Japan's Steep Yield Curve: A Growing Concern For Investors And The Economy

Table of Contents

Understanding Japan's Yield Curve

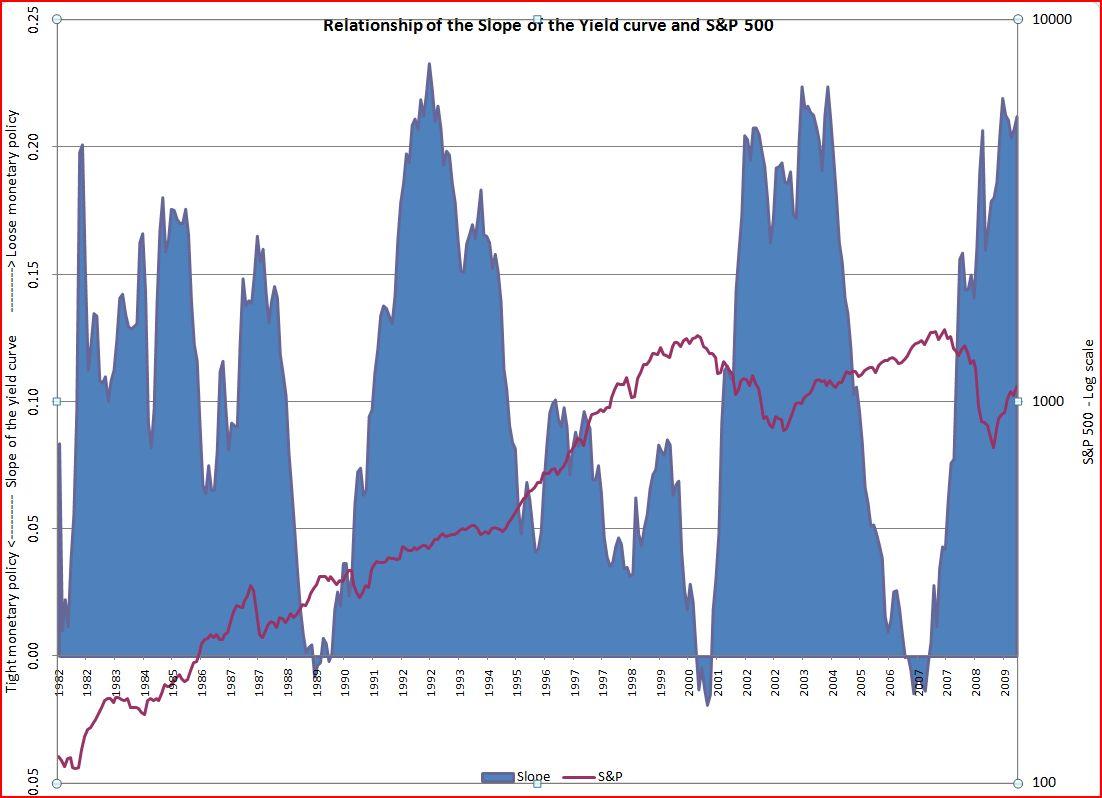

The yield curve is a graphical representation of the relationship between interest rates (or yields) and the time to maturity of debt securities. A normal yield curve slopes upward, indicating that longer-term bonds offer higher yields than short-term bonds to compensate investors for the increased risk associated with longer maturities. Japan's current yield curve, however, presents a different picture: it's significantly steep. This is unusual given Japan's prolonged period of low inflation and low economic growth. The steepness reflects a substantial difference between short-term and long-term interest rates, a situation not typically seen in a low-growth environment.

[Insert chart/graph here illustrating Japan's yield curve over time, clearly showing the steepening trend.]

- Short-term vs. Long-term Interest Rates: Short-term interest rates remain suppressed due to the Bank of Japan's (BOJ) monetary policy, while long-term rates have been rising, influenced by global factors.

- Factors Contributing to Steepness: The steepening is largely attributed to the BOJ's Yield Curve Control (YCC) policy, global interest rate hikes by major central banks (particularly the Federal Reserve), and shifting investor sentiment anticipating potential policy changes from the BOJ.

- Historical Context: Historically, Japan's yield curve has been relatively flat, reflecting its low-inflation, low-growth environment. The current steepness represents a significant deviation from this historical norm.

Implications for Investors

The steepening of Japan's yield curve presents both risks and opportunities for investors. Investing in Japanese Government Bonds (JGBs) carries increased risk given the potential for further interest rate increases. A rise in interest rates leads to capital losses on existing bonds.

- Increased Risk of Capital Losses in JGBs: If interest rates rise further, investors holding JGBs will experience capital losses as the market value of their bonds declines.

- Potential for Higher Returns from Long-Term JGBs (with increased risk): While long-term JGBs offer potentially higher returns, the risk of capital losses is significantly amplified due to the steep yield curve.

- Diversification Strategies: Investors concerned about Japan's yield curve should consider diversifying their portfolios across different asset classes (e.g., global bonds, equities, alternative investments) to mitigate risk.

Macroeconomic Consequences

A steep yield curve can have profound macroeconomic consequences for Japan. Higher long-term interest rates increase borrowing costs for businesses, potentially dampening investment and economic growth. This could also affect consumer spending and potentially lead to higher inflation if long-term rates remain elevated.

- Impact on Business Investment: Increased borrowing costs can discourage businesses from investing in expansion and innovation, leading to slower economic growth.

- Potential for Increased Inflation: While Japan has historically struggled with deflation, persistently high long-term interest rates could contribute to inflationary pressures.

- Effect on the Japanese Yen Exchange Rate: Changes in interest rates can impact the value of the Japanese Yen relative to other currencies.

- Global Market Consequences: A potential crisis in the Japanese bond market could have significant spillover effects on the global economy due to Japan's size and influence.

The Bank of Japan's Response and Future Outlook

The BOJ's current monetary policy, particularly its YCC, has been a major factor influencing the yield curve. The effectiveness of YCC in managing the steepening curve is a subject of ongoing debate. The BOJ may need to adjust its policies in response to market pressures and economic conditions.

- Evaluation of the Effectiveness of YCC: The YCC policy has faced criticism for its unintended consequences, including distorting market signals and potentially fostering financial instability.

- Potential for Policy Changes: The BOJ might adjust its YCC target or even consider outright interest rate hikes, depending on inflation and economic growth trajectories.

- Analysis of Expert Predictions and Market Sentiment: Market analysts and economists hold diverse views on the future trajectory of Japan's yield curve, making it crucial to stay informed about the latest developments.

Conclusion

Japan's steep yield curve represents a significant development with potentially far-reaching implications for investors and the global economy. Understanding the risks and opportunities presented by this unusual situation is critical for effective investment strategies and macroeconomic forecasting. The ongoing debate surrounding the BOJ's response and the uncertain future trajectory of the yield curve highlight the need for continuous monitoring and careful analysis. To stay informed about developments concerning Japan's steep yield curve and its impact, subscribe to reputable financial news sources and consult with qualified financial advisors before making any investment decisions. Staying informed about the evolving dynamics of Japan's yield curve is crucial for navigating these challenging market conditions.

Featured Posts

-

Wnba Strike Looms Angel Reese Weighs In On Player Pay Dispute

May 17, 2025

Wnba Strike Looms Angel Reese Weighs In On Player Pay Dispute

May 17, 2025 -

Star Wars Andor 3 Episodes Available Free On You Tube

May 17, 2025

Star Wars Andor 3 Episodes Available Free On You Tube

May 17, 2025 -

Djokovic In Kortlardaki Hakimiyeti Zirvedeki Yeri Nasil Koruyor

May 17, 2025

Djokovic In Kortlardaki Hakimiyeti Zirvedeki Yeri Nasil Koruyor

May 17, 2025 -

Imminent Wnba Strike Angel Reese And Di Jonai Carrington On Cba Concerns

May 17, 2025

Imminent Wnba Strike Angel Reese And Di Jonai Carrington On Cba Concerns

May 17, 2025 -

Rockwell Automation Oscar Health And Other Stocks Surge Wednesdays Market Movers

May 17, 2025

Rockwell Automation Oscar Health And Other Stocks Surge Wednesdays Market Movers

May 17, 2025