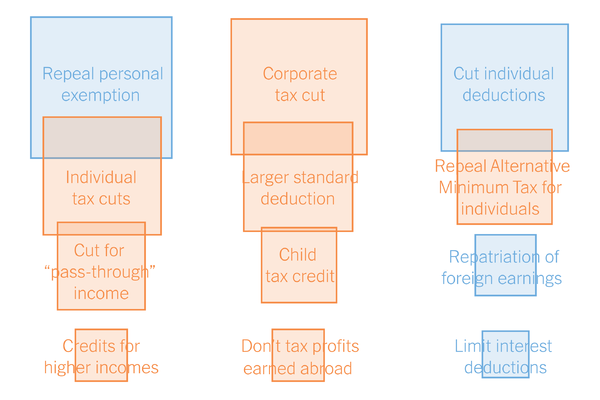

Key Features Of The House Republicans' Trump Tax Cut Legislation

Table of Contents

Individual Income Tax Rate Reductions

The Trump tax cuts significantly impacted individual income tax rates. The proposed changes aimed to simplify the tax brackets and lower the overall tax burden for many Americans.

Lowering Tax Brackets

The legislation proposed lowering the individual income tax brackets, resulting in percentage reductions across the board. This aimed to stimulate economic activity by leaving more disposable income in the hands of taxpayers.

- Specific bracket changes: While the exact figures varied depending on the specific version of the legislation, a common proposal involved reducing the highest individual income tax bracket from 35% to 28%. Lower brackets also saw reductions.

- Impact on different income levels: Lower-income individuals would experience smaller percentage reductions but potentially larger absolute dollar savings due to the structure of the tax brackets. Higher-income individuals would see larger percentage reductions, leading to substantial tax savings in absolute terms.

- Keyword Integration: The Trump tax cuts significantly altered individual tax rates, impacting income tax brackets across the board.

Standard Deduction Increases

The proposed legislation also included significant increases to the standard deduction. This simplification measure aimed to reduce the number of taxpayers who itemized deductions, further streamlining the tax filing process.

- Dollar amounts of the increased standard deduction: The proposed increases aimed to significantly raise the standard deduction amount for both single and married couples, making itemizing less advantageous for a larger portion of the population.

- The effect on the number of taxpayers who itemize: The increased standard deduction was projected to decrease the number of taxpayers itemizing their deductions, leading to simpler tax returns for many.

- Keyword Integration: This aspect of the Trump tax reform greatly impacted tax simplification for many Americans by increasing the standard deduction.

Child Tax Credit Expansions

The Trump tax plan included provisions to expand the Child Tax Credit (CTC), offering additional tax relief to families.

- Increased credit amounts: The proposed legislation sought to increase the amount of the Child Tax Credit, providing greater financial assistance to families with children.

- Potential expansion of eligibility requirements: Some proposals considered expanding eligibility requirements to include a wider range of families.

- Keyword Integration: The expansion of the child tax credit provided significant family tax relief under the Trump tax plan.

Corporate Tax Rate Cuts

The proposed legislation also focused heavily on reducing the corporate tax rate, aiming to boost business investment and economic growth.

Reduction of the Corporate Tax Rate

A central element of the Trump tax cuts was a dramatic reduction in the corporate tax rate.

- The proposed rate reduction percentage: The most commonly discussed proposal was to reduce the corporate tax rate from 35% to 21%. This significant reduction aimed to make the US more competitive globally.

- Potential impact on corporate investment and job creation: Proponents argued that this reduction would stimulate investment, leading to increased job creation and economic growth. Opponents expressed concerns about the potential impact on the national debt and income inequality.

- Keyword Integration: This corporate tax rate reduction was a cornerstone of the business tax cuts proposed under the Trump administration’s economic stimulus plans.

Pass-Through Business Deductions

The Trump tax plan also addressed tax deductions for pass-through businesses.

- Specific deduction percentages or rules: The legislation proposed changes to deductions available for pass-through businesses, such as S corporations and partnerships, aiming to provide tax relief to small business owners. Details varied across proposals.

- The impact on small business owners: The intended effect was to provide tax relief for small business owners, encouraging investment and job growth at the local level.

- Keyword Integration: These provisions provided significant small business tax relief through various tax deductions for pass-through entities.

Other Notable Provisions

Beyond the core elements, the proposed legislation included changes to other areas of the tax code.

Estate Tax Changes

The Trump tax cuts included proposals impacting estate and inheritance taxes.

- Increased exemption amounts: Some proposals suggested significantly increasing the estate tax exemption amount, effectively shielding a larger portion of estates from the tax.

- Potential elimination of the estate tax: More radical proposals considered completely eliminating the estate tax.

- Keyword Integration: These changes to the estate tax and inheritance tax, often referred to as the "death tax," were significant components of the proposed legislation.

Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) was also a focus of the proposed legislation.

- Details of any proposed changes to the AMT: Proposals ranged from modifications to a complete repeal of the AMT.

- The impact on high-income taxpayers: The AMT primarily affected high-income taxpayers, and its potential elimination or modification was a significant element of the debate surrounding the tax legislation.

- Keyword Integration: Discussions regarding AMT repeal and potential tax loopholes were central to the overall debate.

Conclusion

The House Republicans' Trump Tax Cut Legislation represented a significant attempt to reshape the US tax system. Key features included substantial reductions in individual and corporate tax rates, expanded tax credits, and potential changes to the estate tax and AMT. Understanding these key aspects of the "Trump Tax Cut Legislation" is crucial for individuals and businesses to plan effectively. For more detailed information and analysis of the proposed legislation and its potential impact, consult with a qualified tax professional. Learn more about the intricacies of the Trump Tax Cut Legislation and its long-term implications for the US economy.

Featured Posts

-

Proposed Tax Hike On Ivy League Endowments Harvard Yale In Crosshairs

May 13, 2025

Proposed Tax Hike On Ivy League Endowments Harvard Yale In Crosshairs

May 13, 2025 -

The Angela Swartz Story

May 13, 2025

The Angela Swartz Story

May 13, 2025 -

Herthas Woes Boateng And Kruse Offer Differing Diagnoses

May 13, 2025

Herthas Woes Boateng And Kruse Offer Differing Diagnoses

May 13, 2025 -

Sabalenka Falls To Ostapenko In Stuttgart Open Championship Match

May 13, 2025

Sabalenka Falls To Ostapenko In Stuttgart Open Championship Match

May 13, 2025 -

The Intertwined Cases Of Asap Rocky 50 Cent And Tory Lanez A Detailed Analysis

May 13, 2025

The Intertwined Cases Of Asap Rocky 50 Cent And Tory Lanez A Detailed Analysis

May 13, 2025

Latest Posts

-

Sabalenkas Dubai Defeat Paolinis Reign Ends

May 14, 2025

Sabalenkas Dubai Defeat Paolinis Reign Ends

May 14, 2025 -

Muchova Defeats Raducanu At Dubai Tennis Championships

May 14, 2025

Muchova Defeats Raducanu At Dubai Tennis Championships

May 14, 2025 -

Wta News Stearns Early Departure In Austin

May 14, 2025

Wta News Stearns Early Departure In Austin

May 14, 2025 -

Two Weeks And Out Raducanus Coaching Search Continues

May 14, 2025

Two Weeks And Out Raducanus Coaching Search Continues

May 14, 2025 -

Raducanus Dubai Defeat Muchova Triumphs

May 14, 2025

Raducanus Dubai Defeat Muchova Triumphs

May 14, 2025