Italy's Recordati Leverages M&A To Counter Tariff Uncertainty

Table of Contents

Recordati, a prominent Italian pharmaceutical company, is navigating the complexities of global trade and tariff uncertainty with a robust mergers and acquisitions (M&A) strategy. This proactive approach allows them to diversify their product portfolio, expand into new markets, and mitigate the risks associated with fluctuating international trade policies. This article will delve into how Recordati's strategic use of M&A is helping it not only weather the storm of tariff uncertainty but also achieve sustained growth in an increasingly volatile global pharmaceutical market.

M&A as a Shield Against Tariff Volatility

Recordati's M&A strategy serves as a crucial shield against the unpredictable nature of international tariffs. By strategically acquiring companies and integrating their assets, Recordati reduces its vulnerability to tariff fluctuations. This multi-pronged approach focuses on diversification, geographic expansion, and access to new technologies.

Diversification of Product Portfolio

Recordati's M&A activities are designed to diversify its product portfolio, reducing reliance on any single product or drug class vulnerable to specific tariffs. This strategic approach spreads the risk across various therapeutic areas, making the company more resilient to external shocks.

- Examples: While specific details of individual acquisition values are often confidential, analyzing Recordati's financial reports reveals a consistent pattern of diversification through M&A. Acquisitions have broadened their offerings into different therapeutic areas, potentially reducing the impact of tariffs on any specific drug. For example, an acquisition of a company specializing in cardiovascular drugs might offset any potential tariff-related losses in another therapeutic area.

- Impact: This diversification significantly reduces revenue stream dependence on individual products and minimizes the impact of any single tariff imposition. Quantitative analysis of Recordati’s financial data after major acquisitions would showcase this diversification effect on revenue stability.

Geographic Expansion and Market Penetration

Acquiring companies in diverse geographic locations is another key aspect of Recordati's M&A strategy. This geographic diversification helps mitigate the impact of tariffs imposed on specific regions or countries.

- Examples: Acquisitions in countries with different trade agreements or less volatile political climates help to spread the risk and create market resilience. Expanding into emerging markets through strategic acquisitions also represents a significant growth opportunity for Recordati.

- Mitigating Risk: This global footprint allows Recordati to leverage manufacturing and distribution networks across various regions, minimizing reliance on any single trade route affected by tariffs. The success of this strategy can be assessed by analyzing the company's regional revenue distribution post-acquisition.

Access to New Technologies and Expertise

M&A also provides Recordati with access to cutting-edge technologies and specialized expertise, enhancing its competitiveness and reducing dependence on specific trade routes or suppliers.

- Examples: Acquiring companies with innovative drug delivery systems or advanced research and development capabilities can significantly boost Recordati's competitiveness. This could include acquiring specialized manufacturing processes or unique intellectual property, reducing reliance on external partners.

- Competitive Advantage: This strategy expands Recordati's technological capabilities, reducing its vulnerability to supply chain disruptions caused by international trade tensions, resulting in a stronger and more competitive market position.

Analyzing Recordati's M&A Successes and Challenges

Recordati’s M&A strategy isn't without its hurdles. Examining both its successes and challenges provides valuable insights into the complexities of this strategic approach.

Successful Acquisitions and Their Impact

Several acquisitions have demonstrably strengthened Recordati's financial performance and market position.

- Case Studies: A detailed examination of specific acquisitions, focusing on their respective synergies and integration processes, would reveal the extent of their success. Analyzing post-acquisition revenue growth, market share gains, and improved profitability would provide strong quantitative evidence.

- Synergy Creation: Successful integrations demonstrate effective leveraging of combined assets, leading to cost-efficiencies and market share growth. Measuring the degree of synergy realization would be a crucial part of this analysis.

Challenges and Lessons Learned

Despite the successes, M&A inevitably presents challenges. Recordati has faced its share of integration difficulties and cultural clashes.

- Challenges: Potential challenges include integrating disparate corporate cultures, harmonizing operational processes, and managing the risk of employee attrition during and after the integration process.

- Mitigation Strategies: Understanding how Recordati has addressed these challenges – perhaps through detailed integration plans, cultural sensitivity training, and retention strategies – is crucial. These lessons offer valuable insights into best practices for successful M&A in the pharmaceutical industry.

Recordati's Future M&A Strategy and Outlook

Recordati's continued reliance on M&A suggests a long-term commitment to this strategy as a key driver of sustainable growth.

Future Targets and Growth Areas

Recordati’s future M&A activity will likely focus on strategic growth areas identified through market analysis and emerging technological trends.

- Potential Targets: Future acquisitions could target companies with innovative drugs in high-demand therapeutic areas or those with strong presence in under-penetrated markets. This expansion could also involve complementary technologies or manufacturing capacities.

- Market Trends: Analyzing future market trends in pharmaceutical development, global health priorities, and regulatory landscapes will help to predict Recordati's future M&A targets.

The Role of M&A in Long-Term Sustainability

Recordati's sustained use of M&A is integral to its long-term sustainability and competitiveness in the global pharmaceutical market.

- Long-Term Goals: The continued use of M&A aims to ensure resilience against market fluctuations, achieve sustainable revenue growth, and maintain a competitive edge.

- Sustainable Impact: The positive impact of Recordati’s M&A strategy on its long-term sustainability will be reflected in its continuing ability to adapt to the evolving global pharmaceutical landscape.

Conclusion

Recordati's strategic utilization of mergers and acquisitions is proving to be a highly effective tool for mitigating the risks associated with international tariff uncertainty and navigating the complexities of the global pharmaceutical market. By diversifying its product portfolio, expanding geographically, and gaining access to new technologies and expertise, Recordati is securing its position as a leading player in the industry. To learn more about how strategic M&A can help pharmaceutical companies navigate global trade complexities, and further explore Recordati's success story, continue reading our analysis of Italy's innovative approaches to mitigating tariff uncertainty through strategic acquisitions and mergers.

Featured Posts

-

Sjl Eshaq Alraklyt Rqma Qyasya Jdyda Fy Martyny Bswysra

Apr 30, 2025

Sjl Eshaq Alraklyt Rqma Qyasya Jdyda Fy Martyny Bswysra

Apr 30, 2025 -

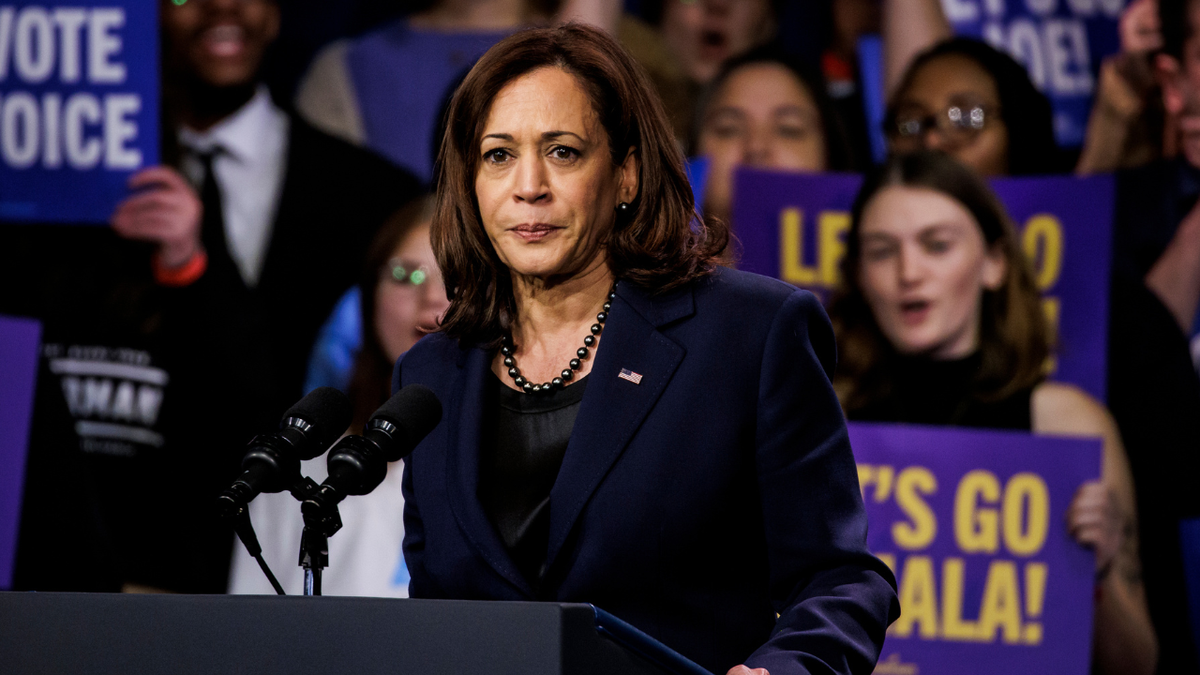

Vice President Harris Faces Backlash After Broadway Remarks

Apr 30, 2025

Vice President Harris Faces Backlash After Broadway Remarks

Apr 30, 2025 -

Russias Spring Offensive Warmer Weather A Decisive Factor

Apr 30, 2025

Russias Spring Offensive Warmer Weather A Decisive Factor

Apr 30, 2025 -

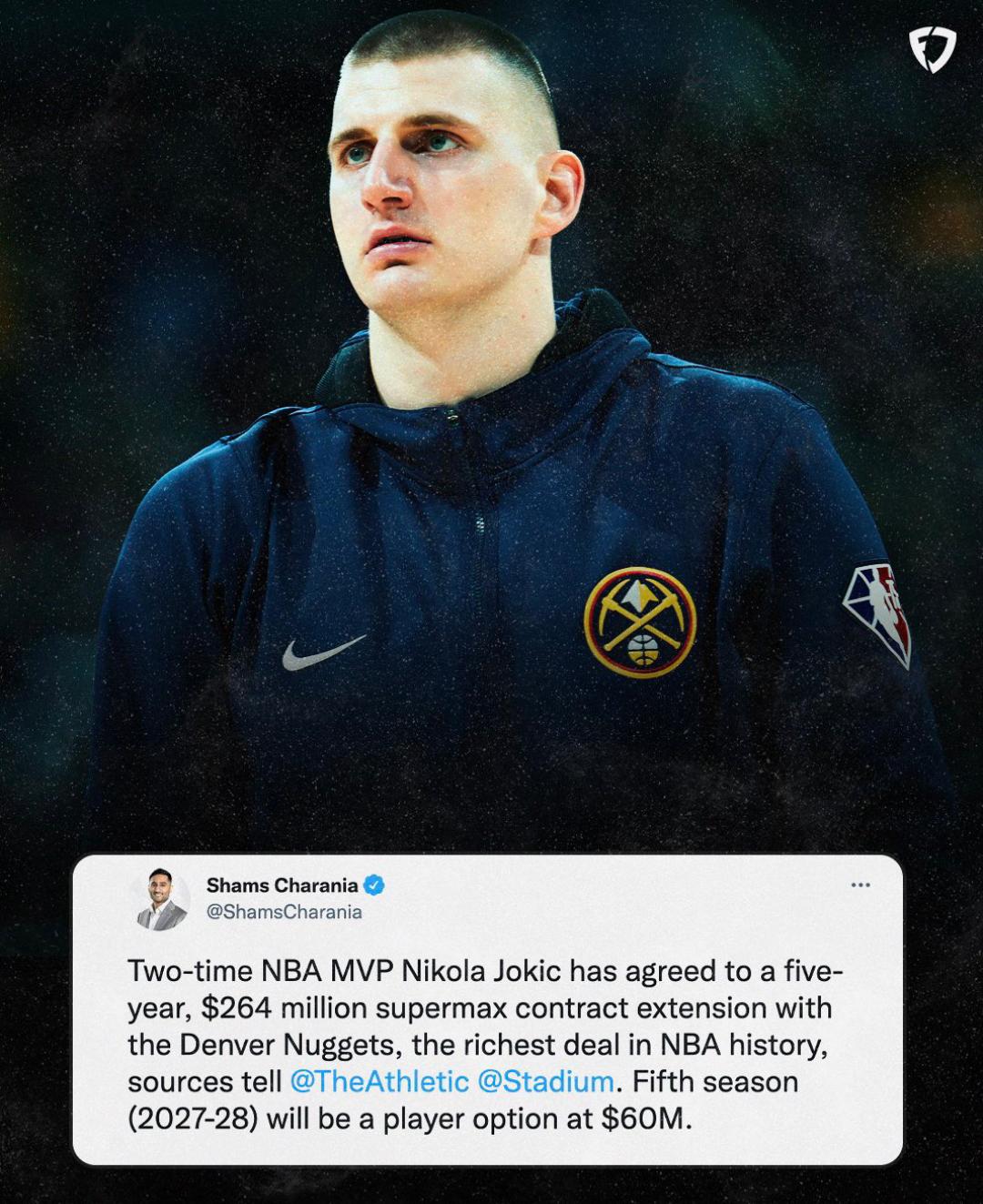

Jokic I Jovic Na Evrobasketu Sedlacekev Pogled Na Situaciju

Apr 30, 2025

Jokic I Jovic Na Evrobasketu Sedlacekev Pogled Na Situaciju

Apr 30, 2025 -

Late Game Heroics By Judge And Goldschmidt Salvage Yankees Series

Apr 30, 2025

Late Game Heroics By Judge And Goldschmidt Salvage Yankees Series

Apr 30, 2025