Jim Cramer's Lone Stand: CoreWeave (CRWV) As The AI Infrastructure Star

Table of Contents

CoreWeave's (CRWV) Unique Value Proposition in the AI Infrastructure Market

CoreWeave (CRWV) isn't just another cloud computing provider; it's carving a niche in the AI infrastructure landscape with a compelling combination of factors.

Superior NVIDIA GPU Access and Scalability

CoreWeave boasts unparalleled access to NVIDIA GPUs, the workhorses of modern AI. This direct access allows for superior scalability and performance, crucial for handling the demanding computational needs of AI workloads.

- Dedicated Infrastructure: Unlike shared cloud environments, CoreWeave offers dedicated infrastructure, minimizing latency and maximizing performance for AI applications.

- Optimized Performance: CoreWeave's infrastructure is specifically optimized for AI workloads, ensuring efficient utilization of NVIDIA GPUs and minimizing resource waste.

- Ease of Deployment: Deploying AI models on CoreWeave’s platform is streamlined, reducing development time and accelerating time to market for AI applications.

- Competitive Advantage: This dedicated, optimized approach provides a significant advantage over competitors relying on less specialized, shared cloud resources.

Focus on the High-Growth Generative AI Sector

CoreWeave is strategically positioned to capitalize on the explosive growth of the generative AI sector. Its infrastructure is perfectly suited to power the computationally intensive tasks involved in training and deploying large language models (LLMs) and other generative AI applications.

- Large Language Models (LLMs): CoreWeave provides the computational power needed to train and run sophisticated LLMs, enabling advancements in natural language processing and conversational AI.

- Image Generation: The company’s infrastructure supports the demanding requirements of AI-powered image generation, fueling innovation in creative industries and beyond.

- Strategic Partnerships: CoreWeave is actively forging partnerships with leading AI companies, further solidifying its position within the generative AI ecosystem. (Specific examples of partnerships would strengthen this point if publicly available.)

Strong Financial Performance and Growth Projections

While still a relatively young company, CoreWeave has demonstrated impressive financial performance and exhibits promising growth projections. (Include specific financial data like revenue growth percentages, profitability indicators, and market capitalization from reputable financial sources here. For example, "CoreWeave reported a [percentage]% increase in year-over-year revenue in Q[quarter], exceeding analyst expectations.") These figures, coupled with the burgeoning AI market, suggest a compelling investment opportunity. However, always consult with a financial advisor before making any investment decisions.

Why Jim Cramer's Belief in CoreWeave (CRWV) Stands Out

Jim Cramer's bullish stance on CoreWeave is notable for its contrarian nature within a currently volatile market.

Contrarian Viewpoint in a Volatile Market

Many investors remain hesitant about the AI sector due to concerns about market volatility and potential overvaluation. Cramer's optimism, therefore, represents a distinct contrarian viewpoint.

- Risk and Reward: Investing in CoreWeave involves inherent risk, given the volatility of the technology sector and the competitive nature of the AI infrastructure market. However, the potential rewards are equally significant, given CoreWeave's growth trajectory.

- Market Sentiment: Understanding the prevailing market sentiment surrounding AI stocks is crucial for evaluating the risks and rewards associated with CoreWeave (CRWV). Negative sentiment might lead to undervaluation, presenting a buying opportunity for long-term investors.

Long-Term Vision for AI Infrastructure

Cramer’s bullishness likely stems from a long-term vision of CoreWeave’s potential to become a dominant force in the AI infrastructure landscape.

- Market Disruption: CoreWeave is well-positioned to disrupt the existing AI infrastructure market through its innovative approach and strategic partnerships.

- Future Growth: Potential for future acquisitions, technological advancements, and expansion into new AI sectors contributes to the long-term growth outlook for CoreWeave.

Risks and Considerations for Investing in CoreWeave (CRWV)

While CoreWeave presents an exciting investment prospect, it's essential to acknowledge potential risks.

Competition and Market Saturation

The AI infrastructure market is becoming increasingly crowded, with established cloud providers and new entrants vying for market share.

- Competitive Landscape: Analyzing the competitive landscape and the strengths of key competitors (e.g., Amazon Web Services, Google Cloud, Microsoft Azure) is crucial for assessing CoreWeave's ability to maintain its competitive edge.

- Market Saturation Risk: The potential for market saturation poses a challenge to CoreWeave's future growth.

Dependence on NVIDIA and Technological Advancements

CoreWeave's reliance on NVIDIA GPUs presents a notable risk.

- NVIDIA Dependence: A significant shift in the GPU market or any disruption to CoreWeave’s relationship with NVIDIA could negatively impact its operations.

- Technological Obsolescence: Rapid technological advancements in AI could render CoreWeave's current infrastructure obsolete, requiring significant capital investment in upgrades.

Conclusion

Jim Cramer's optimistic outlook on CoreWeave (CRWV) presents a compelling, albeit contrarian, perspective on the AI infrastructure market. CoreWeave's unique value proposition, focusing on dedicated NVIDIA GPU access, scalability, and a strategic focus on the high-growth generative AI sector, offers a potentially lucrative investment opportunity. However, potential risks associated with competition, market saturation, and technological advancements should be carefully considered. Ultimately, thorough due diligence and consultation with a financial advisor are vital before making any investment decision. Is CoreWeave (CRWV) your next smart AI infrastructure investment? Learn more about the potential of CoreWeave (CRWV) in the rapidly growing AI market and conduct your own research to make an informed decision.

Featured Posts

-

John Lithgow Und Jimmy Smits Die Rueckkehr In Dexter Resurrection

May 22, 2025

John Lithgow Und Jimmy Smits Die Rueckkehr In Dexter Resurrection

May 22, 2025 -

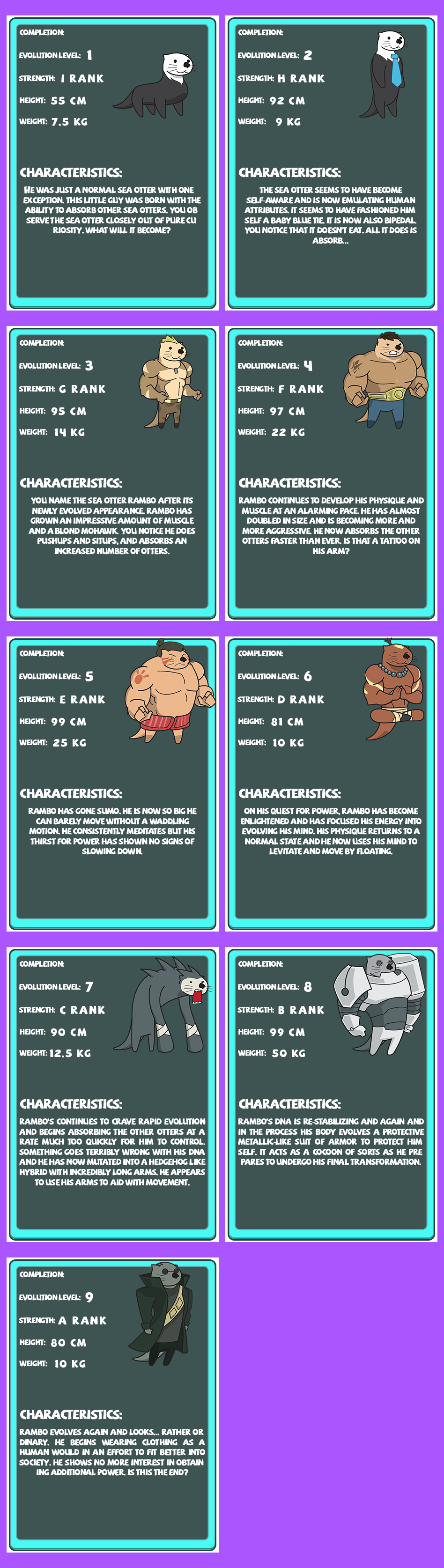

The Evolution Of Otter Management A Wyoming Case Study

May 22, 2025

The Evolution Of Otter Management A Wyoming Case Study

May 22, 2025 -

The Sound Perimeter A Study Of Musics Social Impact

May 22, 2025

The Sound Perimeter A Study Of Musics Social Impact

May 22, 2025 -

Abn Amro Dutch Central Bank Eyes Potential Fine Over Bonuses

May 22, 2025

Abn Amro Dutch Central Bank Eyes Potential Fine Over Bonuses

May 22, 2025 -

Millions Made From Executive Office365 Hacks Fbi Investigation

May 22, 2025

Millions Made From Executive Office365 Hacks Fbi Investigation

May 22, 2025

Latest Posts

-

Dropout Kings Lose Vocalist Adam Ramey At 32 Remembering His Legacy

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey At 32 Remembering His Legacy

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dies At 32

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies At 32

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dead At Age

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dead At Age

May 22, 2025 -

31 Year Old Singer Adam Ramey Of Dropout Kings Dies

May 22, 2025

31 Year Old Singer Adam Ramey Of Dropout Kings Dies

May 22, 2025 -

Adam Ramey Dead At 31 Dropout Kings Singer Passes Away

May 22, 2025

Adam Ramey Dead At 31 Dropout Kings Singer Passes Away

May 22, 2025