Jim Cramer's CoreWeave (CRWV) Investment: A Deep Dive Into The Company's Prowess

Table of Contents

CoreWeave's Business Model: Harnessing the Power of GPUs

CoreWeave's success hinges on its innovative approach to cloud computing. The company distinguishes itself through its efficient utilization of Graphics Processing Units (GPUs).

GPU-as-a-Service (GaaS): A Revolutionary Approach

CoreWeave's core offering is GPU-as-a-service (GaaS). Unlike traditional cloud providers that often offer GPUs as an afterthought, CoreWeave focuses solely on delivering high-performance GPU computing resources on demand. This specialized approach offers several key advantages:

- Unmatched Scalability: CoreWeave allows users to easily scale their GPU resources up or down based on their needs, eliminating the need for significant upfront investments in hardware.

- Cost-Effectiveness: By paying only for the GPU resources consumed, users achieve significant cost savings compared to managing their own on-premise GPU infrastructure.

- Accessibility: CoreWeave simplifies access to high-performance computing power, making it easier for businesses of all sizes to leverage the benefits of GPU acceleration.

- Ease of Use: The platform is designed with user-friendliness in mind, making it accessible to developers and data scientists with varying levels of expertise.

The primary target market for CoreWeave's GaaS offering includes companies heavily reliant on GPU-accelerated workloads, particularly in the fields of artificial intelligence (AI), machine learning (ML), deep learning, high-performance computing (HPC), and data visualization.

Sustainable and Efficient Data Centers

CoreWeave is committed to environmentally responsible practices, building its data centers with sustainability at the forefront. This focus translates into both cost savings and environmental benefits:

- Renewable Energy Sources: CoreWeave actively utilizes renewable energy sources to power its data centers, minimizing its carbon footprint.

- Optimized Cooling Systems: Employing advanced cooling technologies, CoreWeave reduces energy consumption and operational costs associated with cooling massive server farms.

- Reduced Carbon Footprint: The company's commitment to sustainability contributes to a significantly reduced carbon footprint compared to traditional data center operations. This environmentally conscious approach resonates with businesses increasingly prioritizing ESG (Environmental, Social, and Governance) factors.

CoreWeave's Competitive Landscape and Market Position

CoreWeave operates in a competitive market dominated by established giants. Understanding its competitive position is crucial for evaluating its investment potential.

Key Competitors and Differentiation

CoreWeave faces stiff competition from major cloud providers like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. These competitors possess vast resources and extensive market reach. However, CoreWeave differentiates itself through:

- Specialized GPU Offerings: CoreWeave's focus on providing specialized GPU-based services allows it to cater to niche markets and offer superior performance in specific workloads compared to general-purpose cloud platforms.

- Strong Customer Relationships: CoreWeave fosters strong relationships with its clients, providing tailored solutions and exceptional customer support. This personalized approach is a significant differentiator in a market often characterized by impersonal, large-scale service providers.

- Superior Performance: CoreWeave's optimized infrastructure and specialized expertise contribute to superior performance, attracting customers who require high-throughput computing for demanding applications.

Market Growth and Future Potential

The cloud computing market is experiencing explosive growth, driven by the increasing demand for scalable and cost-effective computing resources. The demand for GPU-based services is particularly strong, creating a significant opportunity for CoreWeave.

- Expanding into New Markets: CoreWeave is strategically expanding its services into new markets and verticals, further fueling its growth potential.

- Strategic Partnerships: Collaborations and strategic partnerships with technology leaders provide CoreWeave with access to new technologies and wider market reach.

- Technological Advancements: The company’s continuous investment in research and development enables it to stay at the forefront of technological advancements, offering cutting-edge GPU solutions.

Analyzing the Investment: Risks and Rewards of CRWV

As with any investment, understanding the potential risks and rewards associated with CRWV is crucial.

Potential Risks Associated with CoreWeave

Investing in CoreWeave entails certain risks:

- Competition from Larger Players: The intense competition from established cloud providers presents a significant challenge for CoreWeave.

- Dependence on Specific Technologies: CoreWeave’s reliance on specific GPU technologies could expose it to technological disruptions or shifts in market preferences.

- Economic Downturns: Economic downturns could impact demand for cloud computing services, negatively affecting CoreWeave's revenue and growth.

The Upside Potential of a CRWV Investment

Despite the inherent risks, the potential rewards associated with a CRWV investment are compelling:

- High Growth Potential: CoreWeave's strong market position and growth trajectory suggest a high potential for significant returns on investment.

- Strong Management Team: A skilled and experienced management team increases investor confidence in the company's ability to navigate challenges and capitalize on opportunities.

- First-Mover Advantage: CoreWeave’s early entry into the specialized GPU-as-a-service market provides a first-mover advantage, allowing it to establish a strong market presence before competitors fully catch up.

Conclusion

This in-depth analysis of Jim Cramer's CoreWeave (CRWV) investment reveals a company with a robust business model, a promising market position, and considerable growth potential. While risks undoubtedly exist, the potential rewards associated with CRWV could be substantial. The company’s innovative approach to GPU-as-a-service, coupled with its commitment to sustainable practices, positions it favorably within the rapidly expanding cloud computing sector.

Call to Action: Understanding the intricacies of CoreWeave (CRWV) is vital for investors considering this potentially lucrative opportunity. However, conducting thorough due diligence and consulting with a financial advisor before making any investment decisions related to CoreWeave (CRWV) or any other stock is paramount. Learn more about the complexities of CRWV and its standing within the competitive cloud computing market to make informed investment choices.

Featured Posts

-

Yevrokomisar Pro Golovnu Pereshkodu Dlya Vstupu Ukrayini Do Nato

May 22, 2025

Yevrokomisar Pro Golovnu Pereshkodu Dlya Vstupu Ukrayini Do Nato

May 22, 2025 -

Fbi Search Warrant Served In Lebanon County Pennsylvania What We Know

May 22, 2025

Fbi Search Warrant Served In Lebanon County Pennsylvania What We Know

May 22, 2025 -

Adam Ramey Dropout Kings Lead Singer Passes Away At 32

May 22, 2025

Adam Ramey Dropout Kings Lead Singer Passes Away At 32

May 22, 2025 -

The Traverso Dynasty Chronicling Cannes Film Festival Through The Lens

May 22, 2025

The Traverso Dynasty Chronicling Cannes Film Festival Through The Lens

May 22, 2025 -

Giai Ma Bi An Hai Lo Vuong Tren Cong Ket Noi Usb

May 22, 2025

Giai Ma Bi An Hai Lo Vuong Tren Cong Ket Noi Usb

May 22, 2025

Latest Posts

-

Pat Mc Afee Show Insider Addresses Aaron Rodgers Trade Rumors To Steelers

May 22, 2025

Pat Mc Afee Show Insider Addresses Aaron Rodgers Trade Rumors To Steelers

May 22, 2025 -

No Rodgers Steelers News At Pat Mc Afee Show Insider Reports

May 22, 2025

No Rodgers Steelers News At Pat Mc Afee Show Insider Reports

May 22, 2025 -

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025 -

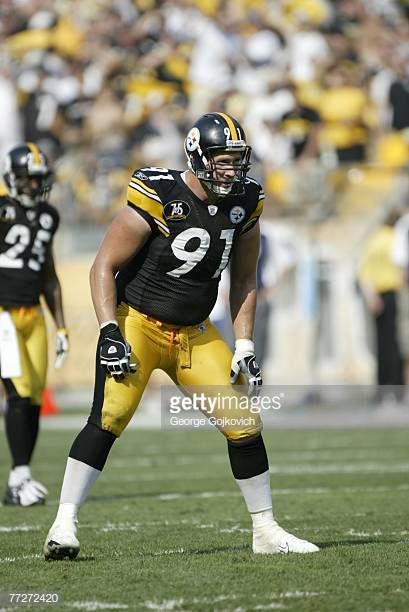

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025 -

Pittsburgh Steelers Mourn The Passing Of Former Defensive Lineman Ray Seals At 59

May 22, 2025

Pittsburgh Steelers Mourn The Passing Of Former Defensive Lineman Ray Seals At 59

May 22, 2025