Is This Cryptocurrency Immune To The Trade War's Effects?

Table of Contents

Understanding the Impact of Trade Wars on Global Markets

Trade wars introduce significant economic uncertainty. Tariffs, sanctions, and retaliatory measures disrupt established trade relationships, impacting various sectors and creating volatility in traditional markets like stocks and bonds. This uncertainty often leads to a "flight to safety," where investors move their capital from riskier assets to those perceived as more stable, like government bonds or precious metals.

- Increased volatility in traditional asset classes: Trade war escalations often trigger sharp price swings in stocks and other traditional investments.

- Decreased investor confidence: Uncertainty surrounding future trade policies undermines investor confidence, leading to decreased investment and economic slowdown.

- Potential capital flight from affected regions: Businesses and investors may move capital away from regions heavily impacted by trade disputes.

Cryptocurrencies as a Hedge Against Trade War Uncertainty

Unlike traditional financial systems, which are often subject to government regulations and trade policies, cryptocurrencies operate on decentralized, blockchain-based networks. This inherent decentralization offers a potential advantage during trade wars. The global nature of cryptocurrencies means they are less susceptible to the localized impacts of trade restrictions.

- Decentralization minimizes government intervention: Cryptocurrencies are not subject to the same level of government control as traditional currencies, potentially making them more resilient to trade-related policies.

- Global accessibility regardless of trade barriers: Cryptocurrencies can be accessed and traded globally, bypassing many traditional trade barriers.

- Potential for price appreciation as investors seek alternatives: During periods of economic turmoil, investors may flock to cryptocurrencies as alternative investments, potentially driving up their price.

Bitcoin's Performance During Past Trade Disputes

Analyzing Bitcoin's historical price movements during previous trade disputes or periods of geopolitical tension provides valuable insight. While a direct causal link isn't always clear, observing Bitcoin price trends alongside trade war events helps understand its potential role as a safe haven asset. Examining data on "Bitcoin price" fluctuations alongside news regarding "trade war impact on Bitcoin" and analyzing "crypto market volatility" during these periods is crucial.

- Specific examples of Bitcoin's response during past trade conflicts: Detailed case studies of Bitcoin's price behavior during specific trade disputes can reveal patterns and correlations.

- Correlation (or lack thereof) between trade tensions and Bitcoin's price: Statistical analysis can determine the strength of the relationship, if any, between trade tensions and Bitcoin's price movements.

Factors Affecting Cryptocurrency's Resilience to Trade Wars

While decentralization offers a degree of protection, other factors significantly influence cryptocurrency prices, even during periods of geopolitical uncertainty. These include regulatory changes, technological advancements, and overall market sentiment.

- Regulatory landscape in different countries: Varying regulatory approaches towards cryptocurrencies across different jurisdictions can affect their price and accessibility.

- Adoption rates and market capitalization: Higher adoption rates and market capitalization generally imply greater resilience against market shocks.

- The role of media coverage and investor sentiment: Positive or negative media coverage and shifts in investor sentiment can significantly influence cryptocurrency prices.

Other Cryptocurrencies and their Trade War Vulnerability

While Bitcoin often serves as a benchmark, other cryptocurrencies (altcoins) exhibit varying degrees of resilience to trade wars. Their vulnerability depends on their specific design, functionality, and market exposure.

- Examples of cryptocurrencies with higher or lower vulnerability: Some cryptocurrencies might be more susceptible to regulatory changes or market fluctuations than others.

- Reasons for varying levels of resilience: Factors like the underlying technology, use cases, and level of adoption contribute to differing levels of resilience.

The Future of Cryptocurrency in a World of Trade Wars

Predicting the future is inherently challenging, but several factors suggest a potential increase in cryptocurrency adoption as a hedge against global instability caused by trade wars.

- Predictions on the long-term impact of trade wars on crypto markets: Experts' opinions and market analyses can shed light on potential future trends.

- Potential for regulatory responses affecting cryptocurrencies: Government actions and regulations could significantly influence cryptocurrency markets.

- The role of technology and innovation in shaping future market dynamics: Technological advancements in the crypto space will continue to impact its resilience and adoption.

Conclusion: Is This Cryptocurrency a Safe Haven in Times of Trade Conflict?

Whether a specific cryptocurrency serves as a safe haven during trade wars depends on several interconnected factors, including its decentralization, regulatory environment, market capitalization, and overall investor sentiment. While the decentralized nature of cryptocurrencies offers potential resilience against some aspects of trade disputes, other factors significantly influence their price and stability. Therefore, before making any crypto investment, thorough research is vital. Carefully analyze the specific cryptocurrency you're considering, understand the current global trade dynamics, and acknowledge the inherent volatility of the cryptocurrency market. Building a well-diversified cryptocurrency portfolio and adopting a cautious approach to cryptocurrency trading are crucial elements of responsible crypto investment.

Featured Posts

-

Nhl 2024 25 Season Key Storylines To Follow

May 09, 2025

Nhl 2024 25 Season Key Storylines To Follow

May 09, 2025 -

Young Thugs Pledge Of Loyalty Details From A Leaked Song

May 09, 2025

Young Thugs Pledge Of Loyalty Details From A Leaked Song

May 09, 2025 -

Oilers Even Series Against Kings With Overtime Victory

May 09, 2025

Oilers Even Series Against Kings With Overtime Victory

May 09, 2025 -

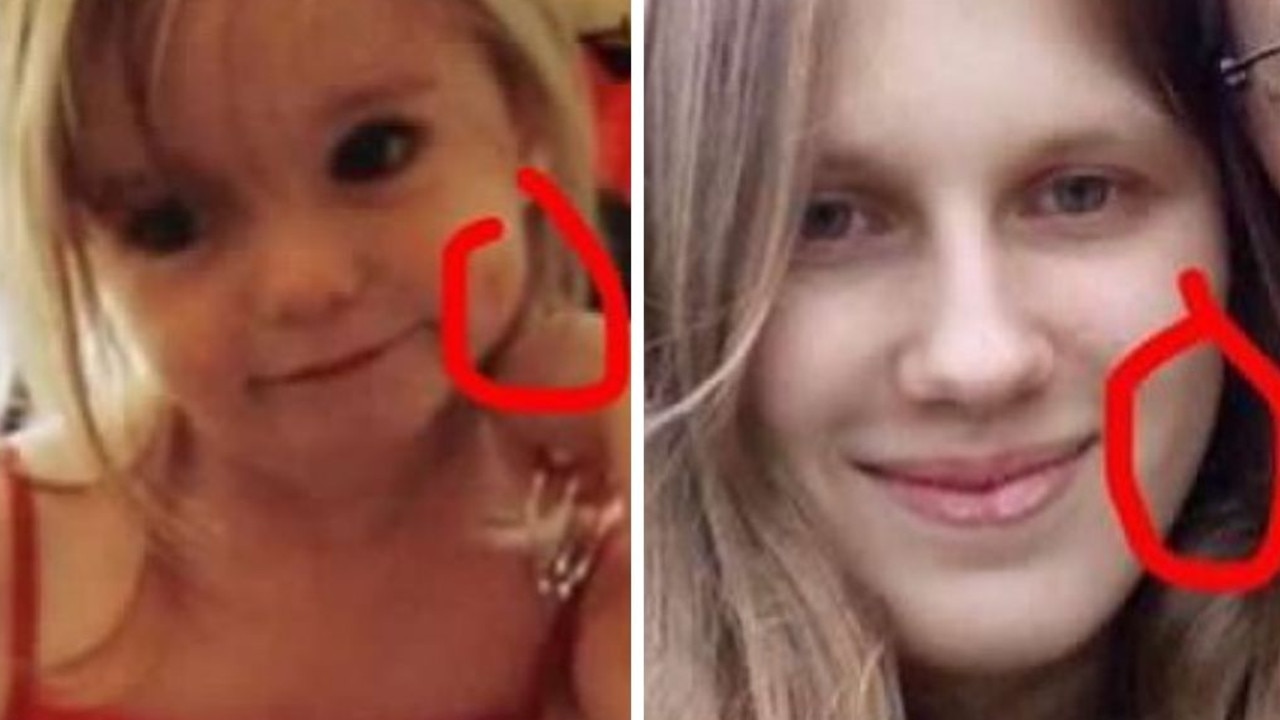

Madeleine Mc Cann Case Polish Woman Faces Stalking Charges

May 09, 2025

Madeleine Mc Cann Case Polish Woman Faces Stalking Charges

May 09, 2025 -

Doohans Future At Williams Addressing The Colapinto Replacement Rumors

May 09, 2025

Doohans Future At Williams Addressing The Colapinto Replacement Rumors

May 09, 2025