Is Riot Platforms Stock A Buy At Its 52-Week Low? (RIOT)

Table of Contents

Analyzing Riot Platforms' Current Financial Health

Riot Platforms' financial health is paramount when considering its stock. A thorough analysis of its revenue, profitability, debt, and liquidity is essential to assess its resilience and future prospects.

H3: Revenue and Profitability:

Riot Platforms' revenue is intrinsically linked to the price of Bitcoin and its mining efficiency. Recent quarters have shown varying degrees of profitability, largely dictated by Bitcoin's price fluctuations and the cost of electricity.

- Q[Insert Quarter]: Revenue of [Insert Dollar Amount], compared to [Insert Dollar Amount] in Q[Previous Quarter]. This represents a [Percentage Change]% change.

- Mining Efficiency: [Insert Metrics, e.g., kWh/TH]. This indicates [Interpretation of Efficiency].

- Profit Margins: [Insert Data on Profit Margins], showing [Interpretation of Profit Margins]. This is significantly impacted by the fluctuating price of Bitcoin and the cost of energy.

Keywords: Riot Platforms financials, RIOT revenue, Bitcoin mining profitability, operating costs, mining efficiency.

H3: Debt and Liquidity:

Understanding Riot Platforms' debt levels and liquidity is crucial for assessing its financial stability. High debt levels can increase vulnerability during market downturns.

- Debt-to-Equity Ratio: [Insert Ratio]. This indicates [Interpretation of Ratio – e.g., a healthy or concerning level of leverage].

- Cash on Hand: [Insert Dollar Amount]. This provides a buffer against potential short-term challenges.

- Upcoming Debt Maturities: [Insert Information on Maturities]. This highlights potential future financial obligations.

Keywords: RIOT debt, liquidity, financial stability, cash flow, debt-to-equity ratio.

Assessing the Bitcoin Market's Impact on RIOT Stock

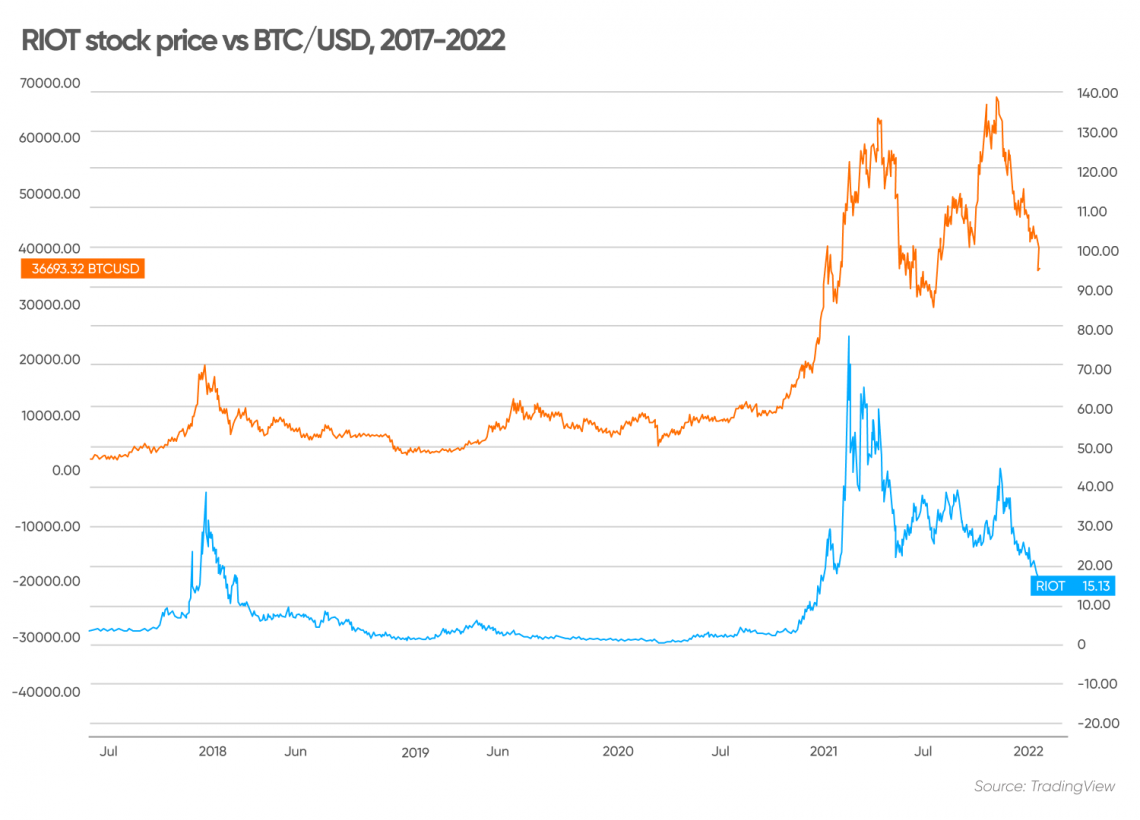

The price of Bitcoin has a profound impact on Riot Platforms' stock price. This correlation is fundamental to understanding RIOT's investment risk.

H3: Bitcoin Price Correlation:

Historically, Riot Platforms stock price has moved in tandem with the price of Bitcoin. A rising Bitcoin price generally boosts RIOT's stock, and vice-versa. Recent Bitcoin price declines have directly contributed to RIOT's 52-week low.

- Correlation Coefficient: [Insert Data if Available]. This quantifies the strength of the relationship between Bitcoin's price and RIOT's stock price.

- Bitcoin Price Predictions: While predicting Bitcoin's price is inherently speculative, understanding potential future price scenarios is critical for assessing RIOT's potential. [Mention reputable sources for price predictions, if any].

Keywords: Bitcoin price prediction, Bitcoin mining stocks, RIOT Bitcoin correlation, cryptocurrency market.

H3: Bitcoin Mining Difficulty and Hashrate:

Bitcoin mining difficulty and Riot's hashrate are key factors influencing its profitability.

- Mining Difficulty: [Explain the concept simply]. An increase in difficulty reduces the profitability of Bitcoin mining.

- Riot Platforms Hashrate: [Insert Data on Riot's Hashrate]. A higher hashrate generally means more Bitcoin mined, but this is also affected by mining difficulty and electricity costs.

Keywords: Bitcoin mining difficulty, hashrate, mining efficiency, Riot Platforms hashrate.

Evaluating the Long-Term Growth Potential of Riot Platforms

Riot Platforms' long-term success hinges on its expansion plans and its competitive position in the Bitcoin mining industry.

H3: Expansion Plans and Future Projects:

Riot Platforms has ambitious plans for expansion, including new mining facilities and technology upgrades. These initiatives could significantly impact its future earnings.

- New Mining Facilities: [Mention any announced projects and their expected capacity].

- Technology Upgrades: [Discuss any plans to improve mining efficiency].

- Diversification Strategies (if any): [Mention any plans to diversify beyond Bitcoin mining].

Keywords: Riot Platforms expansion, future growth, technology upgrades, Bitcoin mining infrastructure.

H3: Competitive Landscape:

The Bitcoin mining industry is competitive. Riot Platforms' success depends on its ability to maintain a strong competitive position.

- Key Competitors: [List major competitors and compare key metrics such as hashrate and energy costs].

- Market Share: [Insert Data on Riot Platform's market share, if available].

Keywords: Bitcoin mining competition, Riot Platforms competitors, industry analysis, market share.

Conclusion:

Riot Platforms stock is currently trading at a 52-week low, largely due to the decline in Bitcoin's price and the overall bear market in cryptocurrencies. While the company's financials and expansion plans show some promise, the volatility inherent in the Bitcoin mining industry presents significant risks. A thorough analysis reveals a mixed outlook, with potential for growth but also substantial risk.

Investment Recommendation: Investing in Riot Platforms stock at its current price requires careful consideration of its financial health, the unpredictable Bitcoin market, and the competitive landscape. It's a high-risk, high-reward proposition.

Call to Action: While Riot Platforms stock presents potential upside, it’s crucial to conduct your own due diligence before investing in RIOT. Carefully consider the risks associated with cryptocurrency mining and the volatility of the Bitcoin market. Thoroughly research Riot Platforms' financials and the broader cryptocurrency market before making any investment decisions regarding Riot Platforms stock (RIOT).

Featured Posts

-

The Urgent Need For Better Mental Healthcare Access

May 02, 2025

The Urgent Need For Better Mental Healthcare Access

May 02, 2025 -

Daisy May Cooper And Charlie Coopers New Bbc Show After Celeb Traitors

May 02, 2025

Daisy May Cooper And Charlie Coopers New Bbc Show After Celeb Traitors

May 02, 2025 -

Is Childhood Investment A Priority The Impact On Mental Health

May 02, 2025

Is Childhood Investment A Priority The Impact On Mental Health

May 02, 2025 -

Christina Aguileras Altered Image A New Photoshoot Sparks Debate Over Retouching

May 02, 2025

Christina Aguileras Altered Image A New Photoshoot Sparks Debate Over Retouching

May 02, 2025 -

Camera Espia Chaveiro Pequena Discreta E Muito Popular

May 02, 2025

Camera Espia Chaveiro Pequena Discreta E Muito Popular

May 02, 2025

Latest Posts

-

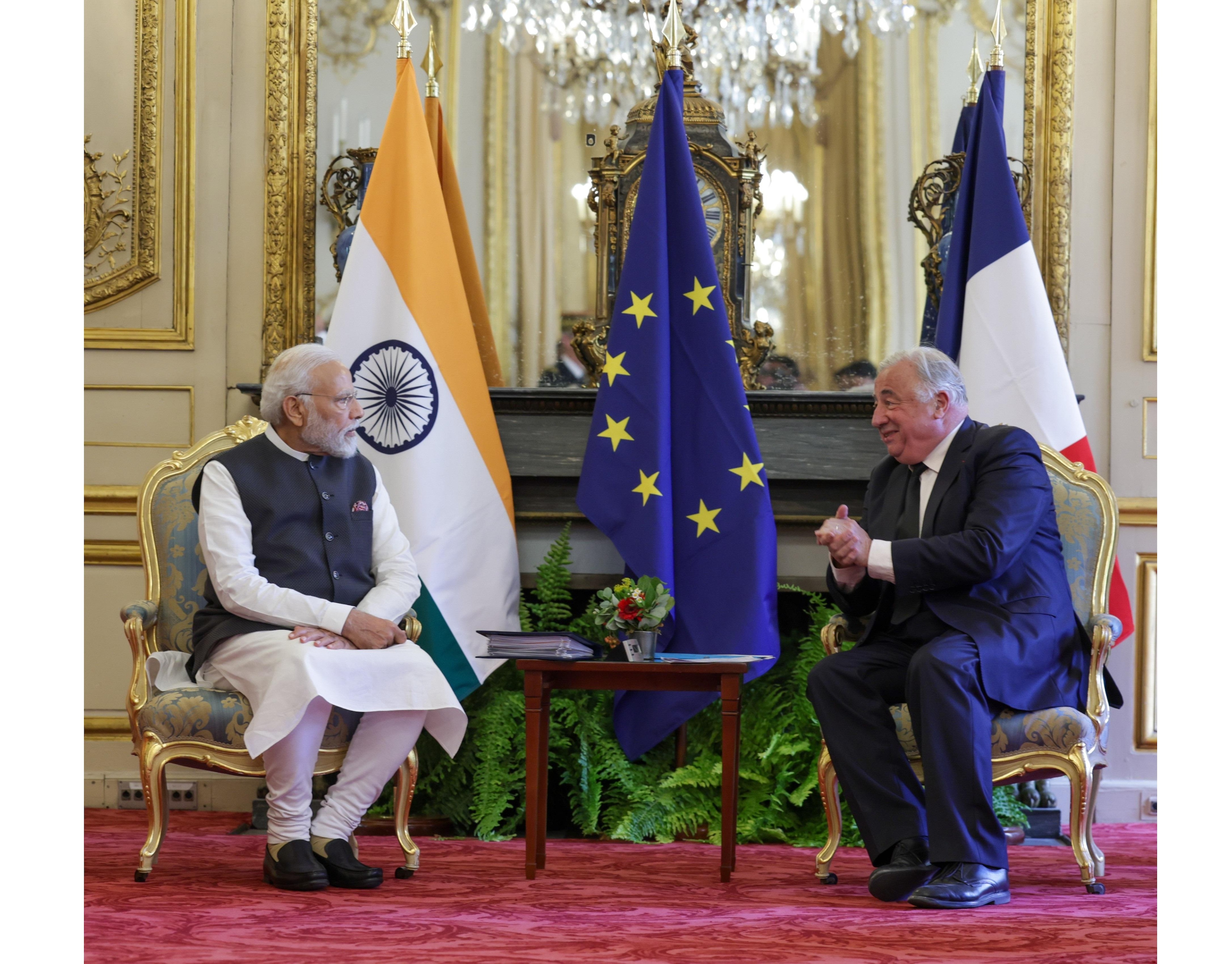

Indias Pm Modis Upcoming France Trip Ai Summit And Ceo Forum Participation

May 03, 2025

Indias Pm Modis Upcoming France Trip Ai Summit And Ceo Forum Participation

May 03, 2025 -

Pm Modis France Visit Key Engagements Include Ai Summit And Ceo Forum

May 03, 2025

Pm Modis France Visit Key Engagements Include Ai Summit And Ceo Forum

May 03, 2025 -

Foreign Secretary Announces Pm Modis Participation In Frances Ai Summit And Ceo Forum

May 03, 2025

Foreign Secretary Announces Pm Modis Participation In Frances Ai Summit And Ceo Forum

May 03, 2025 -

Indias Pm Modi To Engage In Ai Summit And Ceo Forum During France Trip

May 03, 2025

Indias Pm Modi To Engage In Ai Summit And Ceo Forum During France Trip

May 03, 2025 -

Pm Modi To Co Chair Ai Summit Address Business Leaders In France

May 03, 2025

Pm Modi To Co Chair Ai Summit Address Business Leaders In France

May 03, 2025