Japan Trading House Shares Surge: Berkshire Hathaway's Long-Term Investment

Table of Contents

Berkshire Hathaway's Investment in Japanese Trading Houses

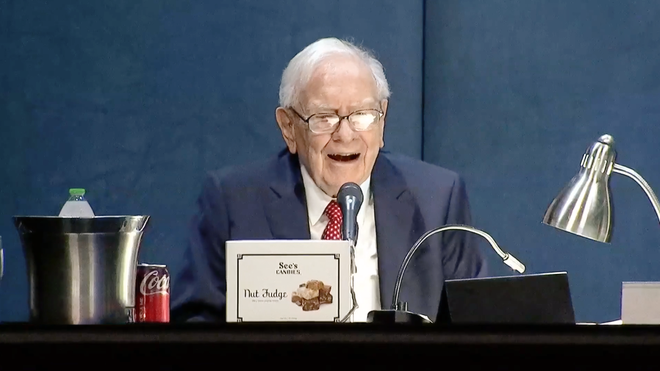

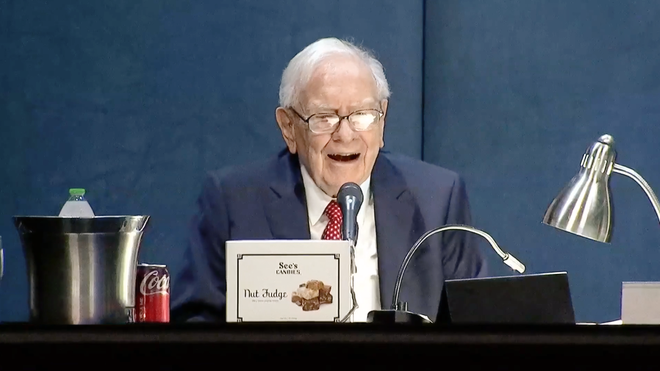

Berkshire Hathaway, renowned for its long-term value investing strategy, recently made a significant investment in five major Japanese trading companies: Mitsui & Co., Mitsubishi Corporation, Sumitomo Corporation, Itochu Corporation, and Marubeni Corporation. This represents a notable departure from Berkshire Hathaway's typical US-focused portfolio, making it a highly unusual and closely watched investment.

- Specific Investments: Berkshire Hathaway acquired approximately 5% stakes in each of the five trading houses. This represents a considerable investment, totaling billions of dollars.

- Uncharacteristic Diversification: This move marks a significant diversification for Berkshire Hathaway, demonstrating a willingness to explore opportunities beyond its traditional US-centric approach. This strategic shift highlights a growing confidence in the long-term prospects of the Japanese economy and the resilience of these established trading giants.

- Reasons for Investment: Several factors likely contributed to Berkshire Hathaway's decision. These include the trading houses' established global networks, diversified businesses spanning energy, metals, and infrastructure, and their strong track records of generating consistent profits, even during periods of economic uncertainty. The relatively low valuations of these companies compared to their US counterparts might also have played a role.

The Surge in Trading House Share Prices

Since Berkshire Hathaway's investment announcement, the share prices of these Japanese trading houses have experienced a significant surge.

- Percentage Increases: Share prices have seen increases ranging from 15% to over 30% for some companies, depending on the specific timeframe and the individual trading house.

- Contributing Factors: While Berkshire Hathaway's investment undoubtedly played a crucial role, other factors have contributed to this surge. Improved corporate performance, driven by strong commodity prices and increased global demand, has boosted investor confidence. Additionally, the overall strengthening of the Japanese economy and increased optimism regarding future growth prospects have all added to the positive momentum. Global commodity price fluctuations, particularly in energy and raw materials, have also played a part.

Analyzing Berkshire Hathaway's Long-Term Investment Strategy

Berkshire Hathaway's investment in Japanese trading houses reflects its long-term, value-oriented investment strategy.

- Potential Returns: Given the current market conditions and the projected growth of the Japanese and global economies, the potential returns on this investment for Berkshire Hathaway are considerable. The long-term nature of the investment allows Berkshire to weather short-term market fluctuations and benefit from sustained growth.

- Risk Mitigation: While there are inherent risks associated with any investment, Berkshire Hathaway's substantial investment and its established track record in identifying undervalued assets suggest a considered approach to risk mitigation. Diversification across five different companies further reduces potential losses.

- Comparison to Past Successes: This strategy echoes previous successful long-term investments made by Berkshire Hathaway, highlighting its commitment to identifying and capitalizing on undervalued, fundamentally strong companies with durable competitive advantages.

The Impact on the Japanese Economy

Berkshire Hathaway's investment and the subsequent surge in trading house share prices have significant implications for the Japanese economy.

- Boosted Investor Confidence: The investment signals a vote of confidence in the Japanese market, attracting further foreign direct investment and potentially stimulating economic growth.

- Increased Foreign Direct Investment: The influx of capital from Berkshire Hathaway and the positive market response could encourage other foreign investors to consider similar investments in Japanese companies.

- Positive Impact on the Japanese Stock Market Index: The surge in trading house share prices has undoubtedly had a positive impact on the overall Japanese stock market index, contributing to improved market sentiment and investor enthusiasm.

Conclusion

The significant surge in Japanese trading house shares following Berkshire Hathaway's substantial long-term investment is a noteworthy development with far-reaching implications. The increase is attributable to a confluence of factors, including Berkshire Hathaway's strategic investment, the improved performance of Japanese trading houses, and broader positive economic trends. This investment not only showcases the enduring appeal of value investing but also underlines the growing attractiveness of the Japanese market for long-term investors.

Learn more about the potential of investing in Japanese trading houses and understand the implications of Berkshire Hathaway's long-term investment strategy. Stay informed about the dynamic changes in the Japanese stock market and explore the opportunities presented by this exciting market shift.

Featured Posts

-

Wednesday 16th April 2025 Daily Lotto Results Announced

May 08, 2025

Wednesday 16th April 2025 Daily Lotto Results Announced

May 08, 2025 -

Data Transfer Solutions Choosing The Right Method

May 08, 2025

Data Transfer Solutions Choosing The Right Method

May 08, 2025 -

Experience The Most Intense War Films An Amazon Prime Guide

May 08, 2025

Experience The Most Intense War Films An Amazon Prime Guide

May 08, 2025 -

Millions In Losses Office365 Executive Account Security Failure

May 08, 2025

Millions In Losses Office365 Executive Account Security Failure

May 08, 2025 -

Thunder Media Feud Players Fire Shots At National Reporters

May 08, 2025

Thunder Media Feud Players Fire Shots At National Reporters

May 08, 2025