Kerrisdale Capital's Report Triggers D-Wave Quantum (QBTS) Stock Decline

Table of Contents

Kerrisdale Capital's Short Position and Critical Report

Kerrisdale Capital, known for its aggressive short-selling strategy, published a report outlining its bearish outlook on D-Wave Quantum. Short selling involves borrowing and selling a stock with the expectation of buying it back at a lower price, profiting from the difference. Their report detailed several key accusations against D-Wave, questioning the company's technology, business model, and financial performance. Specific examples cited in the report (assuming public availability) would be included here, providing concrete evidence of Kerrisdale's claims. For example, the report may have focused on the limitations of D-Wave's quantum annealing approach compared to other quantum computing technologies, or questioned the company's revenue generation strategy.

- Negative media coverage: The report generated widespread negative media attention, further fueling the sell-off.

- Analyst downgrades: Several analysts followed suit, issuing downgrades and sell recommendations for QBTS stock, amplifying the negative sentiment.

- Impact on investor confidence: The report significantly eroded investor confidence in D-Wave's technology and long-term viability, leading to a significant drop in the stock price.

D-Wave Quantum's Response and Stock Performance

D-Wave Quantum responded to Kerrisdale Capital's report with a detailed rebuttal, disputing several of the accusations. The company likely defended its technology, clarified its financial statements, and outlined its strategic plan for future growth. However, the damage was done, and the stock price continued to decline in the days following the report's release.

Analyzing D-Wave's stock performance requires a detailed look at charts and graphs (which would be included here if this were a visual article). We would examine the stock price fluctuations, trading volume spikes, and overall market capitalization changes.

- Stock price fluctuations: The immediate aftermath likely showed a sharp decline followed by periods of volatility.

- Impact on future funding: The negative publicity could potentially hinder future funding rounds or partnerships for D-Wave.

- Investor relations adjustments: D-Wave likely adjusted its investor relations strategy to address investor concerns and restore confidence.

Analysis of Kerrisdale Capital's Claims

Objectively assessing Kerrisdale Capital's claims requires a careful examination of both sides of the argument. This section would include an independent analysis of the validity of the accusations, considering counterarguments and evidence from independent sources. This would involve scrutinizing D-Wave's technology, comparing it to competitors, and analyzing the financial health and business model of the company.

- Examination of D-Wave's technology: An assessment of the strengths and limitations of D-Wave's quantum annealing approach.

- Financial statement analysis: A deep dive into D-Wave's financial performance, including revenue streams, expenses, and profitability.

- Industry comparison: A comparison of D-Wave's position within the broader quantum computing landscape, considering its competitors and market share.

The Implications for Quantum Computing Investors

The Kerrisdale Capital report serves as a cautionary tale for investors in the burgeoning quantum computing sector. The event highlights the inherent risks associated with investing in early-stage companies and volatile markets. Investors need to carefully evaluate their risk tolerance, conduct thorough due diligence, and diversify their portfolios appropriately.

- Importance of due diligence: The incident emphasizes the need for rigorous research and independent analysis before investing in quantum computing stocks.

- Understanding market challenges: Investors must acknowledge the technological and commercial challenges facing the quantum computing industry.

- Diversification strategies: A well-diversified investment portfolio is crucial to mitigate the risks associated with investing in any single sector, especially an emerging one like quantum computing.

Conclusion: Navigating the Volatility of Quantum Computing Stocks like QBTS after the Kerrisdale Capital Report

The Kerrisdale Capital report and the subsequent decline of D-Wave Quantum (QBTS) stock underscore the volatility inherent in the quantum computing market. Thorough due diligence, understanding the technological landscape, and a well-diversified investment strategy are crucial for navigating the risks and opportunities in this exciting yet unpredictable sector. While the long-term prospects of quantum computing remain promising, investors should remain vigilant and informed about the companies in which they invest. Stay updated on the latest news about D-Wave Quantum (QBTS) and other quantum computing stocks by following reputable financial news sources and industry publications. Understanding the dynamics between short-sellers like Kerrisdale Capital and companies like D-Wave Quantum is key to making informed investment decisions in the volatile world of quantum computing stocks.

Featured Posts

-

Check The Latest Rain Forecasts And Timing

May 21, 2025

Check The Latest Rain Forecasts And Timing

May 21, 2025 -

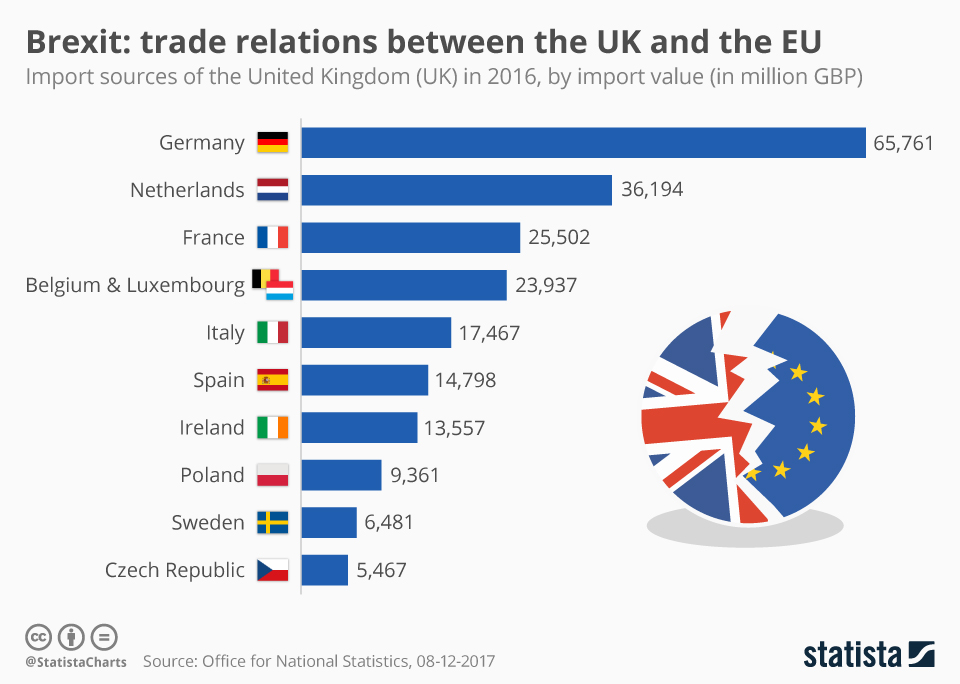

Uk Luxury Lobby Brexits Impact On Eu Export Growth

May 21, 2025

Uk Luxury Lobby Brexits Impact On Eu Export Growth

May 21, 2025 -

Abn Amro Analyse Van De Groei In De Occasionmarkt

May 21, 2025

Abn Amro Analyse Van De Groei In De Occasionmarkt

May 21, 2025 -

D Waves Qbts Quantum Leap Advancing Ai Powered Drug Discovery

May 21, 2025

D Waves Qbts Quantum Leap Advancing Ai Powered Drug Discovery

May 21, 2025 -

Big Bear Ai Bbai Buy Rating Persists Despite Market Volatility

May 21, 2025

Big Bear Ai Bbai Buy Rating Persists Despite Market Volatility

May 21, 2025

Latest Posts

-

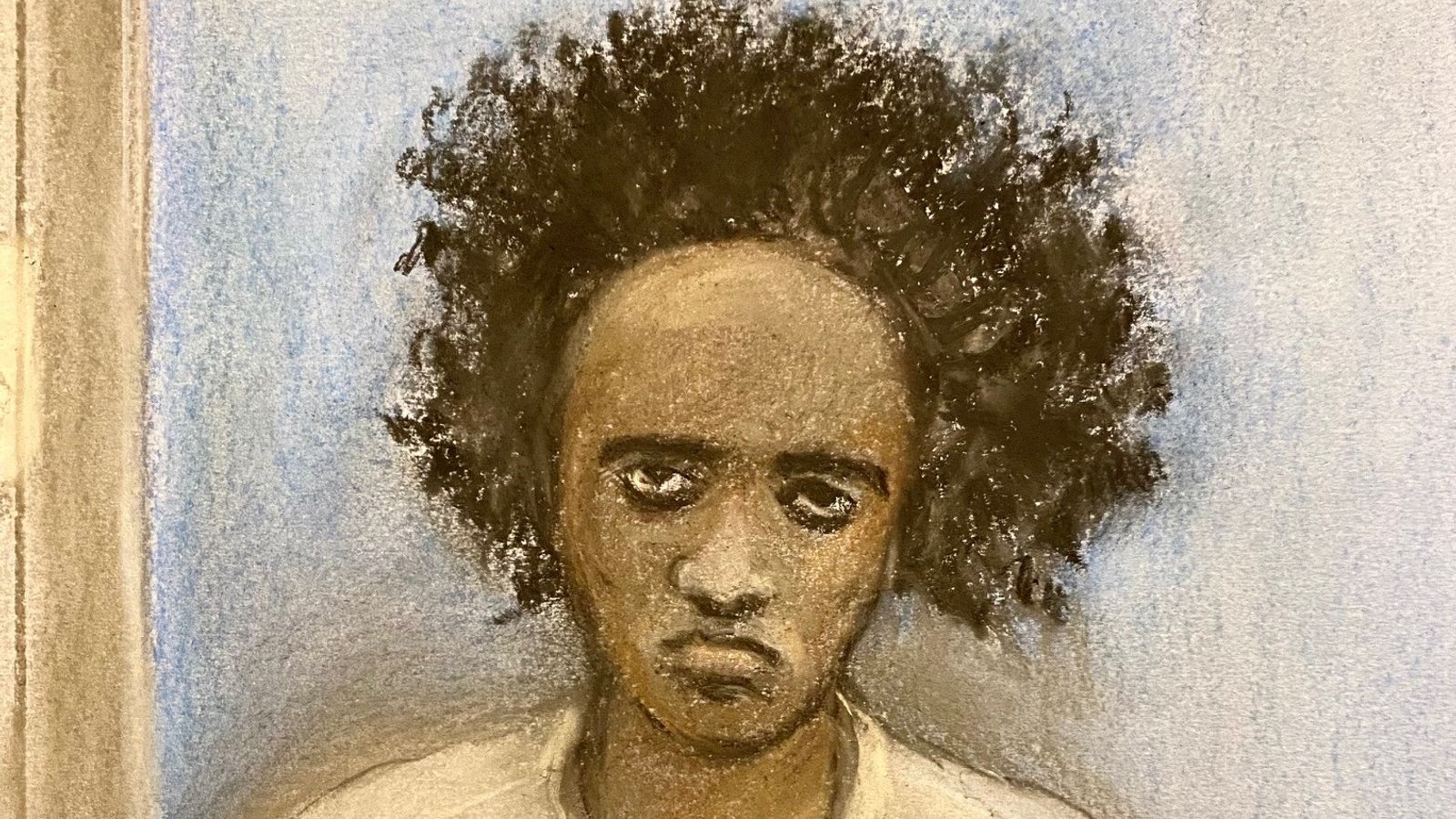

Connolly Loses Appeal Over Racially Abusive Post

May 22, 2025

Connolly Loses Appeal Over Racially Abusive Post

May 22, 2025 -

Mum Jailed For Tweet After Southport Stabbing Homelessness Sentence

May 22, 2025

Mum Jailed For Tweet After Southport Stabbing Homelessness Sentence

May 22, 2025 -

Decision Delayed Ex Tory Councillors Wifes Appeal Over Racial Hatred Tweet

May 22, 2025

Decision Delayed Ex Tory Councillors Wifes Appeal Over Racial Hatred Tweet

May 22, 2025 -

Wife Of Jailed Tory Councillor Says Fire Rant Against Migrant Hotels Wasnt Intended To Incite Violence

May 22, 2025

Wife Of Jailed Tory Councillor Says Fire Rant Against Migrant Hotels Wasnt Intended To Incite Violence

May 22, 2025 -

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025