Is The World's Largest Bond Market In Peril? A Posthaste Perspective

Table of Contents

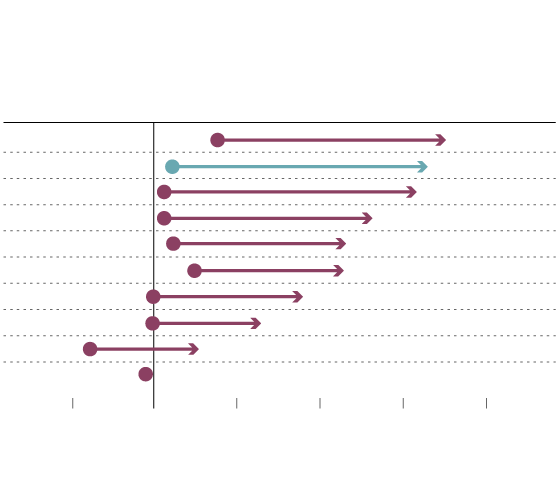

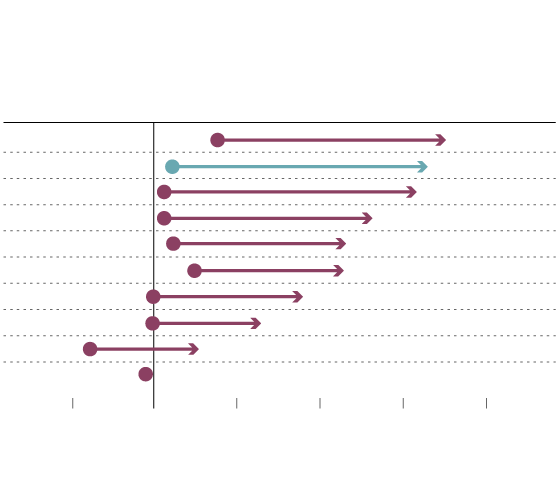

Inflationary Pressures and Their Impact on Bond Yields

The inverse relationship between bond prices and inflation is a fundamental principle of finance. Rising inflation erodes the purchasing power of future interest payments, making existing bonds less attractive. As inflation increases, investors demand higher yields to compensate for this erosion of value. This leads to a fall in bond prices, impacting the value of existing bond holdings within the global bond market, particularly the US Treasury market. The Federal Reserve's response to inflation, often involving raising interest rates, further complicates the situation.

- Impact of inflation on real yields: Real yields, which account for inflation, can become negative, making bonds unattractive to investors seeking positive returns.

- Increased demand for higher-yielding assets: Investors flee from lower-yielding bonds to seek higher returns in other asset classes, like equities or inflation-protected securities, impacting the overall stability of the bond market.

- Potential for capital losses in existing bond holdings: As bond prices fall due to rising inflation and interest rates, investors holding existing bonds face potential capital losses. This risk is particularly significant for investors with long-term bond holdings. The effect ripples across the entire global bond market.

Rising Interest Rates and Their Implications for Bond Investors

Rising interest rates pose a significant challenge to the bond market. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon payments less attractive. This impacts both the US Treasury market and the broader global bond market. The concept of reinvestment risk also comes into play. When bonds mature, the investor must reinvest the proceeds at the then-current, potentially lower, interest rates.

- Impact on bond valuations: Rising interest rates lead to lower bond prices, reducing the value of existing bond portfolios. This effect is amplified for longer-duration bonds.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, potentially slowing economic growth and impacting their ability to service their debt.

- Attractiveness of alternative investment options: Rising rates make alternative investment options, such as high-yield savings accounts or certificates of deposit, more competitive with bonds, potentially drawing investment away from the bond market.

Geopolitical Uncertainty and its Influence on Global Bond Markets

Geopolitical events significantly impact investor sentiment and capital flows within the global bond market. The US Treasury market, often considered a "safe haven" asset, can be affected by global instability. However, this safe-haven status is not absolute and can be challenged during periods of extreme uncertainty. Investors may shift between "flight to quality" (seeking safe havens like US Treasuries) and "flight from risk" (selling all assets, including Treasuries) depending on the severity and nature of the geopolitical event.

- Impact of global events on risk appetite: War, political instability, and other geopolitical shocks reduce investor risk appetite, leading to increased volatility in bond markets worldwide.

- Potential for capital flight from emerging markets to US Treasuries (or vice versa): Depending on the nature of the geopolitical event, capital may flow into or out of US Treasuries relative to emerging market bonds.

- Increased volatility in bond yields during periods of uncertainty: Geopolitical uncertainty increases the unpredictability of bond yields, making it difficult for investors to assess and manage risk.

Potential for a Bond Market Crisis and its Consequences

A major downturn in the bond market, particularly within the US Treasury market, could have significant systemic consequences. The interconnectedness of global financial institutions means that a crisis in one area could trigger a domino effect, impacting the entire global bond market.

- Impact on global financial institutions: Many financial institutions hold significant amounts of bonds, and a sharp decline in bond prices could lead to substantial losses and potential insolvency for some institutions.

- Potential for a credit crunch: A bond market crisis could lead to a credit crunch, as lenders become more hesitant to provide loans, hindering economic activity.

- Consequences for economic growth: A bond market crisis can significantly dampen economic growth by reducing investment and consumer spending.

Is the World's Largest Bond Market Truly in Peril? A Final Assessment

The US Treasury market, the world's largest bond market, faces significant challenges from inflation, rising interest rates, and geopolitical uncertainty. These factors create the potential for a substantial market downturn with potentially severe consequences for the global economy. However, it's important to maintain a balanced perspective. The US Treasury market has historically demonstrated resilience, and its size and liquidity provide a degree of inherent stability.

Understanding the intricacies of the world's largest bond market is crucial for navigating current economic uncertainties. Stay informed about developments in the global bond market and consider diversifying your investments to protect against potential risks related to the US Treasury market and global bond market volatility. Proactive risk management, including careful portfolio diversification, is essential for weathering potential storms in this critical sector of the global economy.

Featured Posts

-

From Scatological Documents To Podcast Ais Role In Content Transformation

May 24, 2025

From Scatological Documents To Podcast Ais Role In Content Transformation

May 24, 2025 -

Evrovidenie Pobediteli Poslednikh 10 Let Gde Oni Seychas

May 24, 2025

Evrovidenie Pobediteli Poslednikh 10 Let Gde Oni Seychas

May 24, 2025 -

I Piu Ricchi Del Mondo 2025 La Classifica Forbes Aggiornata

May 24, 2025

I Piu Ricchi Del Mondo 2025 La Classifica Forbes Aggiornata

May 24, 2025 -

Amundi Djia Ucits Etf A Detailed Look At Its Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Detailed Look At Its Net Asset Value

May 24, 2025 -

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025

Latest Posts

-

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025 -

Free Movie Screenings And Celebrity Appearances At The Usa Film Festival In Dallas

May 24, 2025

Free Movie Screenings And Celebrity Appearances At The Usa Film Festival In Dallas

May 24, 2025 -

The Last Rodeo Neal Mc Donoughs Leading Man Performance

May 24, 2025

The Last Rodeo Neal Mc Donoughs Leading Man Performance

May 24, 2025 -

Usa Film Festival Stars And Free Movies Coming To Dallas

May 24, 2025

Usa Film Festival Stars And Free Movies Coming To Dallas

May 24, 2025 -

Guilty Verdict In Columbus Child Sex Crimes Case

May 24, 2025

Guilty Verdict In Columbus Child Sex Crimes Case

May 24, 2025