Jerome Powell On Tariffs: A Threat To Federal Reserve Goals

Table of Contents

Jerome Powell, as Chairman of the Federal Reserve (often referred to as the Fed), leads the central banking system of the United States. The Fed's primary responsibilities are to maintain price stability and promote maximum employment. These seemingly simple goals become incredibly complex when external factors, such as tariffs, introduce significant economic distortions. This article argues that tariffs, in Powell's view, directly undermine both of these crucial objectives.

Tariffs and Inflation: A Direct Threat to Price Stability

Tariffs, essentially taxes on imported goods, directly increase the cost of those goods. This increase gets passed on to consumers, leading to higher prices across the board. This inflationary pressure can be amplified by supply chain disruptions caused by tariffs. When goods become more expensive or scarcer due to trade restrictions, businesses are forced to raise prices to maintain profitability, leading to a potential inflationary spiral.

- Increased prices for consumer goods: Tariffs on imported goods like electronics, clothing, and furniture directly impact consumer spending power.

- Supply chain disruptions leading to shortages and higher prices: Tariffs can disrupt established supply chains, leading to shortages and further price increases.

- Impact on the Federal Reserve's inflation targets: The Fed aims for a sustainable inflation rate of around 2%. Tariffs push inflation higher, forcing the Fed to potentially take countermeasures that could negatively impact other economic sectors.

- Examples of specific goods affected by tariffs and their price increases: Specific examples, including the impact of steel and aluminum tariffs on various industries, can be cited to illustrate these points, drawing on relevant economic data.

Tariffs and Economic Growth: Stifling Job Creation and Investment

Beyond inflation, tariffs significantly hinder economic growth. Increased prices for imported goods reduce consumer spending. Businesses, facing uncertainty and higher input costs, are less likely to invest, slowing capital expenditures and job creation. Moreover, retaliatory tariffs imposed by other countries can severely damage US export industries, leading to job losses in those sectors.

- Reduced consumer confidence and spending: Higher prices erode consumer purchasing power and confidence, leading to decreased spending.

- Uncertainty hindering business investment: Businesses become hesitant to invest in expansion or new projects under conditions of trade uncertainty.

- Retaliatory tariffs harming US exporters: Other countries often retaliate against US tariffs with their own, reducing the demand for US goods and services.

- Loss of jobs in import-sensitive industries: Industries relying heavily on imported goods face challenges and potential job losses.

- Potential for reduced economic growth: The combined effects of reduced consumer spending, business investment, and exports can severely hamper overall economic growth.

Powell's Public Statements on Tariffs: Analyzing His Concerns

Jerome Powell has repeatedly expressed concerns about the economic ramifications of tariffs. His public statements, speeches, and testimony before Congress consistently highlight the risks to price stability and employment. While he avoids direct political commentary, his concern for the Fed's mandate is clear.

- Specific instances where Powell expressed concerns about tariffs: Specific dates and contexts of Powell's statements should be provided, referencing relevant press releases and transcripts.

- Key phrases and terminology used by Powell to describe the risks of tariffs: Analyzing his choice of words reveals his level of concern, for example, using terms like "significant risks" or "substantial uncertainty."

- Links to relevant speeches and transcripts: Provide hyperlinks to official Federal Reserve sources for verification and further reading.

The Federal Reserve's Response to Tariff-Induced Economic Challenges

The Federal Reserve has limited tools to directly counteract the negative economic impacts of tariffs. Primarily, it can adjust interest rates. Raising interest rates combats inflation but could simultaneously slow economic growth and increase unemployment. Lowering interest rates could stimulate the economy but might exacerbate inflationary pressures fueled by tariffs. This presents a delicate balancing act.

- Potential monetary policy responses: This section should outline potential actions the Fed might take, including adjusting interest rates, quantitative easing, or other monetary policy tools.

- Challenges the Fed faces in addressing tariff-related issues: The Fed's ability to effectively mitigate the effects of trade policy is constrained by the fact that it's not a trade policy-making body.

- The delicate balancing act between inflation and employment: This highlights the core challenge of maintaining price stability without significantly compromising employment.

Jerome Powell's Warnings on Tariffs – A Call to Action

In conclusion, Jerome Powell's public statements consistently demonstrate a deep concern that tariffs pose a significant threat to the Federal Reserve's dual mandate. The inflationary pressures, reduced economic growth, and uncertainty created by tariffs complicate the Fed's ability to maintain price stability and promote maximum employment. The risks associated with tariffs extend far beyond simple trade policy, impacting the broader US economy and impacting everyone.

Understanding Jerome Powell's perspective on tariffs is critical for informed economic participation. Stay updated on the latest developments, the Federal Reserve's responses to this significant challenge, and the ongoing debate surrounding tariffs and their impact on the economy. Referencing reputable economic news sources and the Federal Reserve's official website will help you to stay informed on this crucial issue.

Featured Posts

-

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025 -

Kharkovschina Svadebniy Bum Pochti 40 Brakosochetaniy Za Odin Den

May 25, 2025

Kharkovschina Svadebniy Bum Pochti 40 Brakosochetaniy Za Odin Den

May 25, 2025 -

Ovaj Grad Raj Za Milionerske Penzionere

May 25, 2025

Ovaj Grad Raj Za Milionerske Penzionere

May 25, 2025 -

Jenson Button Returns To The 2009 Brawn Gp A Historic Moment

May 25, 2025

Jenson Button Returns To The 2009 Brawn Gp A Historic Moment

May 25, 2025 -

Escape To The Country Making The Move To Rural Life

May 25, 2025

Escape To The Country Making The Move To Rural Life

May 25, 2025

Latest Posts

-

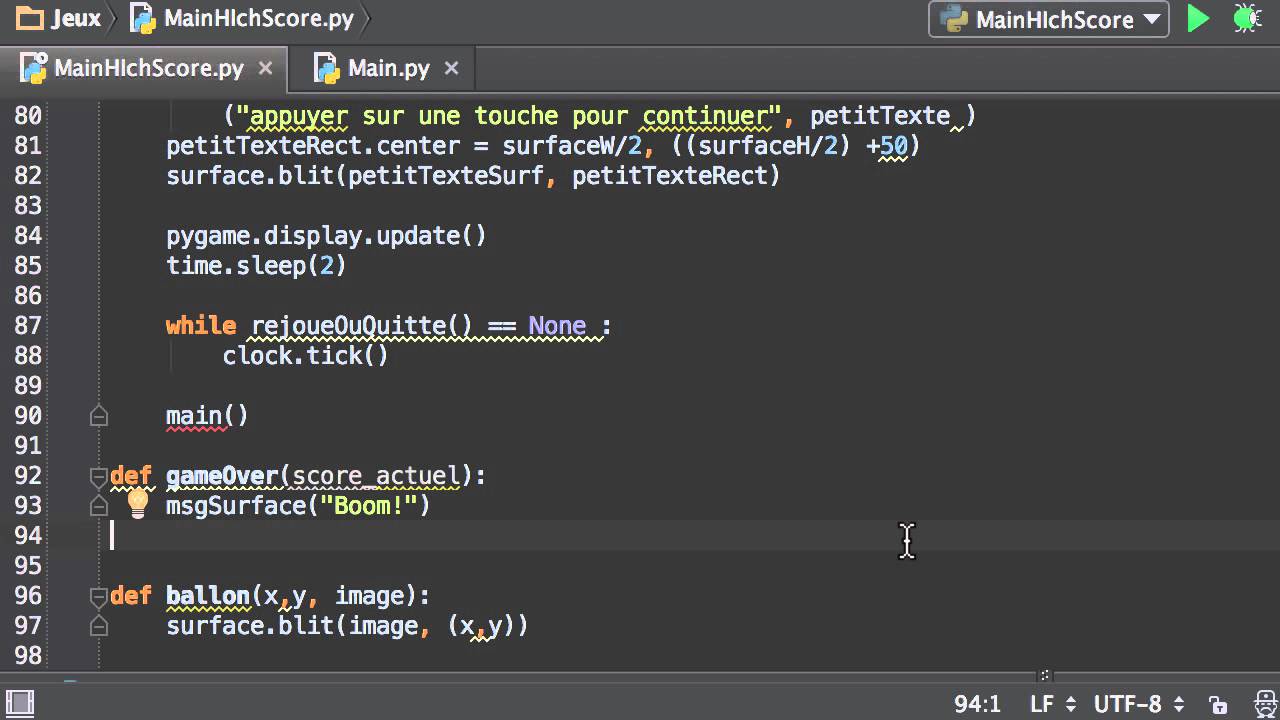

Le Jeu Officiel Du Tour De France Gerez Votre Equipe Avec La Rtbf

May 26, 2025

Le Jeu Officiel Du Tour De France Gerez Votre Equipe Avec La Rtbf

May 26, 2025 -

Rtbf Lance Un Jeu De Management Vivez Le Tour De France Comme Jamais

May 26, 2025

Rtbf Lance Un Jeu De Management Vivez Le Tour De France Comme Jamais

May 26, 2025 -

Le Piratage Iptv En Belgique Impact Sur Rtbf Et Rtl Belgium Et Actions Entreprises

May 26, 2025

Le Piratage Iptv En Belgique Impact Sur Rtbf Et Rtl Belgium Et Actions Entreprises

May 26, 2025 -

Tour De France Le Jeu De Management Cycliste De La Rtbf Arrive

May 26, 2025

Tour De France Le Jeu De Management Cycliste De La Rtbf Arrive

May 26, 2025 -

Piratage Iptv Rtbf Et Rtl Belgium Intensifient La Surveillance Et Les Poursuites

May 26, 2025

Piratage Iptv Rtbf Et Rtl Belgium Intensifient La Surveillance Et Les Poursuites

May 26, 2025