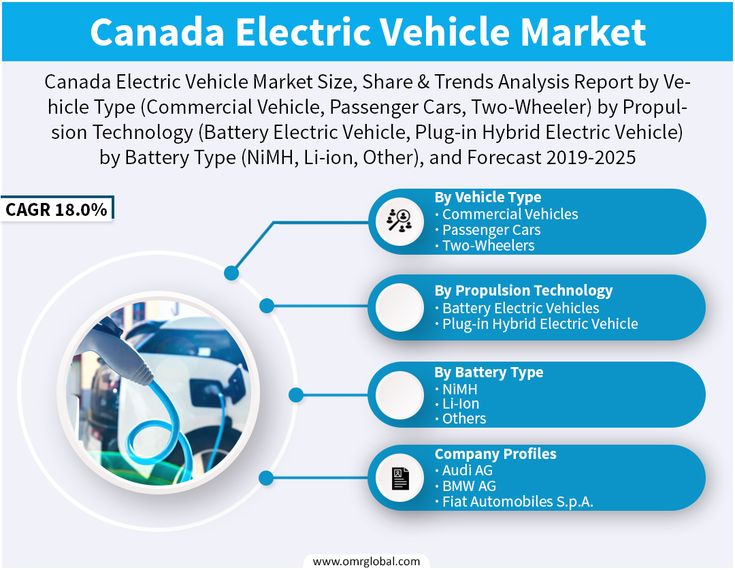

Is The Canadian EV Market Cooling? Three Years Of Declining Interest

Table of Contents

H2: Declining Sales Figures: A Closer Look at the Numbers

Analyzing the trends in electric vehicle sales Canada reveals a complex picture. While overall vehicle sales have fluctuated, the growth rate of EVs has seemingly slowed in recent years.

H3: Analyzing Sales Data from 2020-2023:

To understand the alleged decline, we need to examine the hard data. Using Statistics Canada data and industry reports from reputable sources like the Canadian Vehicle Manufacturers' Association (CVMA), we can track the year-over-year changes.

- 2020: Strong growth driven by initial government incentives and increased EV model availability.

- 2021: Continued growth, but at a slower pace than in 2020.

- 2022: A noticeable slowdown in growth, with percentage increases significantly lower than previous years.

- 2023 (Year-to-Date): Further deceleration, raising concerns about the long-term trajectory of EV adoption in Canada.

A comparison of EV sales to overall vehicle sales demonstrates a shrinking market share for EVs in Canada despite the overall market stabilizing in recent years. Seasonal variations, particularly a surge in sales towards the end of the year due to incentive deadlines, need to be considered when interpreting these figures. These fluctuations, while important, don't fully explain the overall slowing trend observed over the three-year period.

H3: Regional Variations in EV Adoption:

The decline in EV adoption isn't uniform across Canada. Provinces with stronger government incentives and more developed charging infrastructure, such as British Columbia and Quebec, continue to show higher adoption rates. However, even in these regions, growth has slowed compared to previous years.

- British Columbia: High EV adoption, but growth rate has plateaued.

- Quebec: Significant EV sales, but facing similar slowing trends as other provinces.

- Ontario: A large market, but slower adoption compared to BC and Quebec, partly due to infrastructure challenges.

- Prairie Provinces: Lower adoption rates due to factors such as lower population density and longer distances between charging stations.

H2: Factors Contributing to a Potential Slowdown in the Canadian EV Market

Several factors might be contributing to the perceived slowdown in the Canadian EV market.

H3: Rising Inflation and Increased Vehicle Prices:

The significant increase in vehicle prices, exacerbated by inflation and global supply chain disruptions, has made EVs less affordable for many Canadians.

- Price increases: EV prices have risen disproportionately compared to gasoline-powered vehicles in recent years.

- Supply chain issues: Shortages of essential components have further constrained supply and driven up prices.

H3: Concerns about Charging Infrastructure and Range Anxiety:

The lack of widespread, reliable charging infrastructure across Canada remains a significant barrier to EV adoption. Range anxiety – the fear of running out of battery power – continues to be a major concern for potential EV buyers.

- Inadequate charging network: The current charging network is insufficient to support widespread EV adoption, particularly outside major urban centers.

- Range anxiety: Concerns about limited driving range and the availability of charging stations deter many consumers.

H3: Government Incentive Changes and Their Impact:

Changes in government incentives for EV purchases have also played a role. While incentives remain in place, adjustments to programs or their phasing out in some regions could influence consumer decisions.

- Incentive reductions: Some provinces have reduced or modified their EV purchase incentives.

- Incentive eligibility: Changes to eligibility criteria can limit the number of consumers who qualify for incentives.

H2: Counterarguments: Is the Slowdown Temporary or a Misconception?

While the data suggests a slowdown, several counterarguments need consideration.

H3: The Role of Supply Chain Issues:

Global supply chain disruptions have significantly impacted EV production and availability. This artificial scarcity may mask the underlying demand for EVs. Once supply chains normalize, sales could rebound.

H3: Future Projections and Technological Advancements:

Future projections for the Canadian EV market remain positive, driven by anticipated technological advancements such as improved battery technology, increased range, and faster charging times. These innovations could significantly alleviate range anxiety and boost consumer confidence.

H3: Shifting Consumer Preferences and Market Segmentation:

The EV market is evolving, with new models and segments emerging to cater to diverse consumer needs and budgets. Changes in consumer preferences, influenced by technological advancements and improved affordability, will shape future growth.

3. Conclusion:

The data suggests a slowdown in the growth of the Canadian EV market over the past three years. Rising prices, concerns about charging infrastructure, and changes in government incentives have all contributed to this trend. However, it’s crucial to acknowledge the influence of supply chain disruptions and the potential for future growth driven by technological advancements and evolving consumer preferences. The Canadian EV market isn't necessarily cooling, but it's experiencing a period of adjustment.

Key Takeaways: While the Canadian EV market shows signs of slowing growth, this isn't necessarily a sign of declining interest. Supply chain issues, inflation, and infrastructure limitations are key factors.

Call to Action: Stay informed about the evolving Canadian EV market and its future by continuing to follow our analysis. Understanding the factors impacting the Canadian electric vehicle market trends is crucial for both consumers and industry stakeholders. The future of EVs in Canada remains bright, but navigating the current challenges will be key to its continued success.

Featured Posts

-

Broadcoms V Mware Deal At And T Reveals Extreme Price Increase Concerns

Apr 27, 2025

Broadcoms V Mware Deal At And T Reveals Extreme Price Increase Concerns

Apr 27, 2025 -

Trumps Trade Policy Implications For Canada Carney Warns

Apr 27, 2025

Trumps Trade Policy Implications For Canada Carney Warns

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

Alberto Ardila Olivares Tu Garantia Para El Logro De Objetivos

Apr 27, 2025

Alberto Ardila Olivares Tu Garantia Para El Logro De Objetivos

Apr 27, 2025 -

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025

Latest Posts

-

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025 -

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025 -

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025 -

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025