Is Uber Technologies (UBER) A Smart Investment?

Table of Contents

Uber's Financial Performance and Growth Potential

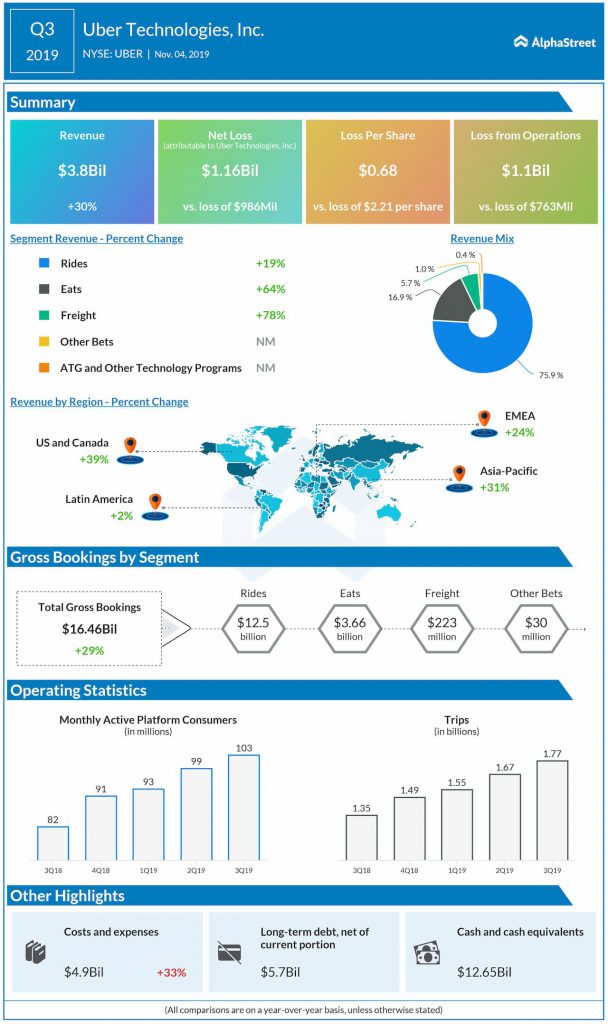

Understanding Uber's financial health is crucial for evaluating its investment potential. Analyzing Uber financials, including UBER revenue and Uber profitability, reveals a complex picture. While Uber has demonstrated significant revenue growth, achieving profitability has been a challenge. Key financial metrics provide valuable insights:

- Revenue Growth: Uber has consistently shown strong revenue growth, driven by increasing user adoption and expansion into new markets. However, profitability hasn't kept pace.

- Earnings Per Share (EPS): Uber's EPS has fluctuated, reflecting the challenges of balancing rapid expansion with profitability. Investors should monitor EPS trends closely.

- Debt Levels: Uber carries a considerable amount of debt, reflecting its significant investments in technology and expansion. High debt levels can pose a risk during economic downturns.

Positive Aspects:

- Increasing revenue from both its ride-sharing and Uber Eats services.

- Successful expansion into numerous international markets.

- Growing market share in many regions.

Challenges and Risks:

- Intense competition from rivals like Lyft and other ride-sharing services.

- High driver acquisition and retention costs.

- Regulatory hurdles and legal challenges in different jurisdictions.

- Fluctuating fuel prices impacting driver earnings and potentially Uber's profitability.

Competitive Landscape and Market Position

The ride-sharing market is highly competitive. Uber's main competitors include Lyft, traditional taxi services, and increasingly, public transportation options in many cities. A competitive analysis reveals Uber's strengths and weaknesses:

Uber's Strengths:

- Strong brand recognition and global reach.

- Advanced technology and features within its app.

- Diverse service offerings beyond ride-sharing, such as Uber Eats.

Weaknesses:

- Price wars and pressure from competitors impacting profitability.

- Challenges in maintaining positive relationships with drivers.

- Ongoing regulatory and legal battles across different regions.

Analyzing Uber's market share in various regions is key. While Uber holds significant market share in many areas, it faces constant pressure from competitors, requiring continuous innovation and strategic adjustments to maintain its competitive edge in the ride-sharing market.

Uber's Technological Innovation and Future Strategies

Uber's investment in technological innovation is a key aspect of its long-term growth strategy. The future of Uber depends heavily on its ability to capitalize on advancements in autonomous vehicles, its success with Uber Eats, and other technological developments.

Potential Benefits:

- Cost reduction through autonomous vehicle technology.

- Increased efficiency and improved service through technological advancements.

- Expansion into new revenue streams through emerging technologies.

Risks and Challenges:

- High development costs associated with autonomous vehicle technology.

- Technological hurdles and potential delays in implementation.

- Competition from other companies investing in similar technologies.

The successful integration of these innovations is crucial for Uber’s long-term success and will significantly affect the Uber stock performance in the coming years.

Regulatory and Legal Environment

The regulatory environment significantly impacts ride-sharing companies like Uber. Different jurisdictions have varying regulations and legal frameworks governing ride-sharing operations.

Positive Regulatory Developments:

- Supportive legislation in some regions that facilitates ride-sharing operations.

- Streamlined licensing procedures in certain areas.

Negative Regulatory Developments:

- Increased regulations and stricter licensing requirements.

- Legal disputes and potential fines related to labor practices and safety regulations.

- Varying regulations across different regions leading to operational complexities.

Navigating this complex regulatory landscape is crucial for Uber's profitability and operational efficiency. Understanding the legal risks associated with Uber's operations in different jurisdictions is vital for any investor considering Uber stock.

Conclusion: Is Investing in Uber Right for You?

Investing in Uber Technologies (UBER) presents both significant opportunities and considerable risks. While Uber demonstrates strong revenue growth and a dominant position in the ride-sharing market, profitability remains a challenge, and intense competition, along with a complex regulatory landscape, poses substantial hurdles. Its technological investments hold great potential but also carry considerable financial and operational risks.

Ultimately, whether Uber Technologies (UBER) is a smart investment depends on your individual financial goals and risk tolerance. Conduct thorough research and consult with a financial advisor before making any investment decisions related to Uber stock or other ride-sharing investments. Understanding Uber's financials, competitive position, and technological roadmap is critical for a well-informed investment strategy within the transportation network and broader technology stock market.

Featured Posts

-

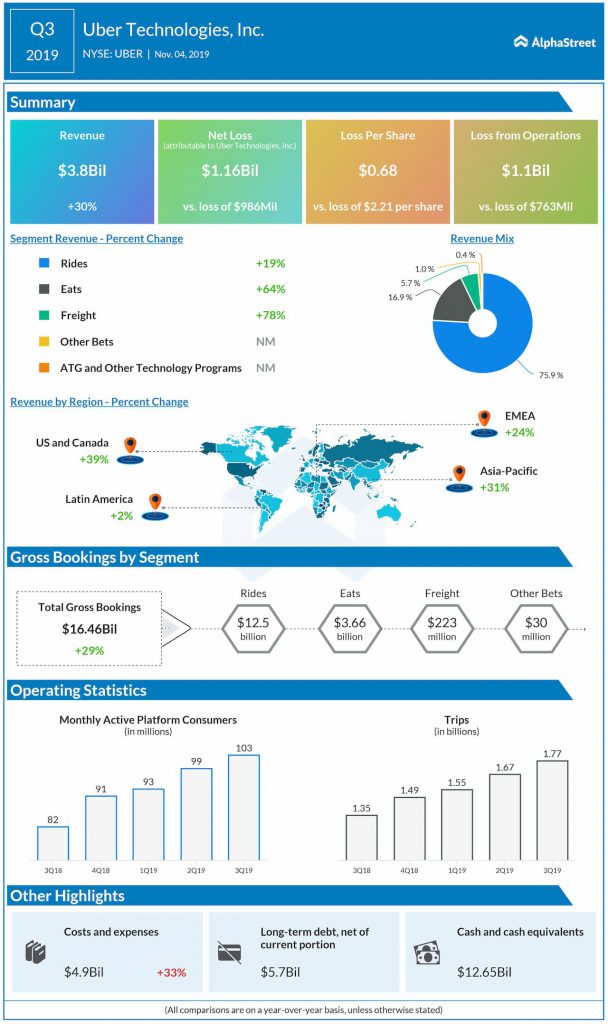

Fortnite Item Shop Lost Skins And Potential Returns

May 17, 2025

Fortnite Item Shop Lost Skins And Potential Returns

May 17, 2025 -

Performance E Granit Xhakes Pasimet Strategjia Dhe Rezultatet Ne Bundeslige

May 17, 2025

Performance E Granit Xhakes Pasimet Strategjia Dhe Rezultatet Ne Bundeslige

May 17, 2025 -

Analisis Del Partido Belgica 0 1 Portugal Goles Y Resumen Completo

May 17, 2025

Analisis Del Partido Belgica 0 1 Portugal Goles Y Resumen Completo

May 17, 2025 -

Kalanick On Past Decision Project Company Name S Abandonment Was A Strategic Error

May 17, 2025

Kalanick On Past Decision Project Company Name S Abandonment Was A Strategic Error

May 17, 2025 -

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 17, 2025

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 17, 2025