Jim Cramer's Foot Locker (FL) Pick: A Genuine Winner?

Table of Contents

Cramer's Rationale for Foot Locker (FL)

Jim Cramer's recommendation of Foot Locker often centers around the brand's resilience and potential for a turnaround. He likely points to Foot Locker's strong brand recognition and established market presence as key strengths. While specific quotes may vary depending on the date of his commentary, his positive outlook is typically fueled by his belief in the company's ability to adapt to changing consumer preferences and navigate the competitive athletic footwear market.

- Brand Strength: Foot Locker remains a recognizable and trusted name in athletic footwear and apparel, providing a solid foundation for growth.

- Turnaround Potential: Cramer likely sees opportunities for Foot Locker to improve its operational efficiency, enhance its e-commerce presence, and potentially develop new product lines or partnerships to boost sales and profitability.

- Market Position: Despite facing strong competition, Foot Locker maintains a significant market share, suggesting it holds a valuable position within the industry. Cramer likely considers this a positive indicator.

- Specific Catalysts: Cramer might have highlighted specific factors, such as new marketing campaigns, improved inventory management, or strategic collaborations, as potential catalysts for improved financial performance. These should be noted in any detailed analysis of his recommendations.

- Keywords: Jim Cramer, Foot Locker stock, FL stock, investment advice, stock recommendation, turnaround strategy

Foot Locker's (FL) Current Financial Performance

Analyzing Foot Locker's financial health requires examining recent financial reports. Key metrics like revenue growth, earnings per share (EPS), and profitability are crucial for assessing its current financial standing and future potential. A thorough review includes looking at these compared to prior periods and industry competitors:

- Revenue Growth: Has Foot Locker's revenue shown consistent growth or decline in recent quarters? This indicates the strength of its sales and market position.

- Earnings Per Share (EPS): EPS reflects the company's profitability on a per-share basis. A positive trend suggests improving financial health.

- Profitability Margins: Analyzing gross profit margins and net profit margins provides insight into Foot Locker's efficiency and cost management.

- Debt Levels: High levels of debt can pose a financial risk. Assessing Foot Locker's debt-to-equity ratio is critical.

- Cash Flow: Positive and healthy cash flow indicates the company's ability to generate funds to invest in future growth or pay off debt.

- Keywords: Foot Locker financials, FL financial reports, revenue growth, earnings per share, debt-to-equity ratio, profitability, financial health, gross profit margin, net profit margin

Market Analysis and Competitive Landscape

The athletic footwear and apparel market is highly competitive, with major players like Nike and Adidas dominating market share. Understanding this landscape is essential to evaluating Foot Locker's prospects:

- Key Competitors: Nike and Adidas pose the most significant challenges to Foot Locker, and their strategies and performance heavily influence the overall market.

- Market Share: Foot Locker's market share and its trends should be tracked to determine its competitiveness.

- E-commerce Growth: The increasing importance of online retail necessitates analyzing Foot Locker's e-commerce strategy and its effectiveness.

- Consumer Spending Habits: Changes in consumer spending patterns, especially in discretionary items like athletic footwear, directly impact Foot Locker's sales.

- Industry Trends: Fashion trends, technological advancements, and evolving consumer preferences influence the overall market and impact Foot Locker's strategy.

- Keywords: Athletic footwear market, apparel market, competitive landscape, Nike, Adidas, market share, e-commerce, consumer spending, industry trends

Risk Factors and Potential Downsides

Investing in Foot Locker (FL) stock involves several inherent risks:

- Economic Downturns: During economic recessions, consumer spending on discretionary items like athletic footwear typically declines.

- Competition: The intense competition from larger brands like Nike and Adidas poses a significant risk to Foot Locker's market share.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of products and increase costs.

- Changing Consumer Preferences: Shifts in fashion trends or preferences towards alternative brands can negatively affect Foot Locker's sales.

- Market Volatility: The stock market is inherently volatile, and FL stock is susceptible to market fluctuations.

- Keywords: Foot Locker risk, investment risk, market volatility, economic downturn, supply chain risk, competitive pressure

Conclusion

Jim Cramer's positive outlook on Foot Locker is based on the brand's strength and potential for a turnaround. However, a thorough assessment necessitates considering Foot Locker's current financial performance within the context of a competitive market and potential risks. Whether Foot Locker represents a "genuine winner" is ultimately dependent on its ability to adapt to changing market dynamics and improve its operational efficiency. The analysis suggests that while Foot Locker has a strong brand, its success hinges on navigating competition and economic uncertainty. Therefore, a "buy," "hold," or "sell" decision requires individual analysis and risk assessment.

Call to Action: Before you invest in Foot Locker (FL) based on Jim Cramer's advice, remember to conduct your own due diligence. Analyze the company's financial statements, assess the competitive landscape, and evaluate the inherent risks involved. Jim Cramer's Foot Locker (FL) analysis should inform, but not dictate, your investment strategy. Remember to always perform your own thorough research before investing in any stock, including Foot Locker (FL).

Featured Posts

-

Portland Timbers Loss To San Jose Ends Winning Streak

May 16, 2025

Portland Timbers Loss To San Jose Ends Winning Streak

May 16, 2025 -

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Serii Pley Off N Kh L

May 16, 2025

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Serii Pley Off N Kh L

May 16, 2025 -

Tom Hanks And Tom Cruise A 1 Debt That Remains Unsettled

May 16, 2025

Tom Hanks And Tom Cruise A 1 Debt That Remains Unsettled

May 16, 2025 -

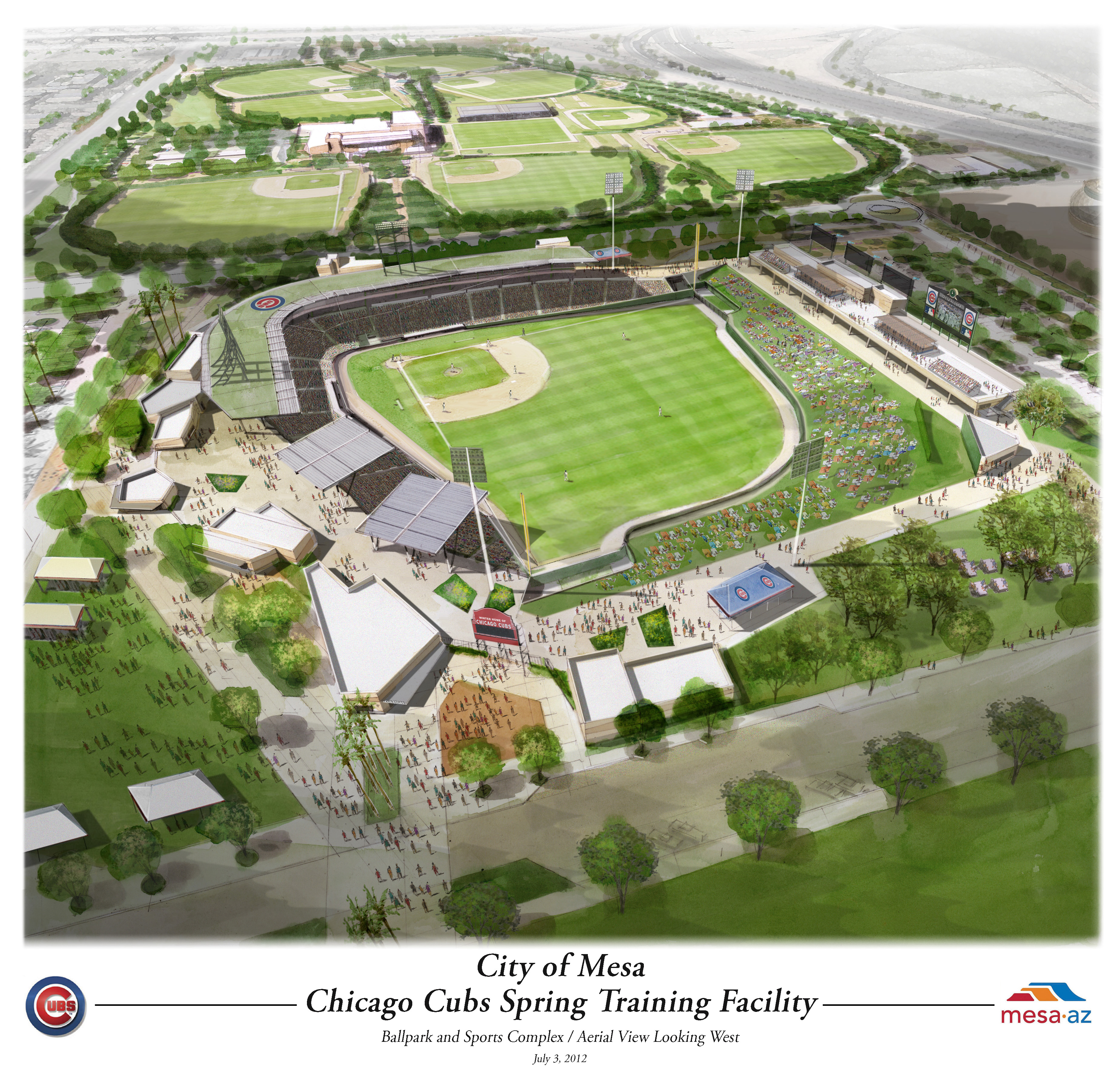

March 4th Cubs Padres Matchup A Spring Training Preview From Mesa

May 16, 2025

March 4th Cubs Padres Matchup A Spring Training Preview From Mesa

May 16, 2025 -

Gsw Campus Security Incident Individual Apprehended

May 16, 2025

Gsw Campus Security Incident Individual Apprehended

May 16, 2025