JBS (JBSS3) Ends Banco Master Asset Purchase Negotiations

Table of Contents

Reasons Behind the Negotiation's Termination

The termination of the JBS (JBSS3) Banco Master acquisition negotiations remains shrouded in some mystery, with official statements offering limited detail. However, several factors likely contributed to the deal's collapse. Speculation points towards a confluence of issues rather than a single decisive factor.

-

Valuation discrepancies between JBS and Banco Master: Significant differences in the perceived value of Banco Master's assets likely played a crucial role. JBS may have deemed the asking price too high, considering current market conditions and the inherent risks associated with integrating Banco Master's operations.

-

Regulatory hurdles or unforeseen legal challenges: The acquisition process might have encountered unexpected legal obstacles or regulatory roadblocks. Antitrust concerns, compliance issues, or difficulties securing necessary approvals from relevant authorities could have proven insurmountable.

-

Changes in market conditions or JBS's strategic priorities: The rapidly evolving financial landscape could have shifted JBS's strategic priorities. Changes in interest rates, economic forecasts, or emerging investment opportunities might have prompted JBS to reconsider the Banco Master acquisition.

-

Potential conflicts of interest: Unforeseen conflicts of interest, either within JBS or with other stakeholders involved in the deal, could have emerged during the due diligence phase, leading to the termination.

Impact on JBS (JBSS3) Stock and Financial Performance

The failed JBS (JBSS3) Banco Master acquisition will undoubtedly impact JBS's stock and financial performance, though the extent remains to be seen.

-

Immediate market reaction to the news: The immediate market reaction was largely negative, with JBS (JBSS3) stock experiencing a dip following the announcement. Investors reacted to the uncertainty created by the failed deal.

-

Analyst predictions for future performance: Analysts are divided on the long-term implications. Some predict a minor impact, given JBS's diversified portfolio. Others are more cautious, highlighting the potential loss of opportunities and the need for JBS to articulate a clear alternative strategic plan.

-

Potential impact on investor confidence: The failed acquisition could erode investor confidence, particularly if JBS fails to clearly communicate its future strategic direction. Transparency and decisive action will be crucial in regaining investor trust.

-

Comparison to JBS's other recent acquisitions (if applicable): A comparison of this failed acquisition with JBS's previous successes and failures would provide valuable insights into its acquisition strategy and risk management capabilities.

Implications for Banco Master and its Future

The failed JBS (JBSS3) acquisition leaves Banco Master in a precarious position, needing to navigate a new strategic path.

-

Impact on Banco Master's financial stability: The failed acquisition could negatively affect Banco Master's financial stability in the short-term, depending on its financial health and reliance on the potential deal.

-

Potential for alternative acquisition offers: Banco Master might attract interest from other potential acquirers, although the terms might be less favorable given the failed JBS negotiation.

-

Banco Master's strategic response to the failed negotiation: Banco Master will need a robust strategic response, potentially involving cost-cutting measures, restructuring, or exploring alternative partnerships to remain competitive.

-

Implications for Banco Master's employees and customers: The outcome for Banco Master's employees and customers will depend heavily on the bank's strategic response and its ability to maintain operational stability.

Wider Market Implications of the Failed JBS (JBSS3) Banco Master Acquisition

The failed JBS (JBSS3) Banco Master acquisition has implications beyond the two companies involved, impacting the wider financial markets and related sectors.

-

Effect on the mergers and acquisitions market in the sector: The failed deal could signal a cooling-off period in the sector, with potential acquirers re-evaluating their strategies and valuations.

-

Potential impact on competitor valuations: The failed acquisition might influence the valuations of JBS's competitors, affecting their future acquisition prospects.

-

Signal for future investment strategies in the sector: The failed deal underscores the importance of thorough due diligence, careful valuation, and proactive risk management in mergers and acquisitions.

-

Analysis of similar failed acquisitions in the past: Analyzing similar failed acquisitions in the past can offer valuable lessons and insights for future transactions in the sector.

Conclusion

The termination of the JBS (JBSS3) Banco Master acquisition negotiations presents a significant development with ramifications for both companies and the broader market. Valuation discrepancies, regulatory hurdles, and shifting market conditions likely contributed to the deal's collapse. The impact on JBS (JBSS3) stock and Banco Master's future remains uncertain, underscoring the volatility and risks inherent in large-scale mergers and acquisitions. The fallout from this failed JBS (JBSS3) Banco Master acquisition will require close monitoring.

Call to Action: Stay informed about the latest developments surrounding JBS (JBSS3) and the future of Banco Master. Continue to follow our coverage for in-depth analysis of the JBS (JBSS3) Banco Master acquisition fallout and its ongoing implications. For further insights into JBS (JBSS3) investments and market trends, subscribe to our newsletter.

Featured Posts

-

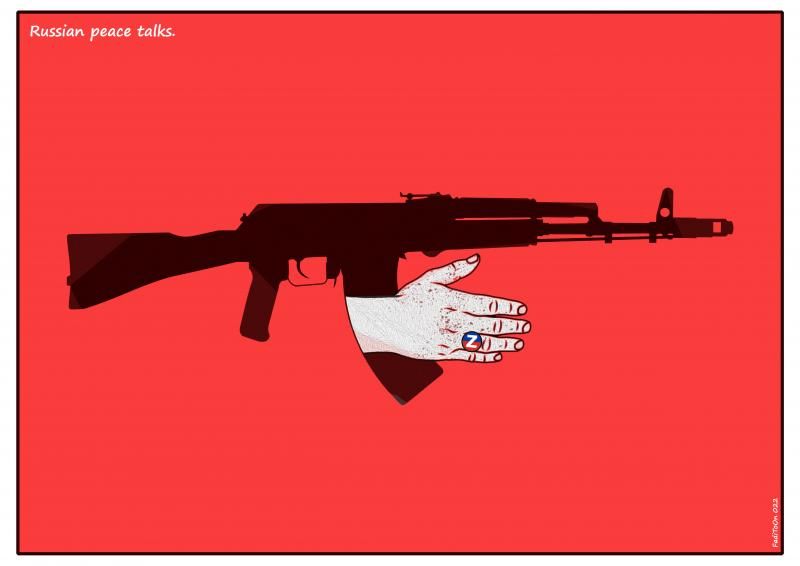

Putins Peace Talks Initiative A Diplomatic Failure

May 18, 2025

Putins Peace Talks Initiative A Diplomatic Failure

May 18, 2025 -

Is There An Osama Bin Laden Documentary On Netflix Explanation

May 18, 2025

Is There An Osama Bin Laden Documentary On Netflix Explanation

May 18, 2025 -

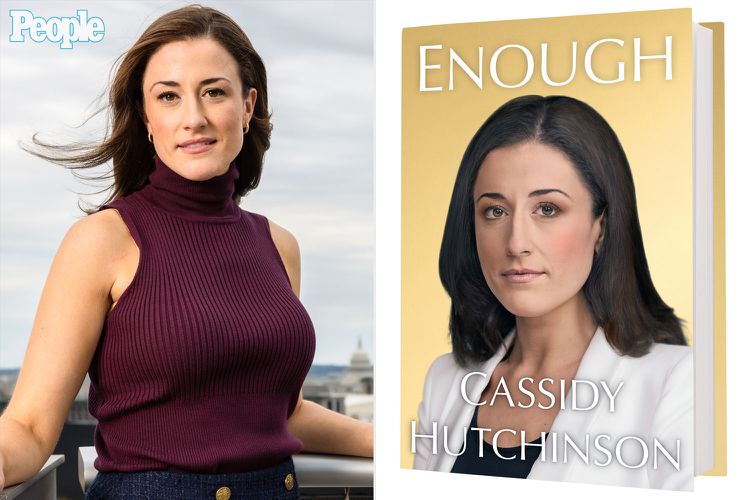

Cassidy Hutchinson Memoir Expected Fall Release Details Jan 6th Testimony

May 18, 2025

Cassidy Hutchinson Memoir Expected Fall Release Details Jan 6th Testimony

May 18, 2025 -

Is This New Investment Strategy Suitable For Retirement

May 18, 2025

Is This New Investment Strategy Suitable For Retirement

May 18, 2025 -

True Crime Docuseries Outperforms 96 Rt Rated Netflix Romance Drama

May 18, 2025

True Crime Docuseries Outperforms 96 Rt Rated Netflix Romance Drama

May 18, 2025

Latest Posts

-

The Kardashian Censori West Feud A New Chapter

May 18, 2025

The Kardashian Censori West Feud A New Chapter

May 18, 2025 -

Is There A Kardashian Censori Alliance Against Kanye West

May 18, 2025

Is There A Kardashian Censori Alliance Against Kanye West

May 18, 2025 -

Kim Kardashian And Bianca Censori United Front Against Kanye

May 18, 2025

Kim Kardashian And Bianca Censori United Front Against Kanye

May 18, 2025 -

Is It Back On Bianca Censori And Kanye West Spotted Together In Spain

May 18, 2025

Is It Back On Bianca Censori And Kanye West Spotted Together In Spain

May 18, 2025 -

Kane Uest Publikatsiya Instruktsii K Pokhoronam Vdokhnovlennaya Pashey Tekhnikom

May 18, 2025

Kane Uest Publikatsiya Instruktsii K Pokhoronam Vdokhnovlennaya Pashey Tekhnikom

May 18, 2025