Is This Bitcoin Rebound Sustainable? Analyzing Market Trends

Table of Contents

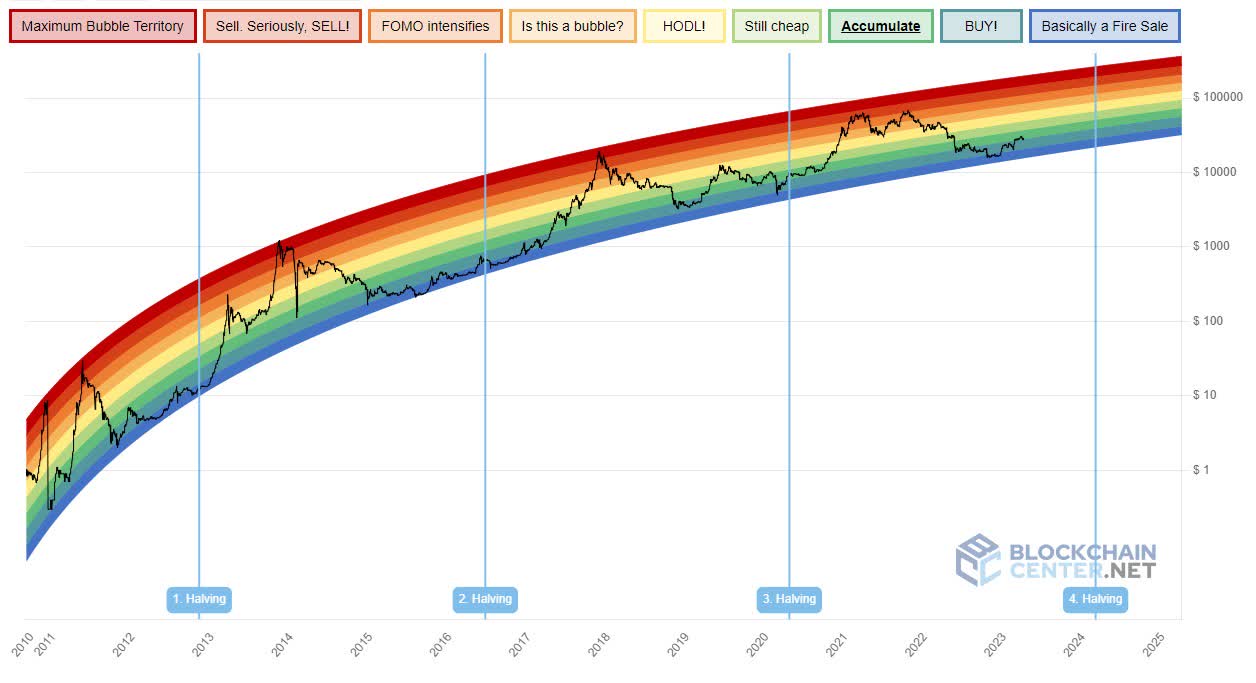

Analyzing Recent Bitcoin Price Movements

Short-Term Volatility vs. Long-Term Trends

The recent Bitcoin price increases have been characterized by significant short-term volatility. For example, Bitcoin experienced a sharp rise from approximately $20,000 in December 2022 to over $30,000 in early 2023, followed by periods of consolidation and minor corrections. Comparing this to historical Bitcoin price patterns reveals a familiar cycle of boom and bust, but the underlying factors may differ this time.

- Specific Price Points and Dates: A significant price jump occurred between January 15th and February 10th, 2023, with a peak exceeding $25,000. Trading volume increased considerably during these periods, according to data from CoinMarketCap.

- Data Sources: Data from CoinGecko corroborates this surge in price and trading activity, further supporting the observation of heightened volatility.

- Short-term vs. Long-term: Short-term traders often focus on these rapid price swings for quick profits. Long-term investors, however, are more concerned with the overall trend and the underlying technological advancements and adoption of Bitcoin.

The Influence of Macroeconomic Factors

Global macroeconomic conditions significantly impact Bitcoin's price. Inflation, interest rates, and recession fears are all major factors influencing investor sentiment towards Bitcoin.

- Inflation Hedge Potential: Bitcoin's limited supply and decentralized nature make it attractive as a potential inflation hedge, driving demand during periods of high inflation.

- Investor Sentiment: Negative economic news often leads to risk-aversion among investors, potentially causing them to sell off Bitcoin alongside other assets. Conversely, positive economic news can boost investor confidence, leading to increased demand for Bitcoin.

- Monetary Policy: Changes in monetary policy by central banks, such as interest rate hikes, can affect the attractiveness of Bitcoin relative to traditional assets.

- Geopolitical Instability: Global events like wars or political unrest can increase demand for Bitcoin as a safe haven asset.

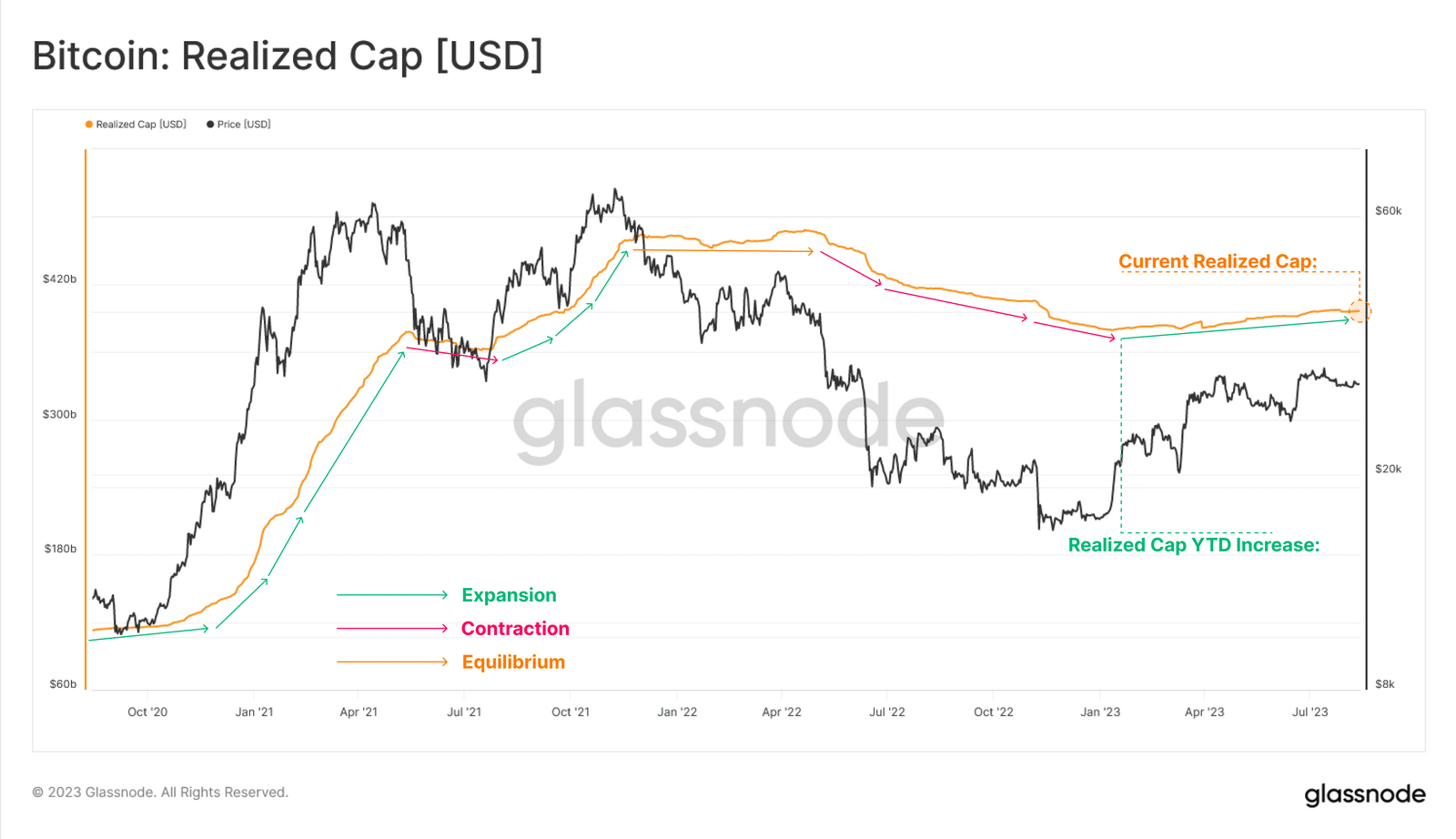

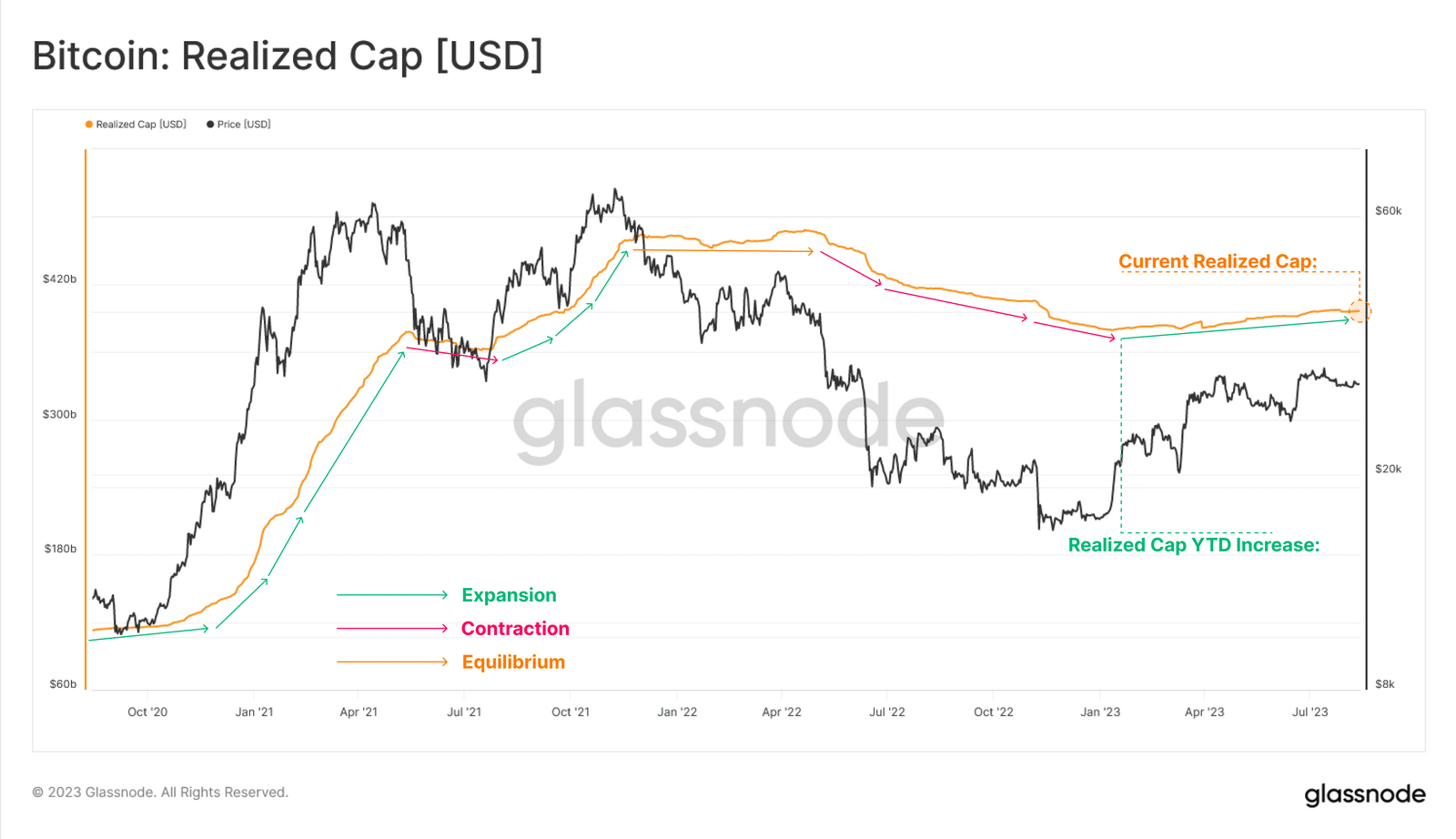

Assessing Key On-Chain Metrics

Bitcoin Network Activity and Adoption

On-chain metrics provide valuable insights into Bitcoin's network health and user engagement. Analyzing transaction volume, active addresses, and mining difficulty gives a clearer picture of its long-term health.

- Increasing Activity: A sustained increase in transaction volume and active addresses suggests growing adoption and network utilization, supporting a more sustainable price rebound. Data from blockchain explorers like Blockstream Info can be consulted.

- Decreasing Activity: Conversely, a decrease in these metrics may indicate declining user interest and could put downward pressure on the price.

- Mining Difficulty: This metric reflects the computational power securing the network. A consistent increase implies a healthy network, while a decrease could suggest concerns.

Whale Activity and Institutional Investment

The actions of large Bitcoin holders ("whales") and institutional investors can significantly influence market trends.

- Whale Accumulation: If large holders accumulate Bitcoin during price dips, it suggests confidence in the long-term prospects and could support a price rebound.

- Selling Pressure: Conversely, large-scale selling by whales can trigger price drops, impacting the sustainability of any upward trend. News regarding large institutional investments in Bitcoin can be a strong indicator of market sentiment.

- Institutional Influence: Increased institutional investment brings more stability and liquidity to the market, potentially reducing volatility and contributing to sustainable growth.

Regulatory Landscape and Its Impact

Global Regulatory Developments

Government regulations worldwide play a crucial role in shaping the Bitcoin market.

- Positive Regulatory Developments: Clear and favorable regulations can attract institutional investment and boost confidence, leading to price stability and growth.

- Negative Regulatory Developments: Restrictive or unclear regulations can create uncertainty and negatively impact Bitcoin’s price and adoption.

- Cross-Country Differences: Different regulatory approaches across countries affect the accessibility and trading of Bitcoin, creating various market dynamics.

Future Regulatory Uncertainty

The future regulatory landscape remains uncertain, presenting both potential opportunities and risks.

- Increased Clarity: More defined regulations could potentially attract mainstream investors and increase market stability.

- Increased Uncertainty: Unpredictable regulatory changes can lead to increased volatility and price fluctuations, undermining sustainability.

Conclusion

Analyzing recent Bitcoin price movements, on-chain metrics, and the regulatory landscape reveals a complex interplay of factors influencing the current rebound. While the recent surge shows potential, its sustainability depends on maintaining positive network activity, attracting further institutional investment, and navigating the evolving regulatory environment. Short-term volatility is expected, but the long-term prospects depend significantly on macroeconomic factors and investor confidence.

While determining the long-term sustainability of this Bitcoin rebound requires ongoing monitoring, understanding the factors influencing the market is crucial for informed investment decisions. Continue to research the latest trends and developments in the Bitcoin market and make calculated decisions about your Bitcoin investment strategy. Stay informed about future developments in the Bitcoin market for a comprehensive understanding of potential price movements and to navigate the complexities of the Bitcoin rebound effectively.

Featured Posts

-

De Escalation Dominates A Report On U S China Trade Talks This Week

May 09, 2025

De Escalation Dominates A Report On U S China Trade Talks This Week

May 09, 2025 -

Investing Made Easy Jazz Cash And K Trades Collaborative Effort

May 09, 2025

Investing Made Easy Jazz Cash And K Trades Collaborative Effort

May 09, 2025 -

Nottingham Attack Inquiry Nhs Trust Boss Pledges Cooperation

May 09, 2025

Nottingham Attack Inquiry Nhs Trust Boss Pledges Cooperation

May 09, 2025 -

Nc Daycare Suspension What Parents Need To Know

May 09, 2025

Nc Daycare Suspension What Parents Need To Know

May 09, 2025 -

Bitcoin Price Prediction 2024 Impact Of Trumps Economic Policies On Btc

May 09, 2025

Bitcoin Price Prediction 2024 Impact Of Trumps Economic Policies On Btc

May 09, 2025