Is The U.S. Dollar Headed For Its Worst 100 Days Under A New Presidency Since Nixon?

Table of Contents

Historical Context: The Nixon Shock and its Implications for the Dollar

The 1971 Decision to Abandon the Gold Standard

President Nixon's 1971 decision to close the gold window, effectively abandoning the Bretton Woods system and the gold standard, sent shockwaves through the global financial system. This momentous decision, driven by persistent balance of payments deficits and escalating inflation, had profound and lasting consequences for the U.S. dollar.

- Events Leading to the Decision: Years of unsustainable U.S. spending, particularly the Vietnam War, fueled inflation and drained the U.S. gold reserves. Foreign governments began demanding gold in exchange for their dollar holdings, putting immense pressure on the U.S. Treasury.

- Immediate Impact: The dollar's value plummeted against other currencies, creating significant uncertainty in global markets. Exchange rates became more volatile, and international trade faced disruption.

- Long-Term Consequences: The abandonment of the gold standard marked the beginning of a floating exchange rate system, leading to increased currency volatility and the emergence of a more complex global monetary system. The dollar's value became increasingly influenced by market forces rather than a fixed gold price. Inflation continued to be a major problem in the subsequent years.

The Aftermath: Inflation, Uncertainty, and Dollar Volatility

The years following Nixon's decision were marked by high inflation, economic uncertainty, and significant fluctuations in the dollar's value. The inflationary pressures that gripped the U.S. economy in the 1970s, sometimes referred to as "stagflation," severely impacted the purchasing power of the dollar.

- Inflationary Pressures: The removal of the gold standard constraint allowed for more expansive monetary policy, exacerbating inflationary pressures.

- Dollar Volatility: The dollar's value fluctuated wildly against other major currencies, creating a volatile environment for businesses engaged in international trade.

- Connecting to Current Conditions: The parallels between the inflationary pressures and economic uncertainty of the Nixon era and the current economic climate are striking, raising questions about the potential for similar volatility in the U.S. dollar.

Current Economic Landscape: Factors Affecting the Dollar's Stability

Inflationary Pressures and Interest Rate Hikes

The U.S. is currently grappling with elevated inflation rates, forcing the Federal Reserve to implement aggressive interest rate hikes. This tightening of monetary policy aims to curb inflation but carries its own risks.

- Current Inflation Rates: Inflation has surged to multi-decade highs, impacting consumer spending and overall economic growth.

- Impact of Interest Rate Hikes: While interest rate hikes can help control inflation, they also slow down economic growth and potentially lead to a recession. The stronger dollar, resulting from higher interest rates, can hurt U.S. exporters.

- Expert Opinions: Economists hold diverse views on the effectiveness and potential side effects of the Federal Reserve's actions on the dollar's stability.

Geopolitical Instability and its Influence on the Dollar

Geopolitical instability, from the war in Ukraine to rising tensions in other regions, further complicates the outlook for the dollar.

- Global Conflicts: Major global conflicts disrupt supply chains, fuel inflation, and increase uncertainty, all of which impact the dollar's value.

- International Trade and Sanctions: Trade wars and sanctions can also significantly affect the dollar's position as a global reserve currency.

- Potential Consequences: Continued geopolitical tensions could lead to increased capital flight and a weakening of the dollar.

The New Administration's Economic Policies and Their Projected Impact

The economic policies of the incoming administration will play a crucial role in shaping the future of the U.S. dollar. Analyzing the potential impact of these policies is crucial for forecasting the dollar's trajectory.

- Planned Economic Policies: The new administration's plans, whether focused on fiscal stimulus, tax cuts, or regulatory changes, will have significant repercussions.

- Impact on Dollar Strength: Depending on their nature, these policies could either strengthen or weaken the dollar, affecting inflation, trade balances, and international investment flows.

- Expert Predictions: Economists offer varying predictions regarding the effectiveness and long-term consequences of the administration's planned policies.

- Key Policy Makers: Understanding the viewpoints and priorities of key economic policymakers within the administration is vital for assessing potential impacts on the dollar.

Comparing Then and Now: Parallels and Divergences

Similarities Between the Two Eras

Both the Nixon era and the current climate share some unsettling similarities:

- Inflationary Pressures: Both periods experienced significant inflationary pressures, impacting the value of the dollar and economic stability.

- Geopolitical Tensions: Both eras witnessed significant geopolitical tensions that added uncertainty to the global economic landscape.

- Shifts in Global Power Dynamics: Both periods saw shifts in global power dynamics, altering the role and influence of the U.S. dollar in the international monetary system.

Key Differences and Why a Direct Comparison Might Be Misleading

While similarities exist, crucial differences prevent a direct comparison:

- Global Financial System: The global financial system is far more interconnected and complex today than it was during the Nixon era.

- Technological Advancements: Technological advancements, particularly in financial technology and communication, have significantly altered how markets react to economic shocks.

- Nature of Economic Challenges: The nature of the current economic challenges, such as globalization, climate change, and technological disruption, differs from the challenges of the 1970s.

Is the U.S. Dollar Headed for its Worst 100 Days Since Nixon? A Final Assessment

The current economic climate shares some concerning parallels with the Nixon era, particularly regarding inflationary pressures and geopolitical uncertainty. However, significant differences in the global financial system and the nature of economic challenges make a direct comparison overly simplistic. Whether the U.S. dollar will experience its "worst 100 days since Nixon" remains uncertain. The impact of the new administration's policies, the evolution of geopolitical tensions, and the Federal Reserve's ability to manage inflation will all play pivotal roles in shaping the dollar's future. A careful monitoring of these factors is crucial. Stay informed about the future of the U.S. dollar and whether it is truly headed for its worst 100 days since Nixon. Subscribe to our newsletter for ongoing analysis and updates on this critical issue.

Featured Posts

-

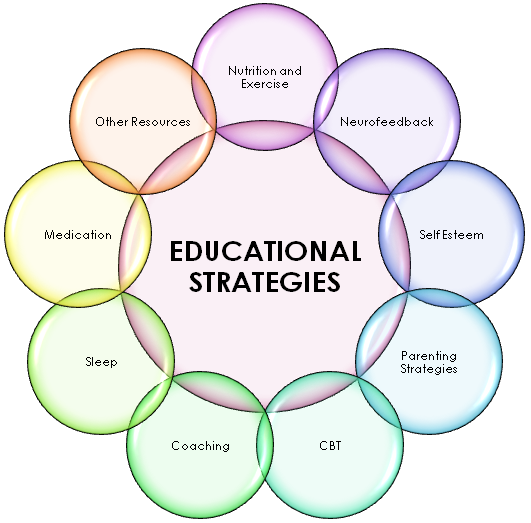

Enhancing Driving Safety Through Research The Case Of Adhd

Apr 29, 2025

Enhancing Driving Safety Through Research The Case Of Adhd

Apr 29, 2025 -

Adhd

Apr 29, 2025

Adhd

Apr 29, 2025 -

Papal Conclave Disgraced Cardinals Voting Eligibility Challenged

Apr 29, 2025

Papal Conclave Disgraced Cardinals Voting Eligibility Challenged

Apr 29, 2025 -

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025 -

Jancker Beerbt Pacult Neuer Trainer Der Austria Wien

Apr 29, 2025

Jancker Beerbt Pacult Neuer Trainer Der Austria Wien

Apr 29, 2025