Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir Technologies (PLTR) has experienced significant volatility since its initial public offering (IPO), leaving many investors questioning whether now is the right time to buy. This comprehensive analysis delves into Palantir's business model, financial performance, competitive landscape, and potential risks to determine if Palantir stock is a buy, hold, or sell. We'll examine key factors influencing Palantir's valuation and its prospects for future growth.

Palantir's Business Model and Revenue Streams

Palantir's revenue streams are primarily derived from two key segments: government contracts and commercial partnerships, both leveraging its powerful data analytics platform, Foundry.

Government Contracts

Palantir has a strong history of securing substantial government contracts, particularly within the US defense and intelligence sectors, and is increasingly expanding internationally. This segment provides a stable, albeit potentially cyclical, revenue base.

- Recent contract wins: Palantir has consistently secured significant contracts, demonstrating continued demand for its solutions from government agencies. Tracking these wins is crucial for assessing future revenue potential.

- Government spending trends: Government budgets and priorities directly influence Palantir's government contract revenue. Understanding these trends is critical for projecting future performance.

- Potential for international expansion: Palantir's expansion into international government markets presents a significant growth opportunity, though success depends on navigating diverse regulatory landscapes and geopolitical factors.

- Risks associated with government contracts: Dependence on government contracts exposes Palantir to risks such as budget cuts, shifting political priorities, and potential contract cancellations.

Commercial Partnerships

Palantir's commercial sector growth is a key indicator of its long-term viability and potential for diversification. The company is actively pursuing partnerships with major corporations across various industries.

- Key commercial clients: Analyzing Palantir's client roster provides insight into the breadth and depth of its commercial market penetration. The addition of large, well-known clients signals strong market acceptance.

- Success rates in commercial adoption: Tracking the success of Palantir's commercial deployments and its ability to deliver value to its clients is crucial for gauging its growth potential.

- Competition in the commercial market: The commercial data analytics market is highly competitive. Assessing Palantir's competitive advantages, such as its advanced AI capabilities and robust platform, is essential.

- Revenue growth projections in this sector: Analyzing revenue projections for the commercial sector is critical in understanding Palantir's overall growth trajectory and diversification success.

Foundry Platform

Palantir's Foundry platform is the backbone of its data integration and analytics offerings. Its ability to integrate diverse data sources and provide actionable insights is a key differentiator.

- Foundry's capabilities: Foundry's sophisticated features, including its AI and machine learning capabilities, provide a significant competitive edge in data analytics.

- Market adoption: Tracking the market adoption rate of Foundry is vital in assessing its success and overall market demand.

- Pricing models: Understanding Palantir's pricing models for Foundry will help in evaluating its profitability and overall market competitiveness.

- Future development plans for the platform: Palantir's investment in research and development for Foundry will determine its ability to maintain a competitive advantage in the ever-evolving data analytics landscape.

Financial Performance and Valuation

A thorough assessment of Palantir's financial performance is essential for determining its investment potential.

Revenue Growth

Analyzing Palantir's historical and projected revenue growth helps investors gauge its financial health and growth trajectory.

- Year-over-year revenue growth: Consistent year-over-year revenue growth signifies a healthy and expanding business.

- Profitability margins: Tracking profitability margins indicates the efficiency of Palantir's operations and its ability to convert revenue into profit.

- Operating expenses: Understanding operating expenses and their trends will help in evaluating cost management and profitability potential.

- Path to profitability: Assessing Palantir's path to consistent profitability is crucial for long-term investment considerations.

Profitability and Margins

Evaluating Palantir's profitability and margins is crucial for assessing its financial strength and sustainability.

- Gross margin: A high gross margin suggests strong pricing power and efficient production.

- Operating margin: A positive and growing operating margin demonstrates efficient operations and cost management.

- Net income: Positive net income indicates profitability and a healthy financial position.

- Free cash flow: Positive free cash flow indicates the company's ability to generate cash after covering operating expenses and capital expenditures.

Stock Valuation

Assessing Palantir's valuation against industry benchmarks and competitors provides crucial context for evaluating its investment appeal.

- Current stock price: The current market price of PLTR stock is a key factor to consider.

- Market capitalization: The market capitalization reflects the overall market value of Palantir.

- P/S ratio: Comparing Palantir's price-to-sales ratio (P/S) to industry averages and competitors provides valuable perspective on its relative valuation.

- Valuation compared to competitors: Comparing Palantir's valuation to competitors like Snowflake or Databricks offers a comparative market perspective.

Risks and Challenges

Investing in Palantir Technologies stock involves inherent risks that potential investors must carefully consider.

Competition

Palantir faces stiff competition in the data analytics market from established players and emerging startups.

- Major competitors: Identifying key competitors like Snowflake, Databricks, and AWS helps to understand the competitive landscape.

- Competitive advantages and disadvantages: Assessing Palantir's competitive advantages (e.g., specialized government expertise, strong AI capabilities) and disadvantages (e.g., high reliance on government contracts, relatively high valuation) is crucial.

- Market share analysis: Analyzing market share trends helps investors to gauge Palantir's position within the competitive landscape.

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to certain risks.

- Potential for contract cancellations: Government contracts can be canceled or delayed due to budgetary constraints or changes in political priorities.

- Political risks: Changes in government policies or regulations can significantly impact Palantir's revenue streams.

- Budgetary constraints: Government budget cuts could lead to reduced contract awards or renegotiations.

Data Privacy and Security Concerns

Handling sensitive data carries inherent risks related to data privacy and security.

- Data security measures: Palantir's data security measures are crucial for mitigating potential risks associated with data breaches or leaks.

- Regulatory compliance: Compliance with data privacy regulations (like GDPR and CCPA) is essential for avoiding legal and financial penalties.

- Potential for data breaches: The possibility of data breaches, though mitigated by robust security protocols, remains a risk.

Conclusion

Determining whether Palantir Technologies stock is a buy now requires a careful weighing of its potential growth prospects against the inherent risks. While Palantir's innovative technology and strong government presence provide a solid foundation, its reliance on government contracts and the competitive nature of the data analytics market pose significant challenges. The company's path to profitability and consistent revenue growth from its commercial sector will be key factors in its future valuation. Based on this analysis, whether Palantir stock is a buy, hold, or sell depends heavily on your individual risk tolerance and investment horizon. While the potential rewards are significant, the risks are substantial. Conduct thorough due diligence and consult a financial advisor before making any investment decisions regarding Palantir Technologies stock or any other security. Remember, this analysis is for informational purposes only and should not be considered investment advice. Always conduct your own research before investing in Palantir Technologies stock.

Featured Posts

-

Thailand Seeks New Bot Governor Amidst Rising Tariff Concerns

May 09, 2025

Thailand Seeks New Bot Governor Amidst Rising Tariff Concerns

May 09, 2025 -

Show Of Support For Wynne Evans After Allegations Surface

May 09, 2025

Show Of Support For Wynne Evans After Allegations Surface

May 09, 2025 -

Rakesh Sharma Indias First Astronaut His Journey And Current Endeavors

May 09, 2025

Rakesh Sharma Indias First Astronaut His Journey And Current Endeavors

May 09, 2025 -

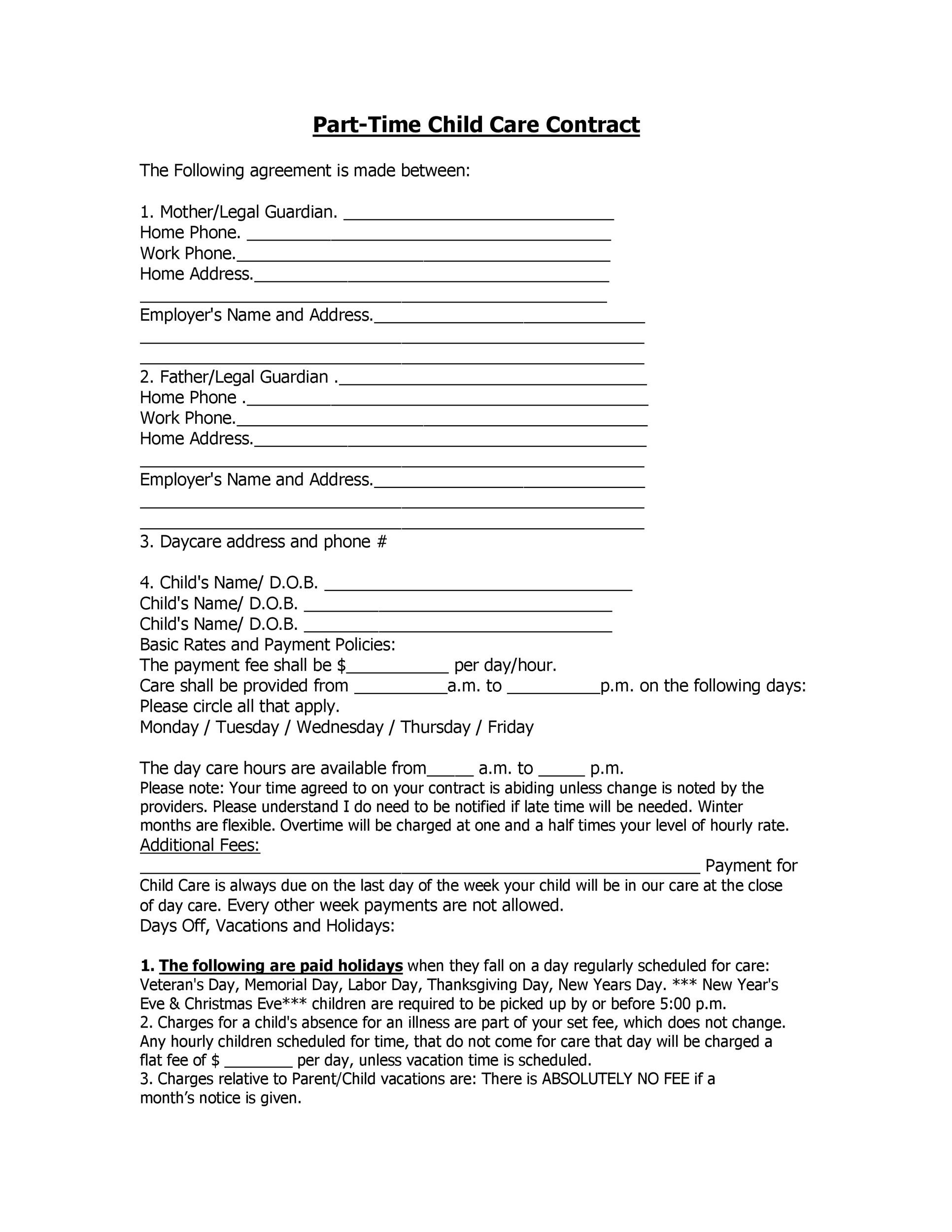

Nc Daycare Suspension What Parents Need To Know

May 09, 2025

Nc Daycare Suspension What Parents Need To Know

May 09, 2025 -

Global Power Shift India Overtakes Uk France And Russia Where Does It Stand

May 09, 2025

Global Power Shift India Overtakes Uk France And Russia Where Does It Stand

May 09, 2025