Is XRP (Ripple) A Buy Under $3? A Comprehensive Investment Guide

Table of Contents

XRP's Current Market Position and Recent Price Action

As of [Insert Current Date], XRP is trading at approximately $[Insert Current Price]. Recent price action has shown [Describe recent price trends – e.g., a period of consolidation, a significant upward or downward trend]. This movement can be attributed to several factors, including ongoing legal battles, partnerships, and broader market sentiment within the cryptocurrency space. Analyzing these influences is vital to understanding XRP's current trajectory.

Relevant Charts and Graphs: [Include charts and graphs illustrating XRP's price history, highlighting key trends and volatility. Source the data clearly.]

- Short-term trends: [Analyze short-term price movements, identifying any patterns or significant events that impacted the price.]

- Long-term trends: [Analyze long-term price trends, considering historical highs and lows to understand the potential for future growth or decline.]

- Support and resistance levels: [Identify key support and resistance levels on the chart, indicating potential price reversal points.]

- Comparison to other cryptocurrencies: [Compare XRP's performance to Bitcoin (BTC) and Ethereum (ETH), highlighting relative strengths and weaknesses.]

Understanding Ripple's Technology and Use Cases

Ripple's technology focuses on enabling fast, efficient, and low-cost cross-border payments for financial institutions. Its solutions, including xRapid, xCurrent, and xVia, aim to streamline international transactions, reducing reliance on traditional correspondent banking networks.

- xRapid: Uses XRP for real-time liquidity solutions, minimizing settlement delays and costs.

- xCurrent: A gross settlement system that connects banks and payment providers, enabling faster and more efficient transactions.

- xVia: An API that allows businesses to integrate Ripple's payment solutions into their existing systems.

Ripple's partnerships with numerous financial institutions globally demonstrate its potential to disrupt the traditional financial landscape. However, scalability and network efficiency remain areas for ongoing evaluation. Its reliance on financial institutions for adoption is a double-edged sword: it offers stability but also limits its decentralized nature compared to other cryptocurrencies.

The SEC Lawsuit and its Impact on XRP's Price

The ongoing SEC lawsuit against Ripple Labs has significantly impacted XRP's price and market sentiment. The SEC alleges that Ripple sold unregistered securities, while Ripple contends that XRP is a currency and not a security. The outcome of this case will profoundly influence XRP's future.

- Key arguments in the SEC lawsuit: [Summarize the core arguments presented by both the SEC and Ripple.]

- Potential outcomes: [Discuss the potential for a settlement, a court ruling in favor of the SEC, or a court ruling in favor of Ripple, and analyze the likely impact of each outcome on XRP's price.]

- Expert opinions and predictions: [Present expert opinions and market predictions regarding the lawsuit's resolution, highlighting the range of possible scenarios.]

- Long-term effects on XRP's regulatory landscape: [Analyze how the outcome could shape future regulations of cryptocurrencies, influencing not only XRP but the broader crypto market.]

Potential Risks and Rewards of Investing in XRP Under $3

Investing in XRP, like any cryptocurrency, involves significant risks. Volatility and regulatory uncertainty are key concerns. However, the potential rewards could be substantial if the price appreciates significantly.

- Market volatility: XRP's price is highly volatile, susceptible to market swings influenced by news, regulatory developments, and overall market sentiment.

- Regulatory risks: The outcome of the SEC lawsuit and potential future regulatory actions pose substantial risks to XRP's future.

- Diversification strategies: Diversifying your investment portfolio across various asset classes is crucial to mitigating risk. Don't put all your eggs in one basket, especially in a volatile market like cryptocurrency.

Technical Analysis and Future Price Predictions (with Disclaimer)

[Include a technical analysis of XRP's chart, using indicators like moving averages, RSI, and MACD. Clearly label all charts and sources.] Disclaimer: This is not financial advice. Technical analysis provides potential insights, but it is not a guarantee of future price movements. Market conditions change rapidly.

- Key technical indicators: [Explain the chosen indicators and their interpretation in relation to XRP's chart.]

- Potential price targets: [Present potential price targets based on the technical analysis, emphasizing the speculative nature of these predictions.]

- Important Disclaimer: [Reiterate that these predictions are not financial advice and should not be the sole basis for investment decisions.]

Conclusion

The decision of whether to buy XRP under $3 is a personal one. Its price is heavily influenced by its technology, the SEC lawsuit's outcome, and broader market conditions. The potential rewards are significant, but so are the risks. Before investing in XRP, conduct thorough research, understand the inherent risks, and only invest what you can afford to lose.

Remember, this guide is for informational purposes only and is not financial advice. Conduct your own due diligence and carefully weigh the potential risks and rewards before deciding if XRP is a buy for you under $3. Consider seeking advice from a qualified financial advisor before making any investment decisions.

Featured Posts

-

Memoir On The Horizon Cassidy Hutchinsons Account Of The January 6th Hearings

May 01, 2025

Memoir On The Horizon Cassidy Hutchinsons Account Of The January 6th Hearings

May 01, 2025 -

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025 -

Finding Alternatives Chinas Response To Us Pharmaceutical Imports

May 01, 2025

Finding Alternatives Chinas Response To Us Pharmaceutical Imports

May 01, 2025 -

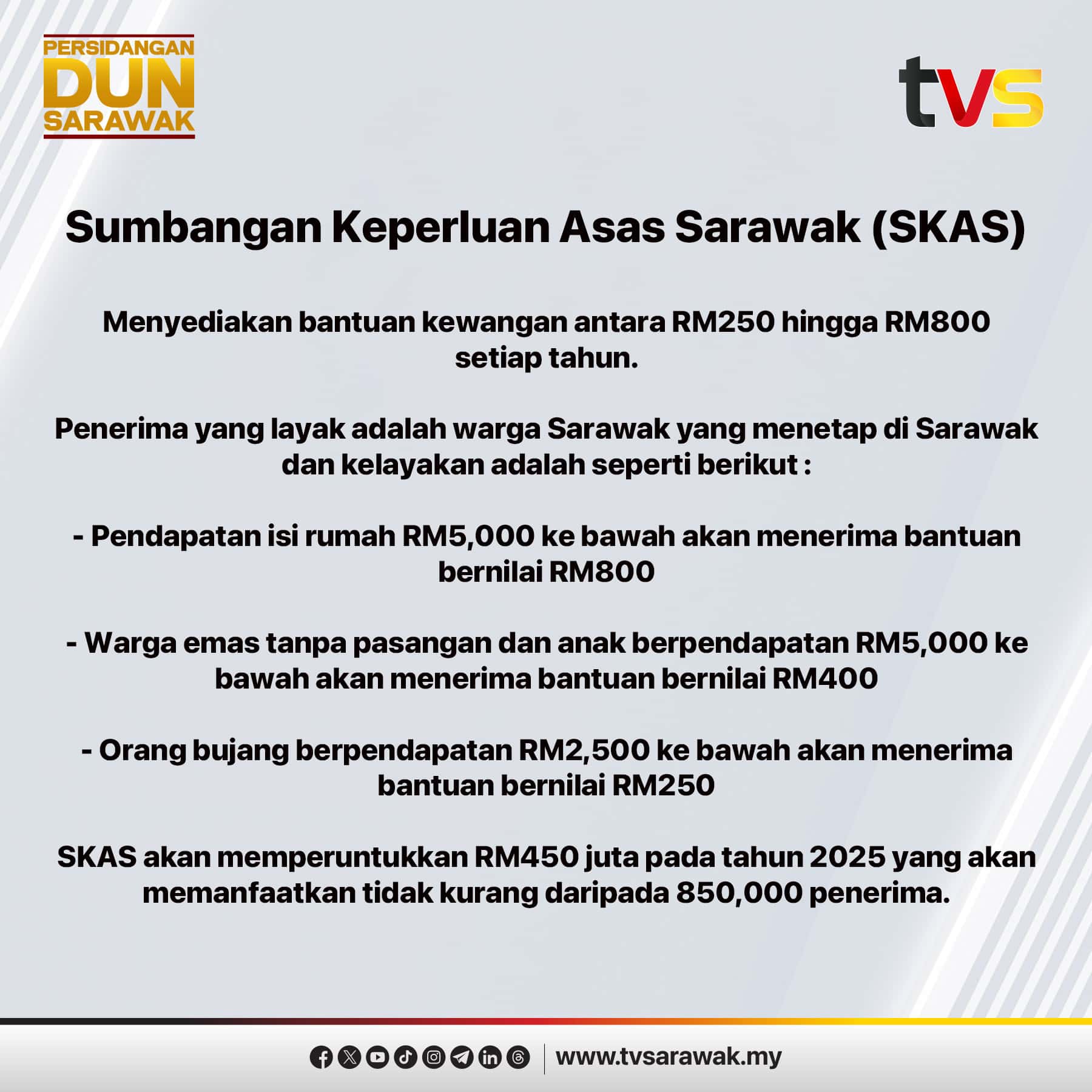

Baitulmal Sarawak Salurkan Bantuan Rm 36 45 Juta Kepada Asnaf Mac 2025

May 01, 2025

Baitulmal Sarawak Salurkan Bantuan Rm 36 45 Juta Kepada Asnaf Mac 2025

May 01, 2025 -

How To Secure Funding On Dragons Den Tips And Advice

May 01, 2025

How To Secure Funding On Dragons Den Tips And Advice

May 01, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025 -

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025 -

Black Sea Oil Spill 62 Miles Of Beaches Closed In Russia

May 01, 2025

Black Sea Oil Spill 62 Miles Of Beaches Closed In Russia

May 01, 2025 -

Major Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025

Major Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025 -

Russias Black Sea Oil Spill Leads To Widespread Beach Closures

May 01, 2025

Russias Black Sea Oil Spill Leads To Widespread Beach Closures

May 01, 2025