Is Palantir Stock A Good Investment Right Now? Risks And Rewards Explained

Table of Contents

Palantir Technologies (PLTR) has captivated the attention of many investors, renowned for its sophisticated data analytics platform serving both government and commercial clients. But is Palantir stock a good investment right now? This in-depth analysis will explore the potential rewards and inherent risks associated with investing in Palantir, empowering you to make a well-informed decision.

Understanding Palantir's Business Model and Growth Potential

Palantir's success hinges on its powerful data analytics platform, Gotham and Foundry, which help organizations integrate, analyze, and visualize complex data sets. This platform's capabilities are driving growth across two key sectors: government and commercial.

Government Contracts: A Cornerstone of Revenue

Government contracts form a substantial part of Palantir's revenue stream. The company works with numerous US government agencies, including those within the intelligence community and defense departments, providing critical data analysis for national security and other important government functions.

- Stability and Growth: These government contracts offer a degree of revenue stability, as they are often long-term and high-value. However, dependence on government spending can also be a risk factor.

- Future Prospects: The ongoing need for advanced data analytics within government agencies suggests continued potential for growth in this sector. The increasing focus on cybersecurity and national defense further strengthens the demand for Palantir's services. Keywords: government data analytics, defense contracting, intelligence agencies.

Commercial Market Expansion: Driving Future Growth

While government contracts are vital, Palantir's expansion into the commercial market is crucial for long-term growth. The company is increasingly attracting clients across various industries, including finance, healthcare, and energy.

- Key Clients and Sectors: Palantir has secured partnerships with major players in these sectors, demonstrating the applicability of its platform across diverse business needs.

- Software as a Service (SaaS) Model: Palantir's shift towards a SaaS model allows for greater scalability and recurring revenue streams, improving profitability and predictability. Keywords: commercial clients, data analytics platforms, software as a service (SaaS), finance, healthcare.

Technological Innovation and Competitive Advantage

Palantir's technological prowess is a key differentiator. Its platform leverages cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) to provide powerful data integration and predictive analytics capabilities.

- AI and Machine Learning: These technologies enhance the platform's ability to identify patterns, predict outcomes, and provide actionable insights, delivering significant value to clients.

- Data Integration: The platform's ability to seamlessly integrate data from disparate sources offers a unique advantage, allowing organizations to make more informed decisions. Keywords: artificial intelligence, machine learning algorithms, data integration, predictive analytics.

Assessing the Risks Associated with Palantir Stock

Despite the potential rewards, investing in Palantir stock involves considerable risks that need careful consideration.

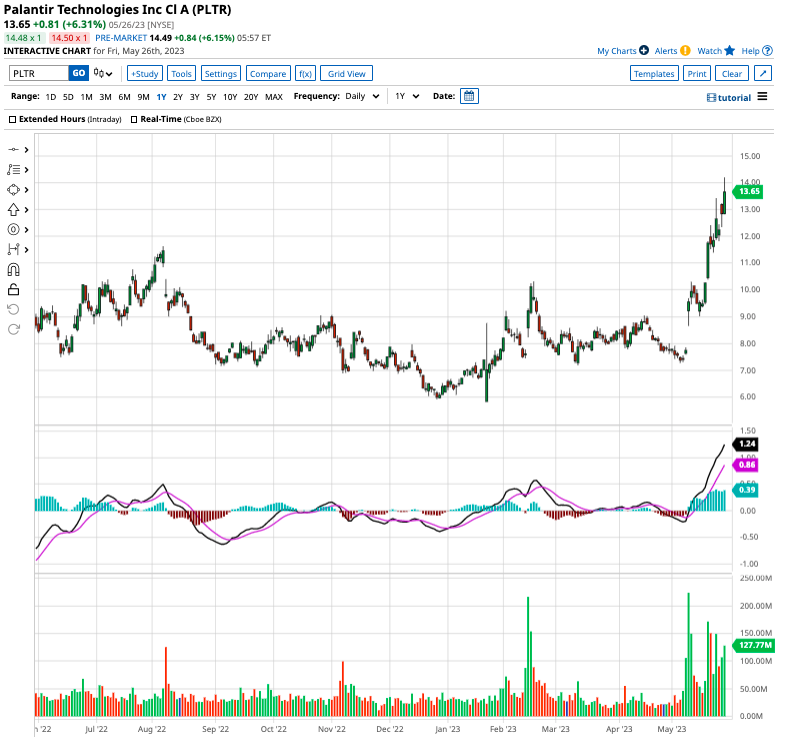

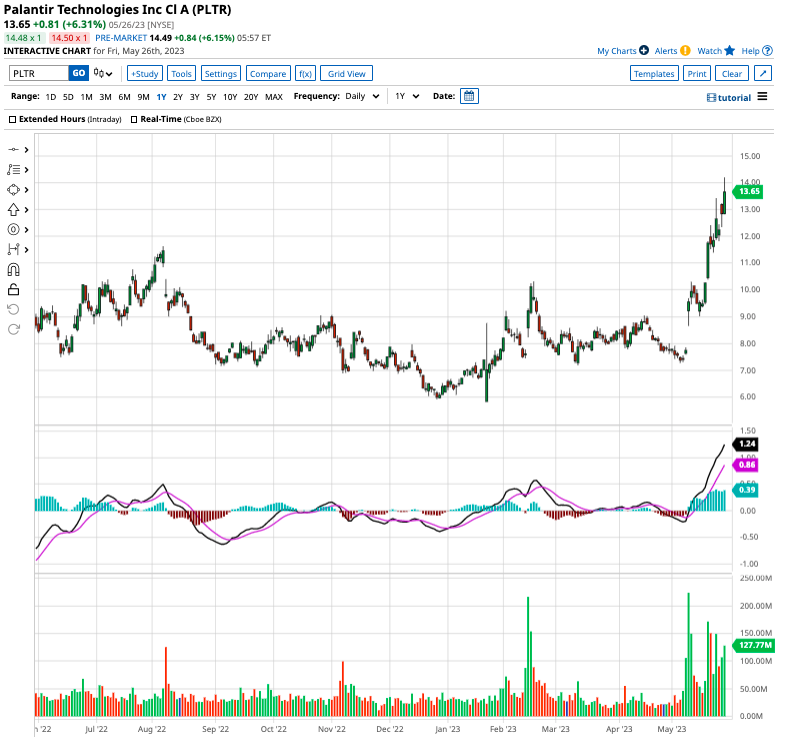

Valuation Concerns and Stock Price Volatility

Palantir's stock price has exhibited significant volatility. While its valuation reflects future growth expectations, it also makes it susceptible to market fluctuations and investor sentiment changes.

- Price-to-Sales Ratio: Investors should analyze Palantir's price-to-sales ratio relative to its competitors to gauge its valuation and potential future performance.

- Market Capitalization: Understanding Palantir's market capitalization within the broader data analytics sector provides valuable context for investment decisions. Keywords: stock valuation, price-to-sales ratio, market capitalization, stock volatility.

Dependence on a Few Key Clients

A considerable portion of Palantir's revenue comes from a relatively small number of major clients. This concentration poses significant risk, as losing a key contract could severely impact the company's financial performance.

- Client Concentration Risk: This risk underscores the importance of Palantir's strategy to diversify its client base and reduce dependence on a few large contracts.

- Contract Renewals: The success of contract renewals with existing major clients is critical to maintain revenue streams. Keywords: client concentration risk, revenue diversification, contract renewal.

Competition in the Data Analytics Market

The data analytics market is highly competitive, with major players like Microsoft and Google offering competing solutions. Palantir must continuously innovate to maintain its competitive edge.

- Market Share: Analyzing Palantir's market share and growth rate relative to its competitors is essential for understanding its position within the market.

- Competitive Landscape: Staying informed about the evolving competitive landscape and technological advancements is crucial for evaluating Palantir's long-term prospects. Keywords: data analytics competition, market share, competitive landscape, Microsoft, Google.

Analyzing the Potential Rewards of Investing in Palantir Stock

Despite the risks, several factors point towards significant potential rewards for Palantir investors.

Long-Term Growth Prospects

Palantir's long-term growth prospects are promising, given the increasing demand for advanced data analytics across various sectors. The company's strategic focus on expansion into new markets and improved profitability enhances its growth trajectory.

- Market Trends: Analyzing the broader market trends in data analytics and related technologies is essential for assessing Palantir's growth potential.

- Return on Investment (ROI): Investors should conduct thorough research to estimate the potential ROI based on Palantir's projected growth and financial performance. Keywords: long-term investment, growth potential, return on investment.

Strong Intellectual Property and Brand Recognition

Palantir possesses a strong portfolio of intellectual property and enjoys significant brand recognition within the data analytics market. This provides a competitive advantage and bolsters its position in the industry.

- Proprietary Technology: Palantir's proprietary technology is a key asset, providing a significant barrier to entry for competitors.

- Brand Value: The company's established reputation and recognition enhance its ability to attract and retain both clients and talent. Keywords: intellectual property, brand recognition, proprietary technology.

Potential for Strategic Acquisitions

Palantir may pursue strategic acquisitions to expand its capabilities or enter new markets. Successful acquisitions can significantly enhance the company's value and strengthen its competitive position.

- Mergers and Acquisitions (M&A): Analyzing Palantir's M&A strategy and potential targets can provide insights into its future growth plans.

- Synergies and Integration: Successful integration of acquired companies is crucial for realizing the benefits of M&A activity. Keywords: mergers and acquisitions, strategic growth, corporate development.

Conclusion

Investing in Palantir stock presents both substantial opportunities and considerable risks. The company's innovative technology and growing client base offer promising long-term growth potential. However, investors must acknowledge challenges like valuation concerns, client concentration, and intense competition in the data analytics market. A thorough assessment of these factors is crucial before making any investment decision.

Ultimately, whether Palantir stock is a good investment for you depends on your risk tolerance, investment horizon, and the results of your own due diligence. Conduct thorough research and consider consulting a financial advisor before investing in Palantir stock or any other similar data analytics investment.

Featured Posts

-

Family Support For Dakota Johnson At Materialist Film Premiere

May 09, 2025

Family Support For Dakota Johnson At Materialist Film Premiere

May 09, 2025 -

Epstein Files Release Pam Bondis Announcement And What It Means

May 09, 2025

Epstein Files Release Pam Bondis Announcement And What It Means

May 09, 2025 -

Doohans F1 Career Montoyas Comments On The Decision

May 09, 2025

Doohans F1 Career Montoyas Comments On The Decision

May 09, 2025 -

1509 R4 5

May 09, 2025

1509 R4 5

May 09, 2025 -

Bao Mau Tien Giang Loi Khai Ve Hanh Vi Bao Hanh Tre

May 09, 2025

Bao Mau Tien Giang Loi Khai Ve Hanh Vi Bao Hanh Tre

May 09, 2025