Lagarde's Strategy: Elevating The Euro's Global Standing

Table of Contents

Combating Inflation and Strengthening the Euro

A strong Euro requires a stable and healthy Eurozone economy. Combating inflation is paramount to achieving this goal, and Lagarde's strategy has centered around aggressive monetary policy adjustments.

Interest Rate Hikes and Monetary Policy

The ECB's aggressive interest rate hikes represent a cornerstone of Lagarde's strategy. By raising borrowing costs, the ECB aims to cool down an overheating economy and curb inflation.

- Inflation Control and Currency Strength: Lower inflation generally leads to a stronger currency. Investors tend to favor currencies in stable, low-inflation economies.

- Impact on Borrowing Costs and Investment: Increased interest rates make borrowing more expensive for businesses and consumers, potentially slowing economic growth. However, this also attracts foreign investment seeking higher returns.

- Effectiveness of the Strategy: While initial rate hikes did strengthen the Euro, the ongoing impact is complex and dependent on several factors including global economic conditions and geopolitical events. Analyzing data from sources like the ECB and Eurostat is crucial for assessing its effectiveness. For example, while inflation has decreased, it remains above the ECB's target, indicating the challenge in balancing economic growth and inflation control.

Managing the Energy Crisis and its Impact

The war in Ukraine and the subsequent energy crisis significantly impacted the Eurozone economy and the Euro's exchange rate. The ECB has had to navigate this crisis while pursuing its inflation-fighting goals.

- ECB Initiatives: The ECB implemented measures to mitigate the energy crisis's impact, including targeted lending programs to support businesses and liquidity provisions to banks.

- Long-Term Effects: The long-term effects of the energy crisis on the Euro's stability are still unfolding. Diversification of energy sources and increased energy efficiency are crucial for future resilience. The success of the green transition initiatives will play a significant role in the long-term health of the Euro and the Eurozone's economy.

Promoting Financial Stability and Eurozone Integration

A strong Euro depends on a robust and integrated Eurozone financial system. Lagarde's strategy emphasizes financial stability and deeper integration.

Supervisory Role and Banking Reform

The ECB plays a crucial role in supervising the Eurozone's banking system. Under Lagarde's leadership, reforms aimed at enhancing the resilience of the banking sector have been implemented.

- Specific Reforms: These reforms have focused on strengthening capital requirements, improving risk management practices, and enhancing supervisory oversight.

- Impact on Investor Confidence: A stable and well-regulated banking sector increases investor confidence, making the Euro more attractive. This directly supports the Euro's global standing. A strong, resilient banking system underpins the stability of the entire Eurozone economy, making it a safer bet for global investors.

Deepening Capital Markets Union

Deepening the Capital Markets Union (CMU) is a key element of Lagarde's strategy. A more integrated capital market allows for greater efficiency in resource allocation and reduces reliance on bank lending.

- Fostering Financial Integration: The CMU facilitates cross-border investment, attracts international capital, and supports a stronger Euro.

- Challenges and Benefits: Challenges include overcoming regulatory hurdles and harmonizing different national markets. However, the benefits of a more efficient and integrated financial market are substantial for the Euro's global standing.

Enhancing the Euro's International Role

Increasing the Euro's usage in international trade and finance is a key strategic goal for the ECB under Lagarde's leadership.

Promoting the Euro in International Trade and Finance

The ECB actively promotes the Euro's use in international transactions to reduce dependence on the US dollar.

- Benefits of Greater Euro Adoption: Reduced reliance on the dollar offers geopolitical advantages and potentially lowers transaction costs.

- Strategies for Increased Usage: The ECB promotes the Euro through various channels, including international partnerships and agreements, encouraging businesses to use the Euro in cross-border transactions and seeking international support for its usage in trade and finance.

Digital Euro and Technological Advancement

The potential introduction of a digital Euro is a significant development that could enhance the currency's competitiveness.

- Advantages of a Digital Euro: A digital Euro could offer increased efficiency, reduced transaction costs, and greater accessibility, attracting new users globally. This modern approach to currency could increase the Euro's appeal and improve its global standing in the digital economy.

- Enhanced International Presence: The digital Euro has the potential to make the Euro a more attractive option for international payments and transactions, increasing its global presence in the digital age.

Conclusion

Christine Lagarde's strategy for elevating the Euro's global standing involves a multifaceted approach, encompassing monetary policy, financial stability, and promotion of international use. While challenges such as geopolitical instability and global economic uncertainty persist, her efforts are critical for bolstering the currency's long-term prospects. Understanding the complexities of Lagarde's strategy is essential for anyone interested in the future of the Euro's global standing and its influence on the international financial landscape. Continued monitoring of ECB policies and economic indicators is crucial to fully comprehend the dynamics impacting the Euro's global standing.

Featured Posts

-

Arsenal Transfer Rumours Imminent Record Breaking Signing

May 28, 2025

Arsenal Transfer Rumours Imminent Record Breaking Signing

May 28, 2025 -

Analyzing The Padres Chances Against The Opponent At Coors Field

May 28, 2025

Analyzing The Padres Chances Against The Opponent At Coors Field

May 28, 2025 -

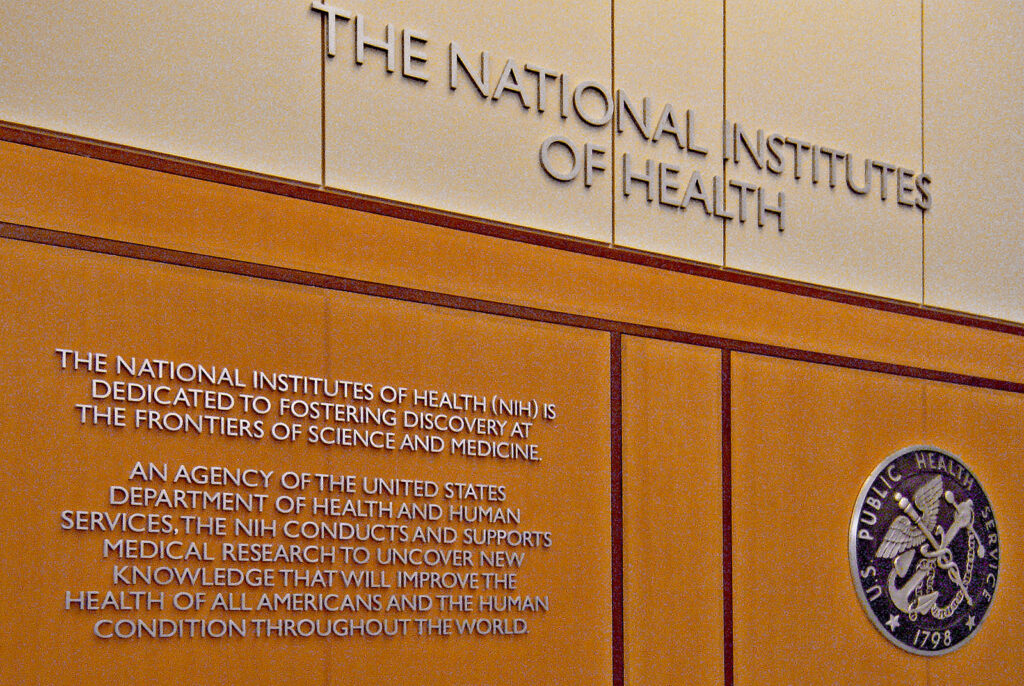

Research Funding Cuts And Ideological Differences Fuel Nih Staff Walkout

May 28, 2025

Research Funding Cuts And Ideological Differences Fuel Nih Staff Walkout

May 28, 2025 -

Bianca Censoris Life Under Kanye Wests Control An Insider Perspective

May 28, 2025

Bianca Censoris Life Under Kanye Wests Control An Insider Perspective

May 28, 2025 -

Gabby Agbonlahor On Arsenals Potential Premier League Signing

May 28, 2025

Gabby Agbonlahor On Arsenals Potential Premier League Signing

May 28, 2025

Latest Posts

-

Cts Eventim Q1 2024 Adjusted Ebitda And Revenue Growth

May 30, 2025

Cts Eventim Q1 2024 Adjusted Ebitda And Revenue Growth

May 30, 2025 -

Dublin 2026 Metallica Weekend Stadium Show Announced

May 30, 2025

Dublin 2026 Metallica Weekend Stadium Show Announced

May 30, 2025 -

Top Music Lawyers 2025 The Billboard Inspired List

May 30, 2025

Top Music Lawyers 2025 The Billboard Inspired List

May 30, 2025 -

Metallicas Aviva Stadium Gig Dublin Concert Dates Confirmed For 2026

May 30, 2025

Metallicas Aviva Stadium Gig Dublin Concert Dates Confirmed For 2026

May 30, 2025 -

Metallica Two Night Dublin Stadium Show Announced For June 2026

May 30, 2025

Metallica Two Night Dublin Stadium Show Announced For June 2026

May 30, 2025