Is This New SPAC Stock The Next MicroStrategy? Investor Analysis

Table of Contents

H2: The Example SPAC's Business Model and Bitcoin Strategy:

H3: Understanding the Example SPAC's Initial Public Offering (IPO): Example SPAC completed its IPO on October 26, 2023, raising $500 million. Its stated objective is to acquire a company in the fintech or blockchain technology sectors. The SPAC's management team has a strong track record in these areas, with experience spanning successful IPOs and mergers & acquisitions in the tech industry. They aim to identify a target company within the next 18 months.

- IPO date: October 26, 2023

- Funds raised: $500 million

- Target acquisition timeframe: 18 months

- Management team experience: Extensive experience in fintech, blockchain, and M&A.

H3: Analyzing the Potential Bitcoin Investment Strategy: While Example SPAC's IPO prospectus doesn't explicitly mention Bitcoin investments, recent interviews with the CEO suggest a strong interest in exploring digital assets as a potential investment strategy for their target acquisition. The management team's background includes individuals with prior experience in cryptocurrency trading, which could influence their future decisions.

- Public statements about cryptocurrency investment: Positive sentiment towards exploring digital assets post-acquisition.

- Existing relationships with crypto companies: Preliminary discussions with several blockchain technology providers.

- Potential regulatory hurdles: Navigating regulatory complexities surrounding cryptocurrency investments will be crucial.

H3: Comparison with MicroStrategy's Bitcoin Holdings and Strategy: MicroStrategy's massive Bitcoin holdings, driven by CEO Michael Saylor's bullish outlook, have generated considerable attention and significant returns (though with considerable volatility). Example SPAC, however, lacks this pre-existing commitment. Any future Bitcoin investment would depend entirely on the characteristics of the acquired company and the strategic vision of the combined entity. Replicating MicroStrategy's success would require a similar level of conviction and long-term commitment to Bitcoin.

- Size of Bitcoin holdings: MicroStrategy holds over 130,000 BTC. Example SPAC currently holds none.

- Investment rationale: MicroStrategy views Bitcoin as a long-term store of value; Example SPAC's rationale would depend on the acquired company.

- Risk management strategies employed by MicroStrategy: MicroStrategy has weathered Bitcoin's price fluctuations. Example SPAC’s strategies would need to be carefully considered.

- Potential for similar returns: Highly uncertain, dependent on several factors, including the target company and market conditions.

H2: Management Team and Market Position:

H3: Assessing the Expertise and Experience of the Management Team: Example SPAC's leadership team comprises seasoned professionals with a proven track record in finance and technology. Key members possess extensive experience in venture capital, corporate finance, and mergers and acquisitions within the tech industry. However, direct experience in the cryptocurrency sector is limited.

- Key personnel biographies: Detailed biographies available on the Example SPAC website.

- Previous roles: Positions at prominent financial institutions and tech companies.

- Relevant expertise: Strong financial and technological expertise.

- Connections within the industry: Extensive network within the fintech and blockchain ecosystem.

H3: Evaluating the Market Opportunity and Competition: The market for fintech and blockchain solutions is rapidly expanding, presenting significant opportunities for Example SPAC’s potential acquisition. However, the competitive landscape is fierce, with numerous established players and startups vying for market share. The SPAC’s success hinges on acquiring a company with a unique value proposition and a strong growth trajectory.

- Key competitors: Numerous established and emerging players in the fintech and blockchain sectors.

- Market size: The global fintech market is valued in the trillions, with substantial growth projected.

- Growth projections: High growth potential, but with inherent risks and uncertainties.

- Potential market share: Difficult to predict without knowing the target acquisition.

H2: Risk Assessment and Investment Considerations:

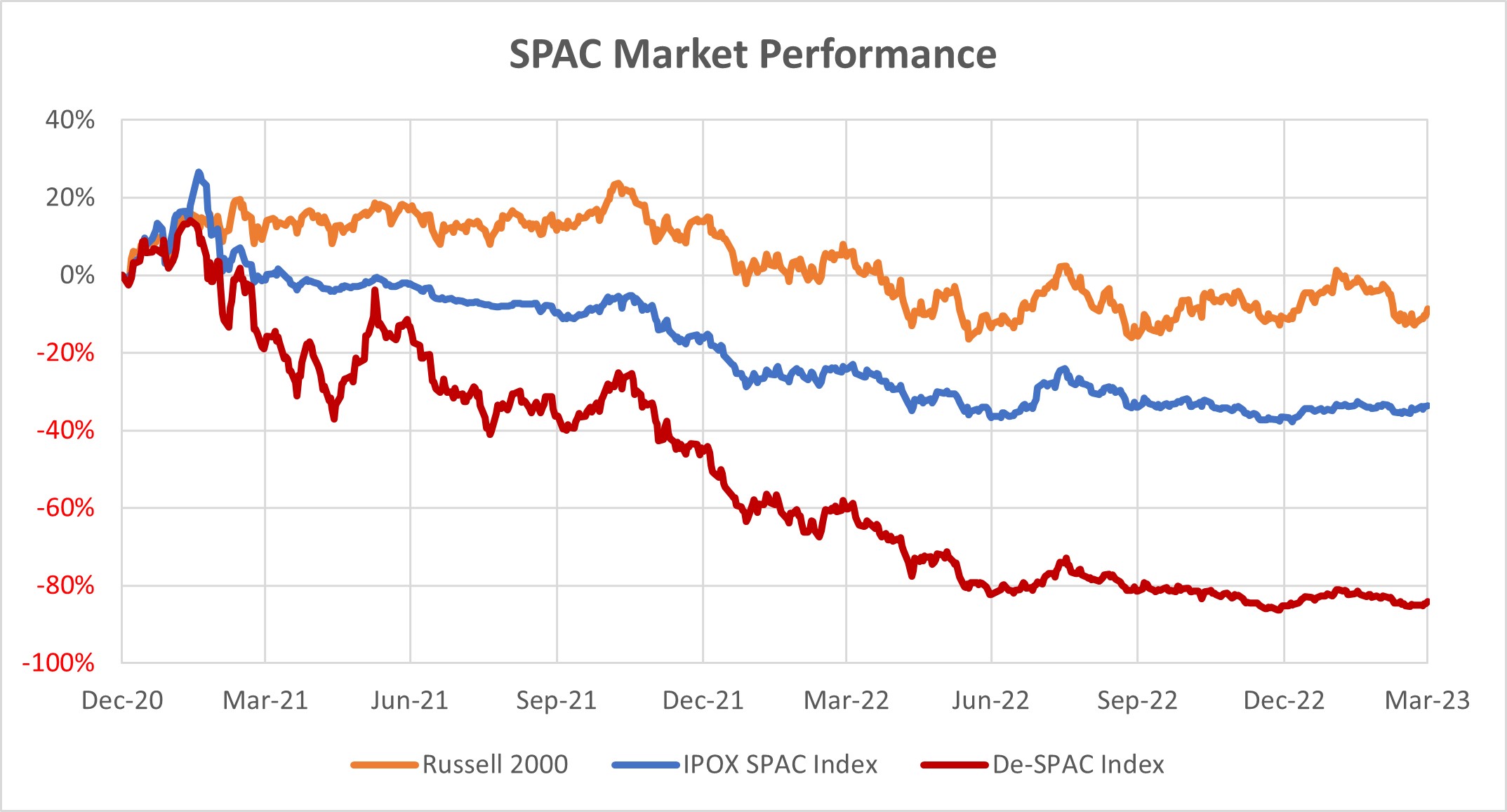

H3: Potential Risks and Challenges: Investing in Example SPAC carries several risks, including the inherent volatility of the SPAC market itself, the uncertainties associated with identifying and acquiring a suitable target company, and the potential for the target company to underperform. Should the acquired company pursue a Bitcoin strategy, further risks associated with cryptocurrency market volatility would arise.

- Market risk: General market downturns can negatively impact SPAC valuations.

- Regulatory risk: Changes in regulations impacting fintech and cryptocurrencies.

- Technological risk: Rapid technological advancements could render some technologies obsolete.

- Competitive risk: Intense competition from established and emerging players.

- Financial risk associated with Bitcoin: Significant price volatility and potential for substantial losses.

H3: Investment Recommendation and Due Diligence: Whether Example SPAC can become the next MicroStrategy remains highly speculative. While the management team's experience is promising, the lack of a pre-defined Bitcoin strategy and the inherent risks associated with SPAC investments and cryptocurrency necessitate a cautious approach. Thorough due diligence is essential. A "Hold" recommendation is advised until the target acquisition is announced and its business plan, including potential crypto strategies, is evaluated.

- Buy/Sell/Hold recommendation: Hold

- Rationale for recommendation: High uncertainty and risk associated with the investment.

- Key factors influencing the decision: Lack of defined Bitcoin strategy, potential target company uncertainty, overall market volatility.

- Call to action: Conduct independent research and thorough due diligence before investing in Example SPAC or any MicroStrategy SPAC stock.

Conclusion: This analysis examined the potential of Example SPAC to emulate MicroStrategy's success in the Bitcoin market. While exhibiting some promising characteristics, including a strong management team and a focus on a growing market sector, potential investors must carefully weigh the inherent risks associated with both SPAC investments and the volatility of the cryptocurrency market. Thorough due diligence, including understanding the SPAC's business model, management team, and market position, is crucial before making any investment decisions. Remember to conduct your own comprehensive research before considering any investment in this or any other MicroStrategy SPAC stock.

Featured Posts

-

Ranking The Top 10 Characters In Saving Private Ryan

May 08, 2025

Ranking The Top 10 Characters In Saving Private Ryan

May 08, 2025 -

Bitcoin Seoul 2025 The Asian Bitcoin Hub

May 08, 2025

Bitcoin Seoul 2025 The Asian Bitcoin Hub

May 08, 2025 -

Uber Stock A Comprehensive Investment Analysis

May 08, 2025

Uber Stock A Comprehensive Investment Analysis

May 08, 2025 -

Gjranwalh Myn Khwnryz Fayrng 5 Afrad Qtl Mlzm Pwlys Mqable Myn Hlak

May 08, 2025

Gjranwalh Myn Khwnryz Fayrng 5 Afrad Qtl Mlzm Pwlys Mqable Myn Hlak

May 08, 2025 -

Hollywood Production At Standstill Amidst Joint Actors And Writers Strike

May 08, 2025

Hollywood Production At Standstill Amidst Joint Actors And Writers Strike

May 08, 2025