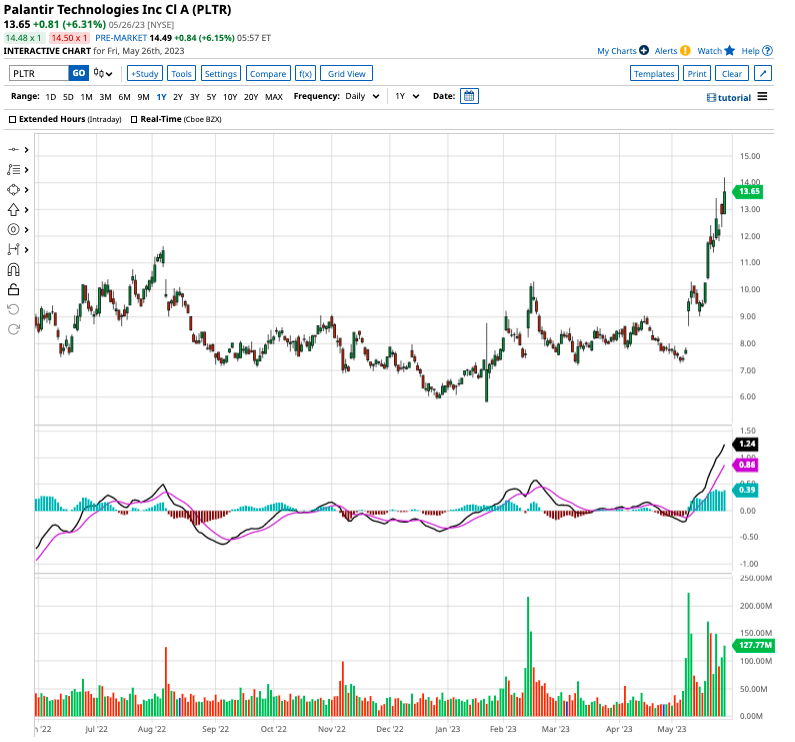

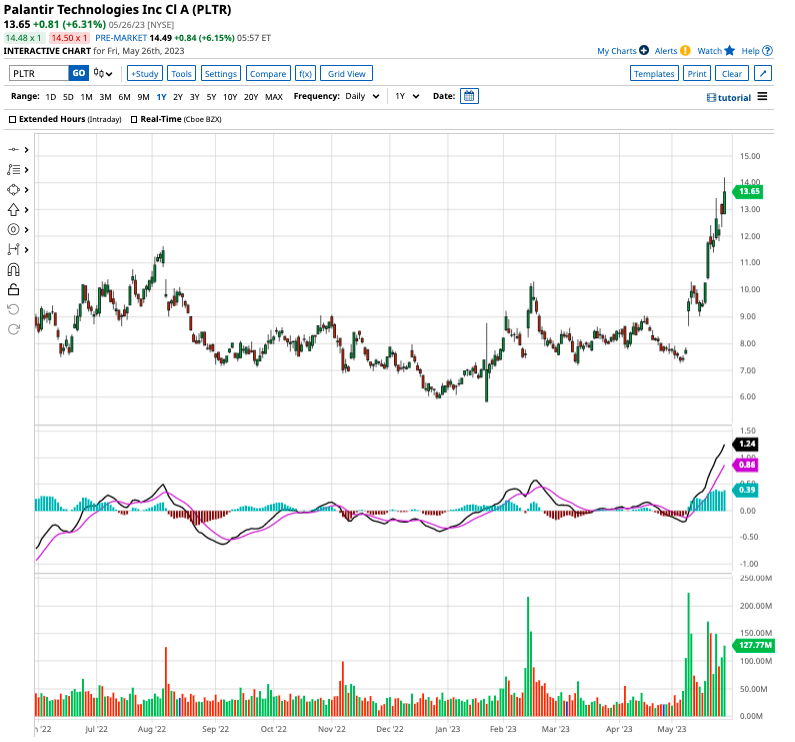

Is Palantir's 30% Stock Decline A Buy Signal?

Table of Contents

Analyzing Palantir's Recent Performance and the Reasons Behind the Decline

Market Sentiment and Tech Stock Sell-Off

The recent decline in Palantir's stock price isn't occurring in isolation. It's part of a broader tech stock correction fueled by several macroeconomic factors. Rising interest rates, persistent inflation, and concerns about the overall economic outlook have led investors to reassess their holdings in growth stocks, including Palantir.

- The Federal Reserve's aggressive monetary policy tightening aims to curb inflation, but it also increases borrowing costs for companies and reduces the appeal of high-growth, high-valuation stocks like PLTR.

- Inflation erodes purchasing power and can lead to decreased consumer spending, potentially impacting Palantir's commercial clients.

- Data points like the Nasdaq Composite Index's recent performance clearly illustrate the widespread sell-off in the tech sector. This broader market trend significantly impacts the performance of individual tech stocks, including Palantir.

These factors, collectively, contribute to a negative market sentiment affecting many technology companies, making it difficult to isolate Palantir's specific challenges from the wider market trends. Understanding this broader context of the tech stock correction is crucial for evaluating Palantir's decline.

Palantir's Financial Performance and Future Outlook

Examining Palantir's recent financial reports is crucial for assessing the health of the company. While revenue growth has been positive, the pace of growth might not meet the expectations of all investors. Analyzing key metrics such as:

- Quarterly earnings: Comparing reported earnings with analysts' expectations reveals whether the company is meeting or exceeding its targets.

- Revenue growth: Sustained revenue growth is vital for any company, especially in the competitive big data analytics sector.

- Profitability: Moving towards profitability is a crucial factor for long-term sustainability. Analyzing profit margins and operating expenses is essential in this regard.

- Future guidance: Management's projections for future performance offer insights into their outlook and expectations.

A comprehensive review of these aspects in conjunction with the broader market conditions provides a more complete picture of Palantir's financial standing and future prospects.

Government Contracts and Revenue Diversification

Palantir's revenue stream is significantly reliant on government contracts, particularly in the areas of national security and intelligence. While these contracts offer stability and predictability, they also present limitations. Over-reliance on any single revenue source is a risk.

- Government spending: Fluctuations in government budgets could affect Palantir's future revenue.

- Commercial sector growth: Expanding into the commercial sector is vital for diversification and long-term growth. Palantir's progress in attracting commercial clients and the success of their commercial offerings should be closely monitored.

- Revenue diversification strategy: The success of Palantir's efforts to diversify its revenue stream away from government contracts is a crucial factor to consider in evaluating its future performance.

Evaluating the Risk and Reward of Investing in Palantir Now

Risks Associated with Palantir Stock

Despite the potential for growth, investing in Palantir carries inherent risks:

- Stock volatility: PLTR stock is known for its significant price swings, indicating high volatility.

- Competition: Palantir operates in a competitive market, facing established players and emerging startups.

- Regulatory hurdles: The nature of Palantir's business might expose it to regulatory scrutiny and potential legal challenges.

- Client concentration: Over-reliance on a few key clients presents a significant risk to revenue stability.

Potential Upside and Long-Term Growth Prospects

While risks exist, several factors suggest a potential upside for Palantir:

- Innovative technology: Palantir's sophisticated data analytics platform has the potential to disrupt several industries.

- Government spending: Increased government investment in national security and intelligence could boost Palantir's government contracts.

- Commercial market expansion: Success in the commercial sector could significantly broaden Palantir's revenue base and reduce reliance on government contracts.

Comparing Palantir to Competitors

Analyzing Palantir's competitive landscape is critical. Comparing its technology, market share, and growth strategy to competitors like other data analytics companies provides a comparative perspective and helps investors assess Palantir's relative position and potential.

Conclusion: Is Palantir's 30% Stock Decline Truly a Buy Signal?

The recent 30% decline in Palantir stock presents a complex investment decision. While the broader tech stock sell-off and concerns about Palantir's reliance on government contracts raise risks, its innovative technology and potential for long-term growth offer substantial upside. Thorough due diligence, including a careful review of Palantir's financial performance, competitive landscape, and future outlook, is essential before making any investment decisions. Weigh the risks and rewards before making your own determination on whether this presents a strategic opportunity to buy Palantir stock. Consider these factors carefully before deciding if this is the right time to buy Palantir.

Featured Posts

-

Sensex Live Market Rebounds Up 100 Points Nifty At 17 950

May 10, 2025

Sensex Live Market Rebounds Up 100 Points Nifty At 17 950

May 10, 2025 -

Les Miserables Cast Weighs Boycott Over Trumps Planned Kennedy Center Performance

May 10, 2025

Les Miserables Cast Weighs Boycott Over Trumps Planned Kennedy Center Performance

May 10, 2025 -

Is The Attorney Generals Fox News Presence A Cause For Concern

May 10, 2025

Is The Attorney Generals Fox News Presence A Cause For Concern

May 10, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Prediction Betting Analysis And Odds

May 10, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Prediction Betting Analysis And Odds

May 10, 2025 -

Disney Raises Profit Expectations On The Back Of Theme Park And Streaming Success

May 10, 2025

Disney Raises Profit Expectations On The Back Of Theme Park And Streaming Success

May 10, 2025