Japan's Bond Market: Steep Yield Curve Poses Economic Challenges

Table of Contents

Understanding the Steepening Yield Curve in Japan's Bond Market

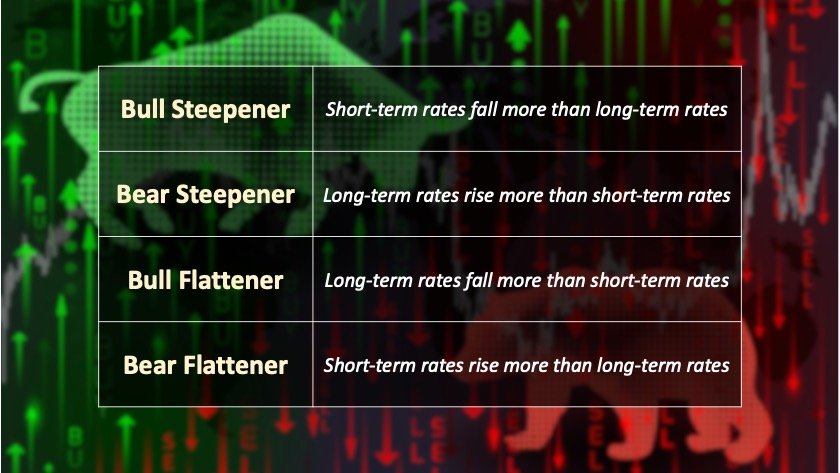

A yield curve graphically represents the relationship between the interest rates (yields) and the time to maturity of debt securities with the same credit quality. A normal yield curve slopes upward, indicating that longer-term bonds offer higher yields to compensate investors for the increased risk associated with longer holding periods. However, a steepening yield curve, as seen currently in Japan's bond market, implies a widening gap between short-term and long-term yields.

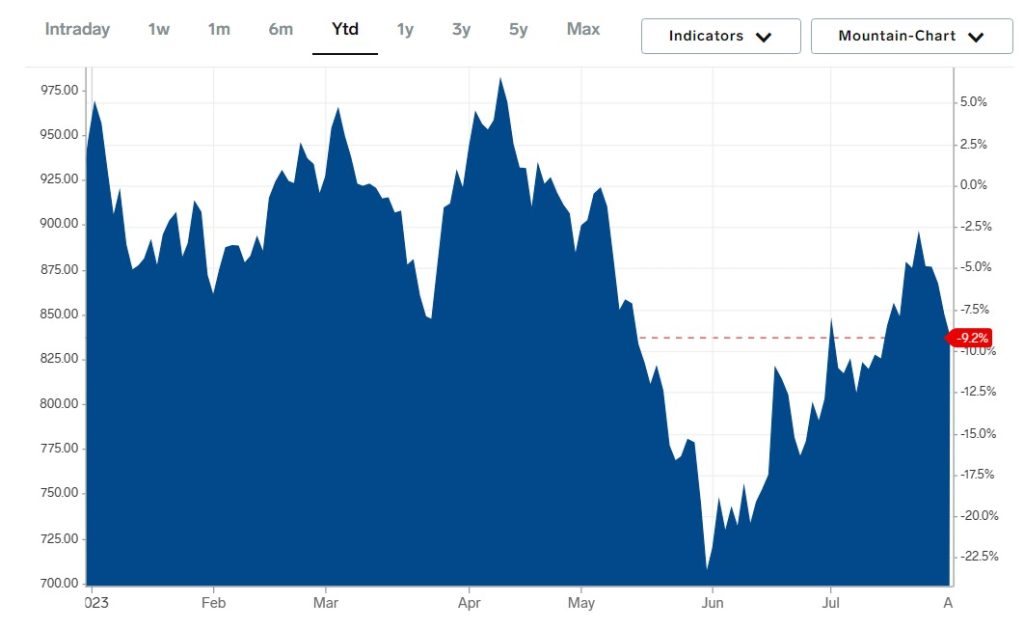

Currently, the Japanese government bond (JGB) market exhibits a significantly steeper yield curve than in recent years. For instance, the yield on 10-year JGBs might be considerably higher than the yield on 2-year JGBs, reflecting increased investor expectations of future interest rate hikes. This divergence is visually represented in the chart below:

[Insert Chart/Graph of Japanese Yield Curve Here – Ideally showing the difference between short-term and long-term yields over time]

- Definition of yield curve and its normal shape: A yield curve plots the yields of bonds with similar credit quality but different maturities. A normal yield curve slopes upwards.

- Factors contributing to the current steepening: Several factors contribute to the steepening yield curve, including growing inflation expectations, adjustments to the BOJ's monetary policy, and increased global interest rates.

- Historical context: Comparing the current steepness to previous periods reveals a significant deviation from historical norms, indicating a potentially volatile market situation.

Economic Implications of a Steep Yield Curve in Japan

A steepening yield curve in Japan carries several potentially negative economic consequences:

- Increased borrowing costs for corporations, hindering investment: Higher long-term interest rates make it more expensive for businesses to borrow money for expansion and investment, potentially slowing economic growth.

- Reduced consumer spending due to higher interest rates on loans: Increased interest rates on mortgages, auto loans, and other consumer credit can lead to reduced consumer spending, impacting aggregate demand.

- Potential slowdown in economic growth: The combined effect of reduced investment and consumer spending can significantly dampen economic growth and potentially lead to a recession.

- Risk of a credit crunch: If borrowing costs rise too sharply, some businesses may find it difficult to access credit, potentially leading to bankruptcies and a credit crunch.

The Bank of Japan's Response and Policy Challenges

The BOJ's current monetary policy, including its Yield Curve Control (YCC) policy, aims to manage long-term interest rates. However, the effectiveness of YCC in the face of a steepening yield curve is increasingly being questioned. The BOJ faces significant challenges:

- Explanation of the BOJ's Yield Curve Control (YCC) policy: YCC aims to keep the 10-year JGB yield around zero percent.

- Effectiveness of past interventions: Past interventions have had limited success in completely controlling the yield curve, indicating the limitations of the current policy.

- Potential policy adjustments and their expected consequences: The BOJ may need to adjust its YCC policy, potentially allowing for higher long-term yields. This could have significant implications for the Japanese economy.

- Political and economic pressures on the BOJ's decision-making: The BOJ's decisions are influenced by political pressures and the need to balance economic stability with other policy goals.

Investment Strategies in a Steepening Japanese Bond Market

Navigating the current market conditions requires careful consideration of risk and opportunity:

- Diversification strategies to reduce risk: Diversifying investments across different asset classes, including Japanese government bonds, corporate bonds, and equities, can help mitigate risk.

- Opportunities in specific sectors: Certain sectors may be less sensitive to rising interest rates, offering potential investment opportunities.

- Importance of risk assessment and careful portfolio management: A thorough understanding of the risks associated with investments in Japan's bond market is crucial.

- Potential for higher yields on longer-term bonds: While riskier, longer-term bonds may offer higher yields in a steepening yield curve environment.

Conclusion

The steepening yield curve in Japan's bond market presents considerable economic challenges. The implications for businesses, consumers, and the BOJ's monetary policy are significant and require careful consideration. Understanding the dynamics of this market, including the potential risks and opportunities, is crucial for informed decision-making. For investors and policymakers alike, continuous monitoring of Japan's bond market and its yield curve is essential for navigating the complexities of this evolving economic landscape. Stay informed on the latest developments in Japan's bond market to make sound investment choices.

Featured Posts

-

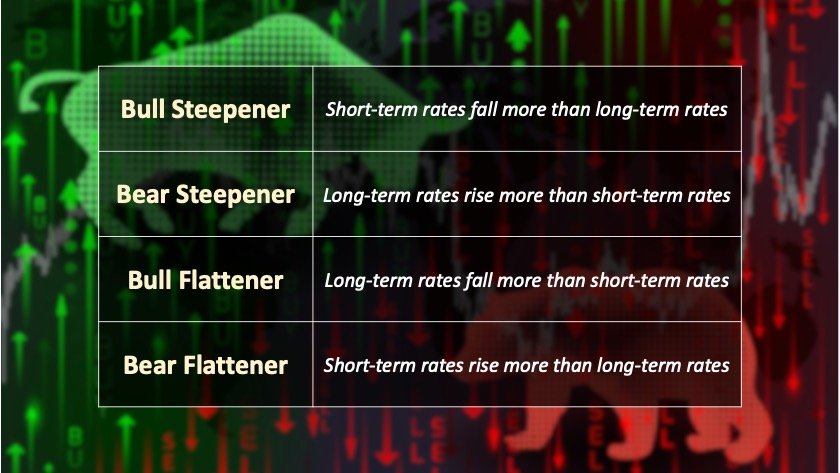

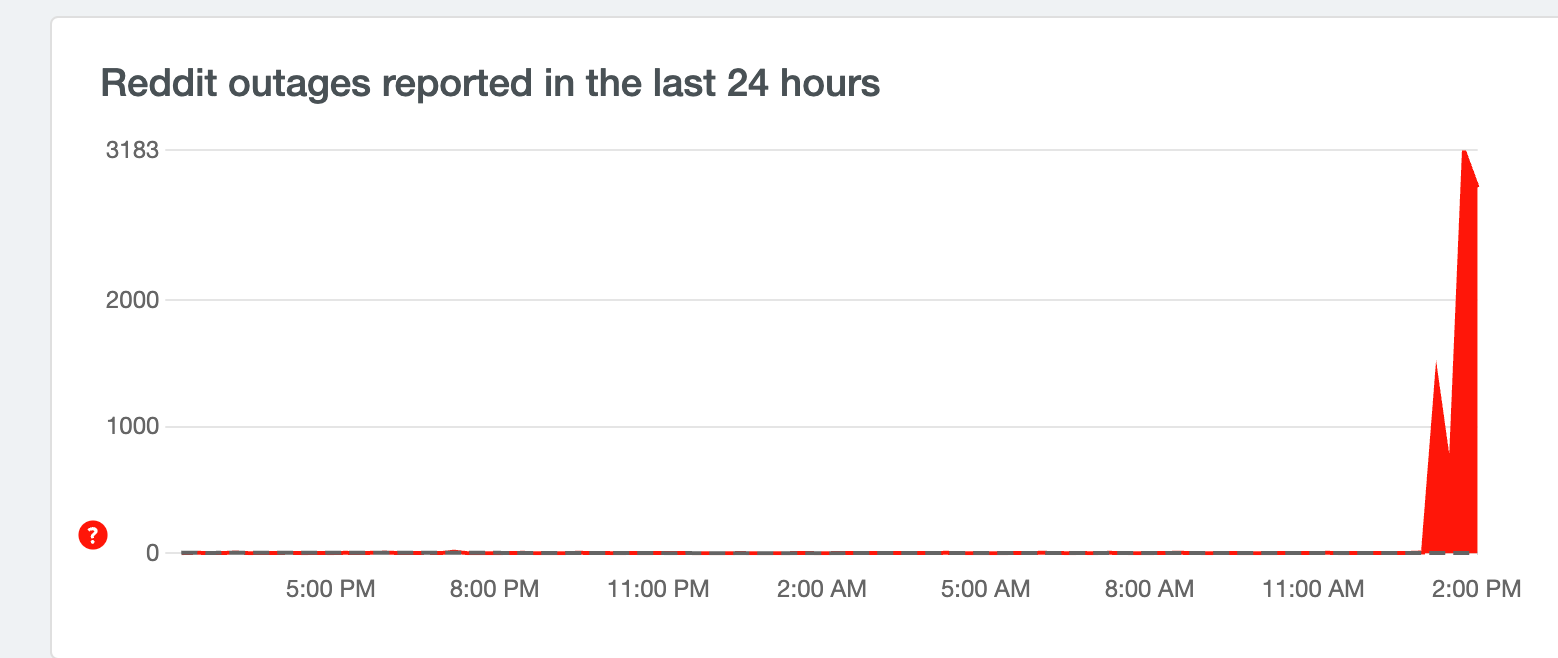

Is Reddit Experiencing An Outage Right Now

May 17, 2025

Is Reddit Experiencing An Outage Right Now

May 17, 2025 -

Novak Djokovic Miami Acik Final Macinda

May 17, 2025

Novak Djokovic Miami Acik Final Macinda

May 17, 2025 -

Tony Gilroy Calls Andor His Most Important Work

May 17, 2025

Tony Gilroy Calls Andor His Most Important Work

May 17, 2025 -

Rare Earth Minerals And The Threat Of A New Cold War

May 17, 2025

Rare Earth Minerals And The Threat Of A New Cold War

May 17, 2025 -

Oil Price Analysis And News Your May 16 Market Overview

May 17, 2025

Oil Price Analysis And News Your May 16 Market Overview

May 17, 2025