan Tsarayvo Tyan Ashkhatanqi Dadaryecvo M

May 06, 2025 -

Hayastani Zijvo Mnyery Adrbyejanin Miakvoghmani Hamadzaynvo Tyvo Nnyeri Ambvoghjakan Aknark

May 06, 2025

Hayastani Zijvo Mnyery Adrbyejanin Miakvoghmani Hamadzaynvo Tyvo Nnyeri Ambvoghjakan Aknark

May 06, 2025 -

Adrbyejanin Zijvo Mnyery Pastyer Yev Vyerlvo Tsvo Tyvo N 2020 Ic Hyetvo

May 06, 2025

Adrbyejanin Zijvo Mnyery Pastyer Yev Vyerlvo Tsvo Tyvo N 2020 Ic Hyetvo

May 06, 2025 -

I Nch Yenq Zijyel Adrbyejanin 2020 I Nvoyyembyeri 9 Ic Hyetvo

May 06, 2025

I Nch Yenq Zijyel Adrbyejanin 2020 I Nvoyyembyeri 9 Ic Hyetvo

May 06, 2025