Is Riot Platforms Stock (RIOT) A Good Investment? Analyzing RIOT And COIN

Table of Contents

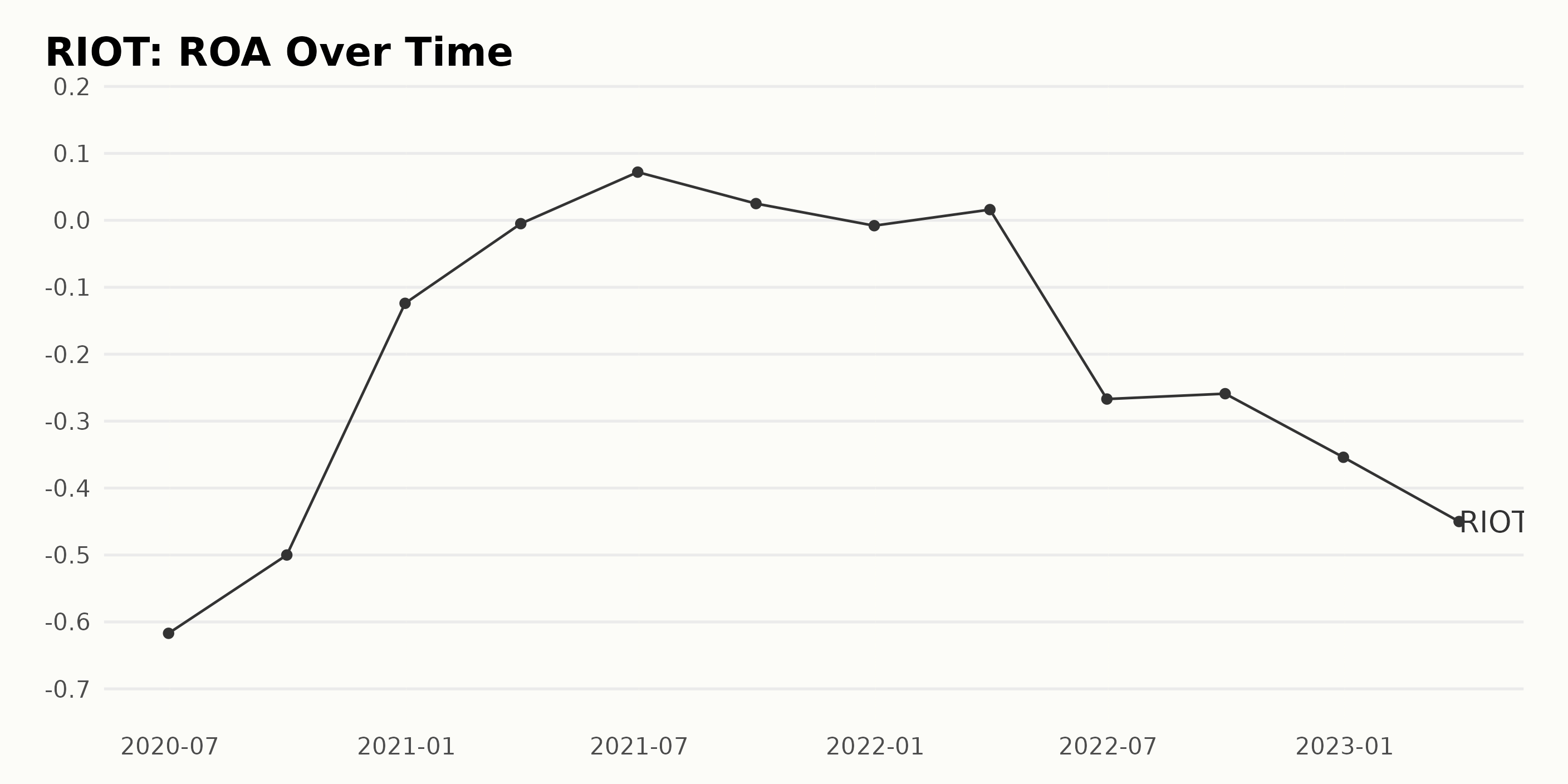

Riot Platforms (RIOT) Financial Performance and Growth Potential

Riot Platforms, a leading Bitcoin miner, has experienced considerable growth, but understanding its financial performance is crucial before considering Riot Platforms stock.

Revenue and Profitability

Riot's revenue is directly tied to Bitcoin's price and its mining capacity. Recent financial reports show fluctuations reflecting the volatility of the cryptocurrency market. For example, [insert specific data from recent financial reports, e.g., Q3 2023 revenue figures, year-over-year growth percentage, profit margins].

- Key Financial Metrics: Revenue, Gross Profit Margin, Net Income, Earnings Per Share (EPS).

- Comparison to Previous Years: Highlight year-over-year growth or decline in key metrics.

- Factors Influencing Profitability: Bitcoin price, energy costs (electricity), mining difficulty, and regulatory changes significantly impact Riot's profitability. Higher Bitcoin prices generally lead to increased revenue and profitability, while rising energy costs can squeeze margins.

Mining Capacity and Hashrate

Riot's mining capacity, measured in Bitcoin mining hashrate (a measure of computing power), is a key indicator of its ability to generate Bitcoin. The company's expansion plans, including new mining facilities and technological upgrades, are vital to its future growth.

- Current and Projected Hashrate: State Riot's current hashrate and projections for future increases. Provide data points and sources if available.

- Planned Facility Expansions: Discuss planned expansions and their impact on hashrate and Bitcoin production.

- Technological Advancements: Mention any investments in more efficient mining equipment or technologies that could boost profitability.

Bitcoin Holdings and Strategy

Riot Platforms holds a significant amount of mined Bitcoin. Its strategy regarding selling or holding these reserves significantly impacts its financial performance and investor perception.

- Size of Bitcoin Reserves: State the approximate number of Bitcoins held by Riot.

- Rationale Behind Holding Strategy: Explain Riot's reasoning behind its Bitcoin holding strategy (e.g., long-term price appreciation, hedging against market volatility).

- Potential Impact on Future Profitability: Analyze how the Bitcoin holding strategy could affect future profits, depending on market fluctuations.

Comparison with a Competitor (Coinbase - COIN)

To gain perspective, let's compare Riot Platforms with Coinbase (COIN), a leading cryptocurrency exchange. While their business models differ significantly, comparing key metrics provides valuable insights.

Key Differences and Similarities

Riot Platforms is a Bitcoin mining company, while Coinbase is a cryptocurrency exchange. This fundamental difference shapes their revenue streams and risk profiles.

- Comparison of Hashrate: Riot has a high hashrate; Coinbase does not directly mine Bitcoin.

- Revenue: Riot's revenue is tied to Bitcoin mining, while Coinbase's revenue is based on transaction fees and other services.

- Profitability: Compare their profit margins and overall profitability.

- Bitcoin Holdings: Riot holds mined Bitcoin; Coinbase's holdings are likely smaller and for operational purposes.

- Market Capitalization: Compare their overall market valuations.

Competitive Advantages and Disadvantages

Riot's competitive advantage lies in its large-scale Bitcoin mining operations and potential for expansion. However, it faces risks associated with Bitcoin price volatility and energy costs. Coinbase, on the other hand, benefits from a diversified revenue stream, but is subject to regulatory risks and competition in the exchange market.

- Advantages for Riot: Scale, potential for growth in mining capacity.

- Disadvantages for Riot: High dependence on Bitcoin price, energy costs.

- Overall Market Positioning: Assess Riot's position relative to Coinbase and other competitors.

Market Risks and Opportunities for RIOT Stock

Investing in Riot Platforms stock involves substantial risks and opportunities. Understanding these factors is crucial for informed decision-making.

Bitcoin Price Volatility

The Bitcoin price is the most significant factor influencing Riot's stock price. Sharp declines in Bitcoin's value directly impact Riot's revenue and profitability.

- Correlation between Bitcoin price and RIOT stock price: Highlight the strong correlation between the two.

- Risk Mitigation Strategies for Investors: Diversification and dollar-cost averaging can help mitigate risks.

Regulatory Landscape

The regulatory environment for cryptocurrency mining and trading is constantly evolving and presents both opportunities and risks.

- Potential Regulatory Changes: Discuss potential changes in regulations impacting Riot’s operations in different jurisdictions.

- Geographical Risks: Highlight risks associated with operating in regions with uncertain or unfavorable regulatory landscapes.

- Impact on Future Operations: Assess how regulatory changes could affect Riot's future operations and profitability.

Energy Costs and Sustainability

Energy costs are a significant expense for Bitcoin mining, and growing environmental concerns are putting pressure on the industry.

- Energy Consumption: Discuss Riot's energy consumption and its efforts to reduce it.

- Sustainability Initiatives: Analyze Riot's commitment to sustainable practices.

- Potential Impact on Long-Term Profitability: Assess how energy costs and sustainability concerns could impact Riot’s long-term profitability and investor perception.

Conclusion: Is Riot Platforms Stock (RIOT) Right for You?

Our analysis shows that Riot Platforms presents both significant opportunities and considerable risks. The company's success is heavily tied to Bitcoin's price and the regulatory landscape. While Riot's expansion plans and Bitcoin holdings offer potential for growth, its high dependence on Bitcoin's price makes it a volatile investment.

Therefore, whether Riot Platforms stock is a good investment depends largely on your risk tolerance and investment strategy. While the potential for high returns is present, so is the risk of substantial losses. Before considering investing in Riot Platforms stock (RIOT), or any cryptocurrency-related stock, it's crucial to conduct thorough due diligence, understand the inherent risks, and assess your risk tolerance. Consider further research on Riot Platforms stock and compare it to other investment opportunities before making a decision. Only consider investing in RIOT if you are comfortable with the significant volatility and risk involved.

Featured Posts

-

How Michael Sheen Erased 1 Million In Debt For 900 Individuals

May 02, 2025

How Michael Sheen Erased 1 Million In Debt For 900 Individuals

May 02, 2025 -

End Of School Desegregation Order Implications For Education

May 02, 2025

End Of School Desegregation Order Implications For Education

May 02, 2025 -

Phipps Slams Wallabies Southern Hemisphere Rugby Dominance Waning

May 02, 2025

Phipps Slams Wallabies Southern Hemisphere Rugby Dominance Waning

May 02, 2025 -

Ely Rda Syd Ka Mwqf Kshmyrywn Ka Msylh Awr Khte Myn Amn

May 02, 2025

Ely Rda Syd Ka Mwqf Kshmyrywn Ka Msylh Awr Khte Myn Amn

May 02, 2025 -

Fortnite Players Revolt Against Music Change

May 02, 2025

Fortnite Players Revolt Against Music Change

May 02, 2025

Latest Posts

-

Scottish Election 2024 Farages Reform Uk And The Snp Conundrum

May 03, 2025

Scottish Election 2024 Farages Reform Uk And The Snp Conundrum

May 03, 2025 -

Farages Reform Party A Scottish Nationalist Alliance In The Making

May 03, 2025

Farages Reform Party A Scottish Nationalist Alliance In The Making

May 03, 2025 -

Reform Uk Backs Snp Farages Shock Holyrood Election Prediction

May 03, 2025

Reform Uk Backs Snp Farages Shock Holyrood Election Prediction

May 03, 2025 -

Internet Fury Nigel Farages Use Of Jimmy Savile Phrase In Reform Campaign

May 03, 2025

Internet Fury Nigel Farages Use Of Jimmy Savile Phrase In Reform Campaign

May 03, 2025 -

Settlement Reached In Farages Legal Battle Against Nat West Over De Banking

May 03, 2025

Settlement Reached In Farages Legal Battle Against Nat West Over De Banking

May 03, 2025