Is The Bond Market Crisis Larger Than You Think?

Table of Contents

Recent headlines scream of inflation, recession, and market volatility. But lurking beneath the surface is a potential crisis that could dwarf them all: a significant bond market upheaval. Is the bond market crisis larger than you think? The answer, unfortunately, is likely yes. This article delves into the escalating risks, exploring the interconnectedness of global markets and outlining strategies for navigating this turbulent period.

Rising Interest Rates and Their Impact on Bond Prices

The foundation of the current unease lies in the inverse relationship between interest rates and bond prices. Understanding the Inverse Relationship: When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This causes the prices of older bonds to fall.

- Impact of Federal Reserve policy on bond yields: The Federal Reserve's aggressive interest rate hikes to combat inflation have directly impacted bond yields. Higher rates make borrowing more expensive, reducing demand for bonds and driving down their prices.

- Analysis of recent interest rate hikes and their effect on bond markets: The series of rate increases in 2022 and 2023 have triggered significant declines in the value of many bond portfolios, particularly those holding longer-term bonds.

- The role of inflation in driving interest rate increases: Persistently high inflation forces central banks to raise interest rates to cool down the economy, creating a ripple effect across bond markets.

- Examples of specific bonds significantly impacted by rising rates: Long-term government bonds and corporate bonds with longer maturities have been particularly vulnerable to these interest rate increases, experiencing substantial price drops.

Keywords: Interest rate risk, bond yield, inflation, Federal Reserve, monetary policy, interest rate hikes, bond price volatility

The Spread of Distress Beyond Government Bonds

The distress isn't confined to government bonds; it's spreading rapidly. Corporate Bond Defaults and Credit Risk: As interest rates climb, companies face higher borrowing costs, increasing the risk of defaults, especially for those with high levels of debt.

- Analysis of high-yield corporate bond spreads: Spreads, the difference between the yields of high-yield corporate bonds and risk-free government bonds, have widened significantly, reflecting growing concerns about defaults.

- Sectors most vulnerable to defaults (e.g., real estate, technology): Sectors heavily reliant on debt financing, like real estate and some technology companies, are particularly vulnerable to rising interest rates and potential defaults.

- The impact of credit rating downgrades on bond valuations: Credit rating downgrades further exacerbate the problem, leading to even lower valuations for affected bonds.

- Examples of recent corporate bond defaults and their ripple effects: High-profile corporate bond defaults can trigger a domino effect, impacting investor confidence and potentially leading to broader market instability.

Keywords: Corporate bonds, high-yield bonds, credit risk, default risk, credit rating agencies, bond defaults, high-yield bond spreads

The Potential for Contagion and Systemic Risk

The interconnectedness of global financial markets is a significant concern. Interconnectedness of Global Financial Markets: A crisis in one segment of the bond market can easily spread to others, creating a potentially devastating domino effect.

- Discussion of systemic risk and its potential for a broader financial crisis: The interconnected nature of global financial markets means that a major bond market crisis could trigger a systemic risk, leading to a wider financial crisis.

- Analysis of the interconnectedness between different bond markets (e.g., US Treasuries and European sovereign debt): Problems in one market, like US Treasuries, can impact investor confidence and spill over into other markets, such as European sovereign debt.

- The role of financial institutions and their exposure to bond market losses: Financial institutions heavily invested in bonds are vulnerable to substantial losses, potentially impacting their stability and lending capacity.

- Potential scenarios for contagion and their consequences: The consequences could include a credit crunch, a sharp economic downturn, and significant market volatility.

Keywords: Systemic risk, financial contagion, global financial markets, interconnectedness, domino effect, credit crunch, market volatility

Strategies for Navigating the Bond Market Crisis

While the situation is challenging, there are steps investors can take. Diversification and Risk Management: A proactive approach to risk management is crucial.

- Importance of diversification across different bond types and asset classes: Diversifying your portfolio across different bond types (e.g., government, corporate, municipal) and asset classes can help mitigate losses.

- Strategies for managing interest rate risk (e.g., duration matching): Techniques like duration matching, which involves aligning the average maturity of your bonds with your investment horizon, can help reduce interest rate risk.

- The role of hedging strategies in mitigating losses: Hedging strategies, such as using derivatives, can help protect against potential losses in a volatile market.

- Recommendations for investors with different risk tolerances: Investors with different risk tolerances should adopt different strategies, ranging from conservative approaches for risk-averse investors to more aggressive strategies for those with a higher risk tolerance.

Keywords: Risk management, diversification, hedging, portfolio management, bond investment strategies, interest rate risk management, duration matching

Conclusion

The bond market crisis is a multifaceted challenge with potentially far-reaching consequences. Rising interest rates, the spread of distress beyond government bonds, and the potential for systemic risk all contribute to a volatile and uncertain environment. Understanding the intricacies of this crisis is paramount for navigating the current market turbulence. Staying informed about developments in the bond market is crucial. Seek professional financial advice to manage your investments effectively and to understand how to mitigate the risks associated with navigating the bond market turmoil. Understanding the bond market crisis and implementing appropriate strategies for managing bond market risk is essential for protecting your financial future.

Featured Posts

-

Best Routes To Avoid Traffic Jams In France This Weekend

May 29, 2025

Best Routes To Avoid Traffic Jams In France This Weekend

May 29, 2025 -

Mum Guilty Of Trafficking Missing Six Year Old Daughter Body Parts Trade Allegations

May 29, 2025

Mum Guilty Of Trafficking Missing Six Year Old Daughter Body Parts Trade Allegations

May 29, 2025 -

Sjobading Guide Til Beste Badetemperaturer Og Vaerforhold

May 29, 2025

Sjobading Guide Til Beste Badetemperaturer Og Vaerforhold

May 29, 2025 -

New Cruise Ship Mein Schiff Relax Sets Sail First Season Details

May 29, 2025

New Cruise Ship Mein Schiff Relax Sets Sail First Season Details

May 29, 2025 -

Everything You Need To Know About The Nike Air Max Dn8 Shoe

May 29, 2025

Everything You Need To Know About The Nike Air Max Dn8 Shoe

May 29, 2025

Latest Posts

-

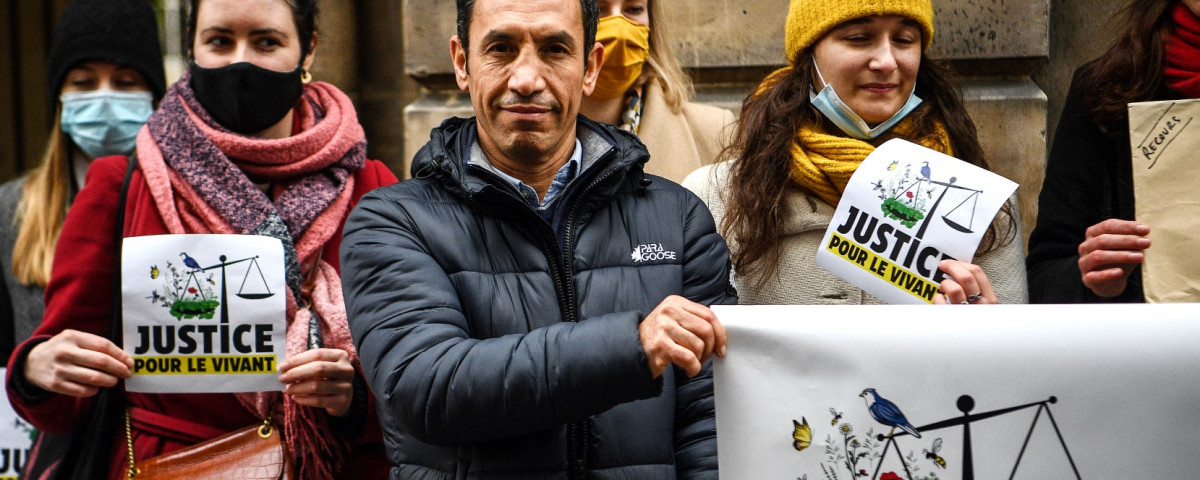

Devoir De Justice Pour Les Etoiles De Mer Une Nouvelle Perspective Sur Les Droits Du Vivant

May 31, 2025

Devoir De Justice Pour Les Etoiles De Mer Une Nouvelle Perspective Sur Les Droits Du Vivant

May 31, 2025 -

Droits Pour Le Vivant Le Cas Des Etoiles De Mer

May 31, 2025

Droits Pour Le Vivant Le Cas Des Etoiles De Mer

May 31, 2025 -

Vers Des Droits Pour Le Vivant La Justice Pour Les Etoiles De Mer Est Elle Possible

May 31, 2025

Vers Des Droits Pour Le Vivant La Justice Pour Les Etoiles De Mer Est Elle Possible

May 31, 2025 -

Evaluation De L Ingenierie Hydraulique Des Castors En Drome Deux Sites

May 31, 2025

Evaluation De L Ingenierie Hydraulique Des Castors En Drome Deux Sites

May 31, 2025 -

Performance Des Ouvrages Castors Analyse De Deux Cours D Eau Dromois

May 31, 2025

Performance Des Ouvrages Castors Analyse De Deux Cours D Eau Dromois

May 31, 2025